Correspondent banks hold accounts for other banks to facilitate international transactions, providing essential services such as payment processing and currency exchange. Intermediary banks act as middlemen in the payment chain when the sender's bank does not have a direct relationship with the recipient's bank. Understanding the roles of both correspondent and intermediary banks is crucial for efficient cross-border fund transfers and minimizing transaction delays.

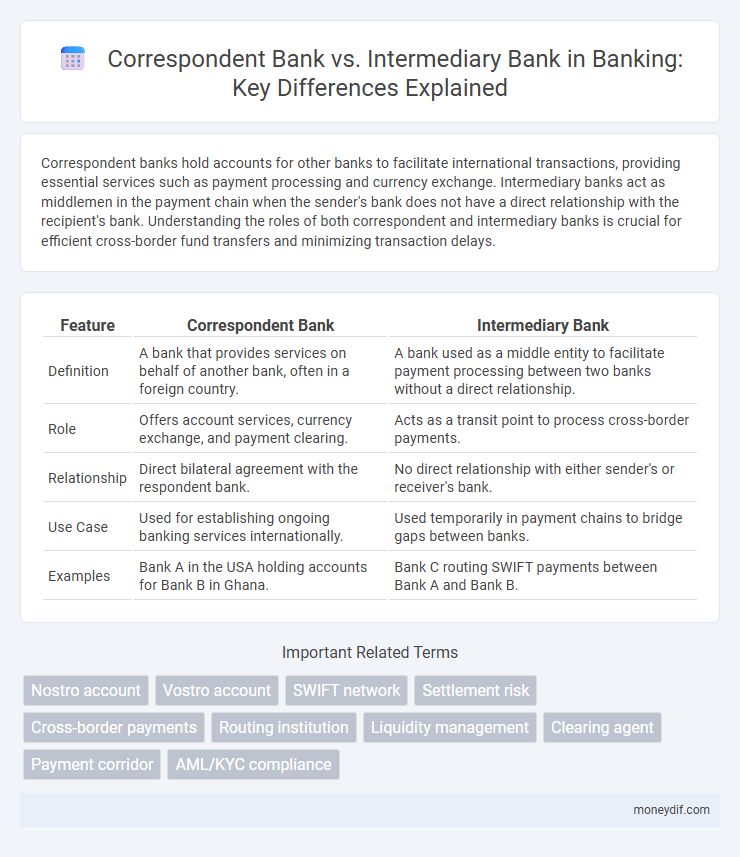

Table of Comparison

| Feature | Correspondent Bank | Intermediary Bank |

|---|---|---|

| Definition | A bank that provides services on behalf of another bank, often in a foreign country. | A bank used as a middle entity to facilitate payment processing between two banks without a direct relationship. |

| Role | Offers account services, currency exchange, and payment clearing. | Acts as a transit point to process cross-border payments. |

| Relationship | Direct bilateral agreement with the respondent bank. | No direct relationship with either sender's or receiver's bank. |

| Use Case | Used for establishing ongoing banking services internationally. | Used temporarily in payment chains to bridge gaps between banks. |

| Examples | Bank A in the USA holding accounts for Bank B in Ghana. | Bank C routing SWIFT payments between Bank A and Bank B. |

Introduction to Correspondent Banks and Intermediary Banks

Correspondent banks act as agents that provide services on behalf of another bank, facilitating international transactions and foreign exchange operations. Intermediary banks serve as middlemen in payment chains, especially when no direct relationship exists between the sender's bank and the recipient's bank. Both institutions are crucial in cross-border banking, enabling seamless transfer of funds and efficient communication within the global financial network.

Defining Correspondent Banking

Correspondent banking involves a financial institution providing services on behalf of another bank, especially in foreign countries, to facilitate international transactions. These banks maintain accounts with one another, enabling the seamless transfer of funds across borders and offering services such as payment processing, foreign exchange, and trade finance. Correspondent banks act as crucial intermediaries in the global banking network, bridging gaps between domestic banks and foreign markets.

Understanding Intermediary Banking

Intermediary banks act as a middle layer between the sender's bank and the recipient's bank in international transactions, facilitating the transfer of funds when a direct account relationship does not exist. Unlike correspondent banks, which maintain bilateral accounts allowing for direct transactions, intermediary banks handle the routing and processing of payments through the global banking network. Understanding intermediary banking is crucial for managing cross-border payments efficiently, minimizing delays and ensuring regulatory compliance.

Key Differences Between Correspondent and Intermediary Banks

Correspondent banks maintain direct accounts with each other, facilitating international transactions by providing services such as foreign exchange and payment processing, while intermediary banks act as middlemen when no direct relationship exists between the sender and recipient banks. Correspondent banks hold deposits for other banks, enabling seamless cross-border settlements, whereas intermediary banks route payments through the correspondent network, often adding fees and processing time. The primary difference lies in the direct account relationship correspondent banks have with one another, contrasted with intermediary banks' role in bridging gaps in the absence of such direct connections.

Roles and Functions in Cross-Border Transactions

Correspondent banks facilitate international payments by maintaining accounts for foreign banks, enabling seamless currency exchange and settlement in cross-border transactions. Intermediary banks act as conduits when no direct relationship exists between the sender's and receiver's banks, ensuring the secure and efficient transfer of funds through the global banking network. Both play crucial roles in mitigating risks and speeding up international money transfers by bridging gaps between domestic and foreign financial institutions.

Importance in International Payment Systems

Correspondent banks play a crucial role in international payment systems by maintaining accounts and providing services for foreign banks, enabling smooth cross-border transactions and currency exchanges. Intermediary banks facilitate the transfer of funds between the originating and beneficiary banks when no direct relationship exists, ensuring payments pass through the global financial network efficiently. Both correspondent and intermediary banks are vital for reducing transaction delays, mitigating risks, and supporting the liquidity necessary for seamless international trade and remittances.

Compliance and Regulatory Considerations

Correspondent banks maintain direct relationships with foreign banks and are fully responsible for compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, ensuring transactions meet all regulatory guidelines. Intermediary banks act as facilitators in the payment chain without a direct relationship to the originator or beneficiary, necessitating stringent due diligence to prevent regulatory breaches and mitigate risks of illicit transactions. Both entities must implement robust compliance frameworks to adhere to international sanctions, regulatory reporting requirements, and risk management protocols in cross-border banking operations.

Risks and Challenges for Correspondent and Intermediary Banks

Correspondent banks face risks such as regulatory compliance challenges, including anti-money laundering (AML) and counter-terrorism financing (CTF) requirements, which can lead to hefty penalties if not properly managed. Intermediary banks encounter risks related to transaction delays and errors due to reliance on multiple parties, increasing operational complexity and potential payment failures. Both types of banks must address challenges in transparency and due diligence to mitigate fraud, reputational damage, and financial losses.

Future Trends in International Banking Relationships

Future trends in international banking relationships emphasize the growing role of digital platforms, potentially reducing reliance on traditional correspondent and intermediary banks by enabling direct cross-border payments and blockchain-based settlements. Innovations in fintech and regulatory frameworks are driving increased transparency and efficiency, diminishing costs and processing times historically imposed by intermediary banks. As banks adopt APIs and real-time payment systems, correspondent banking networks will evolve to support seamless integration, fostering faster, more secure global transactions.

Choosing the Right Banking Partner for Global Transactions

Selecting the right banking partner for global transactions hinges on understanding the distinct roles of correspondent and intermediary banks. Correspondent banks maintain ongoing relationships and provide services such as account management and payment handling for foreign banks, thereby facilitating international trade and remittances. Intermediary banks act as chain links in the payment process, especially when no direct correspondent relationship exists, ensuring secure and efficient funds transfer across different banking networks.

Important Terms

Nostro account

A Nostro account is maintained by a bank with a Correspondent bank to facilitate direct international transactions, while an Intermediary bank acts as a third-party financial institution to route payments when no direct correspondent relationship exists.

Vostro account

A Vostro account is maintained by a correspondent bank on behalf of a domestic bank, enabling international transactions that may involve an intermediary bank to facilitate cross-border fund transfers.

SWIFT network

The SWIFT network facilitates international transactions by securely connecting correspondent banks, which have direct bilateral relationships, and intermediary banks that act as middlemen to route payments when no direct correspondence exists.

Settlement risk

Settlement risk arises when a correspondent bank processes transactions on behalf of a client through an intermediary bank, potentially causing delays or payment failures due to lack of synchronized settlement timing.

Cross-border payments

Correspondent banks establish direct payment relationships for cross-border transactions, while intermediary banks act as middle agents facilitating transfers when no direct correspondent relationship exists.

Routing institution

A routing institution ensures accurate transaction processing by directing payments either through a correspondent bank, which maintains accounts for other banks, or through an intermediary bank that facilitates transfers when no direct relationship exists.

Liquidity management

Liquidity management between correspondent banks and intermediary banks involves optimizing fund availability and settlement times to ensure efficient cross-border payment processing and minimize liquidity costs.

Clearing agent

A clearing agent facilitates fund transfers by coordinating with correspondent banks that maintain accounts for foreign banks and intermediary banks that act as third-party facilitators in multi-bank payment chains.

Payment corridor

A payment corridor involving correspondent banks facilitates direct cross-border transactions by maintaining bilateral accounts, whereas intermediary banks act as third-party facilitators within the payment chain to route funds between banks without direct relationships.

AML/KYC compliance

Correspondent banks directly maintain accounts for foreign banks facilitating international transactions, while intermediary banks serve as middlemen processing payments between correspondent and beneficiary banks to ensure AML/KYC compliance.

Correspondent bank vs Intermediary bank Infographic

moneydif.com

moneydif.com