A repo (repurchase agreement) is a short-term borrowing mechanism where a bank sells securities with a commitment to repurchase them at a higher price, providing liquidity. A reverse repo is the opposite transaction where the bank buys securities and agrees to sell them back later, effectively absorbing liquidity. These tools are crucial for managing short-term interest rates and maintaining liquidity in the banking system.

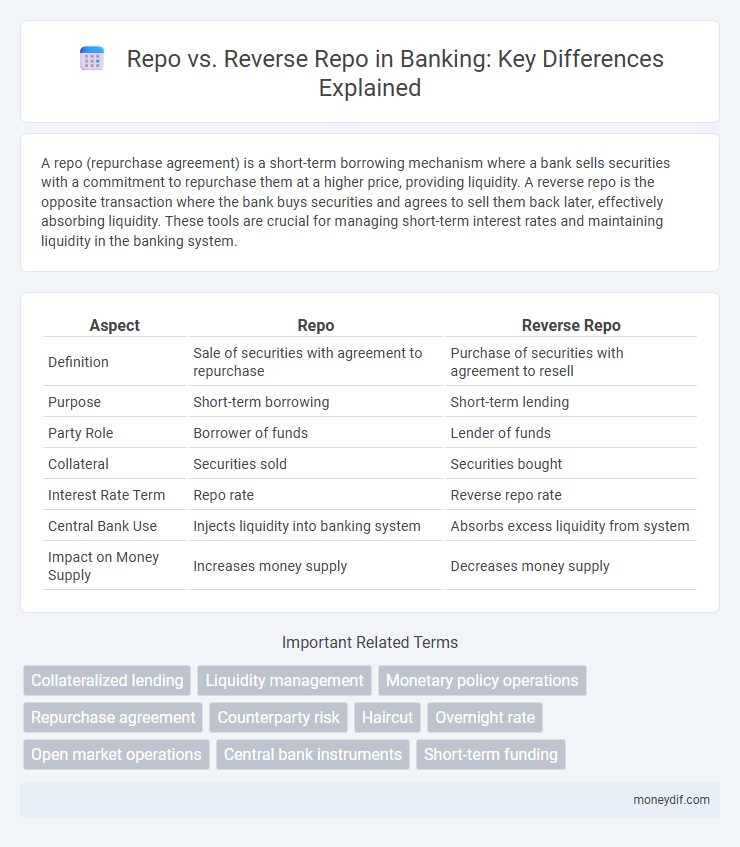

Table of Comparison

| Aspect | Repo | Reverse Repo |

|---|---|---|

| Definition | Sale of securities with agreement to repurchase | Purchase of securities with agreement to resell |

| Purpose | Short-term borrowing | Short-term lending |

| Party Role | Borrower of funds | Lender of funds |

| Collateral | Securities sold | Securities bought |

| Interest Rate Term | Repo rate | Reverse repo rate |

| Central Bank Use | Injects liquidity into banking system | Absorbs excess liquidity from system |

| Impact on Money Supply | Increases money supply | Decreases money supply |

Introduction to Repo and Reverse Repo

Repo (repurchase agreement) is a short-term borrowing mechanism where banks sell government securities to investors with a commitment to repurchase them at a higher price on a future date, effectively serving as collateralized loans. Reverse repo involves the purchase of government securities by banks or the central bank from other financial institutions with an agreement to sell them back later, used primarily to absorb liquidity from the banking system. Both instruments are crucial for managing short-term liquidity, controlling money supply, and implementing monetary policy in the banking sector.

Key Differences Between Repo and Reverse Repo

A repo (repurchase agreement) is a short-term borrowing mechanism where banks sell securities and agree to repurchase them at a higher price, primarily used to raise short-term capital. In contrast, a reverse repo involves buying securities with a commitment to resell them, acting as a tool for banks to invest surplus funds securely. The key differences lie in their roles: repo provides liquidity to borrowers, while reverse repo helps lenders park excess funds safely.

How Repo Transactions Work in Banking

Repo transactions involve the sale of securities by banks or financial institutions with an agreement to repurchase them at a specified date and price, effectively functioning as short-term loans secured by collateral. The repo rate determines the cost of borrowing, influencing liquidity management and interest rates in the banking system. Central banks use repo operations to inject liquidity into the market, stabilizing money supply and controlling inflation.

The Role of Reverse Repo in Liquidity Management

The reverse repo plays a critical role in liquidity management by enabling central banks to absorb excess liquidity from the banking system, thus controlling money supply and stabilizing interest rates. Through reverse repo operations, financial institutions temporarily park their surplus funds with the central bank, earning interest while reducing short-term liquidity in the market. This mechanism helps maintain monetary policy objectives, prevent inflationary pressures, and ensure overall financial stability.

Repo vs Reverse Repo: Impact on Interest Rates

Repo transactions involve banks selling securities with an agreement to repurchase them at a higher price, effectively acting as short-term loans and typically leading to an increase in short-term interest rates. Reverse repo operations occur when the central bank sells securities to absorb excess liquidity, which tends to lower short-term interest rates by reducing money supply. The dynamic interaction between repo and reverse repo rates significantly influences overall market liquidity and benchmark interest rates.

Use Cases of Repo and Reverse Repo in Banks

Repo transactions enable banks to obtain short-term liquidity by selling securities with an agreement to repurchase them at a later date, facilitating cash flow management and funding needs. Reverse repo operations allow banks to invest excess funds securely by purchasing securities with an agreement to sell them back, helping in liquidity absorption and yield optimization. Both instruments support monetary policy implementation by central banks to regulate money supply and maintain financial stability.

Risks Involved in Repo and Reverse Repo Operations

Repo operations carry risks such as counterparty default, where the borrower may fail to repurchase the securities, and collateral risk if the value of securities declines during the contract period. Reverse repo risks include liquidity risk, as the lender's funds are temporarily locked, and market risk, since fluctuations in interest rates can affect profitability. Both transactions require careful assessment of creditworthiness and market volatility to mitigate potential financial losses.

Repo and Reverse Repo in Central Bank Policy

In central bank policy, a repo (repurchase agreement) involves the central bank purchasing securities from commercial banks with an agreement to resell them later, injecting liquidity into the banking system temporarily. The reverse repo transaction occurs when the central bank sells securities to commercial banks with a commitment to repurchase, effectively absorbing excess liquidity to control money supply. These tools are critical for managing short-term interest rates and maintaining monetary stability.

Market Participants in Repo and Reverse Repo Deals

Market participants in repo deals primarily include commercial banks, mutual funds, and hedge funds seeking short-term liquidity or collateralized borrowing. Reverse repo transactions attract central banks and institutional investors aiming to earn risk-free returns by lending funds against securities. Both instruments play crucial roles in managing liquidity and interest rates within the financial system.

Advantages and Disadvantages: Repo vs Reverse Repo

Repos provide banks with quick liquidity by selling securities with an agreement to repurchase them later, enhancing short-term funding flexibility while carrying counterparty risk and interest rate exposure. Reverse repos allow financial institutions to invest surplus funds securely by purchasing securities with an obligation to sell them back, offering safety and control over liquidity but potentially limiting higher returns compared to other investments. Both instruments play crucial roles in monetary policy implementation but vary in risk profiles and impact on balance sheet management.

Important Terms

Collateralized lending

Collateralized lending involves secured borrowing using assets where a repo is a sale of securities with agreement to repurchase, while a reverse repo is a purchase with agreement to resell, both serving as short-term funding and liquidity tools in financial markets.

Liquidity management

Liquidity management involves balancing short-term funding by using repo agreements to obtain cash and reverse repo transactions to invest excess liquidity securely.

Monetary policy operations

Repo operations increase liquidity by selling securities with an agreement to repurchase, while reverse repo operations absorb liquidity by buying securities with an agreement to resell, both crucial tools in central bank monetary policy management.

Repurchase agreement

A repurchase agreement (repo) is a short-term borrowing mechanism where a seller agrees to repurchase securities at a later date, while a reverse repo is the corresponding transaction where the buyer agrees to resell the securities, facilitating liquidity management in financial markets.

Counterparty risk

Counterparty risk in repo and reverse repo transactions involves the possibility that one party may default on its obligation to repurchase or resell securities, impacting liquidity and financial stability.

Haircut

A haircut in repo and reverse repo transactions represents the percentage difference between the market value of collateral and the loan amount to mitigate counterparty risk.

Overnight rate

The overnight rate is influenced by the balance between repo transactions, where banks borrow funds by selling securities, and reverse repo operations, where they lend funds by purchasing securities with an agreement to sell back.

Open market operations

Open market operations involve the central bank conducting repo transactions to inject liquidity by purchasing securities and reverse repo transactions to absorb liquidity by selling securities, thereby managing short-term interest rates and money supply.

Central bank instruments

Central bank instruments include repo operations where banks sell securities to borrow funds and reverse repo operations where they purchase securities to lend funds, managing liquidity and interest rates effectively.

Short-term funding

Short-term funding through repos involves selling securities with an agreement to repurchase them later, while reverse repos entail buying securities with a commitment to resell, both serving as essential liquidity management tools in financial markets.

Repo vs Reverse repo Infographic

moneydif.com

moneydif.com