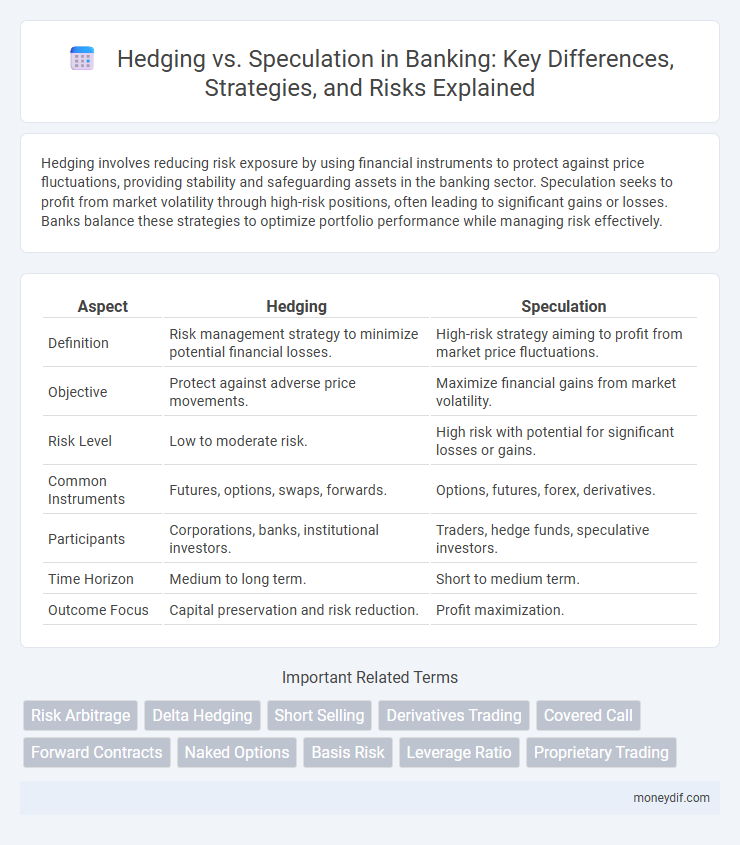

Hedging involves reducing risk exposure by using financial instruments to protect against price fluctuations, providing stability and safeguarding assets in the banking sector. Speculation seeks to profit from market volatility through high-risk positions, often leading to significant gains or losses. Banks balance these strategies to optimize portfolio performance while managing risk effectively.

Table of Comparison

| Aspect | Hedging | Speculation |

|---|---|---|

| Definition | Risk management strategy to minimize potential financial losses. | High-risk strategy aiming to profit from market price fluctuations. |

| Objective | Protect against adverse price movements. | Maximize financial gains from market volatility. |

| Risk Level | Low to moderate risk. | High risk with potential for significant losses or gains. |

| Common Instruments | Futures, options, swaps, forwards. | Options, futures, forex, derivatives. |

| Participants | Corporations, banks, institutional investors. | Traders, hedge funds, speculative investors. |

| Time Horizon | Medium to long term. | Short to medium term. |

| Outcome Focus | Capital preservation and risk reduction. | Profit maximization. |

Introduction to Hedging and Speculation in Banking

Hedging in banking involves strategies that reduce exposure to financial risks such as interest rate fluctuations, currency exchange volatility, and credit defaults, ensuring stability in asset and liability management. Speculation, conversely, entails taking calculated risks in markets by betting on price movements to generate profits, often involving derivatives like futures and options. Banks use hedging primarily for risk management, while speculation aims at maximizing returns through market insights and forecasts.

Key Differences Between Hedging and Speculation

Hedging involves using financial instruments like futures, options, or swaps to reduce risk exposure by locking in prices or rates, ensuring stability in cash flows and protecting assets from adverse market movements. Speculation, in contrast, aims to profit from market fluctuations by taking on higher risk positions without underlying exposure, often leveraging price predictions to achieve significant returns. The key difference lies in hedging's risk mitigation objective versus speculation's pursuit of profit, with hedgers prioritizing loss prevention and speculators embracing volatility for potential gain.

Role of Hedging in Risk Management

Hedging plays a critical role in risk management by mitigating potential losses caused by market volatility through the use of financial instruments such as derivatives, futures, and options. Banks employ hedging strategies to protect their portfolios against fluctuations in interest rates, currency exchange rates, and commodity prices, thereby stabilizing earnings and preserving capital. This risk reduction enables financial institutions to maintain regulatory compliance and enhance investor confidence by minimizing exposure to adverse market movements.

Speculation: Pursuing Profit in Uncertain Markets

Speculation involves actively seeking profit by taking on higher risk through short-term investments in volatile markets, often utilizing derivatives, futures, or options. This strategy relies on predicting price movements, capitalizing on market inefficiencies, and rapid decision-making to maximize returns. While speculation can lead to substantial gains, it also increases exposure to market fluctuations and potential losses, distinguishing it sharply from hedging's risk mitigation focus.

Financial Instruments Used for Hedging and Speculation

Financial instruments used for hedging primarily include options, futures, forwards, and swaps that mitigate risk exposure by locking in prices or rates. Speculation often involves leveraging derivatives such as options and futures contracts to profit from anticipated market movements, emphasizing high-risk and high-reward potential. Both hedging and speculation utilize similar financial tools, but their strategic objectives and risk management approaches differ significantly.

Regulatory Perspectives on Hedging and Speculation

Regulatory frameworks distinctly differentiate hedging from speculation to mitigate systemic risk and promote financial stability within the banking sector. Hedging is often permitted under strict guidelines as it is viewed as a risk management strategy to protect against price volatility, whereas speculation is subject to more stringent oversight due to its higher risk profile and potential to amplify market instability. Agencies like the SEC, CFTC, and Basel Committee implement regulations requiring transparent reporting, position limits, and capital reserves to monitor speculative activities and ensure compliance with risk mitigation standards.

Impact on Bank Profitability and Stability

Hedging strategies in banking reduce exposure to market risks, enhancing profitability stability by minimizing potential losses from interest rate fluctuations or currency volatility. In contrast, speculation involves taking on higher risk positions with the aim of generating higher returns, which can lead to significant profit variability and increased financial instability. Banks that prioritize hedging maintain more predictable earnings and stronger capital reserves, supporting long-term solvency and regulatory compliance.

Case Studies: Hedging and Speculation in Action

In banking, hedging strategies were exemplified by JPMorgan Chase's use of interest rate swaps to mitigate risks associated with fluctuating borrowing costs, successfully stabilizing their balance sheet during volatile markets. Conversely, speculative actions by banks like Lehman Brothers, which engaged heavily in risky mortgage-backed securities, highlight the dangers of speculation leading to significant losses and insolvency. These case studies emphasize the critical distinction between risk management through hedging and pursuing profits via speculation, underscoring the need for prudent banking practices.

Best Practices for Banks: Balancing Hedging and Speculation

Banks should implement rigorous risk management frameworks that prioritize hedging strategies to mitigate market exposure and ensure financial stability. Utilizing derivatives such as futures, options, and swaps allows precise risk transfer while limiting speculative positions to defined thresholds enforces capital adequacy and regulatory compliance. Continuous monitoring through real-time analytics and stress testing supports an optimal balance between hedging effectiveness and controlled speculation aligned with the bank's risk appetite.

Future Trends in Hedging and Speculation within Banking

Emerging technologies such as artificial intelligence and blockchain are reshaping hedging strategies and speculative activities by enhancing risk assessment accuracy and transaction transparency within banking. Regulatory frameworks are evolving to address increased volatility and complex derivatives trading, pushing banks to adopt more sophisticated hedging instruments and algorithms. Market dynamics driven by geopolitical events and digital asset integration are expected to fuel innovation in hedging models while expanding speculative opportunities in banking portfolios.

Important Terms

Risk Arbitrage

Risk arbitrage involves exploiting price inefficiencies during corporate events such as mergers and acquisitions, relying on precise analysis rather than speculation. Hedging in this context minimizes exposure to adverse price movements by offsetting potential losses, whereas speculation entails taking positions based on anticipated market changes, increasing risk.

Delta Hedging

Delta hedging is a risk management strategy used to neutralize the directional risk of options positions by adjusting the hedge ratio to maintain a delta-neutral portfolio. This approach contrasts with speculation, as it aims to minimize exposure to price movements rather than profit from them, distinguishing hedging as a protective mechanism in financial markets.

Short Selling

Short selling involves borrowing shares to sell at a high price, aiming to buy them back later at a lower price for profit, often used as a hedging strategy to protect against potential losses in long positions. In contrast, speculative short selling seeks to profit from anticipated price declines without underlying asset exposure, carrying higher risk and market impact.

Derivatives Trading

Derivatives trading involves contracts like options and futures that derive value from underlying assets, serving dual purposes of hedging risk and enabling speculation. Hedging aims to minimize potential losses by offsetting exposure, while speculation seeks to profit from asset price fluctuations without owning the underlying instrument.

Covered Call

A covered call strategy involves holding a long position in an asset while selling call options on the same asset, effectively generating income and providing partial downside protection as a hedging technique. This strategy balances risk and reward by limiting upside potential for speculative gains while reducing losses, distinguishing it from pure speculation where the goal is to maximize profits without downside protection.

Forward Contracts

Forward contracts serve as a crucial hedging tool by allowing parties to lock in prices and reduce exposure to price volatility in commodities or currencies, thereby minimizing financial risk. Conversely, speculators use forward contracts to capitalize on anticipated price movements, seeking profit by assuming the price risk that hedgers aim to avoid.

Naked Options

Naked options involve selling options without owning the underlying asset, increasing exposure to unlimited risk compared to hedging strategies that aim to reduce portfolio risk by offsetting potential losses. Speculators use naked options to leverage potential high returns from price movements, while hedgers prefer covered options or protective strategies to minimize market volatility impact.

Basis Risk

Basis risk arises when the price movements of a hedging instrument and the underlying asset do not perfectly correlate, leading to imperfect risk mitigation in hedging strategies. Speculators, unlike hedgers, accept basis risk intentionally to profit from anticipated changes in the price relationship between the futures contract and the underlying asset.

Leverage Ratio

The leverage ratio, a key financial metric indicating the proportion of debt used to finance assets, significantly influences hedging and speculation strategies by determining the risk capacity of a firm. In hedging, a lower leverage ratio typically reduces financial risk exposure, while in speculation, higher leverage ratios amplify potential gains and losses, intensifying market volatility effects.

Proprietary Trading

Proprietary trading involves financial firms using their own capital to engage in trading activities aiming for direct profit, often blurring the line between hedging risk exposure and speculative investment. While hedging strategies seek to minimize potential losses by offsetting risk, proprietary trading primarily focuses on speculation to maximize returns through market positions based on price movements.

Hedging vs Speculation Infographic

moneydif.com

moneydif.com