Retail banking vs. Corporate banking focuses on individual consumers compared to businesses, offering services like personal loans versus commercial credit. Savings accounts vs. Checking accounts differ in purpose, with savings designed for earning interest and checking for daily transactions. Fixed-rate mortgages vs. Adjustable-rate mortgages vary in interest stability, providing consistent payments versus fluctuating rates based on market conditions.

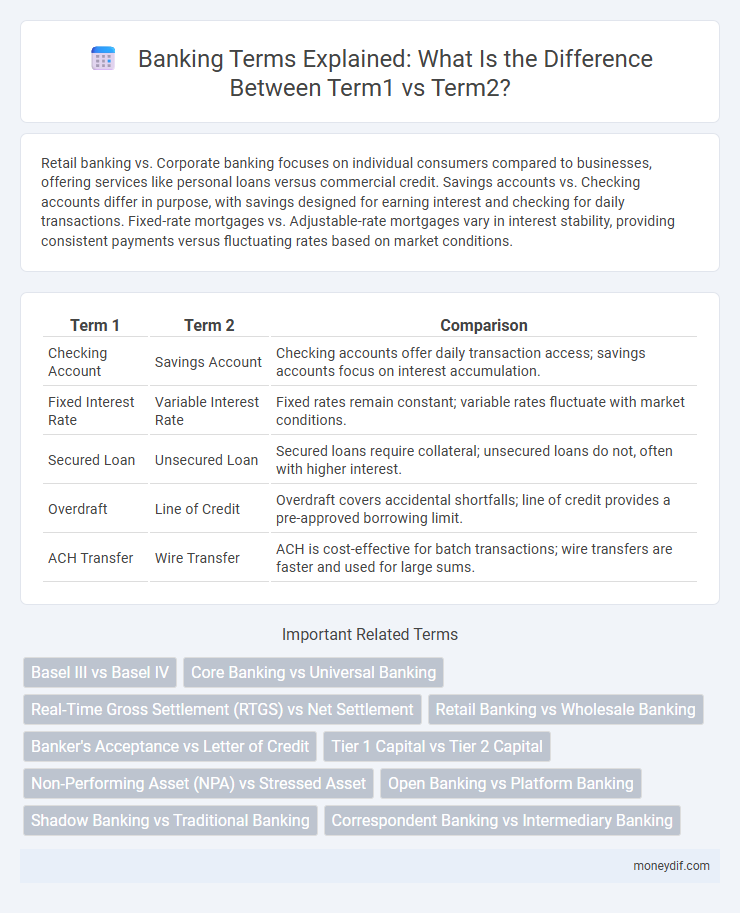

Table of Comparison

| Term 1 | Term 2 | Comparison |

|---|---|---|

| Checking Account | Savings Account | Checking accounts offer daily transaction access; savings accounts focus on interest accumulation. |

| Fixed Interest Rate | Variable Interest Rate | Fixed rates remain constant; variable rates fluctuate with market conditions. |

| Secured Loan | Unsecured Loan | Secured loans require collateral; unsecured loans do not, often with higher interest. |

| Overdraft | Line of Credit | Overdraft covers accidental shortfalls; line of credit provides a pre-approved borrowing limit. |

| ACH Transfer | Wire Transfer | ACH is cost-effective for batch transactions; wire transfers are faster and used for large sums. |

Retail Banking vs Corporate Banking

Retail banking serves individual consumers with services such as savings accounts, personal loans, and credit cards, while corporate banking caters to businesses offering tailored solutions like commercial loans, treasury management, and asset financing. Retail banking emphasizes high-volume, low-value transactions, whereas corporate banking deals with high-value, complex financial activities. Both sectors rely on digital platforms but differ significantly in risk assessment and regulatory compliance requirements.

Digital Banking vs Traditional Banking

Digital banking leverages online platforms and mobile apps to offer real-time transaction processing, 24/7 access, and personalized financial services, contrasting with traditional banking that relies on physical branch visits and paper-based records. Security protocols in digital banking emphasize encryption and biometric authentication, while traditional banking focuses on in-person verification and physical safeguards. Cost efficiency is higher in digital banking due to reduced overhead costs and automated processes, whereas traditional banking incurs expenses related to branch maintenance and manual operations.

Neobank vs Challenger Bank

Neobank vs Challenger Bank highlights key differences in digital banking innovation; Neobanks operate entirely online without physical branches, offering seamless mobile experiences and lower fees, while Challenger Banks combine digital platforms with limited physical presence to compete with traditional banks. Neobanks like Chime focus on user-friendly apps and streamlined services targeting tech-savvy customers, whereas Challenger Banks like Monzo provide more comprehensive banking features and regulatory licenses. Both aim to disrupt traditional banking models but differ in scale, operational structure, and regulatory approach.

Fixed Deposit vs Recurring Deposit

Fixed Deposit (FD) offers a lump-sum investment with a fixed interest rate and tenure, providing higher returns compared to a Recurring Deposit (RD) which involves monthly contributions over a period. FD typically suits investors seeking capital growth with minimal liquidity, while RD favors disciplined savers aiming to build savings incrementally. Both instruments are integral to retail banking, catering to varying risk appetites and financial goals.

Overdraft vs Line of Credit

Overdraft and line of credit are both forms of short-term borrowing but differ significantly in usage and structure; overdraft allows account holders to withdraw beyond their account balance up to a set limit, often with higher interest rates and fees. A line of credit provides a predetermined borrowing limit with flexible access to funds, typically featuring lower interest rates and periodic repayment terms. Banks use overdrafts mainly for covering short-term liquidity gaps, while lines of credit serve ongoing financing needs with broader credit assessment criteria.

SWIFT Transfer vs ACH Transfer

SWIFT Transfer involves international bank-to-bank communication via the Society for Worldwide Interbank Financial Telecommunication network, enabling cross-border payments with high security and standardized messaging protocols. ACH Transfer operates within domestic borders through the Automated Clearing House network, facilitating batch-processed, low-cost electronic payments such as payroll and bill payments. The primary distinctions lie in geographical scope, processing speed, and transaction fees, with SWIFT suited for global transfers and ACH optimized for local, bulk transactions.

Savings Account vs Current Account

Savings accounts offer interest earnings on deposited funds, typically designed for long-term saving goals with limited transaction capabilities. Current accounts provide high liquidity and facilitate frequent transactions without interest, primarily catering to businesses or individuals requiring regular access to funds. Understanding the differences in interest rates, transaction limits, and intended usage helps optimize financial management between Savings Account vs Current Account options.

Credit Union vs Commercial Bank

Credit Union vs Commercial Bank represents two distinct financial institutions with unique structures and purposes; credit unions are member-owned, nonprofit organizations focused on serving their members with lower fees and better interest rates, whereas commercial banks are for-profit entities aiming to maximize shareholder value with a broader range of services. Credit unions often provide personalized customer service and community-oriented lending, while commercial banks offer extensive branch networks, advanced technology platforms, and higher lending limits. Understanding the differences in governance, profit distribution, and service scope is crucial for consumers choosing between credit unions and commercial banks.

Secured Loan vs Unsecured Loan

Secured loans require collateral such as property or assets, reducing risk for lenders and often resulting in lower interest rates. Unsecured loans do not require collateral, leading to higher interest rates due to increased lender risk and stricter credit qualification criteria. Borrowers with strong credit profiles typically access unsecured loans, while those needing larger sums or better terms often opt for secured loans.

Mobile Banking vs Internet Banking

Mobile Banking offers real-time access to banking services via smartphones using dedicated apps or SMS, emphasizing convenience and mobility. Internet Banking requires a web browser interface on any internet-enabled device, providing a wider range of comprehensive financial services and detailed account management. Security protocols differ slightly, with Mobile Banking often integrating biometric authentication, while Internet Banking relies heavily on multi-factor authentication and robust encryption.

Important Terms

Basel III vs Basel IV

Basel III strengthens bank capital requirements and introduces leverage and liquidity ratios to enhance financial stability, while Basel IV refines these standards by tightening risk-weighted asset calculations and revising credit risk, operational risk, and market risk approaches. Basel IV's adjustments aim to reduce variability in risk assessment models, promoting a more consistent and resilient banking framework globally.

Core Banking vs Universal Banking

Core banking focuses on centralized processing of retail banking transactions like deposits, withdrawals, and loan management, enabling real-time updates across branches. Universal banking integrates core banking functions with investment services, insurance, and asset management, providing a comprehensive financial solution under one institution.

Real-Time Gross Settlement (RTGS) vs Net Settlement

Real-Time Gross Settlement (RTGS) processes transactions individually and instantly, ensuring immediate and final settlement which minimizes credit risk, while Net Settlement aggregates multiple transactions to be settled at specific intervals, optimizing liquidity but potentially increasing settlement risk. RTGS is preferred for high-value, time-sensitive payments, whereas Net Settlement suits low-value, bulk transactions requiring cost efficiency.

Retail Banking vs Wholesale Banking

Retail banking focuses on individual consumers with services such as savings accounts, personal loans, and mortgages, while wholesale banking targets corporate clients, offering products like large-scale loans, treasury management, and underwriting. Retail banking emphasizes high-volume, low-value transactions, contrasting with wholesale banking's low-volume, high-value dealings and specialized financial solutions.

Banker's Acceptance vs Letter of Credit

Banker's Acceptance vs Letter of Credit: Banker's Acceptance is a short-term debt instrument issued by a firm and guaranteed by a bank, primarily used in international trade financing to ensure payment at a future date. Letter of Credit is a bank's commitment to pay a seller on behalf of a buyer, providing a secure payment mechanism that reduces risk in cross-border transactions.

Tier 1 Capital vs Tier 2 Capital

Tier 1 capital, also known as core capital, primarily includes common equity and disclosed reserves, serving as a fundamental measure of a bank's financial strength and ability to absorb losses. Tier 2 capital, or supplementary capital, encompasses items like revaluation reserves, hybrid instruments, and subordinated debt, providing additional buffer but considered less secure compared to Tier 1 capital.

Non-Performing Asset (NPA) vs Stressed Asset

Non-Performing Assets (NPAs) are loans or advances where the borrower has failed to make interest or principal repayments for 90 days or more, directly impacting a bank's asset quality and profitability. Stressed Assets encompass NPAs as well as restructured loans and certain special mention accounts (SMAs), indicating broader financial distress but not necessarily complete default.

Open Banking vs Platform Banking

Open Banking enables third-party providers to access bank customers' financial data through APIs, fostering innovation in financial services and enhancing customer control. Platform Banking extends this concept by integrating multiple financial services and partners within a unified digital ecosystem, offering seamless customer experiences and diversified product offerings.

Shadow Banking vs Traditional Banking

Shadow banking operates without the stringent regulatory oversight that governs traditional banking, enabling faster credit creation but increasing systemic risks. Traditional banking relies on depositor funds and central bank regulations, emphasizing stability and consumer protection through insured deposits and capital requirements.

Correspondent Banking vs Intermediary Banking

Correspondent banking involves direct relationships between two banks to facilitate cross-border transactions, while intermediary banking uses a third-party bank to process payments between the originating and beneficiary banks. Correspondent banking is typically preferred for established, high-volume corridors, whereas intermediary banking provides flexibility in complex or less frequent international settlements.

Sure, here’s a list of niche banking terms in a “term1 vs term2” format: Infographic

moneydif.com

moneydif.com