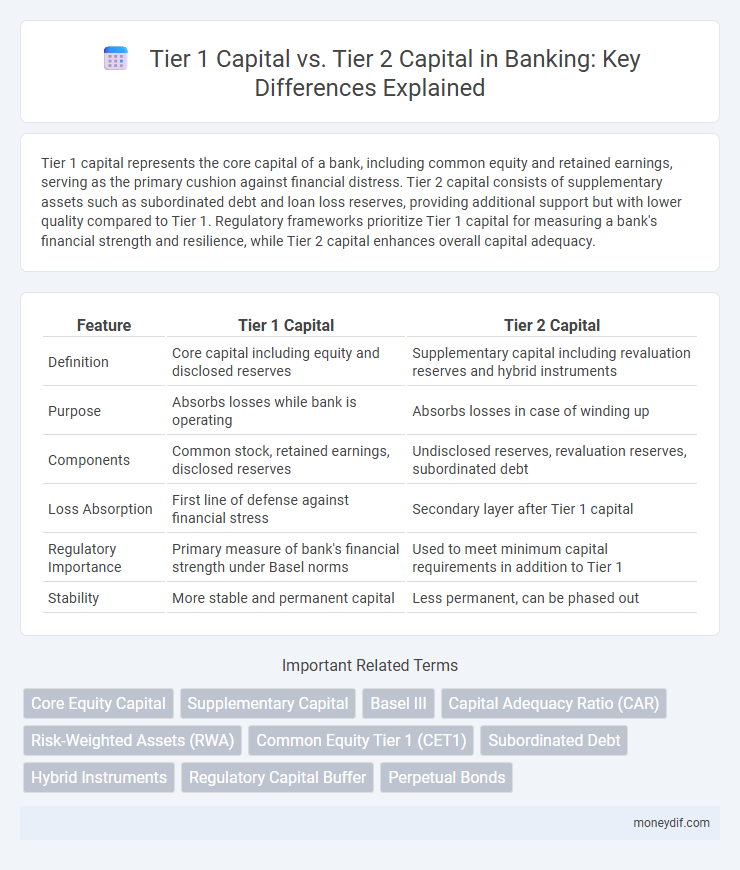

Tier 1 capital represents the core capital of a bank, including common equity and retained earnings, serving as the primary cushion against financial distress. Tier 2 capital consists of supplementary assets such as subordinated debt and loan loss reserves, providing additional support but with lower quality compared to Tier 1. Regulatory frameworks prioritize Tier 1 capital for measuring a bank's financial strength and resilience, while Tier 2 capital enhances overall capital adequacy.

Table of Comparison

| Feature | Tier 1 Capital | Tier 2 Capital |

|---|---|---|

| Definition | Core capital including equity and disclosed reserves | Supplementary capital including revaluation reserves and hybrid instruments |

| Purpose | Absorbs losses while bank is operating | Absorbs losses in case of winding up |

| Components | Common stock, retained earnings, disclosed reserves | Undisclosed reserves, revaluation reserves, subordinated debt |

| Loss Absorption | First line of defense against financial stress | Secondary layer after Tier 1 capital |

| Regulatory Importance | Primary measure of bank's financial strength under Basel norms | Used to meet minimum capital requirements in addition to Tier 1 |

| Stability | More stable and permanent capital | Less permanent, can be phased out |

Introduction to Bank Capital Tiers

Tier 1 capital represents the core equity capital of a bank, including common shares and disclosed reserves, serving as the primary cushion against financial distress. Tier 2 capital consists of supplementary capital such as revaluation reserves, hybrid instruments, and subordinated debt, providing additional loss-absorbing capacity. Both tiers are essential components of regulatory capital frameworks, ensuring banks maintain solvency and protect depositors.

Definition of Tier 1 Capital

Tier 1 capital, also known as core capital, represents a bank's primary funding source and consists mainly of common equity, retained earnings, and disclosed reserves. It serves as the key measure of a bank's financial strength and ability to absorb losses without ceasing operations. Regulatory frameworks like Basel III emphasize Tier 1 capital to ensure banks maintain sufficient capital adequacy and promote systemic stability.

Definition of Tier 2 Capital

Tier 2 capital consists of supplementary financial resources that banks use to absorb losses in case of financial distress, supporting overall regulatory capital beyond Tier 1. It typically includes subordinated debt, hybrid instruments, and loan loss reserves, contributing to a bank's total capital base but with lower loss-absorbing capacity compared to Tier 1 capital. Regulatory frameworks such as Basel III set specific criteria for Tier 2 capital to ensure it provides adequate protection against risks while complementing the core Tier 1 capital.

Key Components of Tier 1 Capital

Tier 1 capital primarily consists of common equity tier 1 (CET1) capital, including common shares, retained earnings, and other comprehensive income, serving as the core measure of a bank's financial strength. Additional Tier 1 capital comprises instruments like non-cumulative preferred stock and certain hybrid securities that provide loss absorption on a going concern basis. These components ensure a bank can withstand financial stress and protect depositors, differentiating Tier 1 capital's quality and permanence from the supplementary nature of Tier 2 capital.

Key Components of Tier 2 Capital

Tier 2 capital primarily consists of subordinated debt, hybrid capital instruments, and loan-loss reserves, providing a supplementary layer of financial stability beyond Tier 1 capital. It includes instruments with a minimum original maturity of at least five years and absorbs losses in the event of a bank's liquidation after Tier 1 capital is depleted. Regulatory frameworks like Basel III stipulate that Tier 2 capital cannot exceed Tier 1 capital, ensuring a balanced capital structure focused on risk absorption and long-term solvency.

Regulatory Requirements for Capital Tiers

Regulatory requirements for Tier 1 capital mandate banks to maintain a minimum ratio of core equity capital to risk-weighted assets, ensuring strong financial stability and loss-absorbing capacity under Basel III standards. Tier 2 capital requirements complement this by including supplementary capital elements such as revaluation reserves and subordinated debt, which provide additional protection but are subject to stricter limits and eligibility criteria. Regulators enforce capital adequacy ratios, with Tier 1 capital typically required to be no less than 6%, while total capital (Tier 1 plus Tier 2) must meet or exceed 8% to comply with Basel framework guidelines.

Tier 1 vs Tier 2: Core Differences

Tier 1 capital primarily consists of common equity and disclosed reserves, reflecting a bank's core financial strength and ability to absorb losses without ceasing operations. Tier 2 capital includes subordinated debt, hybrid instruments, and general loan loss reserves, serving as supplementary capital to support risk absorption beyond Tier 1 capacity. The key difference lies in Tier 1's role as a foundation of financial stability and Tier 2's function as additional buffer capital with lower loss-absorbing capacity.

Importance of Capital Adequacy Ratios

Tier 1 capital, comprising core equity and disclosed reserves, serves as the primary buffer against financial distress, ensuring bank solvency and protecting depositors. Tier 2 capital includes subordinated debt and loan loss reserves, supplementing Tier 1 to absorb losses during economic downturns. Capital adequacy ratios, calculated by dividing regulatory capital by risk-weighted assets, are critical indicators of a bank's financial health and its ability to withstand credit, market, and operational risks.

Impact on Banking Stability and Risk

Tier 1 capital, consisting primarily of common equity and retained earnings, serves as the core measure of a bank's financial strength and resilience, directly impacting banking stability by absorbing losses during financial distress. Tier 2 capital includes subordinated debt and hybrid instruments, providing additional loss-absorbing capacity but with lower quality and less permanence compared to Tier 1, which affects the overall risk profile. A higher proportion of Tier 1 capital enhances investor confidence and regulatory compliance, reducing the likelihood of bank failure and systemic risk in the financial system.

Global Standards and Basel Accords

Tier 1 capital, also known as core capital, primarily consists of common equity and disclosed reserves, serving as the main buffer against bank insolvency under Basel Accords frameworks such as Basel III. Tier 2 capital includes subordinated debt, loan-loss reserves, and hybrid instruments, supplementing Tier 1 but considered less secure due to its lower loss-absorbing capacity. Global banking standards mandate minimum Tier 1 capital ratios to ensure financial stability, with Tier 2 capital ratios acting as additional safeguards, collectively promoting resilience in international banking operations.

Important Terms

Core Equity Capital

Core Equity Capital, a primary component of Tier 1 capital, represents the highest quality capital used to absorb losses, whereas Tier 2 capital includes supplementary capital instruments with lower loss-absorbing capacity.

Supplementary Capital

Supplementary Capital, classified as Tier 2 capital, provides additional financial buffer beyond Tier 1 capital by including items like revaluation reserves and subordinated debt, enhancing a bank's overall regulatory capital strength.

Basel III

Basel III regulations emphasize higher quality and loss-absorbing capacity of Tier 1 capital compared to Tier 2 capital to strengthen bank resilience during financial stress.

Capital Adequacy Ratio (CAR)

Capital Adequacy Ratio (CAR) measures a bank's financial strength by comparing Tier 1 capital, which includes core equity and retained earnings, against risk-weighted assets, while Tier 2 capital supplements CAR with subordinated debts and hybrid instruments to absorb losses.

Risk-Weighted Assets (RWA)

Risk-Weighted Assets (RWA) are used to determine the minimum capital requirements for banks, with Tier 1 capital primarily absorbing losses and providing core capital strength, while Tier 2 capital serves as supplementary capital to cover potential losses beyond Tier 1.

Common Equity Tier 1 (CET1)

Common Equity Tier 1 (CET1) represents the highest quality of Tier 1 capital, consisting primarily of common shares and retained earnings, while Tier 2 capital includes subordinated debt and other supplementary capital instruments.

Subordinated Debt

Subordinated debt is classified as Tier 2 capital because it provides a secondary layer of loss absorption behind Tier 1 capital, which consists of core equity and retained earnings.

Hybrid Instruments

Hybrid instruments qualify as Tier 1 capital when they possess permanent, loss-absorbing features, while those with limited loss absorption and subordination characteristics are classified under Tier 2 capital.

Regulatory Capital Buffer

The Regulatory Capital Buffer primarily focuses on Tier 1 capital to ensure banks maintain a robust core equity base, while Tier 2 capital serves as supplementary support but carries less weight in buffer requirements.

Perpetual Bonds

Perpetual bonds classified as Tier 1 capital provide banks with a permanent, loss-absorbing buffer, whereas those included in Tier 2 capital typically have fixed maturities and lower loss-absorption capacity.

Tier 1 capital vs Tier 2 capital Infographic

moneydif.com

moneydif.com