Securitization involves pooling financial assets and issuing new securities backed by these assets, allowing banks to transfer risk and improve liquidity. Participation refers to the process where several banks jointly finance a loan, sharing both the credit risk and returns without creating new securities. Understanding the differences helps institutions choose between risk diversification and liquidity management strategies in lending.

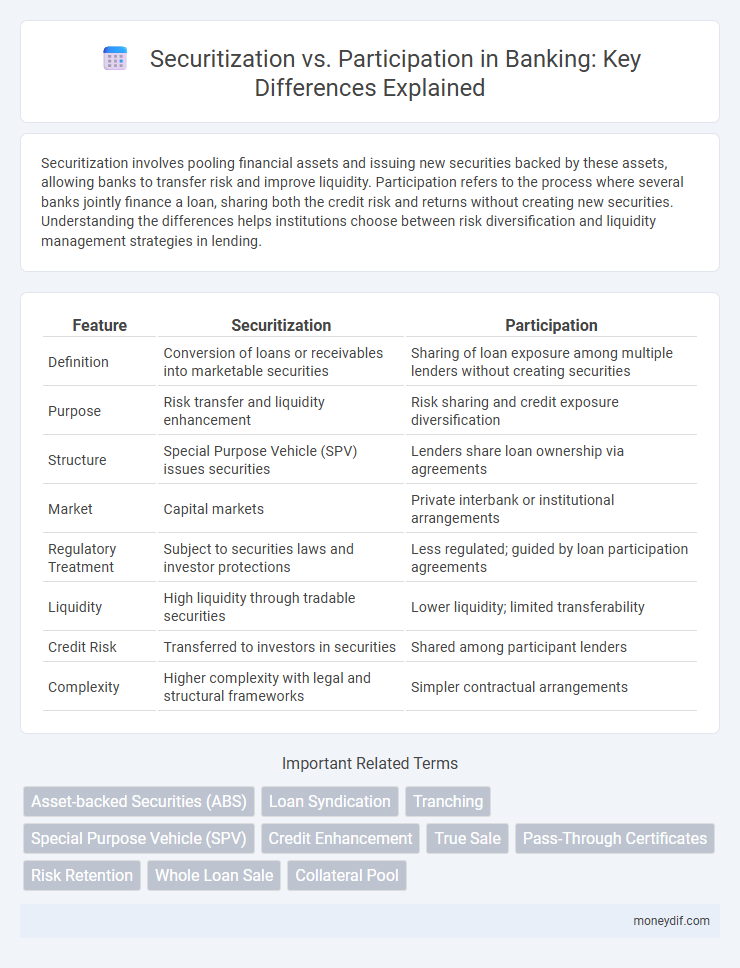

Table of Comparison

| Feature | Securitization | Participation |

|---|---|---|

| Definition | Conversion of loans or receivables into marketable securities | Sharing of loan exposure among multiple lenders without creating securities |

| Purpose | Risk transfer and liquidity enhancement | Risk sharing and credit exposure diversification |

| Structure | Special Purpose Vehicle (SPV) issues securities | Lenders share loan ownership via agreements |

| Market | Capital markets | Private interbank or institutional arrangements |

| Regulatory Treatment | Subject to securities laws and investor protections | Less regulated; guided by loan participation agreements |

| Liquidity | High liquidity through tradable securities | Lower liquidity; limited transferability |

| Credit Risk | Transferred to investors in securities | Shared among participant lenders |

| Complexity | Higher complexity with legal and structural frameworks | Simpler contractual arrangements |

Understanding Securitization in Banking

Securitization in banking involves pooling various financial assets, such as loans or mortgages, and transforming them into marketable securities that can be sold to investors. This process enhances liquidity by converting illiquid assets into tradable instruments while distributing risk among multiple parties. Unlike participation, where a bank sells portions of loans to other institutions without creating new securities, securitization involves structuring and issuing new financial products backed by the underlying asset pool.

What is Participation in Banking?

Participation in banking refers to an arrangement where one bank sells a portion of a loan or asset to another bank or financial institution, thereby sharing both the risks and returns associated with that asset. This method enables the originating bank to manage credit exposure and improve liquidity without transferring the underlying asset's legal ownership. Participation allows institutions to diversify their portfolios and optimize capital requirements while maintaining a direct client relationship.

Key Differences Between Securitization and Participation

Securitization involves pooling various financial assets, such as loans or receivables, and issuing new securities backed by these assets to investors, thereby transferring risk and enhancing liquidity. Participation refers to a direct agreement where a bank sells a portion of a loan or credit exposure to another financial institution, sharing both the credit risk and returns without creating new securities. The key difference lies in securitization creating tradable asset-backed securities for broader market distribution, while participation remains a private risk-sharing arrangement between institutions.

Benefits of Securitization for Banks

Securitization enables banks to efficiently transfer credit risk and enhance liquidity by converting illiquid assets into marketable securities, improving capital adequacy ratios in accordance with Basel III requirements. This process facilitates diversification of funding sources and supports better balance sheet management, allowing banks to free up capital for new lending activities. Enhanced transparency and standardized asset pools in securitization also attract institutional investors, reducing funding costs and strengthening financial stability.

Advantages of Loan Participation for Financial Institutions

Loan participation allows financial institutions to diversify credit risk by sharing loans with multiple investors, reducing exposure to any single borrower default. This structure enhances liquidity by enabling banks to free up capital for new lending opportunities without selling entire loan portfolios. Participation agreements also streamline regulatory compliance and credit monitoring, as lead institutions maintain control and oversight over loan servicing and administration.

Risks Associated with Securitization

Securitization involves pooling financial assets and issuing securities backed by these assets, exposing investors to risks such as credit risk, market risk, and liquidity risk. Unlike participation, securitization carries complexity risks due to the tranching of securities, which can obscure true asset quality and increase information asymmetry. Additionally, securitization can amplify systemic risk if poorly managed, impacting the broader financial market stability.

Participation Risks and Mitigation Strategies

Participation risks in banking primarily include credit risk, liquidity risk, and operational risk due to the shared exposure among multiple financial institutions. Mitigation strategies involve rigorous due diligence, establishing clear legal agreements, and continuous monitoring of participant creditworthiness to manage default probabilities and ensure transparency. Employing collateral arrangements and diversification of participations further reduces potential losses and enhances risk distribution.

Impact on Bank Balance Sheets: Securitization vs Participation

Securitization significantly improves bank balance sheets by transferring assets off-site, reducing risk-weighted assets, and freeing up capital for new lending activities. Participation retains underlying asset exposure on the bank's books, maintaining credit risk and limiting capital relief. This fundamental difference leads securitization to enhance liquidity and regulatory capital ratios more effectively than participation agreements.

Regulatory Considerations for Securitization and Participation

Regulatory considerations for securitization emphasize strict adherence to capital adequacy requirements under frameworks such as Basel III, with risk retention rules mandating originators to hold a minimum stake in the securitized assets to align interests. Participation arrangements typically face fewer regulatory burdens, as they involve direct loan transfers without creating new securities, but still require compliance with credit risk mitigation guidelines and disclosure standards. Both structures must ensure transparency, accurate risk assessment, and compliance with jurisdiction-specific financial regulations to maintain market stability and investor protection.

Choosing the Right Strategy: Securitization or Participation

Choosing between securitization and participation hinges on the bank's risk management preferences and capital optimization goals. Securitization enhances liquidity by converting assets into marketable securities, while participation involves sharing loan risks directly with other financial institutions. Evaluating factors such as regulatory capital requirements, credit risk dispersion, and balance sheet impact is critical to selecting the optimal strategy.

Important Terms

Asset-backed Securities (ABS)

Asset-backed securities (ABS) represent pools of financial assets such as loans or receivables that are securitized to create tradable instruments, providing liquidity and risk diversification. Unlike participation, where investors hold a direct share in the underlying assets, securitization involves creating new securities backed by asset cash flows, enabling broader market access and structured credit enhancements.

Loan Syndication

Loan syndication involves multiple lenders jointly providing funds to a single borrower, sharing both risks and returns. Unlike securitization, which pools and transforms loans into tradable securities, participation entails one lender purchasing a portion of another's loan without creating new securities.

Tranching

Tranching in securitization involves dividing a pool of financial assets into different classes based on risk and return profiles, enabling investors to choose tranches that match their risk appetite, whereas participation refers to investors directly buying portions of a loan or asset without such stratification. This structuring enhances liquidity and risk distribution in securitization, compared to the more straightforward ownership model in participation agreements.

Special Purpose Vehicle (SPV)

A Special Purpose Vehicle (SPV) in securitization isolates financial assets from the originator to enhance creditworthiness and manage risk transfer, acting as a legally separate entity that issues securities backed by pooled assets. In contrast, participation involves multiple lenders sharing a direct interest in a loan without creating a separate entity, leading to less structural isolation and potentially higher credit risk exposure for participants.

Credit Enhancement

Credit enhancement in securitization involves techniques such as overcollateralization and reserve funds to improve the credit profile of asset-backed securities, reducing investor risk. In contrast, participation agreements rely primarily on the creditworthiness of the originator and often lack formal credit enhancement mechanisms, focusing instead on shared exposure to the underlying assets.

True Sale

True Sale in securitization legally transfers assets to a special purpose vehicle, isolating risks from the originator's balance sheet, unlike participation agreements where the originator retains ownership and credit risk. This distinction ensures secured creditors in securitization have priority claims on the asset pool, enhancing investor confidence and potentially lowering funding costs.

Pass-Through Certificates

Pass-Through Certificates represent ownership interests in a pool of securitized assets, enabling investors to receive proportional cash flows generated by the underlying loans, distinguishing them from Participations which involve shared interests without direct ownership. Securitization through Pass-Through Certificates provides greater transparency and tradability compared to Participation agreements that primarily serve as contractual claims among financial institutions.

Risk Retention

Risk retention mandates require originators to hold a specific portion of the credit risk in securitization transactions to align interests and enhance transparency, while participation structures often involve risk-sharing among multiple lenders without mandatory retention. Securitization retains residual risk on the originator's balance sheet, promoting diligent underwriting, whereas participation agreements distribute exposure but typically lack formal risk retention requirements.

Whole Loan Sale

Whole loan sales involve the transfer of the entire mortgage loan from the originator to an investor, differing from securitization, where loans are pooled into tranches and sold as mortgage-backed securities. Unlike loan participation, which allocates fractional ownership interests in a single loan to multiple investors, whole loan sales provide direct ownership and simplify credit risk transfer without ongoing servicing complexities.

Collateral Pool

Collateral pools in securitization serve as aggregated asset portfolios securing issued securities, enhancing creditworthiness and enabling tranche structuring, whereas in participation agreements, collateral pools typically underpin shared ownership in specific loans without issuing securities, focusing on direct risk and income sharing between parties. The securitization collateral pool enables market liquidity through asset-backed securities, while participation collateral provides bilateral credit risk diversification without creating new tradable instruments.

Securitization vs Participation Infographic

moneydif.com

moneydif.com