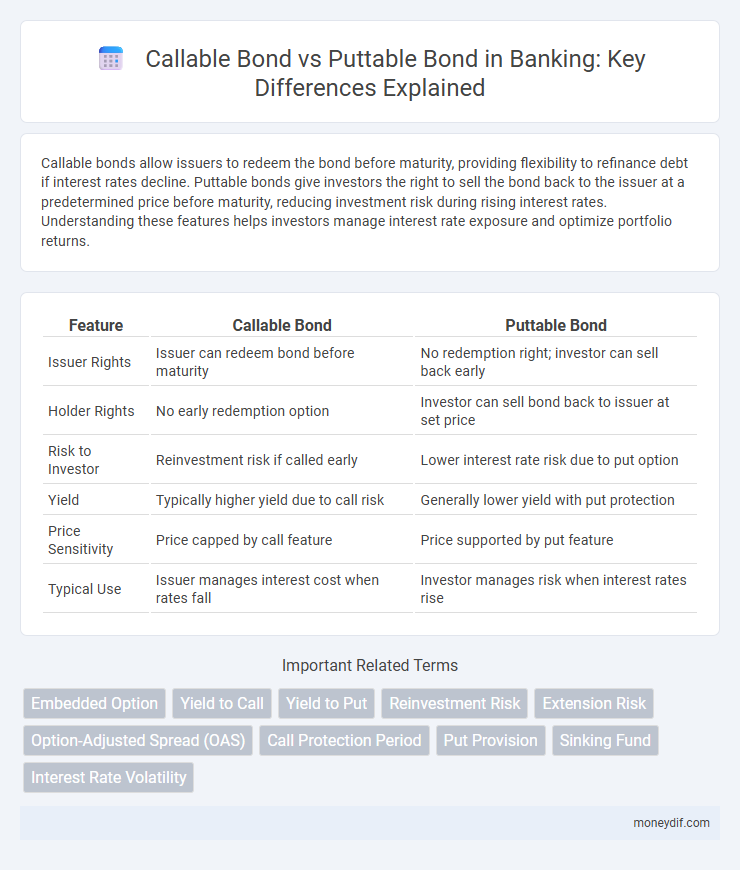

Callable bonds allow issuers to redeem the bond before maturity, providing flexibility to refinance debt if interest rates decline. Puttable bonds give investors the right to sell the bond back to the issuer at a predetermined price before maturity, reducing investment risk during rising interest rates. Understanding these features helps investors manage interest rate exposure and optimize portfolio returns.

Table of Comparison

| Feature | Callable Bond | Puttable Bond |

|---|---|---|

| Issuer Rights | Issuer can redeem bond before maturity | No redemption right; investor can sell back early |

| Holder Rights | No early redemption option | Investor can sell bond back to issuer at set price |

| Risk to Investor | Reinvestment risk if called early | Lower interest rate risk due to put option |

| Yield | Typically higher yield due to call risk | Generally lower yield with put protection |

| Price Sensitivity | Price capped by call feature | Price supported by put feature |

| Typical Use | Issuer manages interest cost when rates fall | Investor manages risk when interest rates rise |

Introduction to Callable and Puttable Bonds

Callable bonds give issuers the right to redeem the bond before maturity, typically to refinance debt at lower interest rates, while puttable bonds provide investors the option to sell the bond back to the issuer at predetermined dates or prices. Callable bonds often carry higher yields to compensate investors for the call risk, whereas puttable bonds generally offer lower yields due to the added investor protection. Understanding these embedded options is crucial for investors assessing interest rate risk and potential returns in fixed-income portfolios.

Key Features of Callable Bonds

Callable bonds give the issuer the right to redeem the bond before its maturity date, typically at a premium price, allowing issuers to refinance debt when interest rates decline. These bonds usually offer higher yields to compensate investors for the call risk, which can limit price appreciation. The call provision reduces the bond's duration and introduces reinvestment risk, impacting the bond's valuation and investor returns.

Key Features of Puttable Bonds

Puttable bonds grant investors the right to sell the bond back to the issuer before maturity, providing protection against interest rate rises and credit risk deterioration. These bonds typically offer lower yields compared to non-puttable bonds due to their embedded put option. Key features include predefined put dates, specified put prices usually at par value, and enhanced investor flexibility in managing interest rate exposure.

Mechanisms of Call and Put Options in Bonds

Callable bonds grant issuers the right to redeem the bond before maturity at a predetermined call price, allowing them to refinance debt if interest rates decline. Puttable bonds provide investors the option to sell the bond back to the issuer at a specified put price, offering protection against rising interest rates or credit deterioration. These embedded call and put options significantly influence bond pricing, yield spreads, and risk management strategies in fixed-income portfolios.

Pros and Cons of Callable Bonds for Issuers and Investors

Callable bonds offer issuers the advantage of refinancing debt if interest rates decline, reducing their interest expenses and providing financial flexibility. Investors, however, face reinvestment risk and limited price appreciation potential since issuers can redeem the bond before maturity, often leading to lower yields. For issuers, the main drawback is potentially higher coupon rates to compensate investors for the call risk, while investors must weigh the trade-off between attractive yields and the possibility of early redemption.

Pros and Cons of Puttable Bonds for Issuers and Investors

Puttable bonds offer investors the advantage of selling the bond back to the issuer before maturity, providing protection against interest rate rises and credit deterioration, which enhances investment flexibility. For issuers, puttable bonds typically demand higher coupon rates to compensate for the investors' option to put, increasing overall borrowing costs. While investors benefit from reduced downside risk, issuers face less certainty in debt management and potential early redemption, complicating cash flow forecasting.

Yield Implications: Callable vs Puttable Bonds

Callable bonds typically offer higher yields to compensate investors for the issuer's right to redeem the bond before maturity, which increases reinvestment risk. Puttable bonds, conversely, provide lower yields as they grant investors the option to sell the bond back to the issuer, reducing interest rate risk. Yield spreads between callable and puttable bonds reflect differences in embedded option values and market interest rate expectations.

Risk Factors in Callable and Puttable Bonds

Callable bonds carry higher reinvestment risk as issuers can redeem the bond before maturity, forcing investors to reinvest at lower interest rates during declining rate environments. Puttable bonds offer investors downside protection by allowing them to sell the bond back to the issuer at predetermined times, reducing interest rate risk and credit risk exposure. The key risk factor in callable bonds is issuer credit quality impacting call likelihood, whereas puttable bonds' risk lies in the issuer's willingness and ability to honor the put option.

Use Cases in Banking and Corporate Finance

Callable bonds provide issuers, often banks and corporations, with the flexibility to refinance debt at lower interest rates when market conditions improve, reducing interest expenses and managing interest rate risk effectively. Puttable bonds offer investors the option to sell the bond back to the issuer before maturity, serving as a risk mitigation tool during market uncertainty or rising interest rates, which is valuable for conservative corporate treasuries managing liquidity. Financial institutions leverage callable bonds to optimize capital structure while using puttable bonds to attract cautious investors seeking downside protection in volatile credit markets.

Choosing Between Callable and Puttable Bonds

Choosing between callable and puttable bonds depends on an investor's risk tolerance and market outlook. Callable bonds offer issuers the right to redeem before maturity, providing higher yields but increased reinvestment risk for investors. Puttable bonds grant holders the option to sell back to the issuer, offering downside protection and flexibility in volatile interest rate environments.

Important Terms

Embedded Option

An embedded option in bonds refers to a feature that allows either the issuer or the bondholder to take specific actions before maturity, such as calling or putting the bond; a callable bond includes an embedded call option enabling the issuer to redeem the bond early, typically to refinance at lower interest rates, while a puttable bond contains an embedded put option allowing the bondholder to sell the bond back to the issuer, often to mitigate interest rate risk. The value of these embedded options significantly influences the bond's price, yield, and risk profile, with callable bonds generally offering higher yields due to the call risk, and puttable bonds providing downside protection to investors through the put option.

Yield to Call

Yield to Call (YTC) measures the return on a callable bond when it is redeemed by the issuer before maturity, often at a premium to face value, reflecting the risk of early redemption. In contrast, puttable bonds offer investors the option to sell the bond back to the issuer at specified dates, affecting yield calculations by providing downside protection against interest rate increases.

Yield to Put

Yield to Put measures the return an investor receives if a puttable bond is sold back to the issuer at the predetermined put date, offering protection against interest rate declines. In contrast, yield to call applies to callable bonds, reflecting the yield assuming the issuer redeems the bond early, typically disadvantaging investors when interest rates fall.

Reinvestment Risk

Reinvestment risk is higher in callable bonds because issuers can redeem the bonds early when interest rates decline, forcing investors to reinvest proceeds at lower yields. In contrast, puttable bonds reduce reinvestment risk as investors have the option to sell the bond back to the issuer at predetermined dates, providing greater control over reinvestment timing and minimizing losses during rising interest rates.

Extension Risk

Extension risk arises in callable bonds when rising interest rates delay redemption, prolonging the investor's exposure to lower yields, while puttable bonds mitigate this risk by allowing investors to redeem the bond early at predefined times, thereby limiting potential losses from unfavorable interest rate shifts. Callable bonds expose investors to reinvestment risk and extended duration during rising rates, whereas puttable bonds provide a protective mechanism to reduce extension risk and maintain portfolio flexibility.

Option-Adjusted Spread (OAS)

Option-Adjusted Spread (OAS) quantifies the yield spread of callable bonds by adjusting for the embedded call option risk, reflecting the cost to the issuer of early repayment flexibility. In contrast, OAS for puttable bonds increases due to the embedded put option, capturing the added value to investors who can force early redemption under favorable conditions.

Call Protection Period

The Call Protection Period in callable bonds is a specified timeframe during which the issuer is prohibited from redeeming the bond early, providing investors with guaranteed interest payments and mitigating reinvestment risk. Puttable bonds, in contrast, typically do not feature a call protection period as they grant investors the option to sell the bond back to the issuer at predetermined dates, enhancing investor control and reducing interest rate risk.

Put Provision

A Put Provision in a bond contract grants the bondholder the right to sell the bond back to the issuer at a predetermined price before maturity, enhancing bondholder protection against interest rate rises or credit deterioration. This contrasts with a Callable Bond, where the issuer holds the right to redeem the bond early, typically to refinance debt at lower interest rates, thus favoring the issuer's financial flexibility.

Sinking Fund

A sinking fund reduces default risk by ensuring the issuer repays callable bonds incrementally, enhancing bondholder security but potentially limiting price appreciation. In contrast, puttable bonds provide investors with the option to sell back the bond before maturity, increasing liquidity and reducing interest rate risk without the need for a sinking fund.

Interest Rate Volatility

Interest rate volatility significantly impacts callable bonds by increasing the issuer's likelihood to call the bond when rates decline, thereby limiting price appreciation for investors. In contrast, puttable bonds provide investors protection against rising rates by allowing them to sell the bond back to the issuer, reducing interest rate risk.

Callable Bond vs Puttable Bond Infographic

moneydif.com

moneydif.com