A bullet loan requires a single lump-sum payment of principal at maturity, with interest typically paid periodically, making it suitable for borrowers looking for short-term financing or expecting a large cash inflow later. An amortizing loan involves regular payments that cover both principal and interest, gradually reducing the loan balance over time, which helps borrowers build equity and manage debt systematically. Choosing between bullet and amortizing loans depends on cash flow stability, financial goals, and repayment capacity.

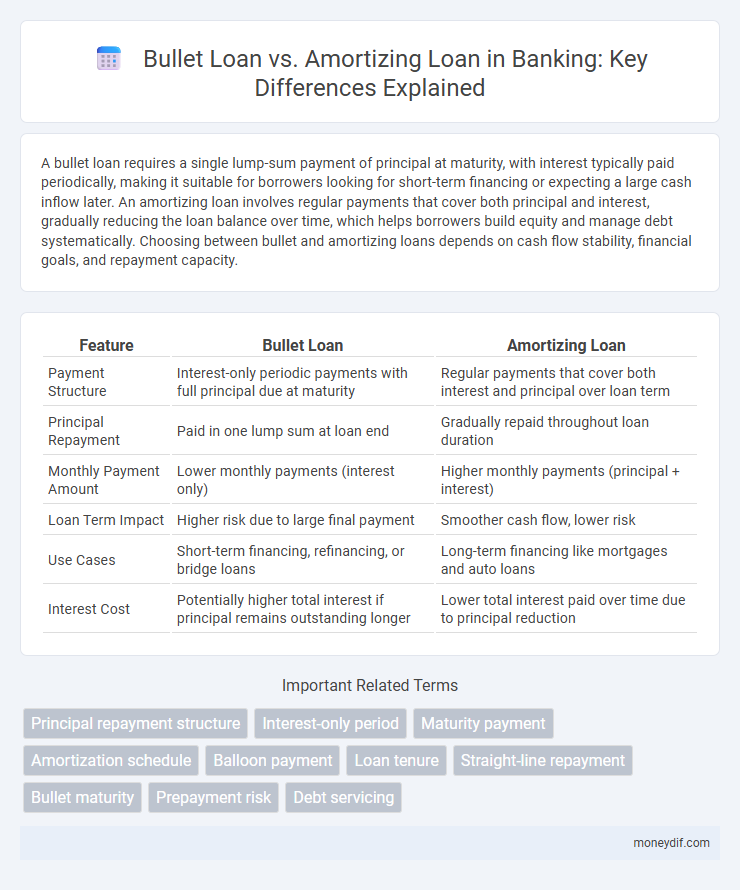

Table of Comparison

| Feature | Bullet Loan | Amortizing Loan |

|---|---|---|

| Payment Structure | Interest-only periodic payments with full principal due at maturity | Regular payments that cover both interest and principal over loan term |

| Principal Repayment | Paid in one lump sum at loan end | Gradually repaid throughout loan duration |

| Monthly Payment Amount | Lower monthly payments (interest only) | Higher monthly payments (principal + interest) |

| Loan Term Impact | Higher risk due to large final payment | Smoother cash flow, lower risk |

| Use Cases | Short-term financing, refinancing, or bridge loans | Long-term financing like mortgages and auto loans |

| Interest Cost | Potentially higher total interest if principal remains outstanding longer | Lower total interest paid over time due to principal reduction |

Understanding Bullet Loans in Banking

Bullet loans in banking involve a single lump-sum repayment of the entire principal and interest at the end of the loan term, providing lower periodic payments during the loan period. These loans are often utilized for short-term financing needs or by borrowers expecting future cash inflows, such as investments or asset sales. Understanding bullet loans is crucial for assessing cash flow impact and risk, especially compared to amortizing loans where repayments are spread evenly over time.

What Are Amortizing Loans?

Amortizing loans require borrowers to make fixed periodic payments that cover both principal and interest, gradually reducing the loan balance to zero by the end of the term. Common examples include traditional mortgages and auto loans, where each installment ensures a predictable repayment schedule and clearer financial planning. These loans contrast with bullet loans, which defer principal repayment until maturity, increasing overall risk and interest costs for borrowers.

Key Differences: Bullet Loan vs Amortizing Loan

Bullet loans require the borrower to repay the entire principal amount in a single lump sum at maturity, resulting in lower periodic payments but a large final payment. Amortizing loans spread both principal and interest payments evenly throughout the loan term, ensuring consistent monthly payments and gradual reduction of the outstanding balance. The key difference lies in the repayment structure, where bullet loans pose higher repayment risk at maturity, while amortizing loans offer predictable cash flow management.

Pros and Cons of Bullet Loans

Bullet loans offer the advantage of lower monthly payments since borrowers only pay interest during the loan term, improving short-term cash flow management. However, the principal is due in a lump sum at maturity, which can create significant repayment risk and may require refinancing or a balloon payment. This structure makes bullet loans suitable for borrowers with expected future income or proceeds but less ideal for those seeking gradual debt reduction.

Advantages and Disadvantages of Amortizing Loans

Amortizing loans offer the advantage of predictable monthly payments that cover both principal and interest, enabling borrowers to gradually build equity and reduce debt over time. These payments provide financial stability and facilitate budgeting, but the disadvantage lies in higher initial monthly costs compared to bullet loans, which may strain cash flow. Additionally, the total interest paid over the loan term can be higher due to consistent principal reduction, whereas bullet loans defer principal repayment to maturity.

Suitable Scenarios for Bullet Loans

Bullet loans are suitable for borrowers expecting a significant cash inflow before the maturity date, such as real estate investors relying on property sales or entrepreneurs anticipating venture capital funding. These loans offer lower periodic payments by deferring the principal repayment to the end of the term, making them ideal for short-term financial strategies or projects with irregular cash flow. Financial institutions often recommend bullet loans for bridging finance, construction loans, or other scenarios where liquidity is expected to improve before full repayment.

When to Choose an Amortizing Loan

An amortizing loan is ideal when consistent monthly payments are preferred, allowing borrowers to gradually reduce the principal and interest over the loan term. This type of loan is beneficial for long-term financial planning, as it ensures full repayment by the end of the schedule without a large lump sum due. Borrowers seeking predictable budgeting and lower risk of future payment shock should opt for an amortizing loan.

Impact on Cash Flow: Bullet vs Amortizing

Bullet loans require repayment of the entire principal at maturity, resulting in lower periodic payments but a significant cash outflow at the end of the loan term. Amortizing loans spread principal and interest payments evenly over the life of the loan, stabilizing monthly cash flow and reducing financial strain. Businesses with fluctuating income may prefer bullet loans for short-term cash flow relief, while amortizing loans offer predictability and long-term budgeting ease.

Risk Factors in Bullet and Amortizing Loans

Bullet loans carry higher risk due to a large lump-sum payment at maturity, increasing default probability if the borrower lacks sufficient funds. Amortizing loans reduce risk by spreading principal and interest payments evenly over time, enhancing repayment predictability and lowering credit risk. Lenders often prefer amortizing loans for stable cash flow, while bullet loans may offer more flexibility but elevate refinancing and liquidity risks.

Making the Right Choice: Bullet or Amortizing Loan

Choosing between a bullet loan and an amortizing loan depends on cash flow stability and repayment capacity. Bullet loans offer lower initial payments with a lump-sum repayment at maturity, ideal for borrowers expecting future liquidity. Amortizing loans spread payments evenly over time, reducing interest risk and building equity, which suits consistent income and long-term financial planning.

Important Terms

Principal repayment structure

Principal repayment structure varies significantly between bullet loans and amortizing loans, with bullet loans requiring a lump-sum principal payment at maturity, while amortizing loans involve scheduled periodic payments that gradually reduce the principal over the loan term. Bullet loans pose higher refinancing risk due to the large final payment, whereas amortizing loans provide predictable cash flow and lower default risk through consistent principal reduction.

Interest-only period

The interest-only period in a bullet loan allows borrowers to pay only interest for a set term, deferring principal repayment until maturity, resulting in lower initial payments but a large lump sum due at the end. In contrast, an amortizing loan requires regular payments of both principal and interest throughout the loan term, gradually reducing the principal balance and avoiding a large final payment.

Maturity payment

Maturity payment for a bullet loan involves a single lump sum repayment of the principal at the end of the loan term, often resulting in interest-only payments during the life of the loan. In contrast, an amortizing loan features periodic payments combining both principal and interest, gradually reducing the loan balance until full settlement at maturity.

Amortization schedule

An amortization schedule for a bullet loan shows a single lump-sum principal repayment at maturity with periodic interest payments, resulting in lower initial cash outflows but a large final payment. In contrast, an amortizing loan's schedule features regular principal and interest payments throughout the loan term, gradually reducing the outstanding balance and spreading repayment evenly.

Balloon payment

A balloon payment is a large lump sum due at the end of a loan term, commonly associated with bullet loans where principal is repaid in full at maturity, contrasting with amortizing loans that spread principal and interest payments evenly throughout the loan period. Bullet loans are preferred for short-term financing or when borrowers anticipate future cash flow, while amortizing loans reduce risk by gradually decreasing the loan balance over time.

Loan tenure

Loan tenure significantly impacts the repayment structure, with bullet loans requiring a lump-sum principal payment at the end of the term, often leading to shorter tenures compared to amortizing loans that spread principal and interest payments evenly over longer periods. Understanding the distinction between bullet and amortizing loan tenures is crucial for borrowers aiming to manage cash flow and financial planning effectively.

Straight-line repayment

Straight-line repayment involves paying an equal amount of principal each period, resulting in declining total payments over time, and contrasts with bullet loans where the entire principal is due at maturity and amortizing loans that combine principal and interest payments in periodic installments. This method reduces interest expense progressively, making it advantageous for borrowers seeking predictable principal reduction without fluctuating payment amounts.

Bullet maturity

Bullet maturity refers to a loan structure where the entire principal amount is repaid at the end of the loan term, contrasting with amortizing loans where principal is gradually paid down through scheduled periodic payments. This repayment method often results in lower regular payments but requires a large lump-sum payment at maturity, affecting cash flow management and risk profiles for borrowers and lenders.

Prepayment risk

Prepayment risk in bullet loans is higher due to the large lump-sum principal repayment at maturity, increasing uncertainty about early repayment and reinvestment rates, whereas amortizing loans reduce this risk by spreading principal repayments over time, providing more predictable cash flows for lenders. Investors prefer amortizing loans when seeking stable income streams, while bullet loans often demand higher yields to compensate for the increased prepayment risk.

Debt servicing

Debt servicing for bullet loans involves a single lump-sum principal repayment at maturity, resulting in lower periodic payments but higher exposure to refinancing risk. Amortizing loans require regular principal and interest payments throughout the loan term, reducing outstanding debt gradually and providing predictable cash outflows for borrowers.

Bullet loan vs Amortizing loan Infographic

moneydif.com

moneydif.com