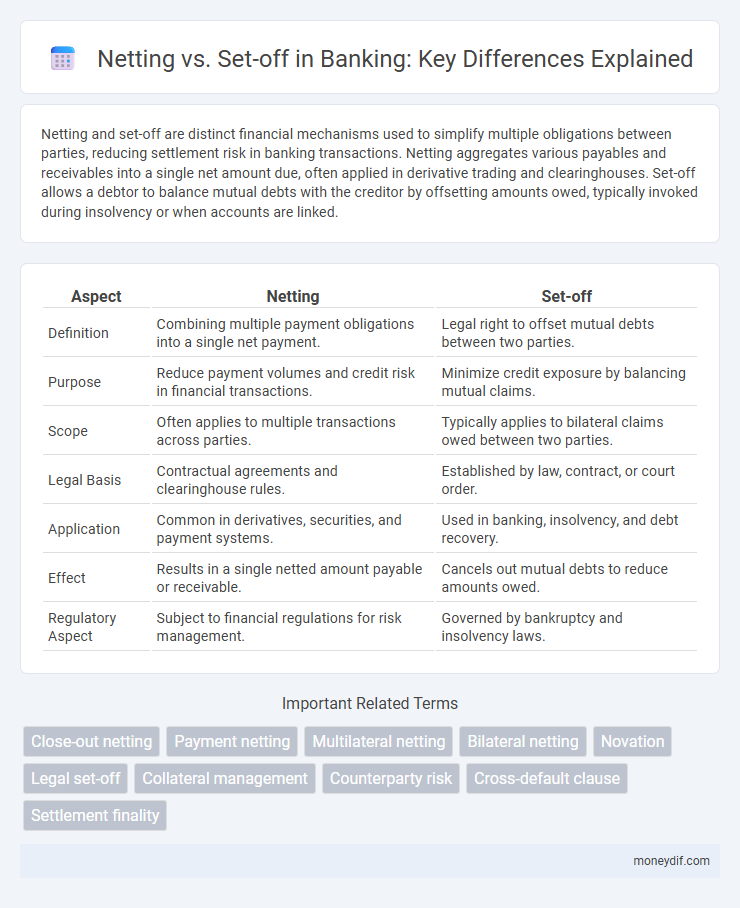

Netting and set-off are distinct financial mechanisms used to simplify multiple obligations between parties, reducing settlement risk in banking transactions. Netting aggregates various payables and receivables into a single net amount due, often applied in derivative trading and clearinghouses. Set-off allows a debtor to balance mutual debts with the creditor by offsetting amounts owed, typically invoked during insolvency or when accounts are linked.

Table of Comparison

| Aspect | Netting | Set-off |

|---|---|---|

| Definition | Combining multiple payment obligations into a single net payment. | Legal right to offset mutual debts between two parties. |

| Purpose | Reduce payment volumes and credit risk in financial transactions. | Minimize credit exposure by balancing mutual claims. |

| Scope | Often applies to multiple transactions across parties. | Typically applies to bilateral claims owed between two parties. |

| Legal Basis | Contractual agreements and clearinghouse rules. | Established by law, contract, or court order. |

| Application | Common in derivatives, securities, and payment systems. | Used in banking, insolvency, and debt recovery. |

| Effect | Results in a single netted amount payable or receivable. | Cancels out mutual debts to reduce amounts owed. |

| Regulatory Aspect | Subject to financial regulations for risk management. | Governed by bankruptcy and insolvency laws. |

Understanding Netting in Banking

Netting in banking refers to the process of consolidating multiple financial obligations between parties into a single net payment or position to reduce credit risk and settlement costs. It streamlines the settlement of transactions by offsetting mutual debts, making it a critical tool in managing counterparty exposure in derivative markets and payment systems. Effective netting agreements improve liquidity management and enhance operational efficiency by minimizing the gross amount of fund transfers required.

Defining Set-off in Financial Transactions

Set-off in financial transactions refers to the right of a debtor to reduce the amount owed to a creditor by any mutual debts that the creditor owes to the debtor. This process allows for the extinguishment or reduction of obligations between parties, enhancing liquidity and minimizing credit risk in banking operations. Distinct from netting, set-off involves direct legal claims on reciprocal debts rather than combining multiple transactions into a single net payment.

Key Differences Between Netting and Set-off

Netting involves consolidating multiple payment obligations into a single net amount payable between parties, primarily used to reduce credit risk and simplify settlements in financial transactions. Set-off allows a debtor to offset mutual debts with a creditor, enabling the reduction of the amount owed by deducting the creditor's claim against the debtor's obligation, often applied in loan agreements and insolvency cases. The key difference lies in netting being a pre-agreed contractual arrangement for simultaneous obligations, whereas set-off is a legal right allowing unilateral deduction of debts when mutual claims exist.

Types of Netting Used by Banks

Banks utilize various types of netting, including bilateral netting, which consolidates obligations between two parties to reduce credit exposure, and multilateral netting, involving multiple parties to streamline multiple transactions into a single obligation. Payment netting aggregates payments due on the same date, minimizing settlement amounts, while close-out netting allows banks to terminate and net obligations upon default or insolvency, mitigating counterparty risk. These netting mechanisms enhance liquidity management and reduce systemic risk within the banking system.

Practical Applications of Set-off

Set-off in banking enables the consolidation of mutual debts between parties, allowing a bank to reduce the amount owed by offsetting it against debts owed to the same customer, which simplifies debt recovery and liquidity management. Practical applications include margin accounts, where banks automatically apply set-off to manage exposure and reduce credit risk in securities trading. This mechanism also facilitates efficient resolution of default scenarios by minimizing outstanding balances without requiring multiple transactions.

Legal Frameworks Governing Netting and Set-off

Legal frameworks governing netting and set-off in banking primarily include the International Swaps and Derivatives Association (ISDA) Master Agreement, which provides standardized terms for netting in derivatives contracts, and national insolvency laws that recognize set-off rights to reduce credit exposure during bankruptcy. Jurisdictions such as the United States enforce netting through the Bankruptcy Code's safe harbor provisions, while the European Union incorporates netting and set-off principles under the Settlement Finality Directive and relevant insolvency regulations. Effective legal recognition of netting and set-off mitigates systemic risk by ensuring enforceability and predictability of debtor-creditor relationships in financial markets.

Risk Management: Netting vs Set-off

Netting reduces credit exposure by consolidating multiple obligations into a single payment, thereby minimizing counterparty risk in banking transactions. Set-off allows banks to offset mutual debts between parties, providing immediate risk mitigation by reducing the total outstanding balance. Effective risk management relies on netting for streamlining complex portfolios, while set-off serves as a legal tool to manage credit risk in bankruptcy or default scenarios.

Netting and Set-off in Loan Agreements

Netting in loan agreements consolidates multiple financial obligations between parties into a single net payment, reducing credit exposure and simplifying settlement processes. Set-off permits a lender to offset amounts owed by the borrower against deposits or other amounts held, enhancing risk management and recovery efficiency. Both mechanisms are crucial in minimizing counterparty risk and ensuring streamlined loan repayment structures.

The Role of Set-off in Debt Recovery

Set-off plays a crucial role in debt recovery by allowing banks to offset a debtor's outstanding obligations with any credits or deposits held in related accounts, thereby simplifying and expediting the repayment process. Unlike netting, which consolidates multiple obligations into a single payment, set-off provides immediate access to available funds to satisfy debts without requiring mutual agreement on a net amount. This mechanism enhances liquidity management and reduces credit risk within banking operations.

Regulatory Considerations for Netting and Set-off

Regulatory considerations for netting and set-off in banking focus on risk reduction and capital requirement optimization under frameworks like Basel III, emphasizing the recognition of netting agreements in prudential calculations. Netting agreements, particularly close-out netting in derivatives, must comply with legal certainty criteria to be enforceable during insolvency, influencing credit risk exposure assessments. Set-off rights, governed by local insolvency laws, impact default risk and require transparent disclosure to align with regulatory standards on counterparty credit risk management.

Important Terms

Close-out netting

Close-out netting consolidates multiple financial obligations into a single net payment upon default or termination, significantly reducing credit exposure between parties. Unlike set-off, which offsets mutual debts as they become due, close-out netting applies upon contract termination and includes the valuation and termination of all outstanding transactions.

Payment netting

Payment netting consolidates multiple payment obligations between parties into a single net amount, enhancing liquidity management and reducing transaction costs, whereas set-off specifically allows a party to offset mutual debts without necessitating a consolidated payment calculation. Netting focuses on streamlining payments across multiple transactions, while set-off is a legal right to balance mutual claims, often used as a defense in debt recovery.

Multilateral netting

Multilateral netting consolidates multiple financial obligations among several parties into a single net payment per participant, enhancing liquidity efficiency compared to bilateral arrangements. Unlike set-off, which applies only to mutual debts between two parties, multilateral netting involves a centralized process to optimize settlement across a network of entities.

Bilateral netting

Bilateral netting consolidates mutual financial obligations between two parties into a single net payment, reducing credit risk and improving liquidity management. Unlike set-off, which offsets mutual debts by operation of law without necessarily creating a new obligation, bilateral netting involves a contractual agreement to combine multiple transactions for net settlement.

Novation

Novation involves replacing an original contract with a new one, effectively transferring obligations between parties and eliminating the original agreement, which contrasts with netting and set-off that focus on consolidating mutual debts without creating new contracts. Netting aggregates multiple financial obligations into a single net payment, while set-off permits one party to reduce amounts owed by the amount the other party owes, both serving as risk management tools in financial transactions.

Legal set-off

Legal set-off allows mutual debts between parties to be extinguished by offsetting one against the other, reducing the net amount owed. Netting differs as it aggregates multiple obligations into a single net payment, often used in financial markets to minimize credit risk and settlement costs.

Collateral management

Collateral management enhances credit risk mitigation by securing assets to cover potential exposures, while netting consolidates multiple obligations into a single payment, reducing overall credit exposure. Set-off permits the mutual offsetting of debts between parties, ensuring efficient liquidation of claims but typically requires legal enforceability and is limited compared to netting's broader application in financial contracts.

Counterparty risk

Counterparty risk in financial transactions is mitigated through netting, which consolidates multiple obligations to reduce exposure, while set-off allows parties to offset mutual debts, limiting default risk. Effective application of netting agreements and set-off rights enhances credit risk management by minimizing the potential loss in case of counterparty default.

Cross-default clause

A cross-default clause triggers a default if any obligation under one agreement defaults, impacting other agreements that include netting and set-off provisions, which help mitigate credit risk by offsetting mutual obligations. Netting consolidates multiple payment obligations into a single net payment, while set-off allows a party to reduce amounts owed by offsetting mutual debts, both critical in managing exposures under cross-default scenarios.

Settlement finality

Settlement finality ensures that once a transaction is settled, it cannot be revoked or undone, providing legal certainty in payment and securities settlement systems. Netting consolidates multiple obligations into a single net payment to reduce credit risk, while set-off allows a party to offset mutual debts, with both mechanisms enhancing financial stability by minimizing exposure during settlement.

Netting vs Set-off Infographic

moneydif.com

moneydif.com