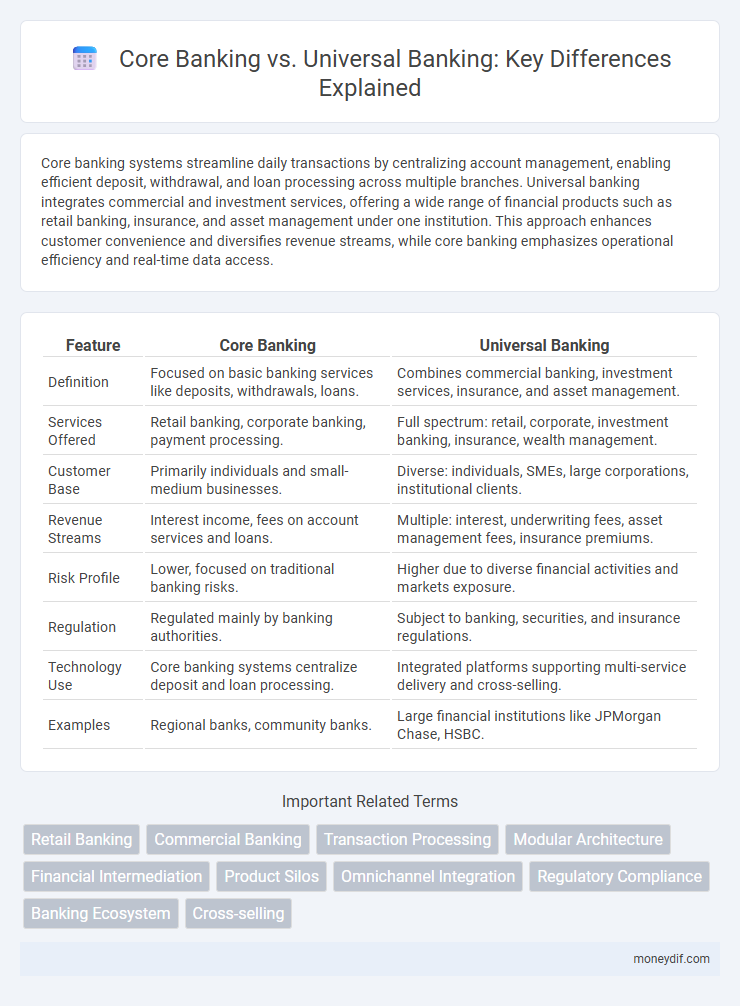

Core banking systems streamline daily transactions by centralizing account management, enabling efficient deposit, withdrawal, and loan processing across multiple branches. Universal banking integrates commercial and investment services, offering a wide range of financial products such as retail banking, insurance, and asset management under one institution. This approach enhances customer convenience and diversifies revenue streams, while core banking emphasizes operational efficiency and real-time data access.

Table of Comparison

| Feature | Core Banking | Universal Banking |

|---|---|---|

| Definition | Focused on basic banking services like deposits, withdrawals, loans. | Combines commercial banking, investment services, insurance, and asset management. |

| Services Offered | Retail banking, corporate banking, payment processing. | Full spectrum: retail, corporate, investment banking, insurance, wealth management. |

| Customer Base | Primarily individuals and small-medium businesses. | Diverse: individuals, SMEs, large corporations, institutional clients. |

| Revenue Streams | Interest income, fees on account services and loans. | Multiple: interest, underwriting fees, asset management fees, insurance premiums. |

| Risk Profile | Lower, focused on traditional banking risks. | Higher due to diverse financial activities and markets exposure. |

| Regulation | Regulated mainly by banking authorities. | Subject to banking, securities, and insurance regulations. |

| Technology Use | Core banking systems centralize deposit and loan processing. | Integrated platforms supporting multi-service delivery and cross-selling. |

| Examples | Regional banks, community banks. | Large financial institutions like JPMorgan Chase, HSBC. |

Understanding Core Banking: Definition and Key Features

Core banking refers to the centralized system that processes daily banking transactions and posts updates to accounts in real-time across branches, enabling services such as deposits, withdrawals, loans, and payments. Key features include seamless integration of multiple banking channels, real-time transaction processing, and a unified customer database that improves operational efficiency and customer experience. Unlike universal banking, which offers a broad range of financial services beyond traditional banking, core banking focuses specifically on the essential banking functions that support retail and corporate customers.

What is Universal Banking? Scope and Benefits

Universal banking refers to a financial system where banks offer a wide range of services including commercial banking, investment banking, asset management, and insurance under one roof. Its scope encompasses deposit-taking, lending, underwriting, advisory, and wealth management, enabling seamless customer experience across multiple financial needs. The benefits include diversified revenue streams, enhanced risk management, operational efficiency, and improved customer loyalty through comprehensive financial solutions.

Core Banking vs Universal Banking: Main Differences

Core banking systems primarily focus on processing day-to-day banking transactions such as deposits, withdrawals, and loan management. Universal banking combines commercial and investment services, offering a wide range of financial products including asset management, insurance, and underwriting alongside core banking functions. The key difference lies in the scope of services, where core banking is transaction-centric while universal banking provides a comprehensive, integrated financial solution.

Service Offerings: Core vs Universal Banking

Core banking primarily focuses on essential services such as deposit accounts, loans, and payment processing, enabling customers to access banking functions across multiple branches seamlessly. Universal banking expands service offerings by integrating investment, insurance, and wealth management products alongside traditional banking, providing a one-stop financial solution. The broader product range in universal banking enhances customer convenience by combining retail, corporate, and non-banking financial services under one institution.

Technology Infrastructure in Core and Universal Banking

Core banking relies on centralized technology infrastructures that enable real-time transaction processing, ensuring seamless access to banking services across multiple branches. Universal banking integrates more complex and scalable technology platforms to support a wide range of financial products, including retail, corporate, and investment banking, enhancing cross-functional service delivery. Both systems leverage advanced IT frameworks, but universal banking demands greater flexibility and interoperability to manage diverse operations efficiently.

Customer Experience: Which Model Delivers More Value?

Core banking systems prioritize streamlined transaction processing and centralized data management, enhancing operational efficiency and quick access to account information for customers. Universal banking integrates a wide range of financial services like loans, investments, and insurance under one platform, offering a holistic customer experience with personalized financial solutions and seamless cross-service interactions. Customers seeking comprehensive service bundles often find greater convenience and value in universal banking models, while those prioritizing fast, reliable transaction handling may prefer core banking systems.

Regulatory Compliance for Core and Universal Banks

Core banking systems prioritize standardized regulatory compliance measures, ensuring efficient monitoring and reporting of transactions to meet central bank mandates and anti-money laundering (AML) regulations. Universal banks face more complex compliance challenges due to diversified financial services, requiring integrated risk management frameworks to adhere to multiple regulatory bodies and cross-sector guidelines. Both banking models deploy advanced compliance technologies, but universal banks emphasize broader regulatory alignment across lending, investment, and insurance verticals.

Operational Efficiency: Comparing the Two Approaches

Core banking systems streamline operational efficiency by centralizing transactions and reducing processing times through real-time data access and automation. Universal banking expands operational scope by integrating diverse financial services, which can complicate workflows but offers economies of scale and cross-selling opportunities. Comparing the two, core banking emphasizes speed and simplicity in daily operations, while universal banking balances efficiency with broader service integration and risk management.

Future Trends: Core Banking and Universal Banking Evolution

Core banking systems are evolving to incorporate advanced AI-driven automation and cloud-based platforms, enabling real-time transaction processing and personalized customer experiences. Universal banking is expanding its ecosystem by integrating fintech partnerships, offering diversified financial services including insurance, asset management, and digital wallets within unified platforms. Future trends indicate a convergence where core banking's technological backbone supports universal banking's broad service model, enhancing operational efficiency and customer-centric innovation.

Choosing the Right Model: Factors Banks Should Consider

When choosing between core banking and universal banking models, banks should evaluate factors such as operational complexity, customer demand for diverse financial services, and regulatory compliance requirements. Core banking offers streamlined services focused on deposit accounts and loans, while universal banking provides a broader range including investment, insurance, and asset management. Assessing market conditions and technological capabilities ensures alignment with the bank's strategic goals and risk management preferences.

Important Terms

Retail Banking

Retail banking focuses on individual customers offering services like savings accounts, mortgages, and personal loans, while core banking refers to the centralized systems that process and manage these financial transactions across branches. Universal banking integrates retail, commercial, and investment services, providing a broader range of financial products beyond the core transactional functions of retail banking.

Commercial Banking

Commercial banking focuses on offering deposit accounts, loans, and payment services primarily to individuals and businesses, relying heavily on core banking systems that ensure real-time transaction processing and accurate record-keeping. Universal banking integrates commercial banking with investment services, leveraging advanced core banking platforms to provide a seamless experience across diverse financial products and regulatory compliance.

Transaction Processing

Transaction processing in core banking systems focuses on efficiently handling high volumes of routine financial operations like deposits, withdrawals, and transfers within a single bank. Universal banking integrates transaction processing across diverse financial services, including investment, insurance, and lending, enabling seamless customer interactions across multiple product lines.

Modular Architecture

Modular architecture in core banking systems enables financial institutions to implement specialized, scalable components tailored to specific banking functions, facilitating seamless integration and faster innovations compared to monolithic universal banking platforms. Core banking focuses on essential transaction processing modules, while universal banking leverages modular architecture to combine retail, investment, insurance, and corporate banking services into a unified, flexible digital ecosystem.

Financial Intermediation

Financial intermediation involves banks acting as intermediaries between depositors and borrowers, with core banking systems streamlining essential services like deposits, loans, and payments, whereas universal banking extends these functions by integrating investment, insurance, and asset management under one institution. Core banking focuses on transactional efficiency, while universal banking supports diversified financial activities, enhancing risk management and customer offerings.

Product Silos

Product silos in core banking systems isolate functions like loans, deposits, and payments into separate modules, limiting data integration and customer insights, while universal banking systems break down these silos by unifying diverse financial products to offer seamless, cross-product customer experiences and enhanced operational efficiency. By enabling centralized data management and real-time information sharing, universal banking platforms improve decision-making, risk assessment, and personalized service delivery compared to traditional core banking silos.

Omnichannel Integration

Omnichannel integration in core banking ensures seamless customer experiences across digital, branch, and call center platforms, focusing on specialized services like deposits and loans. Universal banking leverages omnichannel strategies to unify a broader range of financial products including insurance, investment, and wealth management, providing a comprehensive, one-stop banking solution.

Regulatory Compliance

Regulatory compliance in core banking focuses on ensuring adherence to banking laws and standards specific to basic banking services such as deposits, loans, and payment processing, while universal banking compliance encompasses a broader regulatory framework including investment services, insurance, and asset management. Banks operating under universal banking models must navigate complex cross-sector regulations, requiring advanced compliance systems to manage diverse regulatory obligations effectively.

Banking Ecosystem

Core banking systems centralize financial services and data management, enabling seamless transaction processing and real-time account updates across multiple branches, while universal banking integrates diverse financial services--including retail banking, investment banking, and insurance--under one institution to offer comprehensive customer solutions and cross-selling opportunities. The evolution from core banking to universal banking reflects the industry's shift toward digitization, customer-centric models, and diversified revenue streams by leveraging integrated platforms and advanced data analytics.

Cross-selling

Cross-selling plays a pivotal role in universal banking by leveraging a broad spectrum of financial products and services to enhance customer value and profitability, unlike core banking which primarily focuses on basic deposit and loan services. Universal banks integrate cross-selling strategies across diverse offerings such as wealth management, insurance, and investment products to drive higher customer retention and revenue streams.

Core banking vs Universal banking Infographic

moneydif.com

moneydif.com