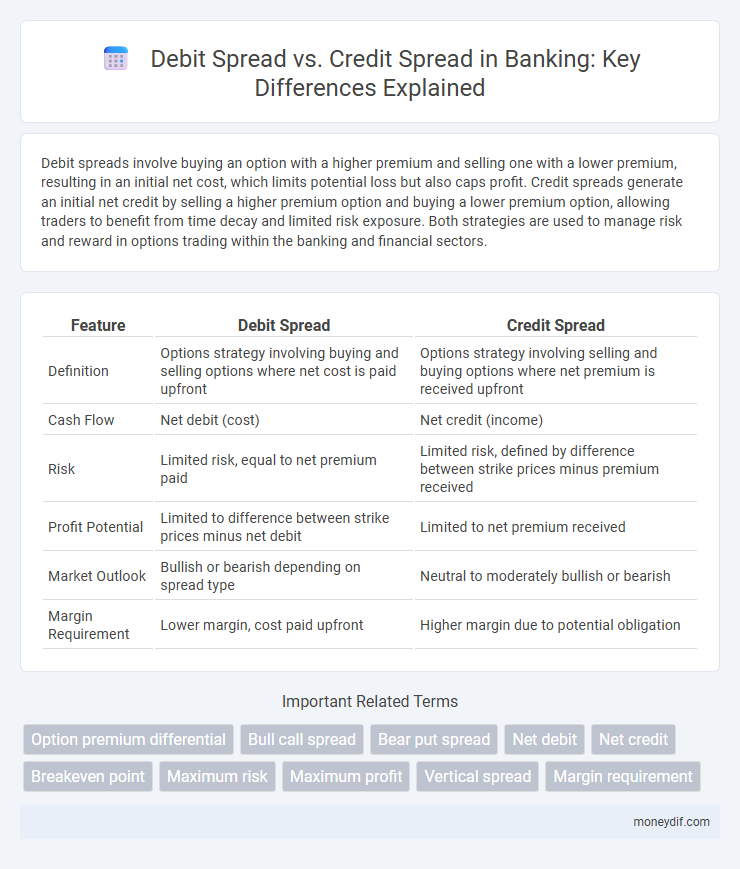

Debit spreads involve buying an option with a higher premium and selling one with a lower premium, resulting in an initial net cost, which limits potential loss but also caps profit. Credit spreads generate an initial net credit by selling a higher premium option and buying a lower premium option, allowing traders to benefit from time decay and limited risk exposure. Both strategies are used to manage risk and reward in options trading within the banking and financial sectors.

Table of Comparison

| Feature | Debit Spread | Credit Spread |

|---|---|---|

| Definition | Options strategy involving buying and selling options where net cost is paid upfront | Options strategy involving selling and buying options where net premium is received upfront |

| Cash Flow | Net debit (cost) | Net credit (income) |

| Risk | Limited risk, equal to net premium paid | Limited risk, defined by difference between strike prices minus premium received |

| Profit Potential | Limited to difference between strike prices minus net debit | Limited to net premium received |

| Market Outlook | Bullish or bearish depending on spread type | Neutral to moderately bullish or bearish |

| Margin Requirement | Lower margin, cost paid upfront | Higher margin due to potential obligation |

Understanding Debit Spreads in Banking

Debit spreads in banking involve simultaneously buying and selling options where the purchased option has a higher premium than the sold option, resulting in an initial net debit or cost. This strategy limits potential losses and gains by defining maximum risk and reward upfront, making it a controlled investment approach in volatile markets. Banks use debit spreads to hedge positions or capitalize on moderate price movements in underlying assets with reduced capital outlay compared to outright option purchases.

What Is a Credit Spread?

A credit spread in banking refers to the difference in yield between two bonds of similar maturity but different credit quality, reflecting the risk premium demanded by investors for bearing additional credit risk. It quantifies the extra yield that investors require to compensate for potential default or downgrade of the lower-rated bond compared to the higher-rated benchmark. Monitoring credit spreads helps financial institutions assess market sentiment on credit risk, price loans accurately, and manage portfolio risk effectively.

Key Differences Between Debit and Credit Spreads

Debit spreads involve an initial cash outflow as the trader pays a premium to enter the position, whereas credit spreads generate an upfront credit by receiving a premium. Risk profiles differ significantly: debit spreads limit maximum loss to the net premium paid with potential for greater profit, while credit spreads cap maximum profit to the net premium received with a defined maximum loss. In terms of market outlook, debit spreads are typically used when a moderate directional move is expected, and credit spreads benefit from neutral to slightly favorable market conditions.

Advantages of Debit Spreads

Debit spreads offer controlled risk by limiting potential losses to the initial investment, making them safer for conservative traders. They require lower capital outlay compared to outright long positions, enhancing capital efficiency in portfolio management. These spreads also provide opportunities to profit from moderate price movements in the underlying asset, increasing strategic flexibility in volatile markets.

Advantages of Credit Spreads

Credit spreads offer traders limited risk with the potential for consistent income through premiums collected from selling options. They require less capital outlay compared to debit spreads due to the net credit received upfront, enhancing capital efficiency. The strategy benefits from time decay and can be adjusted or closed early to lock in profits, making it a flexible choice in managing market risk.

Risk Factors: Debit vs Credit Spreads

Debit spreads involve buying an option at a higher premium and selling one at a lower premium, limiting both potential loss and gain with defined risk exposure primarily due to the net debit paid. Credit spreads receive a net premium upfront from selling a higher premium option and buying a lower premium one, exposing the trader to risk capped by the difference between strike prices minus the net credit received. Risk factors in debit spreads focus on the initial capital outlay and the potential total loss limited to this premium, whereas credit spreads hinge on the obligation of maximum loss if the market moves adversely beyond the sold option's strike price.

Cost Comparison: Debit Spreads vs Credit Spreads

Debit spreads require an initial outlay as traders pay a net premium, leading to a higher upfront cost compared to credit spreads, which result in a net premium received and thus provide immediate income. While debit spreads incur a debit cost that limits potential loss to the premium paid, credit spreads expose traders to potential margin requirements and higher risk despite generating upfront cash flow. Cost efficiency depends on risk tolerance and market outlook, with debit spreads offering controlled risk and credit spreads providing income with contingent liabilities.

Profit Potential in Debit and Credit Spreads

Debit spreads limit profit potential to the net difference between the strikes minus the initial debit paid, making gains capped but more predictable. Credit spreads provide profit potential limited to the premium received upfront, with profits realized if the spread expires worthless or narrows. Risk management and payoff structure distinguish debit and credit spreads in profit generation within options trading.

Choosing the Right Spread for Banking Strategies

In banking strategies, choosing between debit spreads and credit spreads depends on risk tolerance and market outlook. Debit spreads require an initial outlay and limit maximum loss, making them suitable for conservative strategies seeking controlled risk. Credit spreads generate upfront income with defined maximum loss, aligning with banks aiming to capitalize on stable or moderately bullish markets.

Practical Examples of Debit and Credit Spreads

A debit spread involves buying a higher-premium option and selling a lower-premium option, resulting in a net debit, such as purchasing a call option at $5 and selling a call at $3, paying $2 upfront to limit risk while targeting moderate gains. Conversely, a credit spread generates net income by selling a higher-premium option and buying a lower-premium option, like selling a put option at $4 and buying a put at $2, which yields a $2 credit but caps potential loss. These strategies are widely used in banking for hedging or speculative purposes by managing exposure and controlling risk through predefined maximum loss and profit limits.

Important Terms

Option premium differential

Option premium differential defines the net cost or credit in debit and credit spreads, where debit spreads require paying a higher premium upfront and credit spreads generate income by receiving a higher premium initially.

Bull call spread

A Bull call spread is a type of debit spread where an investor buys a lower strike call and sells a higher strike call, contrasting with a credit spread which involves selling a higher premium option and buying a lower premium option for a net credit.

Bear put spread

A bear put spread is a debit spread strategy involving buying a higher strike put and selling a lower strike put to profit from moderate declines, while credit spreads involve receiving premium by selling a higher premium option and buying a lower premium option, typically used in bullish or neutral market conditions.

Net debit

A net debit occurs when entering a debit spread option strategy, involving a higher premium paid for the long option compared to the premium received from the short option, whereas a credit spread generates a net credit by collecting more premium from the short option than paid for the long option.

Net credit

Net credit refers to the initial profit received when the premium collected from selling options in a credit spread exceeds the premium paid, contrasting with a debit spread, which requires an upfront net debit payment.

Breakeven point

The breakeven point for a debit spread equals the strike price of the long option plus the net premium paid, whereas for a credit spread it equals the strike price of the short option minus the net premium received.

Maximum risk

Maximum risk in a debit spread equals the net premium paid, while in a credit spread it equals the difference between strike prices minus the net premium received.

Maximum profit

Maximum profit in a debit spread is limited to the difference between strike prices minus the net debit paid, while in a credit spread, it equals the net credit received when both options expire worthless.

Vertical spread

Vertical spreads in options trading are categorized as debit spreads when the initial cost is paid upfront, and credit spreads when a net premium is received at initiation.

Margin requirement

Margin requirements for debit spreads are generally lower than for credit spreads due to the limited risk of the maximum premium paid compared to the potentially higher risk of credit spreads requiring substantial collateral.

Debit spread vs Credit spread Infographic

moneydif.com

moneydif.com