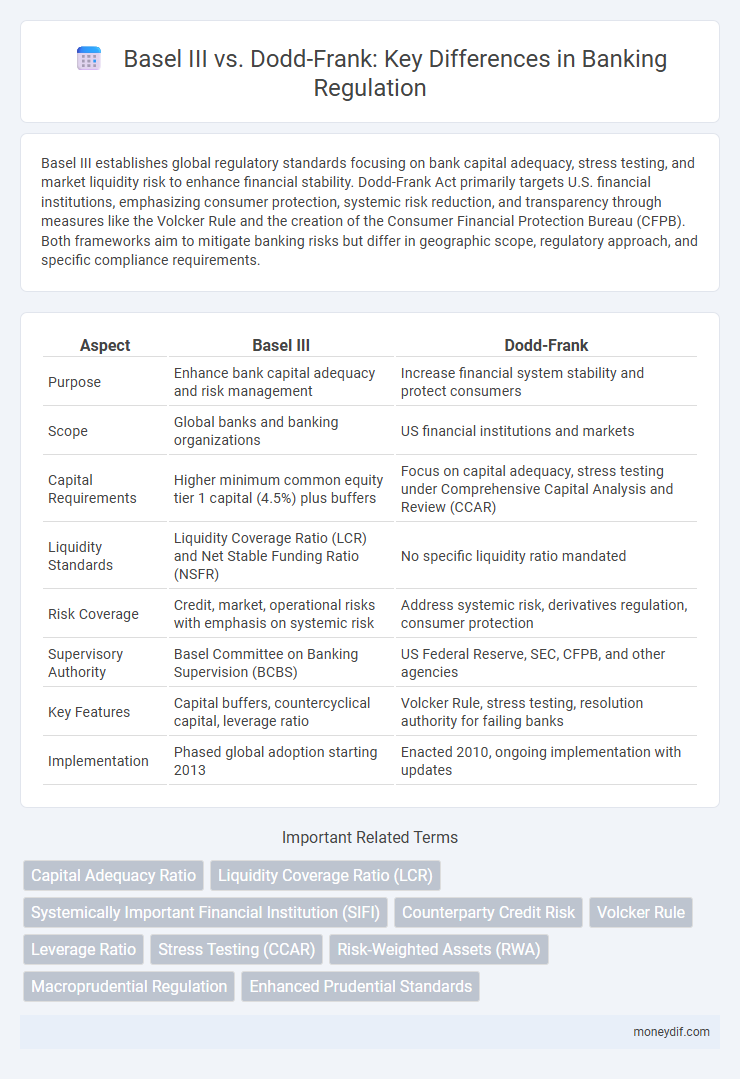

Basel III establishes global regulatory standards focusing on bank capital adequacy, stress testing, and market liquidity risk to enhance financial stability. Dodd-Frank Act primarily targets U.S. financial institutions, emphasizing consumer protection, systemic risk reduction, and transparency through measures like the Volcker Rule and the creation of the Consumer Financial Protection Bureau (CFPB). Both frameworks aim to mitigate banking risks but differ in geographic scope, regulatory approach, and specific compliance requirements.

Table of Comparison

| Aspect | Basel III | Dodd-Frank |

|---|---|---|

| Purpose | Enhance bank capital adequacy and risk management | Increase financial system stability and protect consumers |

| Scope | Global banks and banking organizations | US financial institutions and markets |

| Capital Requirements | Higher minimum common equity tier 1 capital (4.5%) plus buffers | Focus on capital adequacy, stress testing under Comprehensive Capital Analysis and Review (CCAR) |

| Liquidity Standards | Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) | No specific liquidity ratio mandated |

| Risk Coverage | Credit, market, operational risks with emphasis on systemic risk | Address systemic risk, derivatives regulation, consumer protection |

| Supervisory Authority | Basel Committee on Banking Supervision (BCBS) | US Federal Reserve, SEC, CFPB, and other agencies |

| Key Features | Capital buffers, countercyclical capital, leverage ratio | Volcker Rule, stress testing, resolution authority for failing banks |

| Implementation | Phased global adoption starting 2013 | Enacted 2010, ongoing implementation with updates |

Overview of Basel III and Dodd-Frank

Basel III is an international regulatory framework developed by the Basel Committee on Banking Supervision to strengthen bank capital requirements, improve risk management, and enhance transparency in the global banking sector. Dodd-Frank, enacted in the United States in 2010, focuses on reducing systemic risk through increased oversight of financial institutions, implementation of the Volcker Rule, and establishing the Consumer Financial Protection Bureau. Both frameworks aim to promote financial stability but differ in geographic scope, regulatory approach, and specific provisions targeting capital adequacy and risk controls.

Key Objectives and Scope Comparison

Basel III aims to enhance global banking regulation by strengthening capital requirements, improving risk management, and increasing bank liquidity to prevent systemic crises, primarily focusing on internationally active banks. Dodd-Frank targets the U.S. financial system with a broader scope, including consumer protection, derivatives regulation, and systemic risk oversight through entities like the Financial Stability Oversight Council (FSOC). Basel III emphasizes standardized risk-weighted assets and capital buffers, while Dodd-Frank enforces stricter rules on complex financial instruments and imposes stress testing and resolution planning on large banks.

Capital Requirements: Basel III vs Dodd-Frank

Basel III enforces stricter capital requirements by mandating higher common equity Tier 1 (CET1) ratios, generally 4.5% minimum plus additional buffers, to enhance bank resilience against financial stress. The Dodd-Frank Act focuses on stress testing and risk-based capital requirements, aiming to prevent systemic risk by imposing stringent leverage ratios and comprehensive oversight on systemically important financial institutions (SIFIs). Basel III primarily targets global banking stability with standardized international regulations, while Dodd-Frank tailors capital requirements to the U.S. regulatory environment with specific provisions for consumer protection and enhanced transparency.

Liquidity Standards and Risk Management

Basel III establishes global liquidity standards through the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure banks maintain adequate short-term and long-term liquidity buffers. The Dodd-Frank Act emphasizes comprehensive risk management by enhancing oversight through the Volcker Rule, stress testing, and resolution planning to mitigate systemic risks. Both frameworks aim to strengthen financial stability but differ in scope, with Basel III focusing on quantitative liquidity metrics and Dodd-Frank targeting broader risk governance and market conduct.

Stress Testing and Supervisory Oversight

Basel III mandates comprehensive stress testing frameworks to assess banks' capital adequacy under adverse economic scenarios, emphasizing standardized risk modeling and global regulatory consistency. Dodd-Frank requires rigorous supervisory oversight with tailored stress tests, particularly through the Comprehensive Capital Analysis and Review (CCAR), focusing on U.S. systemic financial institutions and ensuring their resilience. Both regulations prioritize enhanced transparency and risk management but differ in scope, with Basel III targeting international banks and Dodd-Frank concentrating on domestic supervisory enforcement.

Impact on U.S. and Global Financial Institutions

Basel III introduced stricter capital and liquidity requirements to strengthen global banks' resilience, significantly impacting U.S. and international financial institutions by enhancing risk management frameworks and promoting greater transparency. The Dodd-Frank Act, specific to the U.S., imposed comprehensive regulatory reforms including stress testing, the Volcker Rule restricting proprietary trading, and stricter supervision of systemically important financial institutions (SIFIs). Combined, these regulations have increased operational costs and compliance burdens but have contributed to greater financial stability and reduced systemic risk across both U.S. and global banking sectors.

Regulatory Compliance and Reporting Differences

Basel III emphasizes enhanced capital adequacy, liquidity standards, and risk management for international banks, while Dodd-Frank focuses on systemic risk reduction and consumer protection primarily within the U.S. financial system. Basel III mandates detailed risk-weighted asset calculations and standardized reporting frameworks such as COREP and FINREP, whereas Dodd-Frank enforces comprehensive stress testing and extensive disclosure requirements like the OCC's Comprehensive Capital Analysis and Review (CCAR). Differences in regulatory scope and reporting frequency reflect Basel III's global prudential approach versus Dodd-Frank's broader financial stability and transparency objectives.

Implementation Challenges and Timelines

Basel III implementation faces significant challenges due to its complex risk-based capital requirements and extended timelines, with full compliance targeted around 2027 in many jurisdictions. Dodd-Frank, implemented primarily in the United States post-2008 financial crisis, presents complexities related to supervisory oversight and stress testing, with phased enforcement beginning as early as 2011. Both regulatory frameworks demand extensive data management and system upgrades, creating considerable operational burdens for banking institutions navigating overlapping deadlines.

Market Stability and Systemic Risk Mitigation

Basel III establishes global regulatory standards to enhance market stability by strengthening bank capital requirements and liquidity buffers, reducing the likelihood of bank failures that could trigger systemic crises. Dodd-Frank focuses on mitigating systemic risk in the U.S. by implementing stricter oversight of large financial institutions, enforcing stress tests, and creating mechanisms like the Orderly Liquidation Authority to manage failing entities without taxpayer bailouts. Both frameworks collectively aim to fortify the financial system against shocks, but Basel III emphasizes international harmonization while Dodd-Frank targets domestic regulatory reforms and consumer protection.

Future Trends and Regulatory Evolution

Basel III emphasizes global capital adequacy, liquidity standards, and risk management to enhance banking sector resilience, while Dodd-Frank focuses on U.S. financial stability and consumer protection through stricter oversight and systemic risk mitigation. Future trends indicate increased harmonization of international banking regulations, integration of climate risk into regulatory frameworks, and adoption of advanced technology for real-time compliance monitoring. Regulatory evolution will likely prioritize enhanced transparency, stronger capital buffers, and adaptive standards to address emerging risks such as cyber threats and fintech disruptions.

Important Terms

Capital Adequacy Ratio

The Capital Adequacy Ratio (CAR) under Basel III mandates banks to maintain a minimum Tier 1 capital ratio of 6%, focusing on risk-weighted assets to enhance financial stability and resilience. In contrast, Dodd-Frank Act imposes stricter capital and stress-testing requirements on U.S. banks to prevent systemic risks, complementing Basel III by emphasizing transparency and consumer protection.

Liquidity Coverage Ratio (LCR)

The Liquidity Coverage Ratio (LCR) under Basel III mandates banks to hold high-quality liquid assets (HQLA) sufficient to cover net cash outflows over 30 days, enhancing global liquidity resilience. Dodd-Frank Act regulations complement this by imposing stress testing and liquidity requirements tailored to U.S. financial institutions, incorporating elements of Basel III while addressing systemic risk at the national level.

Systemically Important Financial Institution (SIFI)

Systemically Important Financial Institutions (SIFIs) are subject to enhanced regulatory frameworks under Basel III and the Dodd-Frank Act to mitigate systemic risks and increase financial stability. Basel III focuses on global capital adequacy, liquidity requirements, and stress testing, while Dodd-Frank emphasizes rigorous supervision, resolution planning, and stricter oversight of SIFIs primarily within the United States.

Counterparty Credit Risk

Counterparty Credit Risk (CCR) management under Basel III emphasizes enhanced capital requirements and rigorous Credit Valuation Adjustment (CVA) risk charges to mitigate potential losses from counterparty default in derivative transactions. The Dodd-Frank Act complements this framework by imposing stringent over-the-counter (OTC) derivatives clearing and margin requirements, fostering greater transparency and reducing systemic risk in the U.S. financial markets.

Volcker Rule

The Volcker Rule, a key component of the Dodd-Frank Act, restricts proprietary trading and limits banks' investments in hedge funds and private equity to reduce financial risks. Basel III complements these regulations by enhancing bank capital requirements and liquidity standards, strengthening overall financial system resilience in contrast to the Volcker Rule's focus on trading activities.

Leverage Ratio

The Leverage Ratio under Basel III requires banks to maintain a minimum non-risk based capital threshold of 3% to restrict excessive leverage and enhance financial stability. In contrast, Dodd-Frank emphasizes stricter leverage limits primarily for systemically important financial institutions (SIFIs), integrating more rigorous stress testing and supervisory reviews to prevent financial crises.

Stress Testing (CCAR)

Stress testing under the Comprehensive Capital Analysis and Review (CCAR) integrates Basel III's rigorous capital adequacy standards with Dodd-Frank's enhanced supervisory framework, emphasizing forward-looking risk assessments and capital planning for large U.S. banks. Basel III's leverage and liquidity requirements complement Dodd-Frank's stress testing mandates, ensuring banks maintain sufficient capital buffers to absorb shocks during economic downturns.

Risk-Weighted Assets (RWA)

Risk-Weighted Assets (RWA) under Basel III provide a standardized framework for banks to measure credit, market, and operational risks, enhancing capital adequacy by assigning risk weights to asset classes. In contrast, Dodd-Frank focuses more on systemic risk and transparency by imposing stricter regulatory standards and stress testing requirements but does not prescribe a uniform RWA calculation methodology like Basel III.

Macroprudential Regulation

Macroprudential regulation enhances financial stability by addressing systemic risks through comprehensive frameworks such as Basel III, which focuses on strengthening bank capital requirements, liquidity, and leverage ratios globally. In contrast, the Dodd-Frank Act emphasizes risk mitigation in the U.S. financial system by implementing stricter oversight on derivatives, increased transparency, and establishing the Financial Stability Oversight Council to monitor systemic threats.

Enhanced Prudential Standards

Enhanced Prudential Standards (EPS) under the Dodd-Frank Act incorporate Basel III international regulatory frameworks to strengthen bank capital requirements, risk management, and supervisory oversight for U.S. systemically important financial institutions (SIFIs). These standards emphasize stricter liquidity coverage ratios, leverage ratios, and stress testing protocols, aligning domestic regulations with global Basel III standards while addressing market-specific risks.

Basel III vs Dodd-Frank Infographic

moneydif.com

moneydif.com