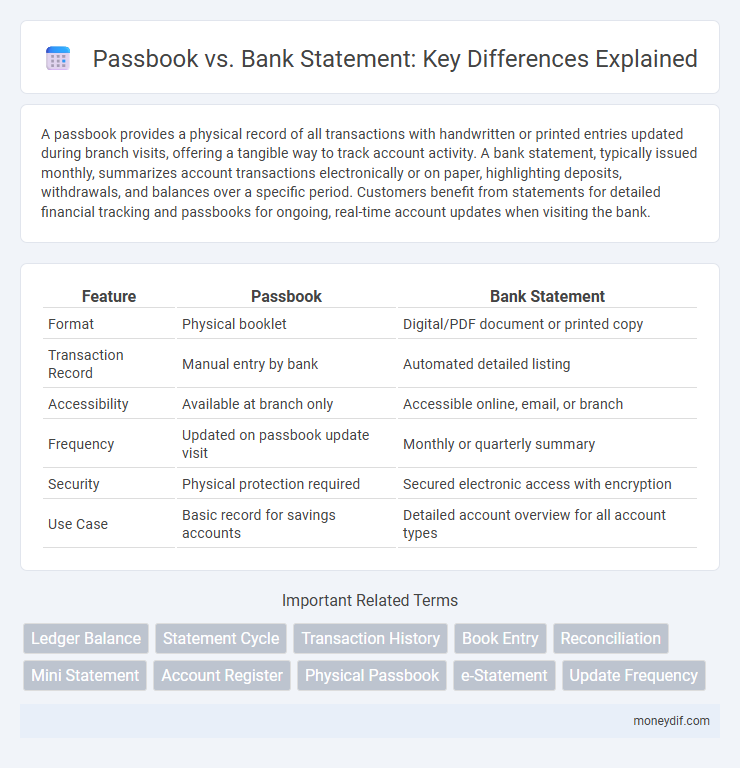

A passbook provides a physical record of all transactions with handwritten or printed entries updated during branch visits, offering a tangible way to track account activity. A bank statement, typically issued monthly, summarizes account transactions electronically or on paper, highlighting deposits, withdrawals, and balances over a specific period. Customers benefit from statements for detailed financial tracking and passbooks for ongoing, real-time account updates when visiting the bank.

Table of Comparison

| Feature | Passbook | Bank Statement |

|---|---|---|

| Format | Physical booklet | Digital/PDF document or printed copy |

| Transaction Record | Manual entry by bank | Automated detailed listing |

| Accessibility | Available at branch only | Accessible online, email, or branch |

| Frequency | Updated on passbook update visit | Monthly or quarterly summary |

| Security | Physical protection required | Secured electronic access with encryption |

| Use Case | Basic record for savings accounts | Detailed account overview for all account types |

Introduction: The Role of Record-Keeping in Banking

Passbooks and bank statements serve as essential tools for maintaining accurate financial records and tracking transaction history. Passbooks provide a tangible, often updated booklet reflecting deposit and withdrawal activities, while statements offer a detailed, typically digital summary of account movements over a specified period. Both methods support transparency, enable effective money management, and help in resolving discrepancies in banking operations.

What is a Passbook?

A passbook is a physical booklet provided by banks to customers as a record of all transactions in their savings accounts, allowing easy tracking of deposits, withdrawals, and interest accrued. It serves as a tangible document that customers can present during banking visits to verify account activity without relying on digital devices. Passbooks are especially useful for those who prefer traditional banking methods or have limited access to online banking platforms.

What is a Bank Statement?

A bank statement is a detailed record provided by a financial institution that lists all transactions, including deposits, withdrawals, and fees, within a specific period. It serves as an official document for account holders to monitor their account activity and reconcile balances. Unlike a passbook, which is typically updated manually, a bank statement is often generated electronically and can be accessed online or in printed form.

Key Features of Passbooks

Passbooks provide a tangible record of all transactions, allowing account holders to monitor deposits, withdrawals, and balances in real-time. They offer enhanced security through physical documentation, reducing risks of digital fraud and unauthorized access. Passbooks are especially beneficial for users with limited internet access, ensuring consistent account tracking without reliance on electronic statements.

Key Features of Bank Statements

Bank statements provide a detailed, chronological record of all transactions within a specified period, including deposits, withdrawals, fees, and interest earned. They often include important information such as account balance updates, transaction descriptions, date stamps, and bank contact details. Unlike passbooks, bank statements are typically issued monthly and can be accessed electronically, offering convenience and enhanced record-keeping for account holders.

Passbook vs Statement: Core Differences

A passbook is a physical document updated manually or electronically during bank visits, providing a tangible record of transactions, whereas a statement is a digital or printed summary issued periodically by the bank detailing account activity. Passbooks offer real-time transaction updates upon bank visits, while statements compile transactions over a set period for comprehensive review. Security features in statements include encryption and password protection, contrasting with the physical security of a passbook that requires safekeeping by the account holder.

Advantages of Using a Passbook

A passbook provides a tangible, easy-to-reference record of all banking transactions, enhancing accessibility for users without digital access. It offers real-time updating at bank branches or ATMs, ensuring accurate and immediate reflection of deposits, withdrawals, and interest accruals. Passbooks also serve as a reliable audit trail for account monitoring, supporting effective financial management and error detection.

Advantages of Opting for Bank Statements

Bank statements provide detailed, organized records of all transactions, allowing for easy tracking and reconciliation of account activities over specified periods. They offer enhanced accuracy and are accessible digitally, which supports efficient financial management and quick dispute resolution. Opting for bank statements reduces the risk of physical loss or damage associated with passbooks while facilitating seamless integration with online banking tools.

Which is More Secure: Passbook or Statement?

Passbooks provide enhanced security by limiting digital exposure and requiring physical possession to access transaction records, reducing risks of cyber theft associated with electronic statements. Bank statements, while convenient for remote access and easy archiving, are vulnerable to hacking, phishing attacks, and unauthorized online access if login credentials are compromised. Therefore, for stringent security, passbooks offer a safer option, especially in regions with higher cyber fraud incidences.

Choosing the Right Option for Your Banking Needs

Passbooks provide a tangible record of all transactions, making them ideal for customers who prefer physical documentation and easy tracking of account activity. Bank statements offer detailed summaries, often with advanced insights and digital accessibility, suitable for tech-savvy users who require comprehensive financial management tools. Selecting between a passbook and a statement depends on your preference for physical records versus digital convenience and the level of detail needed to monitor your banking activities effectively.

Important Terms

Ledger Balance

Ledger balance reflects the actual available funds in an account, while passbook provides a physical record of transactions and statement offers a detailed digital summary for a specific period.

Statement Cycle

The statement cycle refers to the period covered by a bank statement, typically monthly, whereas a passbook is updated in real-time or during each transaction, providing an immediate record of account activity.

Transaction History

Passbook provides a real-time, physical record of transaction history while bank statements offer detailed, periodic electronic summaries for easy tracking and reconciliation.

Book Entry

Book entry systems electronically record ownership of securities, offering faster transaction updates and reduced physical risks compared to traditional passbook methods and bank statements.

Reconciliation

Reconciliation between passbook and bank statement ensures accurate financial tracking by comparing recorded transactions for discrepancies and updating balances accordingly.

Mini Statement

A mini statement provides a brief overview of recent transactions, offering quicker access to account activity compared to a comprehensive passbook or detailed bank statement.

Account Register

An account register offers detailed, real-time transaction tracking and balance updates, while a passbook provides a physical record of transactions, and a statement summarizes monthly account activity for concise financial overview.

Physical Passbook

Physical passbooks offer a tangible, handwritten record of transactions providing easy access and verification compared to digital bank statements that offer searchability and convenience.

e-Statement

An e-Statement provides a secure, digital alternative to traditional passbooks by offering real-time transaction updates and easy online access to account history.

Update Frequency

Passbook updates occur in real-time or daily at banks, while statements are typically generated monthly or quarterly for summarized transaction records.

Passbook vs Statement Infographic

moneydif.com

moneydif.com