On-us transactions occur when both the payer and payee hold accounts within the same bank, enabling faster processing and reduced fees. Off-us transactions involve different financial institutions, often resulting in longer settlement times and additional charges. Understanding the distinction between on-us and off-us payments is crucial for optimizing transaction efficiency and cost management in banking operations.

Table of Comparison

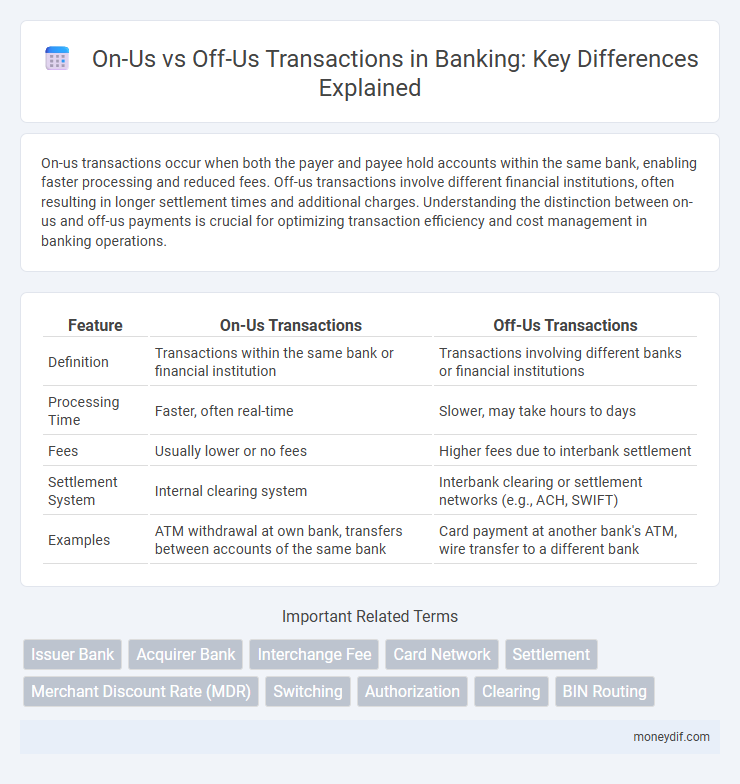

| Feature | On-Us Transactions | Off-Us Transactions |

|---|---|---|

| Definition | Transactions within the same bank or financial institution | Transactions involving different banks or financial institutions |

| Processing Time | Faster, often real-time | Slower, may take hours to days |

| Fees | Usually lower or no fees | Higher fees due to interbank settlement |

| Settlement System | Internal clearing system | Interbank clearing or settlement networks (e.g., ACH, SWIFT) |

| Examples | ATM withdrawal at own bank, transfers between accounts of the same bank | Card payment at another bank's ATM, wire transfer to a different bank |

Understanding On-Us and Off-Us Transactions

On-us transactions occur when both the payer's and payee's accounts are held within the same financial institution, allowing for faster processing and lower fees. Off-us transactions involve accounts held at different banks, requiring interbank networks for settlement and typically incurring higher processing costs. Understanding the distinction between on-us and off-us transactions is crucial for optimizing payment processing efficiency and managing transaction fees in banking operations.

Key Differences Between On-Us and Off-Us Payments

On-us payments occur when both the payer's and payee's accounts are within the same financial institution, allowing for faster processing and lower transaction fees. Off-us payments involve transactions between accounts held at different banks, often requiring interbank clearing systems like ACH or SWIFT, which can result in longer settlement times and higher fees. The key differences between on-us and off-us payments lie in transaction speed, cost, and the infrastructure used for settlement.

How On-Us Transactions Work in Banking

On-us transactions in banking occur when both the payer and the payee hold accounts within the same financial institution, allowing for immediate fund transfers without the need for interbank clearing. These transactions benefit from faster processing times and reduced fees because they bypass external networks such as ACH or wire transfer systems. Banks leverage internal ledgers to update balances instantly, enhancing customer experience through real-time transaction settlement.

The Off-Us Transaction Process Explained

Off-us transactions occur when a customer uses a card issued by one bank at a merchant or ATM served by another bank. The process involves the merchant's bank sending the transaction details to the cardholder's bank for authorization, followed by fund transfer and settlement between the banks through the payment network. This multi-step verification ensures secure and accurate processing across different financial institutions.

Advantages of On-Us Transactions for Banks

On-Us transactions occur when both the payer and the payee hold accounts within the same bank, allowing faster settlement and lower processing costs compared to Off-Us transactions. Banks benefit from enhanced control over transaction data, improved liquidity management, and reduced reliance on external clearinghouses. These advantages contribute to increased operational efficiency and higher profit margins for financial institutions.

Benefits and Risks of Off-Us Transactions

Off-us transactions occur when customers use their cards at merchants or ATMs outside their bank's network, offering greater convenience and broader accessibility for users. These transactions enable enhanced flexibility and increased merchant options but introduce higher risks such as elevated fraud potential, delayed settlement times, and increased processing fees. Effective risk management and advanced fraud detection systems are critical to mitigating the vulnerabilities associated with off-us transactions in the banking sector.

Impact on Settlement Times: On-Us vs Off-Us

On-us transactions, where both the payer and payee hold accounts within the same bank, typically result in faster settlement times due to the absence of interbank reconciliation processes. Off-us transactions involve accounts across different banks, requiring additional verification and communication steps, which can delay settlement by hours or even days depending on the payment networks involved. Faster settlement in on-us transactions enhances liquidity management and reduces credit risk for both banks and customers.

Fees and Costs: Comparing On-Us and Off-Us

On-us transactions occur within the same financial institution, typically resulting in lower or no fees for customers due to reduced processing costs. Off-us transactions involve different banks, often incurring higher fees to cover interbank settlement and network expenses. These cost differences impact consumer fees, merchant surcharges, and bank revenue models in payment processing.

Security Considerations in On-Us and Off-Us Transactions

On-us transactions, where both parties use the same bank, benefit from streamlined security protocols and real-time fraud detection within a unified system. Off-us transactions involve multiple financial institutions, increasing exposure to risks such as data interception and delayed fraud response due to interbank communication. Implementing multi-factor authentication, encryption standards, and robust anomaly detection systems are critical to securing both on-us and off-us banking operations.

Future Trends in On-Us and Off-Us Banking

Future trends in on-us and off-us banking highlight increasing integration of digital payment ecosystems and real-time transaction processing. On-us transactions will benefit from enhanced AI-driven fraud detection and personalized banking experiences, while off-us banking is set to expand cross-border payment solutions using blockchain technology to reduce costs and increase transparency. Both trends converge towards seamless interoperability and customer-centric financial services in a globalized economy.

Important Terms

Issuer Bank

Issuer banks manage transactions where the cardholder uses a card issued by the bank itself (on-us transactions) versus those processed by external banks (off-us transactions). On-us transactions typically result in lower processing fees and faster settlement times for the issuer bank compared to off-us transactions involving interbank networks.

Acquirer Bank

An Acquirer Bank processes payment transactions on behalf of a merchant, distinguishing between on-us transactions, where both the merchant and cardholder accounts are held by the same bank, and off-us transactions, which involve different banks. On-us transactions typically result in faster settlements and lower fees due to internal processing, while off-us transactions require interbank communication and clearing through payment networks.

Interchange Fee

Interchange fees represent charges paid by the acquiring bank to the issuing bank for card transactions, with distinct structures for on-us and off-us transactions; on-us transactions occur when the issuer and acquirer are the same, typically resulting in lower or no interchange fees, while off-us transactions involve different banks, incurring standard interchange fees based on card network rules. These fees impact merchant costs and pricing models, influencing the overall payment processing ecosystem.

Card Network

Card networks facilitate transaction processing by distinguishing between On-us transactions, where the card issuer and merchant bank are the same entity, and Off-us transactions, which involve different financial institutions. This distinction impacts transaction routing, fees, and authorization times, making it critical for optimizing payment processing efficiency and security.

Settlement

Settlement in payment processing refers to the final transfer of funds between banks involved in a transaction. On-us settlements occur when the issuing and acquiring banks are the same, resulting in faster processing, while off-us settlements involve different banks, requiring interbank communication and typically longer processing times.

Merchant Discount Rate (MDR)

Merchant Discount Rate (MDR) is the fee charged by acquiring banks to merchants for processing card transactions, varying significantly between On-us and Off-us transactions; On-us transactions, where both issuer and acquirer are the same entity, often incur lower MDR due to reduced interbank fees, while Off-us transactions involve separate issuer and acquirer banks, leading to higher MDR to cover interchange and network fees. Understanding the differentiation in MDR helps merchants optimize payment acceptance costs and tailor pricing strategies accordingly.

Switching

Switching in payment processing refers to the mechanism that routes transaction data between the card issuer and the merchant's acquiring bank, playing a crucial role in determining whether a transaction is On-us--processed within the same financial institution--or Off-us, where it involves different banks. On-us transactions typically result in faster processing and lower fees due to internal handling, whereas Off-us transactions require interbank communication and clearance through external payment networks.

Authorization

Authorization in payment processing determines whether a transaction is on-us, where both the issuer and acquirer are within the same financial institution, or off-us, involving different banks for issuing and acquiring. On-us transactions typically have faster approval times and lower fees due to internal network handling, while off-us transactions require interbank communication, impacting processing speed and cost.

Clearing

Clearing processes differ significantly between on-us and off-us transactions, where on-us clearing occurs within the same financial institution, enabling faster settlement times and reduced operational complexity. Off-us clearing involves multiple banks or payment networks, requiring interbank communication protocols and often resulting in longer processing durations and additional clearing fees.

BIN Routing

BIN routing determines the transaction flow by identifying whether a payment card is On-us, issued by the same bank processing the transaction, or Off-us, originating from a different bank, affecting authorization and settlement procedures. Accurate BIN routing enhances transaction efficiency, reduces fraud risk, and ensures compliance with card network rules across Visa, Mastercard, and other card schemes.

On-us vs Off-us Infographic

moneydif.com

moneydif.com