A Nostro account is a bank account held by a domestic bank in a foreign currency at another bank, facilitating international transactions and currency exchanges. In contrast, a Vostro account is maintained by a foreign bank for a domestic bank's use, enabling the domestic bank to manage funds on behalf of the foreign institution. Understanding the distinction between Nostro and Vostro accounts is crucial for efficient cross-border banking and accurate reconciliation of international payments.

Table of Comparison

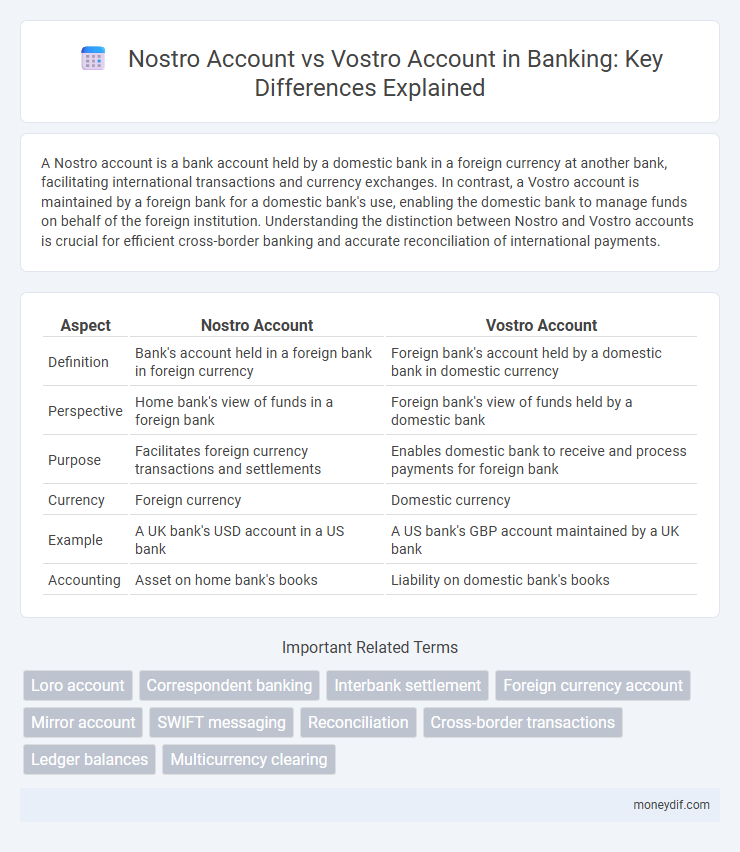

| Aspect | Nostro Account | Vostro Account |

|---|---|---|

| Definition | Bank's account held in a foreign bank in foreign currency | Foreign bank's account held by a domestic bank in domestic currency |

| Perspective | Home bank's view of funds in a foreign bank | Foreign bank's view of funds held by a domestic bank |

| Purpose | Facilitates foreign currency transactions and settlements | Enables domestic bank to receive and process payments for foreign bank |

| Currency | Foreign currency | Domestic currency |

| Example | A UK bank's USD account in a US bank | A US bank's GBP account maintained by a UK bank |

| Accounting | Asset on home bank's books | Liability on domestic bank's books |

Introduction to Nostro and Vostro Accounts

Nostro and Vostro accounts are fundamental concepts in international banking, representing accounts held by banks on behalf of each other in different currencies. A Nostro account refers to the home bank's foreign currency account held in another bank, while a Vostro account is the foreign bank's currency account maintained by the home bank. These accounts facilitate cross-border transactions, currency exchange, and reconciliation between correspondent banks.

Definition of Nostro Account

A Nostro account is a foreign currency account that a domestic bank holds in a correspondent bank abroad, enabling international transactions and foreign exchange operations. It represents the bank's funds deposited in another country, facilitating smooth settlements in the foreign currency. Nostro accounts are essential for managing cross-border payments and foreign exchange risk in global banking.

Definition of Vostro Account

A Vostro account is a bank account that a domestic bank holds on behalf of a foreign bank, denominated in the domestic currency. This type of account enables foreign banks to facilitate local currency transactions and payments within the domestic market. Vostro accounts are essential in correspondent banking for smooth cross-border trade and settlement processes.

Key Differences Between Nostro and Vostro Accounts

Nostro accounts represent a bank's foreign currency holdings held in another bank, facilitating international transactions by reflecting the home bank's funds abroad. Vostro accounts, conversely, are domestic bank accounts maintained on behalf of foreign banks, displaying the foreign bank's funds within the home bank's records. Key differences include their perspective: Nostro accounts record a bank's own money held in foreign banks, while Vostro accounts show foreign banks' money held domestically, crucial for cross-border payment settlements and foreign exchange management.

How Nostro Accounts Work in International Banking

Nostro accounts function as foreign currency accounts that a domestic bank holds in a correspondent bank abroad to facilitate international trade and payments. These accounts record the domestic bank's money held in the foreign bank's local currency, enabling smooth transactions and currency exchange without frequent conversions. By maintaining Nostro accounts, banks streamline cross-border settlements and reduce currency risk in global financial operations.

How Vostro Accounts Operate for Foreign Banks

Vostro accounts operate as foreign currency accounts maintained by a domestic bank on behalf of a foreign bank, enabling the foreign institution to access local currency and facilitate cross-border transactions. These accounts record the domestic bank's liabilities to the foreign bank, allowing seamless fund transfers, currency exchange, and settlement of international payments. Vostro accounts play a critical role in correspondent banking by providing liquidity and efficient transaction processing for foreign banks operating in local markets.

Importance of Nostro and Vostro Accounts in Global Trade

Nostro and Vostro accounts are vital for facilitating international banking transactions, enabling seamless cross-border payments and currency exchanges. Nostro accounts, held by a domestic bank in a foreign bank's currency, ensure efficient settlement of transactions in that foreign currency. Vostro accounts allow foreign banks to hold balances within domestic banks, providing liquidity and trust that support global trade finance and reduce settlement risks.

Example Scenarios: Usage of Nostro vs Vostro Accounts

Nostro accounts, held by a bank in a foreign currency with another bank, enable efficient cross-border payments, such as a US bank maintaining a Nostro account in euros with a European bank to process client transactions in Europe. Vostro accounts represent the foreign bank's liability, used when a European bank holds a Vostro account in US dollars with a US bank to receive and manage funds from US-based clients. These accounts streamline international trade settlements by ensuring accurate currency conversion and timely fund transfers between correspondent banks.

Nostro and Vostro Account Management Challenges

Nostro and Vostro account management involves complex reconciliation and currency risk due to cross-border transactions between correspondent banks. Banks face challenges in maintaining real-time visibility and accuracy of balances, leading to liquidity and compliance risks. Effective integration of automated systems is crucial for minimizing errors and optimizing foreign exchange operations in Nostro and Vostro accounts.

Future Trends in Nostro and Vostro Banking

Future trends in Nostro and Vostro banking emphasize increasing automation and blockchain integration to enhance transparency and reduce reconciliation times. Banks are adopting AI-driven analytics to optimize cross-border cash flow management and minimize foreign exchange risks associated with Nostro and Vostro accounts. Regulatory pressures are driving the development of standardized frameworks that improve security, compliance, and real-time reporting in correspondent banking operations.

Important Terms

Loro account

A Loro account is a third-party perspective account used by one bank to describe another bank's Nostro or Vostro account, facilitating international fund settlements and currency exchanges. While Nostro accounts represent a bank's holdings in foreign currency deposits at another bank, and Vostro accounts reflect the foreign bank's liabilities held at the domestic bank, Loro accounts serve as a reciprocal reference between these institutions.

Correspondent banking

Correspondent banking involves financial institutions maintaining Nostro and Vostro accounts to facilitate international transactions, where a Nostro account represents a bank's foreign currency account held abroad, and a Vostro account is a foreign bank's account held by the domestic bank. These accounts enable seamless cross-border payments, foreign exchange settlements, and liquidity management between correspondent banks.

Interbank settlement

Interbank settlement involves reconciling payments between banks using Nostro and Vostro accounts, where a Nostro account represents a bank's funds held in a foreign bank, and a Vostro account reflects foreign bank funds held within the domestic bank. Efficient management of these accounts ensures accurate tracking and clearing of international transactions, reducing settlement risks and enhancing liquidity management.

Foreign currency account

A foreign currency account enables businesses to hold and manage funds in multiple currencies, facilitating international trade and reducing exchange risks. Nostro accounts represent a bank's foreign currency deposits held in another bank, while Vostro accounts are the corresponding accounts that foreign banks hold with the domestic bank, enabling smooth cross-border transactions and currency settlements.

Mirror account

Mirror accounts replicate the balance of a Nostro account, which a bank holds in a foreign currency at another bank, enabling real-time reconciliation without physical currency transfer. In contrast, Vostro accounts represent the foreign bank's local currency deposits held on behalf of the domestic bank, facilitating cross-border settlements and currency exchanges.

SWIFT messaging

SWIFT messaging enables seamless communication for international banking transactions, where Nostro accounts represent a bank's funds held in a foreign currency at a correspondent bank, and Vostro accounts reflect the correspondent bank's funds held on behalf of the domestic bank. Accurate use of SWIFT MT messages, such as MT103 for payment instructions, ensures precise reconciliation between Nostro and Vostro accounts, facilitating efficient cross-border settlements.

Reconciliation

Reconciliation between Nostro and Vostro accounts involves matching the bank's records of foreign currency transactions (Nostro) with those maintained by the correspondent bank (Vostro) to ensure accuracy and consistency. This process detects discrepancies in balances, foreign exchange rates, or transaction details, facilitating accurate financial reporting and regulatory compliance for cross-border banking operations.

Cross-border transactions

Cross-border transactions rely on Nostro and Vostro accounts to facilitate international payments and settlements, where a Nostro account represents a bank's account held in a foreign currency at another bank, while a Vostro account corresponds to a foreign bank's account held by the domestic bank. Efficient management of these accounts ensures accurate currency exchange, reduces transaction risk, and enhances liquidity in global financial operations.

Ledger balances

Nostro accounts represent a bank's own funds held in a foreign bank, reflecting debit ledger balances, while Vostro accounts record foreign banks' funds held by the domestic bank, showing credit ledger balances. Accurate reconciliation of these ledger balances ensures precise tracking of cross-border transactions and maintains interbank trust.

Multicurrency clearing

Multicurrency clearing involves managing transactions across different currencies, leveraging Nostro and Vostro accounts to streamline foreign exchange settlements; Nostro accounts represent a bank's holdings in a foreign currency with a correspondent bank, while Vostro accounts denote the correspondent bank's liabilities held by the host bank in the domestic currency. Efficient use of these accounts facilitates real-time clearing, reduces settlement risk, and optimizes liquidity management in international banking operations.

Nostro account vs Vostro account Infographic

moneydif.com

moneydif.com