A soft credit pull occurs when an individual's credit is checked without impacting their credit score, commonly used for pre-approvals or background checks. In contrast, a hard credit pull takes place during serious credit applications such as loans or mortgages and can slightly lower credit scores due to the detailed inquiry. Understanding the difference between soft and hard credit pulls helps customers manage their credit health while navigating banking offers and approvals.

Table of Comparison

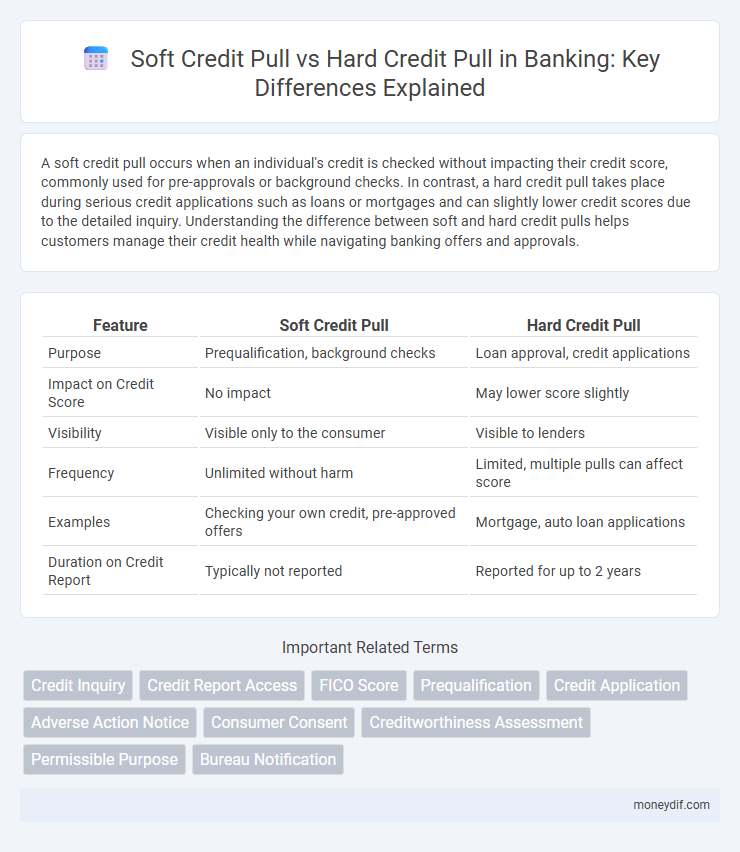

| Feature | Soft Credit Pull | Hard Credit Pull |

|---|---|---|

| Purpose | Prequalification, background checks | Loan approval, credit applications |

| Impact on Credit Score | No impact | May lower score slightly |

| Visibility | Visible only to the consumer | Visible to lenders |

| Frequency | Unlimited without harm | Limited, multiple pulls can affect score |

| Examples | Checking your own credit, pre-approved offers | Mortgage, auto loan applications |

| Duration on Credit Report | Typically not reported | Reported for up to 2 years |

Understanding Soft Credit Pulls in Banking

Soft credit pulls refer to credit inquiries that do not impact an individual's credit score, commonly used by banks for pre-approval offers, account reviews, or background checks. Unlike hard credit pulls, soft inquiries are not visible to lenders and do not affect creditworthiness assessments. Understanding the difference helps consumers manage their credit reports and avoid unnecessary score reductions during routine banking evaluations.

What Is a Hard Credit Pull?

A hard credit pull occurs when a lender or financial institution reviews a consumer's full credit report as part of a credit application process, impacting the credit score. This inquiry is typically initiated during applications for mortgages, car loans, or credit cards, signaling active credit seeking behavior. Hard credit pulls remain on a credit report for up to two years, but their effect on the credit score generally diminishes after a few months.

Key Differences Between Soft and Hard Credit Pulls

Soft credit pulls do not impact credit scores and are typically used for pre-approvals, background checks, or account reviews, while hard credit pulls affect credit scores and occur during loan applications or new credit account requests. Soft inquiries are visible only to the individual and do not signal new credit seeking to lenders, whereas hard inquiries are recorded on credit reports and indicate credit-seeking behavior, potentially lowering credit scores temporarily. Understanding these distinctions helps consumers manage their credit profiles strategically and avoid unnecessary credit score impacts during financial decision-making.

How Soft Pulls Impact Your Credit Score

Soft credit pulls occur when lenders or individuals check your credit report without your explicit permission, typically for pre-approval offers or background checks. These inquiries do not impact your credit score because they do not indicate a new credit risk or application. Maintaining a high credit score relies on limiting hard pulls, while soft pulls provide a way to monitor credit without harming your creditworthiness.

Effects of Hard Pulls on Credit Profiles

Hard credit pulls significantly impact credit scores by causing a temporary decrease, typically between 5 to 10 points, and remain on credit reports for up to two years. Multiple hard inquiries within a short period can amplify negative effects, signaling higher credit risk to lenders and potentially lowering approval chances. Hard pulls differ from soft pulls, which do not affect credit scores and are used primarily for background checks or pre-approvals.

Common Banking Situations for Soft Credit Checks

Soft credit pulls occur in common banking situations such as pre-approved credit card offers, account reviews, and loan prequalification processes, allowing banks to assess creditworthiness without impacting the applicant's credit score. These soft inquiries enable financial institutions to streamline customer service by providing personalized product recommendations and risk management strategies. Unlike hard credit pulls, which happen during final loan approvals or credit applications, soft credit checks do not affect credit reports and maintain consumer privacy during initial financial evaluations.

When Banks Use Hard Credit Inquiries

Banks use hard credit inquiries primarily when evaluating credit applications for loans, credit cards, or mortgages, as these checks provide a comprehensive view of a borrower's creditworthiness. Hard credit pulls impact credit scores by signaling active credit seeking to credit bureaus, which lenders consider when assessing risk. This type of inquiry helps banks make informed lending decisions and manage portfolio risks effectively.

Pros and Cons of Soft versus Hard Credit Pulls

Soft credit pulls perform a non-intrusive check on a borrower's credit, causing no impact on credit scores and allowing lenders to prequalify applicants efficiently. Hard credit pulls provide a thorough evaluation necessary for loan approvals but can temporarily lower credit scores and remain on credit reports for up to two years. Choosing between soft and hard pulls depends on balancing the need for accurate credit assessment with minimizing credit score impact.

How to Minimize the Impact of Hard Credit Checks

To minimize the impact of hard credit checks, limit the number of loan or credit applications within a short timeframe to reduce multiple inquiries on your credit report. Use prequalification or soft credit pulls to assess creditworthiness without affecting credit scores. Regularly monitor your credit report to identify and dispute any unauthorized hard inquiries, ensuring an accurate credit profile.

Soft vs. Hard Credit Pull: Which Matters More for Loan Approval?

Soft credit pulls allow lenders to review a borrower's credit report without impacting their credit score, often used for pre-approval or prequalification purposes. Hard credit pulls occur when a borrower formally applies for credit, potentially lowering their credit score slightly due to increased risk exposure. For loan approval, hard credit pulls carry more weight as they indicate a serious application, directly influencing lending decisions and interest rate offers.

Important Terms

Credit Inquiry

A soft credit pull, often used for pre-approval or background checks, does not impact your credit score, while a hard credit pull occurs during loan or credit applications and can temporarily lower your credit rating. Monitoring the number of hard inquiries is crucial, as multiple hard credit pulls within a short period may signal risk to lenders and affect your creditworthiness.

Credit Report Access

Credit report access differs between soft credit pulls, which do not impact credit scores and are typically used for pre-approvals or personal checks, and hard credit pulls that occur during loan or credit card applications, potentially lowering credit scores by a few points. Lenders rely on hard credit inquiries to assess creditworthiness, whereas consumers can monitor their credit reports through soft pulls without affecting their credit history.

FICO Score

A FICO Score is influenced differently by soft and hard credit pulls, where soft inquiries do not impact the score and are typically used for pre-approved offers or personal credit checks, while hard inquiries occur during loan or credit applications and can slightly lower the score temporarily. Monitoring credit with soft pulls helps maintain a stable FICO Score, whereas multiple hard pulls within a short period can signal higher risk and reduce the creditworthiness in scoring models.

Prequalification

Prequalification involves a soft credit pull that does not impact the applicant's credit score, allowing lenders to provide estimated loan terms based on a preliminary review of credit information. In contrast, a hard credit pull occurs during the actual application process, significantly affecting the credit score and reflecting a formal credit inquiry by potential lenders.

Credit Application

A credit application typically involves either a soft credit pull or a hard credit pull, with soft inquiries used for pre-approvals and do not affect credit scores, while hard inquiries occur during formal loan or credit requests and can temporarily lower credit scores. Understanding the difference between soft and hard credit pulls is essential for managing credit health and applying for loans strategically.

Adverse Action Notice

An Adverse Action Notice is required by the Fair Credit Reporting Act when a lender denies credit based on information from a hard credit pull, which impacts the consumer's credit score, whereas a soft credit pull, used for pre-qualification or background checks, does not affect credit scores and does not typically trigger an Adverse Action Notice. Understanding the distinction between soft and hard credit inquiries is crucial for consumers to manage their credit profile and anticipate when an Adverse Action Notice may be issued.

Consumer Consent

Consumer consent is mandatory before conducting a hard credit pull, which significantly impacts credit scores by recording an inquiry on the consumer's credit report; soft credit pulls, however, occur without explicit consent and do not affect credit scores or appear to lenders. Understanding the difference between these credit check types is crucial for consumers managing their credit health and controlling access to their credit information.

Creditworthiness Assessment

Creditworthiness assessment often involves either a soft credit pull, which checks credit reports without impacting credit scores, or a hard credit pull, which can lower credit scores by signaling active credit seeking. Soft pulls are typically used for pre-approval and background checks, while hard pulls occur during formal loan applications or credit card approvals, directly influencing lenders' decisions based on credit risk.

Permissible Purpose

Permissible Purpose under the Fair Credit Reporting Act (FCRA) allows businesses to perform soft credit pulls, such as pre-approval offers, which do not impact credit scores, whereas hard credit pulls occur with explicit consumer consent for applications like loans and can lower credit ratings. Understanding the distinction ensures compliance and protects consumers' credit standing during credit inquiries.

Bureau Notification

Bureau notifications distinguish between soft credit pulls, which do not impact credit scores and are used for pre-approvals or background checks, and hard credit pulls, which affect credit scores and occur during credit applications like loans or mortgages. Accurate categorization in bureau notifications ensures proper credit reporting and influences lending decisions and credit score calculations.

Soft credit pull vs Hard credit pull Infographic

moneydif.com

moneydif.com