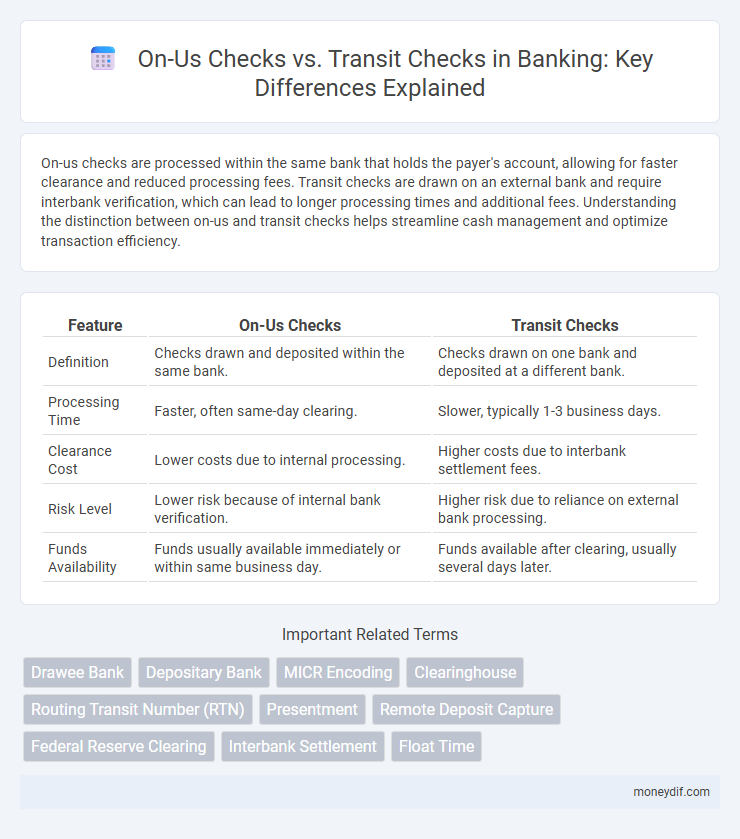

On-us checks are processed within the same bank that holds the payer's account, allowing for faster clearance and reduced processing fees. Transit checks are drawn on an external bank and require interbank verification, which can lead to longer processing times and additional fees. Understanding the distinction between on-us and transit checks helps streamline cash management and optimize transaction efficiency.

Table of Comparison

| Feature | On-Us Checks | Transit Checks |

|---|---|---|

| Definition | Checks drawn and deposited within the same bank. | Checks drawn on one bank and deposited at a different bank. |

| Processing Time | Faster, often same-day clearing. | Slower, typically 1-3 business days. |

| Clearance Cost | Lower costs due to internal processing. | Higher costs due to interbank settlement fees. |

| Risk Level | Lower risk because of internal bank verification. | Higher risk due to reliance on external bank processing. |

| Funds Availability | Funds usually available immediately or within same business day. | Funds available after clearing, usually several days later. |

Understanding On-Us Checks and Transit Checks

On-us checks are payments processed within the same bank where the issuer holds an account, enabling faster clearance and immediate fund availability. Transit checks involve funds drawn from accounts at different banks, requiring interbank communication and longer processing times due to clearinghouse procedures. Understanding the distinction between on-us and transit checks is crucial for banks to manage cash flow, risk, and customer expectations effectively.

Key Differences Between On-Us and Transit Checks

On-us checks are those deposited and cleared within the same bank where the account is held, resulting in faster processing times and immediate fund availability. Transit checks, drawn on a different bank than the deposit bank, require interbank clearing processes, often causing delays of several business days. The primary differentiator lies in the institution handling the check: on-us checks stay within one bank's network, while transit checks involve multiple banking institutions for verification and settlement.

How On-Us Checks Work in Banking Transactions

On-us checks are processed entirely within the same bank where the check is deposited, allowing for faster verification and funds availability compared to transit checks that require interbank clearing. When an on-us check is presented, the bank immediately verifies the account details and available balance internally, reducing processing time and risk of fraud. This streamlined process enables quicker crediting of funds to the depositor's account, improving customer convenience and liquidity management.

The Processing of Transit Checks Explained

Transit checks, also known as non-on-us checks, require processing through the payer's bank or clearinghouse before funds are available. These checks undergo verification and clearing processes that involve interbank communication to confirm the legitimacy and sufficiency of the payer's account. The processing time for transit checks typically ranges from one to several business days, depending on the banking institutions involved and regulatory requirements.

Clearing and Settlement: On-Us vs Transit Checks

On-us checks are cleared and settled internally within the same bank, enabling faster funds availability and reduced processing time. Transit checks require interbank clearing through clearinghouses or the Automated Clearing House (ACH) network, which involves longer settlement periods and additional verification steps. The distinction in clearing mechanisms impacts the overall efficiency and risk management in the banking settlement process.

Advantages and Disadvantages of On-Us Checks

On-us checks, processed within the same bank where the account is held, offer faster clearance and reduced processing costs compared to transit checks, which require interbank clearing. They provide enhanced security through direct verification and typically result in quicker funds availability, benefiting both account holders and banks. However, on-us checks may limit customer flexibility, as they must be deposited at the issuing bank, potentially inconveniencing those who prefer banking with different institutions.

Why Transit Checks Require Specialized Processing

Transit checks require specialized processing because they are drawn on a different bank than the one where they are deposited, necessitating interbank verification and settlement through clearinghouses. This cross-institution nature demands secure handling to prevent fraud and ensure the accurate transfer of funds between banks. On-us checks, by contrast, clear more quickly since they do not involve external bank systems or intermediary processing.

Fraud Detection: On-Us Checks vs Transit Checks

Fraud detection in banking varies significantly between on-us checks and transit checks due to differing verification processes; on-us checks are easier to authenticate as they are processed within the same financial institution, enabling real-time validation against internal databases. Transit checks, processed between different banks, present higher fraud risks since verification depends on interbank communication and third-party clearing systems, increasing the chances of alteration or counterfeit detection delays. Advanced fraud detection technologies like AI-driven pattern analysis and multi-factor authentication are critical in mitigating risks associated with transit checks, whereas on-us checks benefit from more immediate fraud flagging through integrated bank systems.

Compliance Requirements for On-Us and Transit Checks

On-us checks require stringent compliance with internal bank policies and regulatory guidelines such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations, as these checks are drawn and deposited within the same bank. Transit checks, which are drawn on one bank but deposited at another, involve additional compliance steps including interbank settlement rules, verification of the paying bank's credentials, and adherence to the Uniform Commercial Code (UCC) provisions to mitigate fraud risks. Both check types necessitate robust customer identification processes and transaction monitoring to ensure compliance with federal regulations and reduce potential money laundering activities.

Impact of On-Us and Transit Checks on Bank Operations

On-us checks, being processed within the same bank, streamline operations by reducing clearing times and lowering processing costs, enhancing liquidity management. Transit checks require interbank communication and clearing, increasing operational complexity, settlement risk, and resource allocation for verification and reconciliation. Efficient handling of both on-us and transit checks is critical for optimizing transaction workflows and maintaining regulatory compliance in banking institutions.

Important Terms

Drawee Bank

A Drawee Bank is the financial institution responsible for paying the amount specified on a check when presented for payment, acting as the party that holds the drawer's account. In On-us checks, the drawee bank and the depository bank are the same, facilitating faster processing, while in Transit checks, the drawee bank differs from the depository bank, requiring interbank clearing procedures.

Depositary Bank

A Depositary Bank processes both on-us checks, which are drawn on accounts within the same bank, and transit checks, which are drawn on different financial institutions, requiring interbank clearing. Efficient handling of these checks impacts the bank's liquidity management and risk exposure in the check collection process.

MICR Encoding

MICR encoding distinguishes On-us checks, drawn on the same bank as the depositing institution, from Transit checks, drawn on different banks, by specific characters in the magnetic ink characters at the check's bottom. This encoding ensures accurate and efficient automated processing, routing On-us checks directly to the issuer bank and routing Transit checks through the clearinghouse system.

Clearinghouse

Clearinghouse services facilitate the processing of On-us checks, which are payments made between accounts within the same bank, and Transit checks, which originate from a different bank. Efficient clearinghouse operations reduce settlement times and minimize the risk of fraudulent transactions by authenticating and reconciling these checks through electronic networks.

Routing Transit Number (RTN)

Routing Transit Number (RTN) uniquely identifies financial institutions and determines the routing of checks; On-us checks bear the RTN of the issuing bank, enabling immediate internal processing, while Transit checks feature an RTN from an external bank, requiring interbank clearance. Accurate RTN usage optimizes transaction speed and reduces processing errors between financial institutions.

Presentment

Presentment involves submitting a check to the bank for payment, differentiating between on-us checks, which are drawn on the same bank where they are deposited, and transit checks, which are drawn on a different bank. Processing on-us checks is typically faster and incurs lower fees due to internal handling, while transit checks require interbank clearing protocols and may take longer to settle.

Remote Deposit Capture

Remote Deposit Capture (RDC) enables businesses to electronically deposit checks by scanning and transmitting images to their bank, distinguishing between on-us checks, which are drawn on the same bank holding the RDC account, and transit checks, drawn on a different financial institution. On-us checks typically clear faster due to internal processing, while transit checks require additional interbank clearing procedures, impacting settlement times and risk management strategies.

Federal Reserve Clearing

Federal Reserve Clearing differentiates between on-us checks, which are processed within the same bank, and transit checks, which require interbank clearing via the Federal Reserve System. Efficient settlement of transit checks through Federal Reserve Clearing ensures secure, timely fund transfers across financial institutions nationwide.

Interbank Settlement

Interbank settlement involves the transfer of funds between different banks to clear payments, where on-us checks are processed internally within the issuing bank, resulting in faster clearance times and lower processing costs, while transit checks require interbank communication and settlement through clearinghouses or correspondent banks, often leading to longer settlement periods and additional fees. Efficient management of both on-us and transit checks is crucial for maintaining liquidity and minimizing operational risks in the banking system.

Float Time

Float time refers to the delay between the deposit of a check and the actual availability of funds, typically shorter for on-us checks, which are processed within the same bank, compared to transit checks that require interbank clearing. On-us checks often clear within one business day, while transit checks can take several days due to the involvement of intermediary banks and clearinghouses.

On-us checks vs Transit checks Infographic

moneydif.com

moneydif.com