Syndicated loans involve multiple lenders pooling resources to provide a single large loan to a borrower, spreading the risk among participating banks. Bilateral loans are agreements between a single lender and borrower, offering more straightforward negotiation and faster approval processes. Syndicated loans are typically used for substantial financing needs, while bilateral loans suit smaller or more specific funding requirements.

Table of Comparison

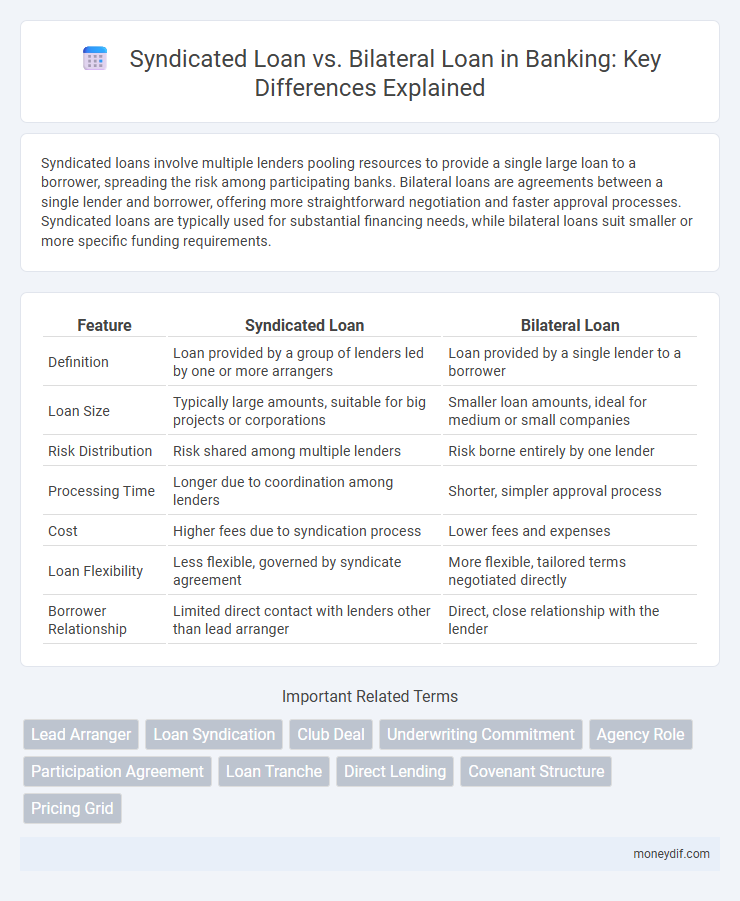

| Feature | Syndicated Loan | Bilateral Loan |

|---|---|---|

| Definition | Loan provided by a group of lenders led by one or more arrangers | Loan provided by a single lender to a borrower |

| Loan Size | Typically large amounts, suitable for big projects or corporations | Smaller loan amounts, ideal for medium or small companies |

| Risk Distribution | Risk shared among multiple lenders | Risk borne entirely by one lender |

| Processing Time | Longer due to coordination among lenders | Shorter, simpler approval process |

| Cost | Higher fees due to syndication process | Lower fees and expenses |

| Loan Flexibility | Less flexible, governed by syndicate agreement | More flexible, tailored terms negotiated directly |

| Borrower Relationship | Limited direct contact with lenders other than lead arranger | Direct, close relationship with the lender |

Introduction to Syndicated and Bilateral Loans

Syndicated loans involve multiple lenders pooling resources to provide large-scale financing to a single borrower, spreading risk and increasing capital availability compared to bilateral loans, which feature a direct agreement between one lender and one borrower. Bilateral loans typically offer faster negotiation and more flexible terms, suited for smaller financing needs or simpler credit structures. Syndicated loans are favored for complex deals requiring substantial amounts, such as corporate expansions or infrastructure projects, leveraging the combined expertise and credit capacity of a lender syndicate.

Key Differences Between Syndicated and Bilateral Loans

Syndicated loans involve multiple lenders sharing the risk and funding a single borrower, providing larger credit amounts compared to bilateral loans, which are agreements between one lender and one borrower. Syndicated loans typically feature complex structuring, with a lead arranger managing communication and coordination, whereas bilateral loans are simpler and faster to execute due to direct negotiation. Risk distribution, loan size, and administrative complexity are primary differentiators between syndicated and bilateral lending arrangements.

Structure and Parties Involved

A syndicated loan involves a group of lenders, usually banks, pooling resources to provide a large loan to a single borrower, with a lead arranger coordinating the deal and managing the syndicate. In contrast, a bilateral loan is a direct agreement between one lender and one borrower, offering simpler terms and fewer parties involved. Syndicated loans distribute risk among multiple institutions, while bilateral loans concentrate risk and decision-making on a single lender.

Loan Documentation and Processes

Syndicated loans involve multiple lenders sharing the risk and documentation, requiring a lead arranger to coordinate standardized loan agreements and streamline communication among parties. Bilateral loans are negotiated directly between a single lender and borrower, resulting in simpler, customized documentation and faster approval processes. The complexity and duration of loan documentation typically increase with syndicated loans due to the need to accommodate diverse lender requirements and consensus-building.

Advantages of Syndicated Loans

Syndicated loans offer advantages such as risk sharing among multiple lenders, which reduces individual exposure and enhances credit capacity for large-scale financing. These loans provide borrowers with access to a broader pool of capital, enabling more flexible terms and potentially lower interest rates. The collaboration between banks also streamlines complex transactions, providing efficient management and administrative processes.

Advantages of Bilateral Loans

Bilateral loans offer streamlined decision-making and faster approval processes due to the involvement of a single lender, enhancing borrower flexibility. They typically involve lower administrative and legal costs compared to syndicated loans, reducing overall transaction expenses. Confidentiality and customized loan terms are more easily maintained in bilateral agreements, aligning closely with specific borrower needs.

Risk Allocation and Management

Syndicated loans distribute risk among multiple lenders, reducing individual exposure and enabling larger financing amounts for borrowers with higher credit needs. Bilateral loans concentrate risk with a single lender, allowing for more tailored risk management but increasing the lender's vulnerability to borrower default. Effective risk allocation in syndicated loans involves coordinated due diligence and loan monitoring, while bilateral loans rely on direct borrower-lender communication and individualized credit assessment.

Cost and Fee Structures

Syndicated loans generally involve higher upfront fees and administrative costs due to multiple lenders coordinating the credit facility, while bilateral loans typically have lower fees reflecting the single-lender arrangement. The complexity of syndication leads to additional agent bank fees and possible margin premiums, increasing the overall cost compared to bilateral loans. Borrowers may find bilateral loans more cost-effective for smaller financing needs, whereas syndicated loans offer diversified risk sharing but at a premium cost.

Suitability for Different Borrowers

Syndicated loans are suitable for large corporations and projects requiring substantial capital, as they involve multiple lenders sharing risk and funding. Bilateral loans cater to small- and medium-sized enterprises (SMEs) needing simpler, more flexible financing arrangements with a single lender. The choice depends on borrower size, funding needs, and complexity of the financing structure.

Decision Factors: Choosing Between Syndicated and Bilateral Loans

Decision factors between syndicated and bilateral loans center on the borrower's capital requirements and risk distribution preferences. Syndicated loans suit large-scale financing needs by spreading risk across multiple lenders and providing diversified funding sources, while bilateral loans offer simplicity and direct negotiation with a single lender, ideal for smaller amounts or specific relationship banking. Assessing credit exposure, loan size, pricing flexibility, and administrative complexity guides optimal loan structuring in corporate finance decisions.

Important Terms

Lead Arranger

A Lead Arranger in syndicated loans coordinates the loan syndication process by structuring the financing and distributing portions among multiple lenders, enhancing risk distribution compared to bilateral loans managed by a single lender. Syndicated loans offer larger financing amounts and diversified credit exposure, while bilateral loans provide quicker decision-making and simpler negotiation processes due to their one-on-one lender-borrower relationship.

Loan Syndication

Loan syndication involves multiple lenders pooling resources to provide a large syndicated loan, spreading risk and increasing capital availability, unlike a bilateral loan which is granted by a single lender directly to the borrower. Syndicated loans offer greater flexibility and diversification for borrowers with substantial financing needs, while bilateral loans are simpler and faster to negotiate for smaller credit requirements.

Club Deal

A club deal involves a group of lenders jointly providing a syndicated loan to a single borrower, distributing risk and capital commitments, unlike a bilateral loan where financing is secured from a single lender, leading to simpler negotiation but potentially higher risk concentration. Syndicated loans through club deals often feature shared due diligence and coordinated administration, enhancing borrower access to larger capital amounts compared to bilateral loans with individual lender terms.

Underwriting Commitment

Underwriting commitment in syndicated loans involves a financial institution guaranteeing the entire loan amount, distributing risk among multiple lenders, while bilateral loans rely on a single lender assuming full credit risk, often resulting in less diversified exposure. Syndicated loans with underwriting commitments provide borrowers with increased funding capacity and risk-sharing benefits compared to the more concentrated risk profile of bilateral loans.

Agency Role

The agency role in syndicated loans involves a lead bank coordinating between multiple lenders and the borrower, facilitating communication, administering payments, and managing the loan's legal and operational framework, which contrasts with bilateral loans where a single lender directly interacts with the borrower without intermediary oversight. Syndicated loans offer diversified risk among lenders and complex administration handled by the agent, whereas bilateral loans provide simpler, faster negotiations with less administrative burden but concentrated risk.

Participation Agreement

A Participation Agreement governs the relationship between the lead lender and participating lenders in a syndicated loan, detailing rights, obligations, and payment priorities, unlike a bilateral loan which involves a direct agreement between a single borrower and lender. Syndicated loans distribute risk across multiple financial institutions, while bilateral loans concentrate credit exposure in one lender.

Loan Tranche

A loan tranche refers to a portion of the total loan amount distributed in phases or segments, commonly used in syndicated loans where multiple lenders participate, each contributing varying tranches based on their risk and capacity. In contrast, bilateral loans involve a single lender providing the entire loan sum in one tranche, simplifying the agreement but limiting the borrower's access to diversified funding sources.

Direct Lending

Direct lending typically involves non-bank lenders providing capital directly to borrowers, while syndicated loans are large credit facilities shared among multiple lenders to diversify risk, and bilateral loans involve a single lender and borrower agreement. Direct lending often overlaps with bilateral loans by offering customized financing, whereas syndicated loans are used for larger, more complex funding needs requiring multiple participants.

Covenant Structure

Covenant structures in syndicated loans typically involve standardized, stringent financial and performance covenants enforced across multiple lenders, ensuring consistent risk management and borrower accountability. In contrast, bilateral loans often feature more flexible, negotiable covenants tailored to the individual lender-borrower relationship, allowing for customized terms and adjustments.

Pricing Grid

A pricing grid for syndicated loans typically reflects complexity and risk distribution among multiple lenders, often resulting in tiered interest rates based on credit quality and tranche structure, whereas bilateral loans usually have a simpler pricing model with a fixed or variable interest rate negotiated directly between one borrower and one lender. Syndicated loans often feature pricing adjustments tied to loan facility utilization and financial covenants, while bilateral loans emphasize customized terms aligned with the single lender's risk appetite.

Syndicated loan vs Bilateral loan Infographic

moneydif.com

moneydif.com