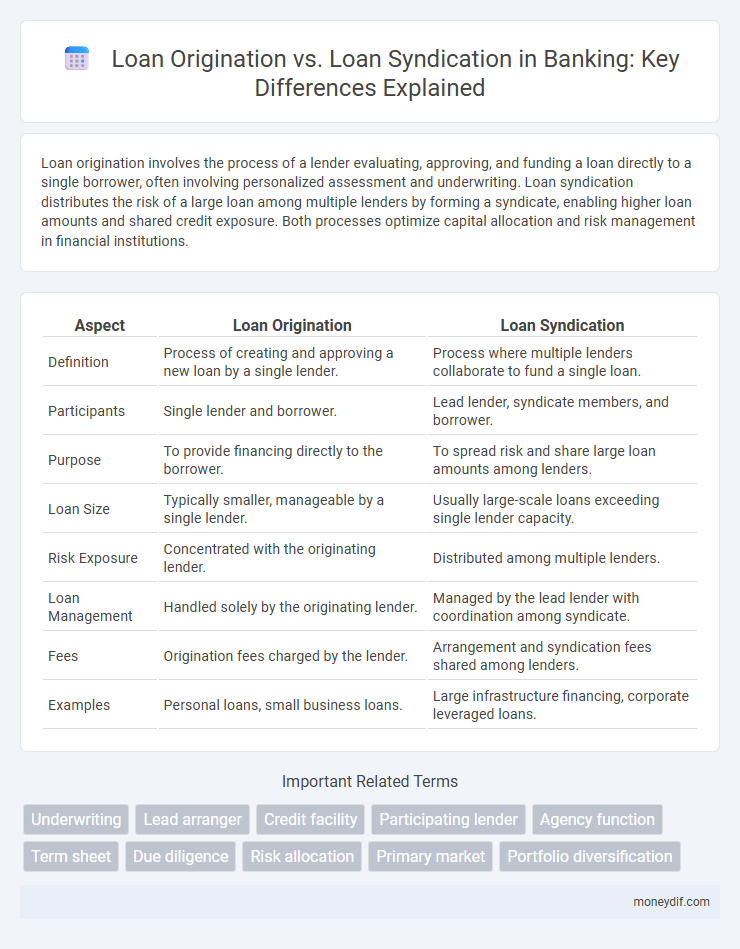

Loan origination involves the process of a lender evaluating, approving, and funding a loan directly to a single borrower, often involving personalized assessment and underwriting. Loan syndication distributes the risk of a large loan among multiple lenders by forming a syndicate, enabling higher loan amounts and shared credit exposure. Both processes optimize capital allocation and risk management in financial institutions.

Table of Comparison

| Aspect | Loan Origination | Loan Syndication |

|---|---|---|

| Definition | Process of creating and approving a new loan by a single lender. | Process where multiple lenders collaborate to fund a single loan. |

| Participants | Single lender and borrower. | Lead lender, syndicate members, and borrower. |

| Purpose | To provide financing directly to the borrower. | To spread risk and share large loan amounts among lenders. |

| Loan Size | Typically smaller, manageable by a single lender. | Usually large-scale loans exceeding single lender capacity. |

| Risk Exposure | Concentrated with the originating lender. | Distributed among multiple lenders. |

| Loan Management | Handled solely by the originating lender. | Managed by the lead lender with coordination among syndicate. |

| Fees | Origination fees charged by the lender. | Arrangement and syndication fees shared among lenders. |

| Examples | Personal loans, small business loans. | Large infrastructure financing, corporate leveraged loans. |

Loan Origination: Definition and Process

Loan origination refers to the complete process by which a borrower applies for a new loan and the lender evaluates, approves, and disburses the funds. This process involves steps including application submission, credit assessment, underwriting, documentation, and loan approval. Efficient loan origination systems enhance risk management and customer experience by streamlining these stages using digital platforms and automated credit scoring models.

Understanding Loan Syndication in Banking

Loan syndication in banking involves multiple lenders collaborating to fund a single borrower, distributing risk and enabling larger loan amounts that individual banks might not support alone. Unlike loan origination, where a single financial institution processes and funds the loan, syndication requires coordination among banks, legal structuring, and agreement on terms such as interest rates and repayment schedules. This method is particularly effective for financing large projects, corporate acquisitions, or high-value real estate developments by leveraging the strengths and capital of multiple lenders.

Key Differences Between Loan Origination and Loan Syndication

Loan origination involves the process where a financial institution creates a new loan agreement directly with a borrower, assessing credit risk, underwriting, and setting terms. Loan syndication, on the other hand, distributes this risk by involving multiple lenders who collectively fund a single loan, often for large-scale projects or corporate financing needs. Key differences include loan origination focusing on single lender-borrower relationship and credit evaluation, while syndication emphasizes risk sharing, collaboration among lenders, and managing complex, high-value loans.

Benefits of Traditional Loan Origination

Traditional loan origination offers comprehensive risk assessment and personalized underwriting, ensuring tailored loan terms aligned with borrower credit profiles. It facilitates direct lender-borrower relationships that enhance communication and loan servicing efficiency. This method contributes to stronger regulatory compliance and reduces the complexity often associated with syndicated loan structures.

Advantages of Loan Syndication for Large Borrowers

Loan syndication enables large borrowers to access substantial funding by pooling resources from multiple lenders, reducing the risk exposure for any single institution. It offers enhanced credit capacity and diversified financing sources, facilitating complex, high-value projects that may exceed individual lender limits. Syndicated loans also provide borrowers with streamlined negotiation processes and flexible terms tailored to large-scale capital requirements.

The Role of Banks in Loan Origination

Banks play a crucial role in loan origination by assessing borrower creditworthiness, structuring loan terms, and ensuring regulatory compliance. They act as the primary interface between borrowers and financial markets, managing risk through detailed underwriting and credit analysis. This process enables banks to extend credit efficiently, supporting economic growth and providing liquidity to individuals and businesses.

How Loan Syndication Mitigates Risk

Loan syndication mitigates risk by distributing the credit exposure among multiple lenders, reducing the likelihood of substantial losses for any single financial institution. This collaborative approach allows banks to finance large-scale projects or corporate loans that exceed individual lending limits, enhancing portfolio diversification and stability. Syndicated loans also involve shared due diligence and risk assessment, improving the overall quality and resilience of the loan structure.

Regulatory Considerations in Loan Origination vs Syndication

Regulatory considerations in loan origination primarily focus on borrower creditworthiness, anti-money laundering (AML) compliance, and disclosure requirements to ensure transparency and risk mitigation. Loan syndication involves additional regulatory oversight related to coordination among multiple lenders, adherence to syndicate agreements, and compliance with securities laws when portions of the loan are sold or transferred. Both processes require stringent adherence to banking standards, but syndication demands more complex regulatory navigation due to the involvement of multiple parties and cross-jurisdictional issues.

Technological Innovations in Loan Origination and Syndication

Technological innovations in loan origination leverage AI-powered credit scoring and automated document processing to accelerate approvals and enhance risk assessment accuracy. In loan syndication, blockchain technology ensures secure, transparent sharing of loan data among multiple lenders, streamlining deal structuring and reducing settlement times. Cloud-based platforms enable seamless collaboration, improve compliance monitoring, and facilitate real-time tracking of syndicated loan portfolios.

Choosing Between Loan Origination and Loan Syndication

Choosing between loan origination and loan syndication depends on factors such as loan size, risk distribution, and borrower profile. Loan origination suits smaller loans with single-lender control, while loan syndication spreads risk among multiple banks for larger or more complex financings. Assessing capital capacity and regulatory implications helps banks decide the optimal approach for efficient portfolio management.

Important Terms

Underwriting

Underwriting in loan origination involves assessing borrower creditworthiness and directly funding individual loans, ensuring risk evaluation and capital allocation for single lenders. In contrast, loan syndication underwrites larger credit facilities by distributing risk among multiple financial institutions, coordinating due diligence, and structuring shared repayment terms.

Lead arranger

The lead arranger plays a critical role in loan syndication by structuring the loan package, negotiating terms, and coordinating among multiple lenders to distribute risk. In loan origination, the focus is on the initial creation and underwriting of the loan, whereas loan syndication involves the lead arranger managing the distribution of that loan to other financial institutions.

Credit facility

Credit facility structures vary significantly between loan origination, where a single lender issues and manages the loan, and loan syndication, which involves multiple lenders sharing the credit risk and funding. Loan origination typically offers streamlined approval and servicing, whereas loan syndication enables larger financing amounts by distributing risk across a group of financial institutions.

Participating lender

A participating lender in loan origination directly provides capital to the borrower, taking on the credit risk and managing individual loan terms. In loan syndication, participating lenders collectively fund portions of a larger loan, sharing risk and returns while one lead bank administers the loan agreement.

Agency function

Loan origination involves a single financial institution acting as the primary agency to evaluate, approve, and disburse loans directly to borrowers. Loan syndication differs by distributing the credit risk among multiple agencies or lenders who collectively finance a large loan, enhancing risk management and capital allocation.

Term sheet

A term sheet in loan origination outlines the initial lending terms between a single borrower and a lender, detailing interest rates, repayment schedules, and covenants. In loan syndication, the term sheet coordinates terms across multiple lenders, defining each participant's commitment, risk exposure, and the lead arranger's roles to streamline the shared financing process.

Due diligence

Due diligence in loan origination involves a comprehensive assessment of a borrower's creditworthiness, financial statements, and collateral to mitigate default risk, while in loan syndication, it focuses on evaluating the lead bank's underwriting process, loan structure, and potential syndicate participants to ensure risk distribution and compliance with regulatory standards. Both processes prioritize accurate data verification, borrower analysis, and legal documentation, but loan syndication due diligence also assesses inter-lender agreements and secondary market conditions.

Risk allocation

Risk allocation in loan origination primarily involves the lender assuming full credit risk, focusing on individual borrower assessment and underwriting precision. In loan syndication, risk is distributed among multiple lenders, reducing exposure for each participant through shared credit responsibility and collateral.

Primary market

Primary market activities encompass loan origination, where financial institutions directly issue new loans to borrowers, while loan syndication involves multiple lenders collaboratively funding a single large loan to distribute risk and increase capital availability. Loan origination focuses on individual borrower assessment and underwriting, whereas loan syndication prioritizes structuring agreements among diverse lenders to support high-value financing needs.

Portfolio diversification

Portfolio diversification in loan origination involves spreading credit risk across multiple individual loans originated by a single lender, enhancing risk management and return stability. In loan syndication, diversification is achieved by multiple lenders jointly funding a single large loan, distributing credit exposure and improving capital allocation efficiency.

Loan origination vs Loan syndication Infographic

moneydif.com

moneydif.com