Open banking empowers customers by enabling third-party providers to access banking data through APIs, fostering innovation and personalized financial services. Embedded finance integrates financial products directly into non-banking platforms, streamlining customer experiences without the need to visit traditional banks. Both models revolutionize banking by enhancing accessibility and convenience, yet embedded finance emphasizes seamless integration while open banking prioritizes data sharing and collaboration.

Table of Comparison

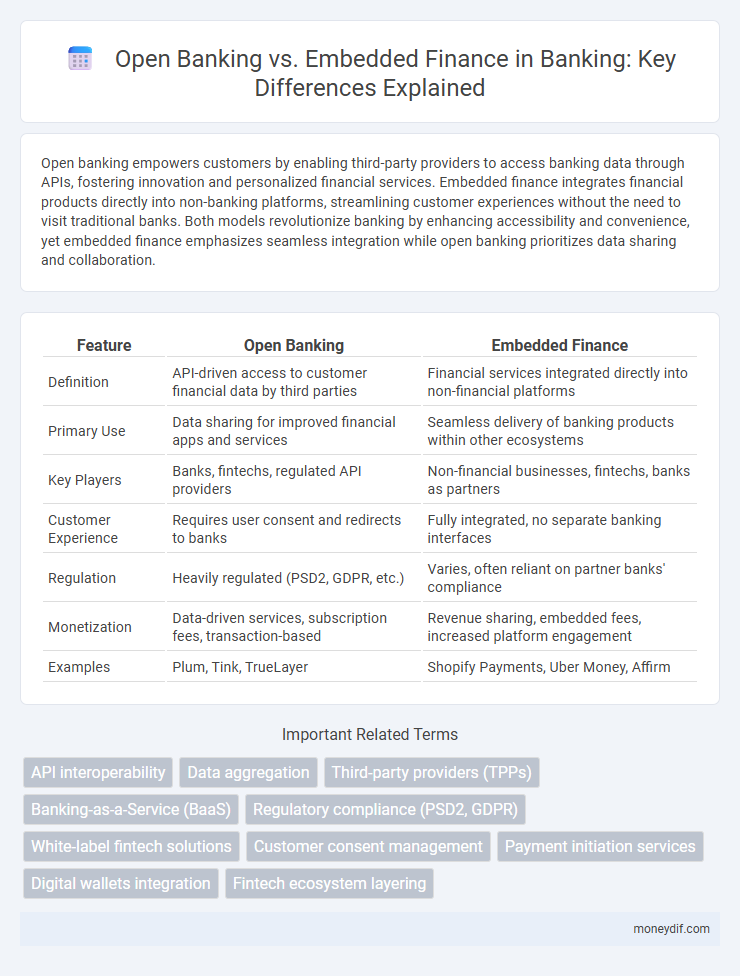

| Feature | Open Banking | Embedded Finance |

|---|---|---|

| Definition | API-driven access to customer financial data by third parties | Financial services integrated directly into non-financial platforms |

| Primary Use | Data sharing for improved financial apps and services | Seamless delivery of banking products within other ecosystems |

| Key Players | Banks, fintechs, regulated API providers | Non-financial businesses, fintechs, banks as partners |

| Customer Experience | Requires user consent and redirects to banks | Fully integrated, no separate banking interfaces |

| Regulation | Heavily regulated (PSD2, GDPR, etc.) | Varies, often reliant on partner banks' compliance |

| Monetization | Data-driven services, subscription fees, transaction-based | Revenue sharing, embedded fees, increased platform engagement |

| Examples | Plum, Tink, TrueLayer | Shopify Payments, Uber Money, Affirm |

Understanding Open Banking and Embedded Finance

Open banking refers to the secure sharing of financial data between banks and third-party providers through APIs, enabling customers to access personalized financial services and enhanced transparency. Embedded finance integrates financial services directly into non-financial platforms, allowing seamless transactions such as payments, lending, and insurance within apps or websites without navigating to traditional banking channels. Understanding both concepts is crucial for leveraging new digital banking innovations and improving customer experience across diverse ecosystems.

Key Differences Between Open Banking and Embedded Finance

Open banking enables third-party providers to access bank data via APIs, promoting financial transparency and customer control over data sharing. Embedded finance integrates financial services directly into non-bank platforms, such as e-commerce or software applications, offering seamless user experiences without redirecting to traditional bank interfaces. Key differences include the scope of integration--open banking focuses on data accessibility and interoperability, while embedded finance emphasizes service embedding within customer journeys--and regulatory frameworks, as open banking often operates under stricter compliance mandates like PSD2 in Europe.

Core Benefits of Open Banking for Banks and Customers

Open banking enables banks to securely share customer data with third-party providers, fostering innovation and personalized financial services, which enhances customer experience and loyalty. Customers benefit from increased transparency, streamlined access to diverse financial products, and improved control over their financial data. Banks gain new revenue streams, enhanced collaboration opportunities, and strengthened competitive positioning through API-driven ecosystems.

Embedded Finance: Enhancing Non-Financial Platforms

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless transactions without redirecting users to traditional banks. This approach enhances user experience by embedding payments, lending, insurance, and investment options into apps, websites, and digital ecosystems. By leveraging APIs and fintech innovations, embedded finance drives new revenue streams and increases customer engagement for e-commerce, SaaS, and retail businesses.

Regulatory Considerations: Open Banking vs Embedded Finance

Regulatory considerations for open banking primarily involve strict compliance with data privacy laws such as PSD2 in Europe and similar mandates requiring secure customer consent and API standardization for third-party access. Embedded finance faces evolving regulatory scrutiny as financial services integrate within non-financial platforms, raising concerns about licensing, consumer protection, and anti-money laundering compliance across diverse industries. Navigating these frameworks demands continuous adaptation to overlapping regulations ensuring transparency, security, and accountability in both open banking and embedded finance ecosystems.

Security and Data Privacy in Both Approaches

Open banking leverages APIs to securely share customer data with third-party providers, emphasizing strong authentication protocols and regulatory compliance like PSD2 to safeguard privacy. Embedded finance integrates financial services directly into non-bank platforms, requiring robust encryption and stringent access controls to protect sensitive data within diverse ecosystems. Both approaches prioritize end-to-end security measures to mitigate risks, but open banking depends heavily on standardized regulatory frameworks, whereas embedded finance relies on platform-specific security implementations.

Impact on Customer Experience and Engagement

Open banking enhances customer experience by providing secure access to a wide range of financial services through APIs, enabling personalized financial management and seamless account aggregation. Embedded finance integrates financial products directly into non-financial platforms, streamlining transactions and reducing friction for users within familiar environments. The impact on customer engagement is profound as open banking fosters transparency and control, while embedded finance drives convenience and immediacy, both reshaping expectations for digital banking interactions.

The Role of APIs in Open Banking and Embedded Finance

APIs serve as the critical infrastructure enabling seamless data exchange in both open banking and embedded finance, facilitating secure access to customer financial data and third-party services. In open banking, APIs empower banks to share standardized data with authorized third parties, expanding financial product offerings and enhancing user experience. Embedded finance leverages APIs to integrate banking services directly into non-financial platforms, driving innovation by embedding payment processing, lending, and insurance within everyday applications.

Future Trends: Open Banking and Embedded Finance Convergence

Open banking and embedded finance are rapidly converging, driven by advancements in API integration and regulatory frameworks like PSD2 and Open Banking standards. This convergence enables seamless, personalized financial services embedded directly within non-bank platforms, enhancing customer experience and expanding market reach. Future trends indicate increased collaboration between banks and fintechs, leveraging data interoperability and AI to deliver innovative, real-time financial solutions across diverse ecosystems.

Choosing the Right Approach for Financial Innovation

Open banking enables secure data sharing through APIs, fostering collaboration between banks and fintechs to create tailored customer experiences. Embedded finance integrates financial services directly into non-financial platforms, streamlining user access and enhancing convenience without redirecting to traditional banking interfaces. Selecting the right approach depends on organizational goals, target audience, and the desired level of control over customer experience in financial innovation.

Important Terms

API interoperability

API interoperability enables seamless data exchange between Open Banking platforms and Embedded Finance solutions, facilitating secure access to customer financial information and real-time payment processing. This integration enhances user experience by allowing third-party developers to build innovative financial services that leverage both regulated banking APIs and embedded payment infrastructures.

Data aggregation

Data aggregation in open banking enables the secure gathering of customer financial information across multiple banks via APIs, enhancing transparency and personalized services. Embedded finance leverages aggregated data within non-financial platforms to seamlessly integrate financial products, driving user engagement and tailored financial experiences.

Third-party providers (TPPs)

Third-party providers (TPPs) in open banking leverage APIs to access customer financial data securely, enabling innovative services like account aggregation and payment initiation. Embedded finance integrates TPP functionality directly into non-financial platforms, offering seamless financial services such as lending or payments without redirecting users to traditional banks.

Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) enables third-party providers to integrate banking services directly into their platforms, leveraging APIs to offer seamless financial products without traditional banking infrastructure. Open banking focuses on secure data sharing between banks and third parties, enhancing transparency and customer control, while embedded finance embeds banking functions within non-financial apps, creating frictionless user experiences and driving new revenue streams.

Regulatory compliance (PSD2, GDPR)

PSD2 mandates secure customer authentication and data sharing for open banking, enhancing transparency and consumer control over financial data, while GDPR enforces strict data privacy and consent requirements across both open banking and embedded finance ecosystems. Embedded finance leverages these regulations by embedding compliance protocols into seamless financial services integration, ensuring data protection and regulatory adherence within third-party platforms.

White-label fintech solutions

White-label fintech solutions enable businesses to integrate Open Banking APIs for seamless account aggregation, payments, and data sharing, enhancing customer experience without building infrastructure from scratch. Embedded finance leverages these solutions to embed financial services like lending or insurance directly within non-financial platforms, accelerating product innovation and monetization.

Customer consent management

Customer consent management plays a critical role in Open Banking by ensuring secure and transparent data sharing between financial institutions and third-party providers under strict regulatory frameworks such as PSD2. In contrast, Embedded Finance integrates financial services directly within non-financial platforms, leveraging seamless consent capture mechanisms to enhance user experience while maintaining compliance with data privacy standards.

Payment initiation services

Payment initiation services (PIS) enable consumers to make payments directly from their bank accounts through open banking APIs, offering enhanced security and real-time transaction capabilities. Embedded finance integrates PIS within non-financial platforms, streamlining user experience by allowing seamless payments without redirecting to external banking apps.

Digital wallets integration

Digital wallets integration leverages open banking APIs to securely access banking data and initiate payments, enhancing user authentication and transaction transparency. Embedded finance seamlessly incorporates digital wallet functionalities within non-financial platforms, enabling direct payment processing and financial services without redirecting users to external banking apps.

Fintech ecosystem layering

Fintech ecosystem layering divides the infrastructure into core banking systems, open banking APIs, and end-user applications, enabling seamless data exchange and service integration. Open banking emphasizes secure third-party access to financial data, while embedded finance integrates financial services directly into non-financial platforms, enhancing user experience within the fintech value chain.

Open banking vs Embedded finance Infographic

moneydif.com

moneydif.com