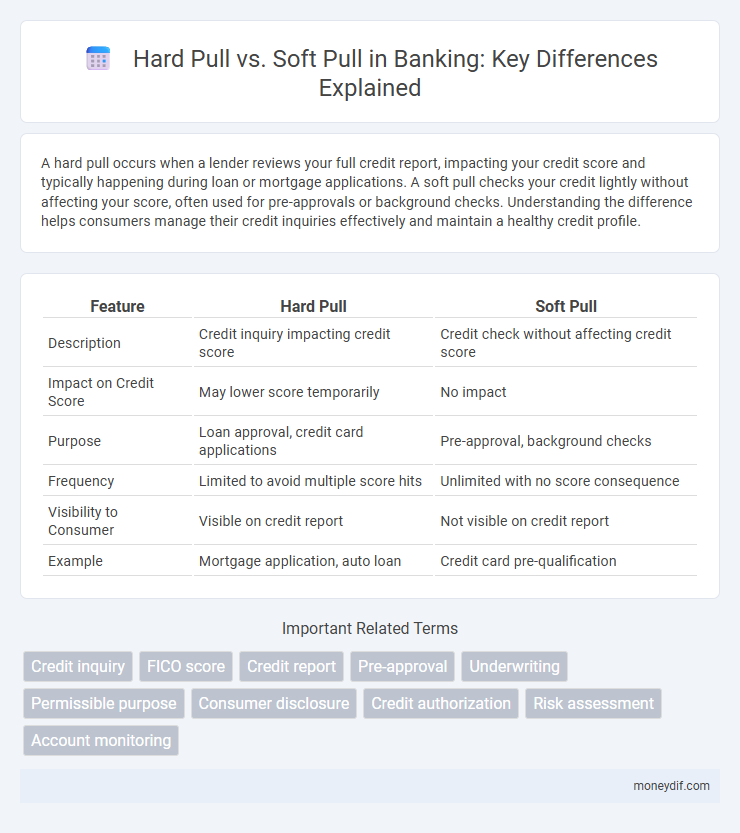

A hard pull occurs when a lender reviews your full credit report, impacting your credit score and typically happening during loan or mortgage applications. A soft pull checks your credit lightly without affecting your score, often used for pre-approvals or background checks. Understanding the difference helps consumers manage their credit inquiries effectively and maintain a healthy credit profile.

Table of Comparison

| Feature | Hard Pull | Soft Pull |

|---|---|---|

| Description | Credit inquiry impacting credit score | Credit check without affecting credit score |

| Impact on Credit Score | May lower score temporarily | No impact |

| Purpose | Loan approval, credit card applications | Pre-approval, background checks |

| Frequency | Limited to avoid multiple score hits | Unlimited with no score consequence |

| Visibility to Consumer | Visible on credit report | Not visible on credit report |

| Example | Mortgage application, auto loan | Credit card pre-qualification |

Understanding Hard Pulls and Soft Pulls in Banking

Hard pulls and soft pulls refer to different types of credit inquiries performed by banks during credit evaluations. A hard pull occurs when a bank requests your full credit report, impacting your credit score and typically used for loan or credit card applications. Soft pulls, on the other hand, do not affect your credit score and are often used for pre-approvals or background checks in banking.

Key Differences Between Hard and Soft Credit Inquiries

Hard credit inquiries occur when a lender reviews your credit report to make lending decisions, impacting your credit score and remaining on your report for up to two years. Soft credit pulls are used for background checks or pre-approvals, do not affect credit scores, and are visible only to the individual consumer. Understanding these distinctions helps consumers manage credit applications strategically to minimize negative effects on their credit health.

How Hard Pulls Affect Your Credit Score

Hard pulls occur when a lender checks your credit report as part of a loan or credit application, causing a temporary dip in your credit score, usually by a few points. Multiple hard inquiries within a short period, especially from different creditors, can signal higher credit risk to scoring models like FICO, potentially lowering your score further. Monitoring and minimizing hard pulls can help maintain a healthier credit profile, as opposed to soft pulls, which do not impact your credit score.

When Do Banks Use Soft Pulls?

Banks use soft pulls primarily during pre-qualification checks for credit cards, loan offers, or account upgrades, ensuring that the inquiry does not impact the applicant's credit score. Soft pulls typically occur when existing customers review their credit or when businesses perform background credit checks without issuing a formal application. These inquiries provide a snapshot of creditworthiness without signaling an active credit application to credit bureaus.

Implications of Hard Pulls for Loan Applications

Hard pulls on credit reports occur when a lender reviews your credit as part of a loan application, causing a temporary dip in your credit score by a few points for up to one year. Multiple hard inquiries within a short period, especially for similar loan types such as mortgages or auto loans, are often treated as a single event to minimize score impact. Frequent hard pulls can signal increased credit risk to lenders, potentially reducing approval chances or leading to higher interest rates.

Protecting Your Credit: Managing Soft Pulls

Managing soft pulls effectively protects your credit by ensuring multiple credit inquiries remain invisible to lenders, thus preventing any negative impact on your credit score. Soft pulls are typically used for pre-approvals, background checks, and account reviews, allowing consumers to shop around for the best banking products without risking credit damage. Monitoring your credit reports regularly helps identify unauthorized soft pulls, ensuring your credit remains secure and accurately reflects your financial behavior.

Common Scenarios for Hard Pulls in Banking

Hard pulls in banking commonly occur during credit card applications, mortgage approvals, and auto loans, where lenders assess a borrower's creditworthiness by accessing detailed credit reports. These inquiries generate a hard pull, which can slightly lower credit scores and remain visible to other lenders for up to two years. Major financial institutions carefully use hard pulls to evaluate risks before extending significant credit or loan products.

The Impact of Multiple Hard Pulls on Your Credit

Multiple hard pulls from credit inquiries can significantly lower your credit score, especially when they occur within a short period, indicating higher credit risk to lenders. Each hard inquiry typically reduces your score by a few points, and frequent checks may suggest financial distress or overextension. Soft pulls, by contrast, do not affect your credit score and are used for pre-approved offers or account reviews, making them preferable for routine credit assessments.

How to Check for Hard and Soft Pulls on Your Credit Report

To check for hard and soft pulls on your credit report, obtain a free credit report from major credit bureaus such as Equifax, Experian, or TransUnion. Hard inquiries, often triggered by loan or credit card applications, appear with lender names and impact credit scores, while soft inquiries, including pre-approved offers and personal credit checks, do not affect your score. Regularly reviewing these reports helps identify unauthorized hard pulls that might signal potential fraud or credit misuse.

Best Practices for Minimizing Negative Effects of Credit Inquiries

Soft pulls should be prioritized for pre-approval processes to avoid impacting credit scores, as they do not affect credit reports. Hard pulls, which occur during final loan approvals, should be minimized by grouping applications within a short timeframe, typically 14 to 45 days, to reduce multiple score hits. Consumers and lenders must monitor the frequency of hard inquiries and opt for prequalification options using soft pulls to maintain optimal credit health.

Important Terms

Credit inquiry

A hard pull credit inquiry temporarily lowers your credit score by being recorded on your credit report when applying for new credit, whereas a soft pull inquiry does not affect your score and is used primarily for background checks or pre-approved offers.

FICO score

A FICO score is only impacted by a hard pull, which occurs during credit applications, while soft pulls for background checks or pre-approvals do not affect the score.

Credit report

A credit report reflects your credit history and is impacted differently by hard pulls, which can lower your credit score, compared to soft pulls that do not affect your score.

Pre-approval

Pre-approval typically involves a hard pull on your credit report, which can impact your credit score, whereas soft pulls used for pre-qualification do not affect your credit rating.

Underwriting

Underwriting typically involves a hard pull on credit reports to assess risk accurately, while a soft pull is used for preliminary screening without affecting the applicant's credit score.

Permissible purpose

Permissible purpose under the Fair Credit Reporting Act (FCRA) dictates when a hard pull, which affects credit scores, or a soft pull, which does not impact credit scores, can legally be conducted for credit inquiries.

Consumer disclosure

Consumer disclosure requires lenders to clearly inform borrowers that a hard pull impacts credit scores, while a soft pull does not affect credit ratings or lending decisions.

Credit authorization

Credit authorization involves either a hard pull, which impacts credit scores and is used for loan approvals, or a soft pull, which does not affect scores and is typically used for pre-approvals or background checks.

Risk assessment

Risk assessment in credit evaluation differentiates between hard pull, which impacts credit scores by recording lender inquiries, and soft pull, which allows background checks without affecting credit ratings.

Account monitoring

Account monitoring using soft pulls preserves credit scores by only checking credit reports without lender notifications, while hard pulls impact credit scores due to detailed lender inquiries during credit applications.

Hard pull vs Soft pull Infographic

moneydif.com

moneydif.com