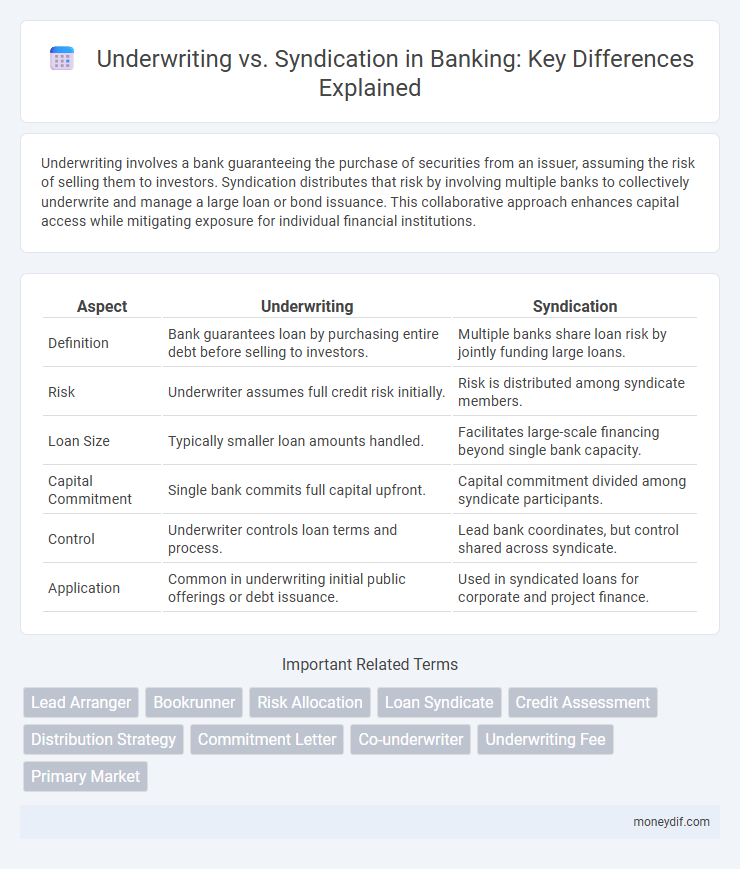

Underwriting involves a bank guaranteeing the purchase of securities from an issuer, assuming the risk of selling them to investors. Syndication distributes that risk by involving multiple banks to collectively underwrite and manage a large loan or bond issuance. This collaborative approach enhances capital access while mitigating exposure for individual financial institutions.

Table of Comparison

| Aspect | Underwriting | Syndication |

|---|---|---|

| Definition | Bank guarantees loan by purchasing entire debt before selling to investors. | Multiple banks share loan risk by jointly funding large loans. |

| Risk | Underwriter assumes full credit risk initially. | Risk is distributed among syndicate members. |

| Loan Size | Typically smaller loan amounts handled. | Facilitates large-scale financing beyond single bank capacity. |

| Capital Commitment | Single bank commits full capital upfront. | Capital commitment divided among syndicate participants. |

| Control | Underwriter controls loan terms and process. | Lead bank coordinates, but control shared across syndicate. |

| Application | Common in underwriting initial public offerings or debt issuance. | Used in syndicated loans for corporate and project finance. |

Introduction to Underwriting and Syndication in Banking

Underwriting in banking involves the process where financial institutions assess and assume the risk of a loan or security issuance, ensuring capital is raised efficiently for clients. Syndication refers to multiple banks collaborating to distribute the risk and share the funding of large loans or bond issuances that exceed a single bank's risk appetite. Both underwriting and syndication play critical roles in managing financial risk, optimizing capital allocation, and facilitating large-scale funding solutions in corporate finance.

Core Definitions: What is Underwriting? What is Syndication?

Underwriting in banking refers to the process where a financial institution evaluates and assumes the risk of issuing new securities or loans, guaranteeing their purchase and facilitating capital raising for clients. Syndication involves multiple banks or financial institutions cooperating to jointly finance large loans or securities issuance, thereby distributing risk and increasing lending capacity. Both underwriting and syndication are essential mechanisms in capital markets, enabling efficient risk management and diversified investment opportunities.

Key Differences Between Underwriting and Syndication

Underwriting involves a financial institution, typically an investment bank, guaranteeing the purchase of an entire issue of securities, assuming full risk before selling to investors. Syndication refers to a group of banks jointly providing a large loan or financing arrangement, distributing risk among participants without guaranteeing the entire amount individually. The key difference lies in underwriting's risk assumption by a single entity versus syndication's risk-sharing model among multiple lenders.

The Role of Banks in Underwriting

Banks play a critical role in underwriting by assessing the credit risk and determining the terms of loans or securities issued to clients, ensuring financial viability and compliance with regulatory standards. Underwriting involves banks guaranteeing the purchase of securities, which mitigates risk for issuers while providing confidence to investors. This process enables efficient capital raising in the financial markets and supports economic growth through risk management and liquidity provision.

The Syndication Process Explained

The syndication process in banking involves multiple lenders collaborating to provide a large loan that exceeds the capacity of a single institution, spreading risk among participants. The lead bank, or arranger, structures the loan, negotiates terms, and coordinates the distribution of loan portions to syndicate members. This process enhances capital efficiency, enables financing of substantial projects, and reduces individual lender exposure to credit risk.

Risks and Rewards: Underwriting vs. Syndication

Underwriting in banking involves the lender assuming full risk for loan repayment, offering a higher potential reward through interest income and fees but exposing the bank to significant credit risk. Syndication spreads this risk among multiple financial institutions, reducing individual exposure while potentially lowering each participant's fee income and influence on loan terms. The choice between underwriting and syndication hinges on balancing risk appetite with the desire for fee revenue and portfolio diversification.

Common Scenarios: When to Use Underwriting or Syndication

Underwriting is commonly utilized when a bank or financial institution assumes full risk by purchasing the entire loan or security issue, ideal for smaller deals or when the institution has high confidence in the borrower's creditworthiness. Syndication is preferred for larger, riskier loans, where multiple lenders share the exposure and capital required, typically in complex transactions such as leveraged buyouts or large infrastructure projects. Banks often choose underwriting to maintain control and maximize fees, while syndication is selected to diversify risk and leverage collective lending capacity.

Regulatory Frameworks Governing Both Processes

Underwriting in banking is regulated by frameworks such as the SEC's Regulation D and the Investment Company Act, ensuring issuer disclosures and investor protections, while syndication is governed by banking laws including the Dodd-Frank Act and Basel III, focusing on risk distribution and capital adequacy. Regulatory bodies like the Financial Industry Regulatory Authority (FINRA) oversee underwriting practices to maintain market integrity, whereas syndication transactions adhere to interbank agreements and compliance standards for loan participation. Both processes require strict adherence to anti-money laundering (AML) and Know Your Customer (KYC) regulations to mitigate financial crimes and enhance transparency.

Impact on Bank Balance Sheets and Capital Management

Underwriting commitments require banks to hold capital against the full amount of the loan or security, directly impacting their balance sheets by increasing risk-weighted assets and capital reserves. Syndication, by distributing portions of the loan to other financial institutions, reduces the originating bank's balance sheet exposure and helps optimize capital management by lowering regulatory capital requirements. Effective syndication strategies enhance liquidity and risk diversification, enabling banks to maintain stronger capital ratios while supporting larger financing deals.

Future Trends in Underwriting and Syndication

Future trends in underwriting emphasize increased automation and AI-driven risk assessment models, enhancing accuracy and efficiency. Syndication is evolving with blockchain technology to streamline transaction transparency and facilitate real-time syndicate communication. Both processes are integrating advanced data analytics to improve decision-making and borrower profiling in an increasingly digital banking environment.

Important Terms

Lead Arranger

A lead arranger structures and negotiates the financing deal, coordinating underwriting commitments and managing the syndication process to distribute loan portions to other lenders.

Bookrunner

The bookrunner leads underwriting by managing the issuance process and allocating shares while syndication involves forming a group of underwriters to spread risk and distribute securities.

Risk Allocation

Risk allocation in underwriting involves a single insurer assuming full liability, while syndication distributes risk among multiple insurers to minimize exposure.

Loan Syndicate

Loan syndication involves multiple lenders collaboratively underwriting and distributing a large loan, spreading risk and enhancing capital availability for borrowers.

Credit Assessment

Credit assessment in underwriting focuses on evaluating individual loan risk for single lenders, while syndication spreads credit risk across multiple lenders by collectively assessing borrower creditworthiness.

Distribution Strategy

Distribution strategy in underwriting focuses on assessing and assuming risk for insurance policies or securities, while syndication involves collaborating with multiple parties to share risk and distribute financial products more broadly.

Commitment Letter

A commitment letter outlines the underwriter's obligation to fund a specified portion of a loan, distinguishing the underwriting process from syndication, where risk is shared among multiple lenders.

Co-underwriter

A co-underwriter shares risks and responsibilities in underwriting financial securities, collaborating closely with other underwriters during the syndication process to distribute the issuance.

Underwriting Fee

Underwriting fees are the charges an underwriter receives for assuming the risk and facilitating the issuance of securities, whereas syndication involves multiple underwriters sharing the risk and fees associated with large-scale securities offerings.

Primary Market

Primary market transactions involve underwriting, where investment banks guarantee the sale of new securities, versus syndication, which distributes risk by involving multiple banks in the issuance process.

Underwriting vs Syndication Infographic

moneydif.com

moneydif.com