Primary dealers are authorized financial institutions that trade government securities directly with the central bank, playing a crucial role in implementing monetary policy and providing liquidity. Secondary dealers, on the other hand, operate by buying and selling securities in the secondary market, facilitating trading among investors without direct involvement in central bank operations. Understanding the distinctions between these dealer types is essential for grasping the dynamics of government securities markets and liquidity distribution.

Table of Comparison

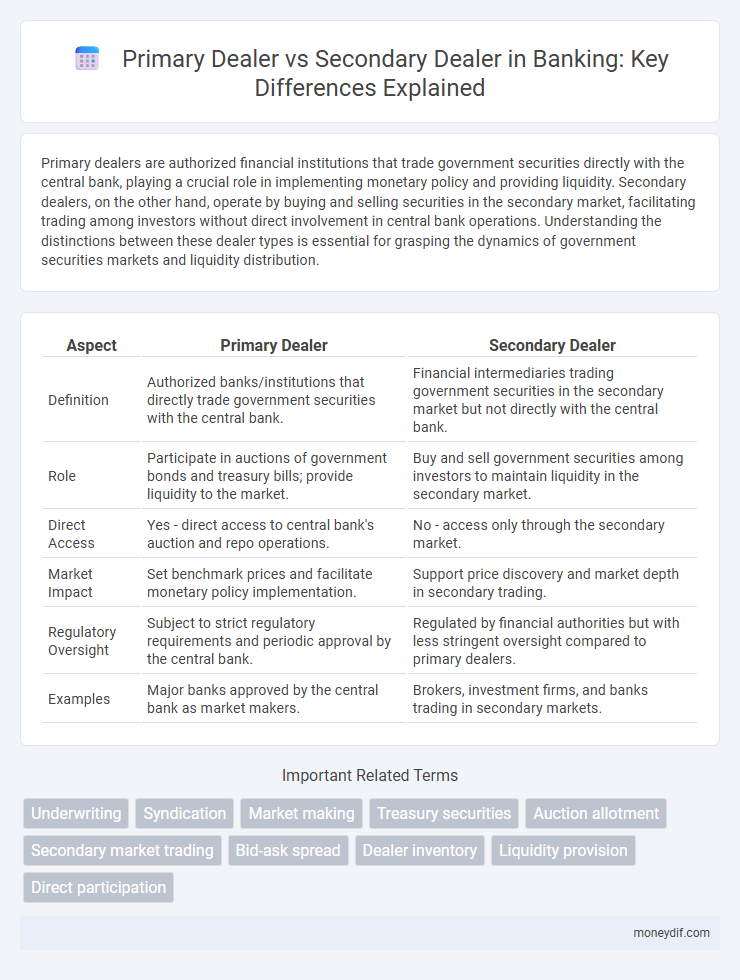

| Aspect | Primary Dealer | Secondary Dealer |

|---|---|---|

| Definition | Authorized banks/institutions that directly trade government securities with the central bank. | Financial intermediaries trading government securities in the secondary market but not directly with the central bank. |

| Role | Participate in auctions of government bonds and treasury bills; provide liquidity to the market. | Buy and sell government securities among investors to maintain liquidity in the secondary market. |

| Direct Access | Yes - direct access to central bank's auction and repo operations. | No - access only through the secondary market. |

| Market Impact | Set benchmark prices and facilitate monetary policy implementation. | Support price discovery and market depth in secondary trading. |

| Regulatory Oversight | Subject to strict regulatory requirements and periodic approval by the central bank. | Regulated by financial authorities but with less stringent oversight compared to primary dealers. |

| Examples | Major banks approved by the central bank as market makers. | Brokers, investment firms, and banks trading in secondary markets. |

Overview of Primary and Secondary Dealers

Primary dealers are financial institutions authorized by central banks to participate directly in government securities auctions, facilitating liquidity and market stability. Secondary dealers operate in the secondary market, buying and selling government securities post-auction to provide continuous market making and price discovery. Both play crucial roles in maintaining efficient functioning and depth in the government bond markets.

Key Roles in Financial Markets

Primary dealers serve as crucial intermediaries in government securities markets by directly participating in Treasury auctions and providing liquidity to the market. Secondary dealers facilitate the buying and selling of securities after the initial issuance, enabling efficient market operations and price discovery. Both play vital roles in maintaining market stability and ensuring continuous trade flow between issuers and investors.

Regulatory Requirements for Dealers

Primary dealers are authorized financial institutions obligated to participate directly in government securities auctions and adhere to stringent regulatory capital and reporting requirements set by central banks. Secondary dealers, while also registered entities in the securities market, primarily facilitate trading among investors and comply with less rigorous regulations focused on transparency and fair trading practices. Regulatory frameworks enforce strict compliance and risk management standards on primary dealers to ensure market stability, whereas secondary dealers operate under guidelines that promote liquidity and price discovery.

Functions of Primary Dealers

Primary dealers play a vital role in the government securities market by underwriting new issues and ensuring liquidity through mandatory participation in auctions. They act as market makers, facilitating smooth trading and price discovery by maintaining inventory and providing continuous bid and offer quotes. These institutions also support monetary policy implementation by transmitting central bank signals to the broader financial market.

Functions of Secondary Dealers

Secondary dealers primarily facilitate the distribution and trading of government securities in the secondary market, ensuring liquidity and efficient price discovery. They support primary dealers by purchasing securities from them and enabling investors to buy or sell these instruments without directly participating in primary auctions. Their function is crucial for maintaining market stability and providing continuous access to government bonds for a wide range of investors.

Advantages of Primary Dealership

Primary dealers enjoy direct access to government securities auctions, allowing them to purchase bonds at face value before they reach the open market. This privileged position enhances liquidity management and profit opportunities by enabling early market entry and greater inventory control. Furthermore, primary dealers often benefit from exclusive communication channels with central banks, facilitating timely monetary policy insights and strategic decision-making.

Differences Between Primary and Secondary Dealers

Primary dealers are financial institutions authorized to trade directly with central banks and participate in government securities auctions, playing a crucial role in market liquidity and monetary policy implementation. Secondary dealers operate by buying and selling securities in the secondary market but do not have the authorization to engage directly with the central bank or participate in initial government bond issuances. The distinction lies in primary dealers' direct relationship with central banks and their obligation to support market functioning, while secondary dealers focus on trading existing securities among investors.

Impact on Market Liquidity

Primary dealers play a crucial role in enhancing market liquidity by actively participating in government bond auctions and providing continuous bid and ask prices, ensuring smoother price discovery and efficient trading. Secondary dealers contribute to liquidity by facilitating the trading of securities in the secondary market, allowing investors to buy and sell without affecting initial issuance. The combined activities of primary and secondary dealers stabilize market conditions and improve overall investor confidence.

Risks Associated with Each Dealer Type

Primary dealers face significant market risk due to their obligation to participate in government securities auctions and maintain minimum holdings, exposing them to price volatility and liquidity pressures. Secondary dealers encounter counterparty risk and operational risk as they primarily trade securities in the secondary market, relying on the creditworthiness and settlement efficiency of other market participants. Both dealer types must manage regulatory compliance risks that impact their capital adequacy and reputational standing.

Choosing Between Primary and Secondary Dealership

Selecting between a primary dealer and a secondary dealer depends on access to government securities and direct participation in bond auctions, with primary dealers having exclusive rights to underwrite and trade new issues. Secondary dealers specialize in the trading of existing securities, providing liquidity and market depth but lack the authority to participate in initial offerings. Financial institutions prioritize primary dealerships for investment-grade access and influence on bond pricing, while secondary dealers are ideal for portfolio diversification and secondary market transactions.

Important Terms

Underwriting

Primary dealers actively underwrite new securities issuances directly from issuers, while secondary dealers primarily facilitate trading of existing securities in the secondary market.

Syndication

Primary dealers directly purchase government securities at auction and facilitate market liquidity, while secondary dealers trade these securities in the secondary market, aiding syndication by distributing bond issuances more broadly.

Market making

Primary dealers facilitate market making by underwriting and distributing new securities, while secondary dealers support liquidity through ongoing trading and price stabilization in the secondary market.

Treasury securities

Primary dealers purchase Treasury securities directly from the U.S. Treasury during auctions, while secondary dealers trade these securities on the open market, providing liquidity and price discovery.

Auction allotment

Auction allotment is primarily allocated to primary dealers, who participate directly in government securities auctions, while secondary dealers engage in the subsequent trading of these securities in the market.

Secondary market trading

Secondary market trading involves transactions of securities between secondary dealers and other market participants, whereas primary dealers primarily facilitate government securities issuance and provide liquidity directly to the treasury.

Bid-ask spread

Primary dealers typically face narrower bid-ask spreads compared to secondary dealers due to their direct access to issuers and higher trading volumes.

Dealer inventory

Primary dealers directly transact with central banks to facilitate monetary policy implementation, while secondary dealers operate within the broader market by trading inventory acquired from primary dealers.

Liquidity provision

Primary dealers facilitate liquidity provision by directly underwriting government securities, while secondary dealers primarily maintain market liquidity through trading these securities post-issuance.

Direct participation

Direct participation involves primary dealers trading securities directly with the government, whereas secondary dealers facilitate trades between investors without direct government involvement.

Primary dealer vs Secondary dealer Infographic

moneydif.com

moneydif.com