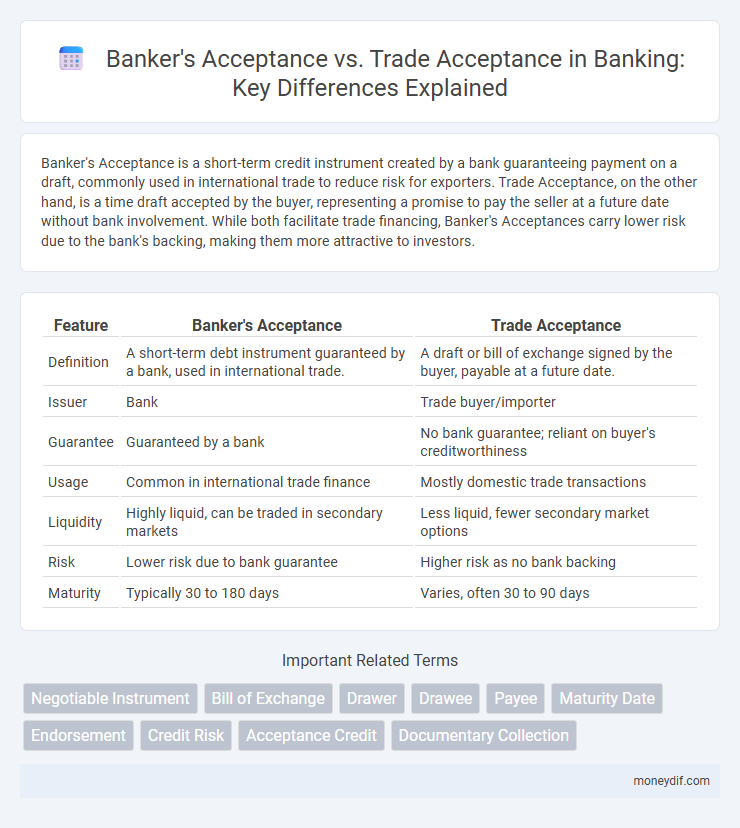

Banker's Acceptance is a short-term credit instrument created by a bank guaranteeing payment on a draft, commonly used in international trade to reduce risk for exporters. Trade Acceptance, on the other hand, is a time draft accepted by the buyer, representing a promise to pay the seller at a future date without bank involvement. While both facilitate trade financing, Banker's Acceptances carry lower risk due to the bank's backing, making them more attractive to investors.

Table of Comparison

| Feature | Banker's Acceptance | Trade Acceptance |

|---|---|---|

| Definition | A short-term debt instrument guaranteed by a bank, used in international trade. | A draft or bill of exchange signed by the buyer, payable at a future date. |

| Issuer | Bank | Trade buyer/importer |

| Guarantee | Guaranteed by a bank | No bank guarantee; reliant on buyer's creditworthiness |

| Usage | Common in international trade finance | Mostly domestic trade transactions |

| Liquidity | Highly liquid, can be traded in secondary markets | Less liquid, fewer secondary market options |

| Risk | Lower risk due to bank guarantee | Higher risk as no bank backing |

| Maturity | Typically 30 to 180 days | Varies, often 30 to 90 days |

Overview of Banker’s Acceptance and Trade Acceptance

Banker's Acceptance is a short-term, negotiable financial instrument guaranteed by a bank, primarily used to finance international trade transactions by ensuring payment to the seller. Trade Acceptance is a time draft drawn by the seller and accepted by the buyer as a promise to pay at a future date, typically used in domestic trade without bank guarantee. Banker's Acceptance carries lower credit risk due to bank backing, whereas Trade Acceptance relies on the buyer's creditworthiness alone.

Key Differences Between Banker’s and Trade Acceptances

Banker's Acceptance is a short-term, negotiable financial instrument guaranteed by a bank, primarily used in international trade to facilitate payments and reduce credit risk. Trade Acceptance is a time draft drawn by the seller on the buyer without bank guarantee, relying solely on the buyer's creditworthiness for domestic trade credit. The key difference lies in the credit assurance, with Banker's Acceptance backed by a bank, enhancing liquidity and trust, whereas Trade Acceptance depends on the buyer's reputation, carrying higher risk and limited negotiability.

How Banker’s Acceptances Work in Banking

Banker's Acceptances function as time drafts guaranteed by banks, serving as a secure payment promise for future transactions, primarily in international trade finance. These financial instruments provide liquidity by enabling businesses to sell accepted drafts in secondary markets before maturity, thus facilitating smoother cash flow and reduced credit risk. Banks validate and endorse these acceptances, leveraging their creditworthiness to assure payment to the holder upon maturity.

The Process Behind Trade Acceptances

Trade acceptance involves a seller drawing a time draft on the buyer, who then accepts the draft, committing to pay a specified amount at a future date, thus creating a negotiable instrument. This process differs from a banker's acceptance, where a bank guarantees payment, providing additional credit support and lower risk for the holder of the draft. Trade acceptances facilitate international and domestic trade by allowing sellers to extend credit with a formalized payment commitment directly from the buyer.

Advantages of Using Banker’s Acceptance

Banker's Acceptance offers enhanced liquidity and credit risk mitigation by being a time draft guaranteed by a bank, making it more attractive to investors and financial institutions. It facilitates smoother international trade transactions by providing a reliable payment mechanism backed by the bank's creditworthiness. The negotiability and acceptance of Banker's Acceptance in secondary markets ensure better financing opportunities and lower borrowing costs for businesses compared to Trade Acceptance.

Benefits and Risks of Trade Acceptance

Trade Acceptance benefits include facilitating international and domestic trade by providing a negotiable instrument that improves cash flow and credit terms for both buyers and sellers. Risks involve potential default by the drawee, leading to credit exposure for the accepting party and possible delays in payment settlement. Proper assessment of the drawee's creditworthiness is essential to mitigate these risks and ensure secure transaction outcomes.

Role of Banker’s Acceptance in International Trade

Banker's Acceptances (BAs) serve as crucial short-term financial instruments in international trade by providing guarantees from banks that facilitate the financing of import and export transactions. Unlike Trade Acceptances, which are drawn by sellers on buyers without bank backing, BAs enhance trust and reduce credit risk for exporters by ensuring payment upon maturity. Their role in international trade includes enabling smoother liquidity flow, mitigating payment uncertainty, and supporting cross-border commercial activities.

Use Cases for Trade Acceptance in Commerce

Trade Acceptance serves as a pivotal financing tool in commerce by facilitating payment guarantees between buyers and sellers in domestic or international transactions without immediate cash exchange. It is commonly used in the purchase of goods, enabling sellers to offer credit terms while assuring payment at a future date, thus enhancing cash flow management and trust in trade relationships. This instrument supports suppliers in securing funds earlier through discounting with financial institutions, making it integral to supply chain and working capital optimization.

Legal and Financial Implications

Banker's Acceptance (BA) is a time draft guaranteed by a bank, reducing credit risk and serving as a negotiable instrument widely used in international trade finance. Trade Acceptance (TA) is a time draft drawn by the seller on the buyer without bank guarantee, bearing higher credit risk and limited market acceptance compared to BA. Legally, BAs are secured by the bank's commitment, enhancing liquidity and enforceability, while TAs rely on the buyer's creditworthiness, impacting their financial reliability and risk profile.

Choosing Between Banker’s Acceptance and Trade Acceptance

Choosing between Banker's Acceptance and Trade Acceptance depends on the creditworthiness of the accepting party and the risk appetite of the involved entities. Banker's Acceptance is preferred for international trade due to bank guarantee reducing credit risk, while Trade Acceptance is suitable for transactions where trust between buyer and seller is established, often used in domestic trade. Cost, liquidity, and credit risk profiles of both instruments influence the decision in trade finance strategies.

Important Terms

Negotiable Instrument

Negotiable instruments such as Banker's Acceptances and Trade Acceptances facilitate international and domestic trade by guaranteeing payment; Banker's Acceptances are time drafts accepted by a bank ensuring payment to the holder, while Trade Acceptances are drafts accepted by the buyer, reflecting direct obligations between buyer and seller without bank guarantee. The key distinction lies in credit risk and payment assurance, with Banker's Acceptances offering higher security and liquidity in financial markets compared to Trade Acceptances.

Bill of Exchange

A Bill of Exchange serves as a negotiable instrument used in international and domestic trade, with a Banker's Acceptance representing a time draft guaranteed by a bank, enhancing creditworthiness and liquidity, while a Trade Acceptance is drawn by the seller on the buyer without bank involvement, reflecting direct credit terms between trading parties. Banker's Acceptances are often used in financing import-export transactions due to bank backing, whereas Trade Acceptances rely solely on the buyer's credit risk in commercial trade.

Drawer

A drawer in finance initiates a Banker's Acceptance by instructing a bank to pay a certain amount on a specified date, providing greater credit assurance than a Trade Acceptance, which is created by the seller's direct promise to pay without bank involvement. The drawer's role in a Banker's Acceptance facilitates negotiability and market liquidity, contrasting with the typically less liquid Trade Acceptance tied solely to the buyer's creditworthiness.

Drawee

The drawee in a Banker's Acceptance is typically a bank that guarantees payment, ensuring higher creditworthiness and liquidity, whereas in a Trade Acceptance, the drawee is a buyer in the commercial transaction, making it primarily a credit instrument between businesses. This distinction impacts the acceptance's risk profile and negotiability in financial markets.

Payee

A payee in a Banker's Acceptance is typically a seller or exporter who receives payment upon acceptance by a bank, ensuring higher creditworthiness and reduced risk compared to a Trade Acceptance, where the payee relies solely on the buyer's credit without bank involvement. This distinction impacts the payee's assurance of payment timing and reliability in international trade finance.

Maturity Date

The maturity date for a Banker's Acceptance typically ranges from 30 to 180 days from issue and is guaranteed by a bank, providing liquidity and credit assurance in international trade finance. Trade Acceptances also mature within a similar timeframe but are accepted by the seller rather than a bank, making them less secure but useful for domestic trade credit arrangements.

Endorsement

Endorsement in Banker's Acceptance involves the transfer of a negotiable financial instrument guaranteed by a bank, enhancing creditworthiness and liquidity in international trade financing. Trade Acceptance endorsement, on the other hand, reflects a seller's promise to pay the buyer at a specified future date, primarily used in domestic commercial transactions to facilitate credit sales.

Credit Risk

Credit risk in Banker's Acceptances arises from the bank's promise to pay, offering higher security compared to Trade Acceptances, which depend solely on the creditworthiness of the drawer or buyer. The lower default risk in Banker's Acceptances often results in better liquidity and pricing in financial markets relative to Trade Acceptances.

Acceptance Credit

Acceptance credit is a short-term financing tool where a bank guarantees payment on a time draft, commonly known as a Banker's Acceptance, providing secure liquidity for importers and exporters; in contrast, a Trade Acceptance is a draft accepted by the buyer without bank involvement, relying primarily on the buyer's creditworthiness for payment assurance. Banker's Acceptances offer lower risk due to bank backing, making them more marketable and widely used in international trade finance compared to Trade Acceptances which are typical in domestic transactions.

Documentary Collection

Documentary Collection involves a bank acting as an intermediary to exchange shipping documents for payment or a promise to pay, where Banker's Acceptance (BA) is a time draft guaranteed by a bank, offering higher credit reliability. Trade Acceptance is a time draft drawn by the seller and accepted by the buyer without bank guarantee, used primarily in seller-buyer credit arrangements with lower credit risk assurance than Banker's Acceptance.

Banker’s Acceptance vs Trade Acceptance Infographic

moneydif.com

moneydif.com