Callable bonds allow issuers to redeem the bond before maturity, giving them flexibility to refinance at lower interest rates, while putable bonds grant investors the right to sell the bond back to the issuer, providing downside protection against rising interest rates. The value of callable bonds decreases with falling interest rates due to the call risk, whereas putable bonds increase in value as investors gain the option to exit early. Understanding these features helps investors manage interest rate risk and tailor their fixed-income portfolios accordingly.

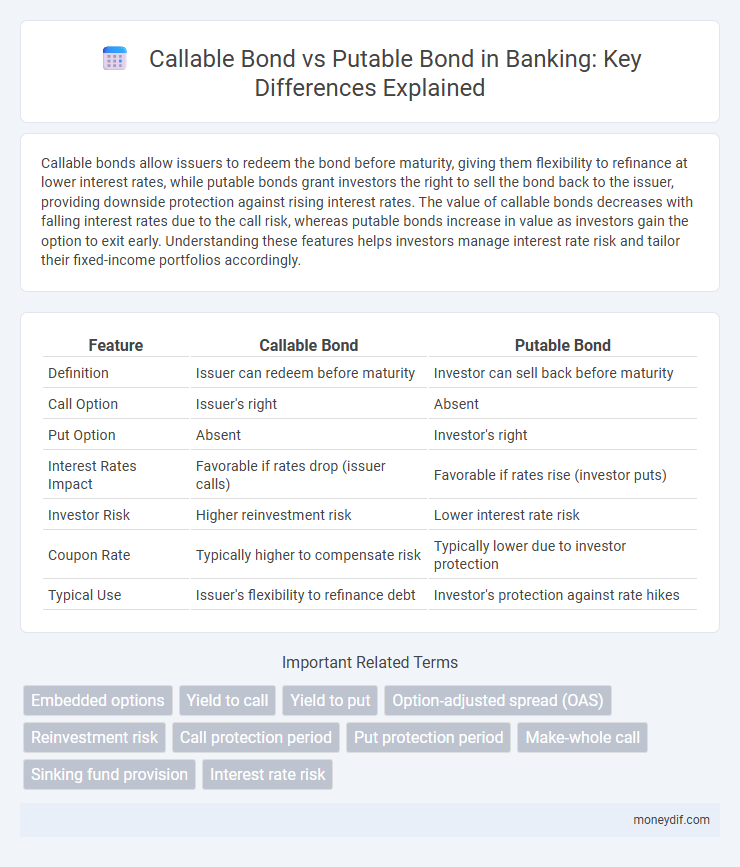

Table of Comparison

| Feature | Callable Bond | Putable Bond |

|---|---|---|

| Definition | Issuer can redeem before maturity | Investor can sell back before maturity |

| Call Option | Issuer's right | Absent |

| Put Option | Absent | Investor's right |

| Interest Rates Impact | Favorable if rates drop (issuer calls) | Favorable if rates rise (investor puts) |

| Investor Risk | Higher reinvestment risk | Lower interest rate risk |

| Coupon Rate | Typically higher to compensate risk | Typically lower due to investor protection |

| Typical Use | Issuer's flexibility to refinance debt | Investor's protection against rate hikes |

Introduction to Callable and Putable Bonds

Callable bonds give the issuer the right to redeem the bond before its maturity date, providing flexibility to refinance debt if interest rates decline. Putable bonds grant the bondholder the option to sell the bond back to the issuer at a predetermined price before maturity, offering protection against rising interest rates. Both instruments are designed to manage interest rate risk and enhance investment strategies in fixed-income markets.

Key Features of Callable Bonds

Callable bonds allow the issuer to redeem the bond before its maturity date, typically at a predetermined call price, providing flexibility to manage debt in falling interest rate environments. These bonds often offer higher yields to compensate investors for the reinvestment risk associated with potential early redemption. The call feature can lead to price volatility, as the bond's value is capped by the likelihood of being called when interest rates decline.

Key Features of Putable Bonds

Putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, offering downside protection against interest rate increases. These bonds typically feature lower yields compared to non-putable bonds because they reduce investment risk. Key features include fixed interest payments, specified put dates, and predetermined put prices that enable holders to limit potential losses.

How Callable Bonds Benefit Issuers

Callable bonds benefit issuers by providing the option to redeem the bonds before maturity, allowing them to refinance debt at lower interest rates when market conditions improve. This flexibility helps issuers reduce interest expenses and manage debt more efficiently. By controlling the timing of repayments, issuers can optimize capital structure and improve financial stability.

How Putable Bonds Protect Investors

Putable bonds protect investors by granting the right to sell the bond back to the issuer before maturity at a predetermined price, reducing downside risk in declining interest rate environments. This feature ensures investors can exit their positions if market conditions worsen or credit quality deteriorates, enhancing portfolio flexibility and capital preservation. By contrast, callable bonds favor issuers with early redemption options, exposing investors to reinvestment risk and potential losses.

Interest Rate Risk and Callable Bonds

Callable bonds expose investors to higher interest rate risk because issuers can redeem the bonds early when interest rates decline, forcing bondholders to reinvest at lower yields. Investors demand higher yields on callable bonds to compensate for this reinvestment risk, which leads to increased price volatility compared to non-callable or putable bonds. Putable bonds mitigate interest rate risk by allowing investors to sell the bond back to the issuer at a predetermined price, providing protection against rising interest rates.

Interest Rate Risk and Putable Bonds

Callable bonds expose investors to higher interest rate risk as issuers can redeem the bond early when rates decline, limiting price appreciation. Putable bonds reduce interest rate risk by allowing bondholders to sell the bond back to the issuer at a predetermined price if interest rates rise, protecting against price depreciation. This embedded put option increases bond value and provides downside protection in volatile rate environments.

Pricing Differences: Callable vs Putable Bonds

Callable bonds typically trade at lower prices than putable bonds due to the issuer's option to redeem the bond before maturity, which limits potential price appreciation. Putable bonds command higher prices because the investor holds the right to sell the bond back to the issuer at a predetermined price, providing downside protection. The embedded call option in callable bonds increases yield to compensate investors for early redemption risk, while the embedded put option in putable bonds usually results in lower yields reflecting added investor security.

Market Scenarios Favoring Callable or Putable Bonds

Callable bonds are favored in declining interest rate environments as issuers can redeem these bonds early to refinance at lower rates, reducing debt costs. Putable bonds become advantageous during rising interest rate scenarios, allowing investors to sell the bonds back to issuers before prices decline, thus limiting potential losses. Market volatility and credit risk perceptions also influence the preference, with callable bonds appealing to issuers seeking flexibility and putable bonds providing investors protection against adverse rate movements.

Choosing Between Callable and Putable Bonds

Investors choose callable bonds to benefit issuers' ability to redeem early when interest rates decline, potentially yielding higher coupon rates as compensation for call risk. Putable bonds appeal to investors seeking downside protection by allowing bondholders to sell back the bond before maturity if interest rates rise or credit quality declines. Assessing interest rate forecasts, issuer credit risk, and investment horizon helps determine whether the optionality in callable or putable bonds aligns better with portfolio objectives.

Important Terms

Embedded options

Callable bonds feature embedded call options allowing issuers to repay debt early, whereas putable bonds include embedded put options enabling investors to sell bonds back before maturity.

Yield to call

Yield to call measures the return on a callable bond if redeemed by the issuer before maturity, while putable bonds offer investors the yield to put, allowing early sale back to the issuer under favorable conditions.

Yield to put

Yield to put measures the effective return on a putable bond when the holder exercises the put option, contrasting with callable bonds where the issuer's call option typically limits yield by redeeming early.

Option-adjusted spread (OAS)

Option-adjusted spread (OAS) quantifies the yield spread of callable bonds, which include issuer call options lowering yields, versus putable bonds, which embed holder put options typically increasing yields to reflect added investor protection.

Reinvestment risk

Callable bonds expose investors to reinvestment risk by allowing issuers to redeem bonds early at lower rates, whereas putable bonds mitigate reinvestment risk by granting investors the option to sell bonds back to issuers before maturity.

Call protection period

Call protection period extends the time during which a callable bond cannot be redeemed by the issuer, providing investors with guaranteed interest payments, whereas putable bonds grant investors the right to sell the bond back to the issuer, often without a comparable protection period.

Put protection period

Put protection period for a putable bond is the specific timeframe during which the bondholder can exercise the put option, unlike callable bonds where the issuer retains the right to redeem the bond before maturity but the holder has no put rights.

Make-whole call

A make-whole call provision in callable bonds requires the issuer to compensate bondholders by paying the present value of remaining coupon payments if the bond is redeemed early, whereas putable bonds give holders the right to sell the bond back to the issuer at a predetermined price, protecting investors from interest rate declines.

Sinking fund provision

Sinking fund provisions reduce credit risk by requiring callable bonds to retire portions early, whereas putable bonds offer investors the option to sell back, minimizing losses without mandatory sinking fund constraints.

Interest rate risk

Callable bonds expose investors to higher interest rate risk due to issuer call options that limit price appreciation, whereas putable bonds reduce interest rate risk by allowing investors to sell the bond back to the issuer at predetermined prices.

Callable bond vs Putable bond Infographic

moneydif.com

moneydif.com