A tranche loan divides the principal into multiple segments with staggered repayment schedules, offering flexibility in cash flow management for borrowers. Bullet loans require a lump sum repayment of the entire principal at maturity, providing lower periodic payments but higher risk at the end of the term. Understanding the key differences between tranche and bullet loans is crucial for selecting the optimal financing structure tailored to specific project cash flows and risk tolerance.

Table of Comparison

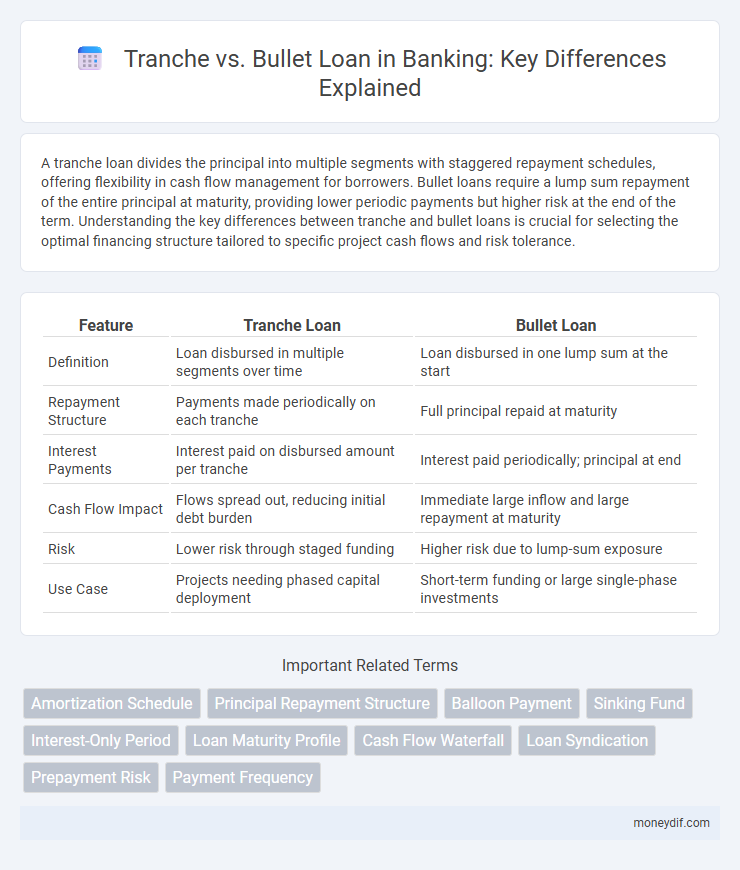

| Feature | Tranche Loan | Bullet Loan |

|---|---|---|

| Definition | Loan disbursed in multiple segments over time | Loan disbursed in one lump sum at the start |

| Repayment Structure | Payments made periodically on each tranche | Full principal repaid at maturity |

| Interest Payments | Interest paid on disbursed amount per tranche | Interest paid periodically; principal at end |

| Cash Flow Impact | Flows spread out, reducing initial debt burden | Immediate large inflow and large repayment at maturity |

| Risk | Lower risk through staged funding | Higher risk due to lump-sum exposure |

| Use Case | Projects needing phased capital deployment | Short-term funding or large single-phase investments |

Understanding Tranche Loans in Banking

Tranche loans in banking involve dividing a loan into several portions with distinct disbursement schedules and varying interest rates or maturities, allowing tailored repayment structures that align with borrower needs and risk profiles. Each tranche is treated as a separate entity, often with different covenants and terms, providing lenders flexibility in managing credit risk and cash flow. Understanding tranche loans enables banks to optimize loan portfolios by mitigating risk exposure while offering borrowers structured financing solutions.

What Is a Bullet Loan?

A bullet loan is a type of debt instrument where the borrower repays the entire principal amount in a single lump sum at the end of the loan term, rather than through periodic installments. This structure often includes regular interest payments throughout the loan duration, making it attractive for borrowers expecting substantial cash flow at maturity. Bullet loans are commonly used in corporate finance and real estate, offering flexibility in cash management and aligning repayment with large liquidity events.

Key Structural Differences: Tranche vs Bullet Loan

Tranche loans involve multiple disbursements spread over time, allowing borrowers to access funds in stages based on project milestones or cash flow needs, which contrasts with bullet loans that provide a single lump-sum payment at the outset. Bullet loans require repayment of the entire principal amount in one payment at maturity, while tranche loans structure repayments according to the disbursed amounts, often optimizing interest costs and financial flexibility. The key structural difference lies in cash flow timing and repayment schedules, with tranche loans supporting phased funding and bullet loans focusing on a large, deferred principal repayment.

Repayment Schedules: Tranche Loan vs Bullet Loan

Tranche loans involve multiple disbursements with scheduled repayments of principal and interest over time, allowing for flexible cash flow management. Bullet loans require a single lump-sum repayment of the principal at maturity, while interest payments are made periodically during the loan term. The repayment schedule difference impacts borrower liquidity and risk, with tranche loans spreading out repayment burden and bullet loans concentrating it at the end.

Risk Assessment: Tranche and Bullet Loans Compared

Tranche loans involve multiple disbursements with staggered repayment schedules, spreading credit risk over time and allowing more detailed risk assessment at each stage. Bullet loans require a single repayment of principal at maturity, increasing default risk due to the large lump-sum payment but simplifying risk evaluation to the borrower's ability at loan maturity. Lenders assessing tranche loans benefit from ongoing portfolio monitoring, while bullet loans demand rigorous upfront credit analysis to mitigate concentrated repayment risk.

Advantages of Tranche Loans for Borrowers

Tranche loans offer borrowers enhanced flexibility by allowing disbursement of funds in multiple stages, matching cash flow needs and reducing interest costs on unused amounts. This structure supports better financial planning and mitigates the risk of overborrowing compared to bullet loans, where the entire amount is released upfront. Borrowers benefit from tailored repayment schedules and improved liquidity management aligned with project milestones.

Pros and Cons of Bullet Loans

Bullet loans offer the advantage of lower periodic payments since the principal is repaid in a lump sum at maturity, improving short-term cash flow for borrowers. However, the accumulation of principal repayment at the end can create significant refinancing risk and financial strain if the borrower lacks sufficient liquidity. This structure is beneficial for clients expecting future cash inflows but increases exposure to interest rate fluctuations and repayment pressure upon maturity.

Use Cases: When to Choose Tranche or Bullet Loans

Tranche loans are ideal for businesses requiring staged disbursements aligned with project milestones, such as construction or phased expansions, enabling precise cash flow management and reduced interest on undrawn amounts. Bullet loans suit borrowers with predictable lump-sum repayment capacity, commonly used for short-term financing or refinancing where principal is repaid at maturity, minimizing early repayment pressures. Selecting between tranche and bullet loans depends on cash flow timing, project structure, and repayment strategy, making tranche loans preferable for ongoing funding needs and bullet loans optimal for single repayment events.

Impact on Cash Flow and Financial Planning

Tranche loans allow borrowers to receive funds in portions based on project milestones, improving cash flow management by aligning disbursements with capital needs and reducing idle cash. Bullet loans require repayment of principal in a lump sum at maturity, placing pressure on future cash flow and necessitating precise financial planning to ensure sufficient liquidity at loan end. Efficient cash flow forecasting and strategic reserves are crucial for managing bullet loans, while tranche loans offer more flexibility in timing expenditures.

Which Loan Structure Suits Your Banking Needs?

Tranche loans provide flexibility by allowing borrowers to draw funds in segments based on project milestones, optimizing cash flow management in banking transactions. Bullet loans, conversely, require a lump-sum repayment at maturity, benefiting borrowers with predictable cash inflows or short-term financing needs. Assessing loan repayment capacity, cash flow consistency, and project timelines helps determine whether a tranche or bullet loan structure best suits your banking requirements.

Important Terms

Amortization Schedule

An amortization schedule breaks down each payment of a tranche loan, showing how principal and interest are gradually paid over time, unlike a bullet loan where the principal is repaid in full at maturity. Tranche loans feature structured payments aligned with the amortization schedule, whereas bullet loans require only interest payments until the final lump-sum principal repayment.

Principal Repayment Structure

The principal repayment structure for tranche loans involves scheduled amortization where principal is repaid periodically, reducing outstanding balance over time. In contrast, bullet loans require a lump-sum principal repayment at maturity, resulting in no principal reduction during the loan term.

Balloon Payment

Balloon payment refers to a large, lump-sum repayment due at the end of a loan term, commonly associated with both tranche and bullet loans where interim payments may be smaller or interest-only. In a tranche loan, balloon payments can occur at the conclusion of each disbursed segment, while bullet loans require a single balloon payment covering the entire principal, highlighting differences in cash flow structuring and risk management.

Sinking Fund

A sinking fund in a tranche loan mandates periodic principal repayments, reducing default risk by gradually lowering debt over time, whereas a bullet loan requires a single lump-sum principal repayment at maturity, increasing the borrower's repayment burden at loan end. This fundamental difference affects cash flow management and risk profiles in structured finance and corporate lending.

Interest-Only Period

An Interest-Only Period in a loan allows borrowers to pay only interest without principal amortization, often applied in Tranche loans where incremental funding occurs. Bullet Loans typically do not feature an Interest-Only Period as the entire principal is repaid in a lump sum at maturity, emphasizing different repayment structures and cash flow management.

Loan Maturity Profile

Loan maturity profiles for tranche loans exhibit staggered repayment schedules aligned with individual disbursements, enabling phased principal amortization and flexible cash flow management. In contrast, bullet loans consolidate principal repayment at a single maturity date, concentrating default risk but providing borrowers with interest-only payments during the loan term.

Cash Flow Waterfall

Cash flow waterfall structures prioritize payment distribution among tranches based on seniority, ensuring senior tranches receive principal and interest before junior ones, which contrasts with bullet loans that repay principal in a lump sum at maturity. This mechanism mitigates risk by providing staged payment schedules, allowing tranche investors to assess cash flow timing and default sensitivity more accurately compared to bullet loan obligations.

Loan Syndication

Loan syndication involves multiple lenders sharing portions of a large loan, often structured into tranches with different terms and repayment schedules; tranche loans allow staggered disbursements and repayments, while bullet loans require a single principal repayment at maturity. Tranche loans optimize cash flow management by aligning disbursements and amortizations with project milestones, whereas bullet loans simplify repayment but carry higher refinancing risk at maturity.

Prepayment Risk

Prepayment risk in tranche structures impacts cash flow predictability, as early loan repayments may reduce interest income on senior tranches while potentially benefiting subordinate tranches differently. In contrast, bullet loans concentrate prepayment risk at maturity, where a lump-sum repayment can affect reinvestment opportunities and portfolio valuation abruptly.

Payment Frequency

Payment frequency in tranche loans often involves multiple periodic repayments aligned with each disbursement, enhancing cash flow management for borrowers, while bullet loans typically require a single lump-sum payment at maturity, concentrating repayment risk. Tranche loans allow for staggered principal and interest payments corresponding to each tranche, whereas bullet loans focus repayment on the principal at the end, influencing the loan's amortization and credit risk profiles.

Tranche vs Bullet Loan Infographic

moneydif.com

moneydif.com