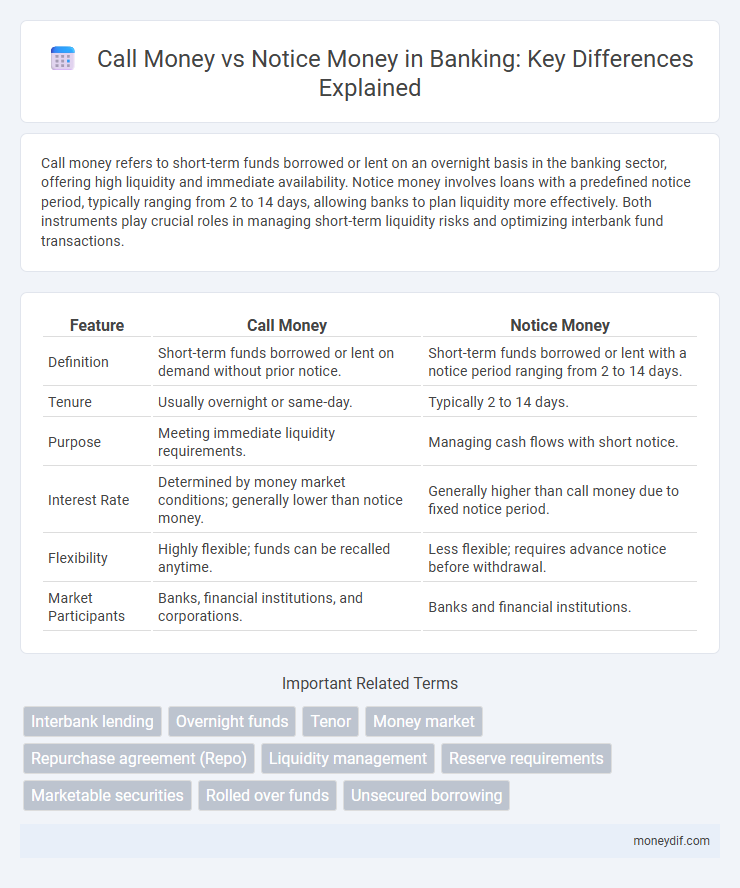

Call money refers to short-term funds borrowed or lent on an overnight basis in the banking sector, offering high liquidity and immediate availability. Notice money involves loans with a predefined notice period, typically ranging from 2 to 14 days, allowing banks to plan liquidity more effectively. Both instruments play crucial roles in managing short-term liquidity risks and optimizing interbank fund transactions.

Table of Comparison

| Feature | Call Money | Notice Money |

|---|---|---|

| Definition | Short-term funds borrowed or lent on demand without prior notice. | Short-term funds borrowed or lent with a notice period ranging from 2 to 14 days. |

| Tenure | Usually overnight or same-day. | Typically 2 to 14 days. |

| Purpose | Meeting immediate liquidity requirements. | Managing cash flows with short notice. |

| Interest Rate | Determined by money market conditions; generally lower than notice money. | Generally higher than call money due to fixed notice period. |

| Flexibility | Highly flexible; funds can be recalled anytime. | Less flexible; requires advance notice before withdrawal. |

| Market Participants | Banks, financial institutions, and corporations. | Banks and financial institutions. |

Understanding Call Money in Banking

Call money in banking refers to short-term funds lent or borrowed between financial institutions for one day, facilitating immediate liquidity management in the money market. It is highly liquid and has no predetermined maturity, allowing the lender to recall the funds at any time, which makes it crucial for meeting short-term cash requirements. Compared to notice money, which requires prior notice before repayment, call money offers more flexibility but typically carries higher interest rates due to the overnight risk.

What is Notice Money?

Notice Money refers to short-term funds lent or borrowed in the money market with a specified notice period before withdrawal, typically ranging from 2 to 14 days. Unlike Call Money, which can be recalled on the same day, Notice Money requires advance notice, offering more stability for lenders and a fixed time frame for borrowers. It is commonly used by banks and financial institutions to manage short-term liquidity needs while ensuring predictability in fund availability.

Key Differences Between Call Money and Notice Money

Call money refers to short-term funds borrowed or lent for one day, offering high liquidity and typically used for interbank transactions. Notice money involves borrowing or lending funds for a period between 2 to 14 days, requiring a notice before repayment, making it less liquid than call money but more stable. Both instruments are essential in the money market for managing short-term liquidity, with notice money providing a slightly longer horizon and fixed term compared to the overnight nature of call money.

Importance of Call Money in Interbank Lending

Call money plays a crucial role in interbank lending by providing instant liquidity for banks needing overnight funds, enabling smooth settlement of payments and efficient cash management. Unlike notice money, which requires prior notice before withdrawal, call money offers immediate access, facilitating rapid response to short-term liquidity demands. This liquidity mechanism helps maintain stability in the banking system and influences short-term interest rates in the money market.

Notice Money: Role and Features

Notice money plays a crucial role in the interbank market by facilitating short-term borrowing with a predefined notice period, typically ranging from 2 to 14 days. This instrument provides financial institutions with flexible liquidity management options, offering interest rates that generally fall between call money and term deposits. Notice money transactions enhance stability in the overnight funds market by allowing banks to plan liquidity needs in advance while maintaining access to funds with short notice.

Tenure and Maturity: Call Money vs Notice Money

Call money refers to short-term funds borrowed or lent for a very brief period, typically ranging from one day to fourteen days, and can be recalled by the lender at any time. Notice money involves lending or borrowing funds for a period longer than call money, generally from 2 to 14 days, with the borrower required to give a prior notice of repayment. The key distinction lies in tenure flexibility: call money has no fixed maturity and can be demanded instantly, whereas notice money requires advance notice before maturity, offering a slightly longer and more predictable time frame.

Interest Rates: How Call and Notice Money Differ

Call money interest rates are typically more volatile and fluctuate daily based on short-term liquidity demands among banks, often reflecting immediate funding needs. Notice money interest rates are generally higher and more stable, set for fixed periods ranging from 2 to 14 days, compensating lenders for the advance notice before funds must be returned. This distinction in interest rates illustrates the trade-off between liquidity flexibility in call money and assured, short-term lending duration in notice money markets.

Participants in Call and Notice Money Markets

Call money markets primarily involve banks and financial institutions borrowing and lending funds for very short durations, often overnight, facilitating liquidity management. Notice money markets extend to similar participants but include non-bank entities such as mutual funds and corporate treasuries, with transactions featuring longer notice periods typically ranging from 2 to 14 days. The active participation of scheduled commercial banks, cooperative banks, mutual funds, and financial intermediaries ensures efficient short-term fund allocation in both markets.

Risks and Benefits of Call Money and Notice Money

Call money offers high liquidity with same-day settlement, benefiting banks needing overnight funds but carries the risk of sudden rate fluctuations impacting short-term borrowing costs. Notice money requires a minimum notice period before withdrawal, providing slightly higher interest rates and reducing the risk of abrupt fund recall, but limits immediate access to funds. Both instruments serve interbank lending needs, balancing liquidity management against interest rate exposure and operational flexibility.

Regulatory Framework Governing Short-Term Funds

Call money and notice money are integral components of the banking regulatory framework governing short-term funds, governed primarily by central bank guidelines such as those from the Reserve Bank of India (RBI). Call money, typically repayable on demand with maturities up to one day, is subject to stringent liquidity ratios and exposure limits to ensure systemic stability. Notice money, with maturities ranging from 2 to 14 days, must comply with prescribed limits on interbank lending and borrowing, maintaining transparency and risk mitigation within the short-term funds market.

Important Terms

Interbank lending

Interbank lending involves short-term funds transfer between banks where call money refers to overnight loans repayable on demand, while notice money requires advance notice of 1 to 14 days before repayment.

Overnight funds

Overnight funds are short-term borrowings settled the next day, positioned between call money--which has no fixed tenure and can be recalled immediately--and notice money, which requires a minimum notice period of 2 to 14 days before repayment.

Tenor

Tenor in call money markets refers to the shortest borrowing period often overnight, whereas in notice money markets it ranges from 2 to 14 days, defining the fixed duration borrowers must notify lenders prior to repayment.

Money market

Call money is a short-term loan repayable on demand in the money market, whereas notice money requires a predetermined notice period before repayment, typically ranging from 2 to 14 days.

Repurchase agreement (Repo)

Repurchase agreements (Repos) are short-term borrowing instruments often compared to call money and notice money in money markets, where call money is a one-day unsecured loan and notice money requires prior notice for repayment, making repos secured transactions with defined collateral unlike the typically unsecured call and notice money loans.

Liquidity management

Effective liquidity management requires balancing call money's overnight borrowing flexibility with notice money's short-term stability to optimize cash flow and minimize interest costs.

Reserve requirements

Reserve requirements influence banks' reliance on call money for overnight liquidity and notice money for short-term funding beyond one day, impacting interbank borrowing strategies.

Marketable securities

Marketable securities serve as collateral in the call money and notice money markets, where call money involves overnight loans and notice money refers to short-term loans with a notice period typically ranging from 2 to 14 days.

Rolled over funds

Rolled over funds in call money markets represent overnight lending extended daily, whereas notice money involves loans with a fixed maturity between 2 to 14 days, impacting liquidity management and interest rate dynamics.

Unsecured borrowing

Unsecured borrowing in call money involves short-term funds borrowed on an overnight basis with no collateral, typically used for immediate liquidity needs, whereas notice money requires a prior notice period, usually ranging from 2 to 14 days, offering slightly longer-term unsecured funding. The call money market facilitates instant borrowing and lending among banks and financial institutions, while notice money allows for planned, short-term financing with agreed notice, impacting liquidity management and interest rate determination in the interbank market.

Call money vs Notice money Infographic

moneydif.com

moneydif.com