A letter of credit ensures payment to the beneficiary upon presentation of specified documents, providing security in international trade by reducing payment risk. A bank guarantee, on the other hand, serves as a promise by the bank to cover a loss if the applicant fails to fulfill contractual obligations, offering protection primarily to the beneficiary. Both instruments mitigate financial risks but differ in their application, with letters of credit facilitating transactions and bank guarantees securing contractual performance.

Table of Comparison

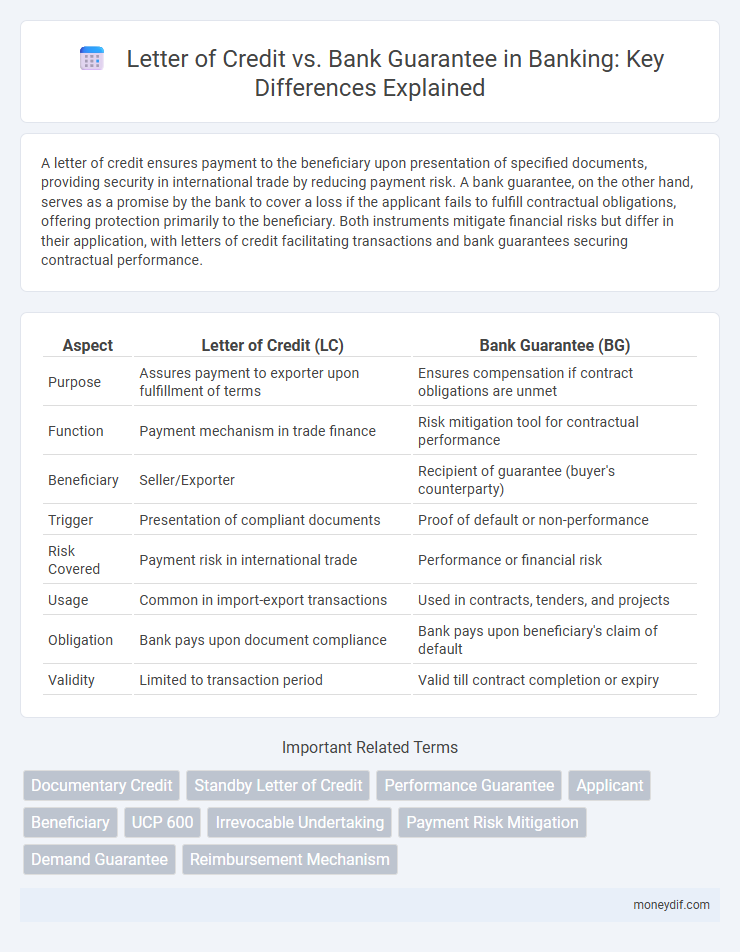

| Aspect | Letter of Credit (LC) | Bank Guarantee (BG) |

|---|---|---|

| Purpose | Assures payment to exporter upon fulfillment of terms | Ensures compensation if contract obligations are unmet |

| Function | Payment mechanism in trade finance | Risk mitigation tool for contractual performance |

| Beneficiary | Seller/Exporter | Recipient of guarantee (buyer's counterparty) |

| Trigger | Presentation of compliant documents | Proof of default or non-performance |

| Risk Covered | Payment risk in international trade | Performance or financial risk |

| Usage | Common in import-export transactions | Used in contracts, tenders, and projects |

| Obligation | Bank pays upon document compliance | Bank pays upon beneficiary's claim of default |

| Validity | Limited to transaction period | Valid till contract completion or expiry |

Introduction to Letters of Credit and Bank Guarantees

Letters of credit are payment assurances issued by banks on behalf of buyers to sellers, ensuring payment upon meeting specific documentation and terms. Bank guarantees serve as risk mitigants by promising compensation to the beneficiary if the applicant fails to fulfill contractual obligations. Both instruments facilitate trade and financial transactions by reducing credit risk and enhancing trust between parties.

Definition and Purpose: Letter of Credit vs Bank Guarantee

A Letter of Credit is a financial instrument issued by a bank guaranteeing a buyer's payment to a seller upon fulfillment of specified conditions, primarily facilitating trade transactions. A Bank Guarantee is a promise by the bank to cover a loss if the client fails to meet contractual obligations, providing assurance to the beneficiary. Letters of Credit ensure payment certainty in international trade, whereas Bank Guarantees secure performance and risk management in various contractual agreements.

Key Differences Between Letters of Credit and Bank Guarantees

Letters of credit and bank guarantees serve as financial instruments but differ fundamentally in risk assumption and purpose. A letter of credit ensures payment to the seller upon meeting specific terms, reducing payment risk in trade transactions, while a bank guarantee promises compensation to the beneficiary if the applicant defaults on contractual obligations. Letters of credit are prevalent in import-export financing, whereas bank guarantees are commonly used to secure performance or advance payment obligations in various contractual agreements.

Types of Letters of Credit and Their Uses

Letters of credit (LCs) come in various types, including revocable, irrevocable, confirmed, unconfirmed, standby, and revolving LCs, each serving specific trade financing needs. Irrevocable letters of credit are the most commonly used, offering secure payment assurance for exporters by guaranteeing funds once contractual conditions are met. Confirmed letters of credit provide an added layer of security through a secondary bank's guarantee, making them ideal for high-risk international trade transactions.

Common Forms of Bank Guarantees

Common forms of bank guarantees include performance guarantees, payment guarantees, bid bonds, and advance payment guarantees, each securing specific contractual obligations in banking and trade finance. A letter of credit differs by providing a payment commitment on behalf of the buyer to the seller, ensuring funds are available upon presentation of compliant documents. Bank guarantees primarily protect beneficiaries against losses from the applicant's failure to fulfill contractual terms, enhancing trust in domestic and international transactions.

Process Flow: How Letters of Credit Work

Letters of Credit (LC) involve a formal process where the buyer's bank issues a payment guarantee to the seller upon presentation of compliant shipping documents conforming to the LC terms. The process flow begins with the buyer applying for an LC, which is then issued by the issuing bank and communicated to the seller's advising bank. Upon shipment, the seller submits the required documents to the advising bank, which verifies compliance before the issuing bank releases payment, ensuring secure and conditional fund transfer.

Process Flow: How Bank Guarantees Operate

Bank guarantees involve a process where the applicant requests the bank to issue a guarantee in favor of the beneficiary, ensuring payment or performance obligations. The bank evaluates the applicant's creditworthiness and, upon approval, issues the guarantee, which the beneficiary can claim if the applicant defaults. This process flows through application submission, bank assessment, issuing the guarantee, and settlement upon demand or contract fulfillment.

Risks and Benefits: Letter of Credit vs Bank Guarantee

A Letter of Credit minimizes payment risk by ensuring funds are available before shipment or service delivery, offering security to exporters but requiring strict compliance with documentary terms, which can cause delays. Bank Guarantees provide a safety net for the beneficiary by promising compensation if the principal fails to fulfill contractual obligations, reducing credit risk without immediate payment but potentially exposing the applicant to financial liability. Both instruments mitigate transaction risks but differ in execution timing and obligations, making Letters of Credit preferable for trade finance and Bank Guarantees ideal for project bidding and performance assurance.

When to Use a Letter of Credit vs a Bank Guarantee

A Letter of Credit is ideal for international trade transactions where payment assurance and shipment verification are critical, providing the seller with a secure payment method upon document compliance. In contrast, a Bank Guarantee is more suitable for domestic contracts or situations requiring financial assurance of performance or payment if the applicant defaults. Choosing between the two depends on whether the priority is payment upon delivery (Letter of Credit) or risk mitigation for contractual obligations (Bank Guarantee).

Conclusion: Choosing the Right Financial Instrument

Selecting the appropriate financial instrument between a letter of credit and a bank guarantee depends on the nature of the transaction and risk allocation. A letter of credit provides secure payment assurance in trade by involving the bank as an intermediary, while a bank guarantee offers a fallback payment promise if contractual obligations are unmet. Understanding the specific requirements and risk tolerance of the parties involved ensures optimal protection and financial efficiency.

Important Terms

Documentary Credit

Documentary Credit, commonly known as a Letter of Credit, ensures payment to exporters by banks upon compliance with specified documents, providing security in international trade transactions. Unlike a Bank Guarantee, which backs the performance or financial obligations of a party, a Letter of Credit directly facilitates payment, making it a more reliable tool for mitigating payment risks in cross-border commerce.

Standby Letter of Credit

A Standby Letter of Credit (SBLC) functions as a financial safety net, ensuring payment obligations are met if the applicant defaults, making it distinct from a traditional Letter of Credit (LC), which primarily facilitates payment for actual trade transactions. Unlike a Bank Guarantee that directly promises compensation upon default, an SBLC operates as a secondary payment mechanism contingent on the beneficiary's demand and proof of non-performance, offering more flexible risk management in international trade.

Performance Guarantee

Performance Guarantees and Letters of Credit are financial instruments ensuring contract fulfillment, where a Performance Guarantee is typically a Bank Guarantee that promises compensation for non-performance, while a Letter of Credit guarantees payment upon presentation of specified documents. Bank Guarantees related to Performance Guarantees provide a safety net for contractual obligations, offering a monetary fallback, whereas Letters of Credit focus primarily on secure payment facilitation in trade transactions.

Applicant

An applicant is the party requesting issuance of a letter of credit, ensuring payment to the beneficiary upon compliance with stipulated terms, while in a bank guarantee, the applicant requests the bank to guarantee payment to the beneficiary if the applicant defaults on contractual obligations. Letters of credit primarily facilitate trade transactions by reducing payment risk, whereas bank guarantees serve as a financial safety net backing the applicant's performance or payment commitments.

Beneficiary

A beneficiary in a letter of credit transaction is the party entitled to receive payment upon fulfilling specified terms, ensuring payment security in international trade. In a bank guarantee, the beneficiary gains assurance that the guarantor bank will cover losses if the applicant fails to meet contractual obligations, providing financial risk mitigation.

UCP 600

UCP 600 governs letters of credit by establishing standardized rules for documentary credits, ensuring secure and efficient international trade payments, while bank guarantees function as separate irrevocable commitments and are not regulated under UCP 600. Letters of credit under UCP 600 primarily facilitate payment upon compliance with terms, whereas bank guarantees provide financial assurance for contractual obligations without triggering immediate payment.

Irrevocable Undertaking

An Irrevocable Undertaking ensures a binding commitment from the bank, similar to a Letter of Credit, by guaranteeing payment once stipulated conditions are met, whereas a Bank Guarantee offers a secondary payment assurance, activating only upon the applicant's default. Letters of Credit primarily facilitate trade transactions by providing direct payment assurance, while Bank Guarantees serve as risk mitigation tools for contractual obligations.

Payment Risk Mitigation

Payment risk mitigation through letters of credit offers buyers and sellers a secure transaction framework by ensuring payment upon compliance with documentary terms, whereas bank guarantees provide a financial assurance only if the buyer defaults, placing more risk on the beneficiary. Letters of credit are preferred in international trade for minimizing non-payment risks due to their enforceable conditions, while bank guarantees serve as secondary security typically used in contractual obligations or bid bonds.

Demand Guarantee

A Demand Guarantee provides an unconditional payment assurance from the guarantor bank upon beneficiary's demand, differentiating it from a Letter of Credit which involves a documentary compliance check before payment. Unlike Bank Guarantees that may require evidence of default, Demand Guarantees are strictly pay-on-demand instruments often used in international trade to secure contractual obligations.

Reimbursement Mechanism

A reimbursement mechanism in trade finance ensures timely repayment to the issuing bank under a Letter of Credit (LC) or Bank Guarantee (BG), where the buyer's bank commits to reimburse the issuing bank upon presentation of compliant documents or demand. Letters of Credit rely on documentary compliance for reimbursement, while Bank Guarantees trigger payment upon beneficiary's claim, making distinct operational and risk management frameworks essential for each instrument.

Letter of credit vs Bank guarantee Infographic

moneydif.com

moneydif.com