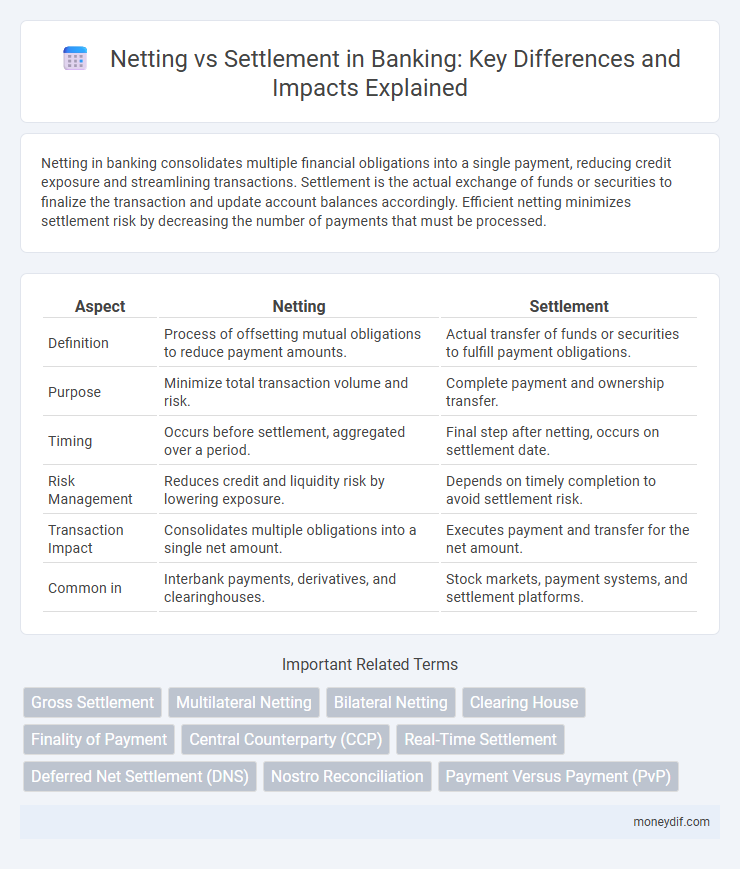

Netting in banking consolidates multiple financial obligations into a single payment, reducing credit exposure and streamlining transactions. Settlement is the actual exchange of funds or securities to finalize the transaction and update account balances accordingly. Efficient netting minimizes settlement risk by decreasing the number of payments that must be processed.

Table of Comparison

| Aspect | Netting | Settlement |

|---|---|---|

| Definition | Process of offsetting mutual obligations to reduce payment amounts. | Actual transfer of funds or securities to fulfill payment obligations. |

| Purpose | Minimize total transaction volume and risk. | Complete payment and ownership transfer. |

| Timing | Occurs before settlement, aggregated over a period. | Final step after netting, occurs on settlement date. |

| Risk Management | Reduces credit and liquidity risk by lowering exposure. | Depends on timely completion to avoid settlement risk. |

| Transaction Impact | Consolidates multiple obligations into a single net amount. | Executes payment and transfer for the net amount. |

| Common in | Interbank payments, derivatives, and clearinghouses. | Stock markets, payment systems, and settlement platforms. |

Understanding Netting in Banking

Netting in banking refers to the process of consolidating multiple financial obligations between parties to determine a single net payment amount, reducing the number of transactions and minimizing credit risk. This technique is crucial for streamlining interbank settlements, optimizing liquidity management, and lowering operational costs. Unlike settlement, which involves the actual exchange of funds or securities, netting focuses on offsetting payment obligations before final settlement occurs.

The Basics of Settlement Processes

Settlement processes in banking involve the final transfer of securities or funds between parties to complete a transaction, ensuring that obligations are fully discharged. Netting reduces the number of transactions by offsetting mutual obligations, minimizing the volume of payments or securities that must be exchanged during settlement. Efficient settlement systems reduce counterparty risk and improve liquidity management in financial markets.

Types of Netting in Financial Transactions

Types of netting in financial transactions include bilateral netting, multilateral netting, and payment netting, each designed to reduce credit risk and optimize liquidity management between counterparties. Bilateral netting consolidates obligations between two parties into a single net payment, while multilateral netting involves multiple parties, simplifying complex transaction networks. Payment netting aggregates payment obligations to minimize the total number of transactions, enhancing operational efficiency in banking settlements.

Key Differences Between Netting and Settlement

Netting consolidates multiple financial obligations into a single net payment to reduce credit risk and exposure, whereas settlement involves the actual transfer of funds or securities to fulfill transaction obligations. Netting optimizes liquidity by minimizing the total amount exchanged between parties, while settlement finalizes the transaction, ensuring legal ownership and delivery. The key difference lies in netting's role in mitigating risk through aggregation, compared to settlement's function of completing the transaction flow.

Benefits of Netting for Banks

Netting reduces the total number of transactions banks must process, lowering operational costs and minimizing settlement risks. By consolidating multiple obligations into a single payment, banks free up liquidity and enhance capital efficiency. This streamlined approach improves risk management and regulatory compliance while fostering stronger interbank relationships.

Risks Associated with Settlement

Settlement risk arises when one party fails to deliver securities or funds as agreed, potentially causing financial losses and liquidity shortages. This risk is heightened in cross-border transactions due to time zone differences and varying regulatory frameworks. Netting reduces exposure by offsetting mutual obligations, whereas settlement exposes parties to the full principal amount, increasing counterparty risk significantly.

Netting’s Role in Reducing Credit Exposure

Netting plays a crucial role in reducing credit exposure by offsetting mutual obligations between counterparties, thereby minimizing the total amount of credit at risk. This process consolidates multiple transactions into a single net payment, significantly lowering the volume of outstanding receivables and payables. Financial institutions leverage netting to enhance liquidity management and mitigate counterparty risk within the banking sector.

Settlement Finality: What It Means for Banks

Settlement finality guarantees that once transactions are settled, payments are irrevocable and unconditional, reducing counterparty risk for banks. This legal certainty enables banks to manage liquidity efficiently and maintain accurate balance sheets. Clear settlement finality supports financial stability by preventing the unwinding of settled payments and minimizing systemic risk in interbank markets.

Regulatory Perspectives on Netting and Settlement

Regulatory perspectives on netting emphasize its critical role in reducing counterparty credit risk and enhancing financial stability by legally ensuring enforceability of close-out netting agreements under insolvency laws. Settlement regulations focus on mitigating settlement risk through timely transfer of funds and securities, supported by central counterparties (CCPs) and real-time gross settlement (RTGS) systems to increase market transparency and operational resilience. Compliance with frameworks such as the Basel III, the European Market Infrastructure Regulation (EMIR), and the Dodd-Frank Act underscores the regulatory commitment to robust netting and settlement processes in global banking markets.

Future Trends in Netting and Settlement Technologies

Future trends in netting and settlement technologies emphasize increased adoption of blockchain and distributed ledger technology (DLT) to enhance transparency and reduce settlement times in banking transactions. Artificial intelligence and machine learning are being integrated to optimize risk management and improve the accuracy of netting calculations, leading to more efficient capital usage. Regulatory frameworks are evolving to support real-time settlement systems, fostering greater interoperability between financial institutions and reducing systemic risks in the post-trade process.

Important Terms

Gross Settlement

Gross settlement involves the immediate, individual transfer of funds or securities for each transaction without bundling, contrasting with netting where multiple obligations are consolidated to reduce the number of settlements. This process minimizes settlement risk by ensuring finality and irrevocability in real-time, critical in high-value payment systems like Real-Time Gross Settlement (RTGS) networks.

Multilateral Netting

Multilateral netting streamlines the settlement process by consolidating multiple parties' obligations into a single net payment, reducing transaction volumes and counterparty risk compared to traditional bilateral netting. This method enhances efficiency in financial markets by minimizing settlement costs and improving liquidity management among diverse participants.

Bilateral Netting

Bilateral netting consolidates multiple financial obligations between two parties into a single net payment, reducing credit risk and settlement costs compared to gross settlement. Unlike settlement that processes each transaction individually, netting streamlines operations by offsetting reciprocal obligations, enhancing capital efficiency and liquidity management.

Clearing House

A clearing house acts as an intermediary to facilitate netting by offsetting multiple financial obligations into a single payment, reducing counterparty risk and improving liquidity management. This process contrasts with settlement, which involves the actual exchange of securities and funds to finalize the transaction.

Finality of Payment

Finality of payment ensures that once a transaction is settled, it is irrevocable and unconditional, which is critical for reducing credit risk in both netting and settlement processes. Netting aggregates multiple payment obligations into a single net payment, while settlement involves the actual transfer of funds or securities to conclude the transaction definitively.

Central Counterparty (CCP)

A Central Counterparty (CCP) mitigates counterparty risk by interposing itself between trading parties and performing netting, which consolidates multiple obligations into a single net payment, reducing settlement volume and risk exposure. By ensuring timely settlement of netted positions, CCPs enhance market stability and liquidity, minimizing the chances of settlement failures.

Real-Time Settlement

Real-time settlement eliminates the delay between transaction execution and final payment, unlike traditional netting processes where multiple obligations are aggregated to reduce the number of transactions. This direct settlement approach reduces counterparty risk by ensuring immediate transfer of funds, improving liquidity and operational efficiency in financial markets.

Deferred Net Settlement (DNS)

Deferred Net Settlement (DNS) optimizes liquidity by aggregating multiple financial obligations into a single net payment at a predetermined time, reducing the number of individual settlements compared to gross settlement. DNS contrasts with netting, where transaction amounts are offset continuously or at intervals, but settlement finality in DNS occurs only once, enhancing operational efficiency and lowering settlement risk in payment systems.

Nostro Reconciliation

Nostro reconciliation ensures accuracy by matching internal records of foreign currency accounts with corresponding statements from correspondent banks, crucial for identifying discrepancies in netting and settlement processes. Netting aggregates multiple payment obligations to reduce transaction volume, while settlement involves the actual transfer of funds, making precise reconciliation vital to confirm that netted amounts align with settled transactions.

Payment Versus Payment (PvP)

Payment Versus Payment (PvP) is a settlement mechanism that ensures the simultaneous exchange of equivalent value in different currencies, eliminating settlement risk in foreign exchange transactions. It contrasts with netting, which aggregates multiple payment obligations to reduce the number of transactions, but PvP specifically guarantees that one payment occurs if and only if the corresponding payment is made, enhancing transactional security in cross-currency settlements.

Netting vs Settlement Infographic

moneydif.com

moneydif.com