Factoring and forfaiting are two financial services that help businesses manage cash flow by converting receivables into immediate funds. Factoring involves the sale of short-term receivables, typically invoices, to a factor who assumes the credit risk and collects payments from customers, while forfaiting is focused on medium to long-term receivables, such as promissory notes or bills of exchange, and often involves export finance without recourse to the exporter. Both instruments provide liquidity but differ in terms of transaction duration, risk assumption, and the nature of receivables handled.

Table of Comparison

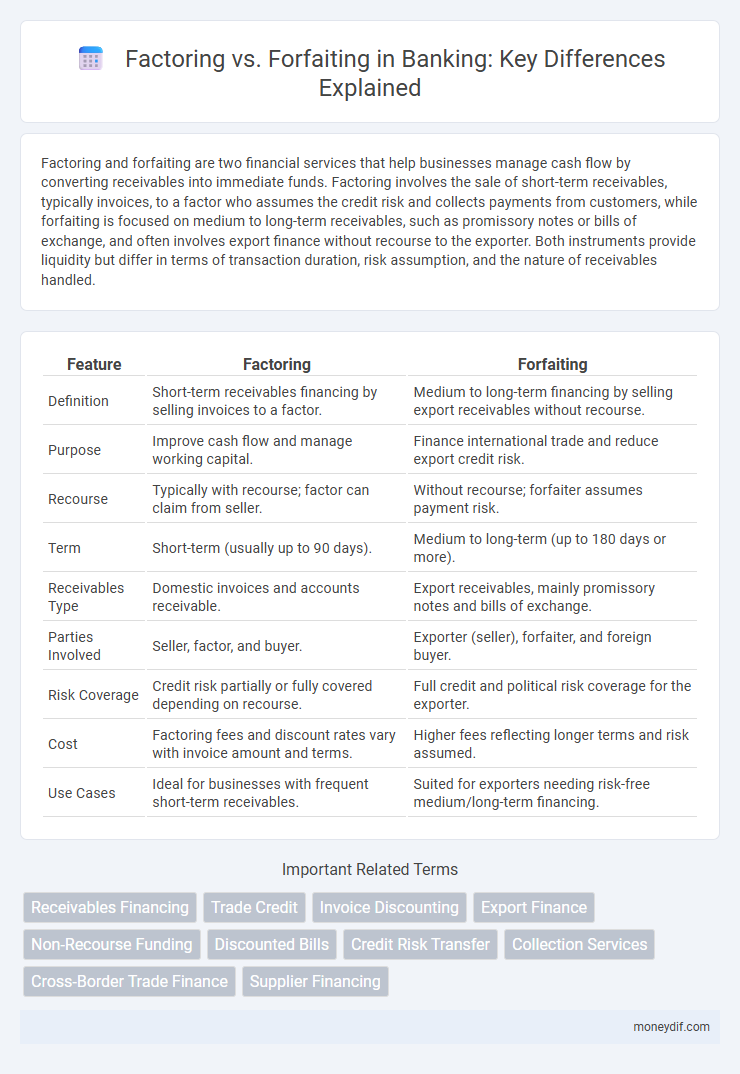

| Feature | Factoring | Forfaiting |

|---|---|---|

| Definition | Short-term receivables financing by selling invoices to a factor. | Medium to long-term financing by selling export receivables without recourse. |

| Purpose | Improve cash flow and manage working capital. | Finance international trade and reduce export credit risk. |

| Recourse | Typically with recourse; factor can claim from seller. | Without recourse; forfaiter assumes payment risk. |

| Term | Short-term (usually up to 90 days). | Medium to long-term (up to 180 days or more). |

| Receivables Type | Domestic invoices and accounts receivable. | Export receivables, mainly promissory notes and bills of exchange. |

| Parties Involved | Seller, factor, and buyer. | Exporter (seller), forfaiter, and foreign buyer. |

| Risk Coverage | Credit risk partially or fully covered depending on recourse. | Full credit and political risk coverage for the exporter. |

| Cost | Factoring fees and discount rates vary with invoice amount and terms. | Higher fees reflecting longer terms and risk assumed. |

| Use Cases | Ideal for businesses with frequent short-term receivables. | Suited for exporters needing risk-free medium/long-term financing. |

Understanding Factoring and Forfaiting: Key Differences

Factoring involves the sale of short-term receivables to improve cash flow, primarily used for domestic transactions and ongoing customer relationships. Forfaiting is the purchase of medium to long-term receivables, typically export receivables, providing non-recourse financing with no recourse to the seller. The key differences lie in the transaction duration, risk assumption, and the types of receivables involved, where factoring supports working capital needs and forfaiting facilitates international trade finance.

How Factoring Works in Modern Banking

Factoring in modern banking involves a financial institution purchasing a company's accounts receivable at a discount, providing immediate cash flow and transferring credit risk. The bank or factoring company manages collections and credit control, enabling businesses to focus on operations while reducing exposure to client defaults. This service is particularly advantageous for companies with short-term receivables seeking liquidity without incurring additional debt.

The Mechanics of Forfaiting in International Trade

Forfaiting in international trade involves the purchase of receivables from exporters at a discount, allowing immediate cash flow without recourse to the exporter. This financial technique mitigates credit risk by transferring the responsibility of debt collection to the forfaiter, who assumes all associated risks. Unlike factoring, forfaiting typically handles medium- to long-term receivables backed by negotiable instruments such as promissory notes or bills of exchange, making it suitable for capital goods and large shipments.

Benefits of Factoring for Small and Medium Enterprises

Factoring provides small and medium enterprises (SMEs) with immediate cash flow by converting accounts receivable into working capital, reducing payment delays and improving liquidity management. It eliminates the need for collateral, making financing more accessible for SMEs with limited asset bases, while also transferring credit risk to the factoring company. This financial solution supports business growth by enabling SMEs to meet operational expenses and invest in new opportunities without waiting for customer payments.

Forfaiting: Advantages for Exporters and Importers

Forfaiting offers exporters a non-recourse financing solution that eliminates credit risk and improves cash flow by converting receivables into immediate funds. Importers benefit from extended payment terms and simplified transaction management without impacting their working capital. This trade finance method enhances cross-border trade by providing guaranteed payment and mitigating political and commercial risks associated with international transactions.

Risk Mitigation: Factoring vs Forfaiting

Factoring mitigates risk by transferring accounts receivable to a factor who assumes the credit risk of customer non-payment, enhancing cash flow predictability for businesses. Forfaiting involves the purchase of medium to long-term receivables, typically backed by promissory notes or bills of exchange, shifting political and commercial risks to the forfaiter. Both methods serve as effective risk mitigation tools, with factoring tailored for short-term receivables and forfaiting suited for international trade with extended payment terms.

Cost Structures: Comparing Factoring and Forfaiting

Factoring typically involves ongoing service fees and interest rates that vary based on invoice terms and credit risk, making it suitable for short-term cash flow management. Forfaiting incurs a one-time discount fee applied to the entire receivable amount, often higher than factoring costs but beneficial for medium to long-term, high-value export transactions. Both financing methods require careful analysis of cost structures to align with business cash flow needs and transaction sizes.

Documentation and Process Flow in Factoring and Forfaiting

Factoring documentation primarily involves invoices, purchase orders, and receivables agreements that facilitate quick verification and credit risk assessment by the factor. Forfaiting requires a more extensive set of documents, including promissory notes, bills of exchange, and letters of credit, due to its focus on medium to long-term export receivables. The factoring process flow emphasizes ongoing credit management and collections, while forfaiting follows a one-time purchase of receivables with full payment upfront, minimizing post-sale responsibilities.

Regulatory Framework Affecting Factoring and Forfaiting

Factoring and forfaiting are financial services governed by distinct regulatory frameworks that impact transaction structures and risk management. Factoring regulations often emphasize debtor protection, including transparency and disclosure requirements under national laws and guidelines set by bodies like the International Factoring Association. Forfaiting is typically regulated under international trade finance rules, aligning with standards from the International Chamber of Commerce (ICC) and Basel III, focusing on credit risk and anti-money laundering compliance.

Choosing Between Factoring and Forfaiting: Factors for Businesses

Businesses must assess factors such as the size of the transaction, credit risk, and payment terms when choosing between factoring and forfaiting. Factoring suits companies seeking short-term working capital with receivables management, while forfaiting is ideal for exporters requiring cash flow for medium to long-term international trade receivables without recourse. Evaluating the nature of the debt, cost implications, and need for risk transfer guides optimal selection to improve liquidity and reduce credit exposure.

Important Terms

Receivables Financing

Receivables financing involves Factoring, which provides immediate cash by selling short-term receivables to a factor, and Forfaiting, which offers non-recourse payment guarantee for medium- to long-term receivables through selling export bills to a forfaiter.

Trade Credit

Trade credit enhances cash flow management by allowing businesses to defer payments, while factoring and forfaiting convert receivables into immediate cash with factoring focused on short-term domestic invoices and forfaiting specializing in long-term international export receivables.

Invoice Discounting

Invoice discounting accelerates cash flow by allowing businesses to borrow against outstanding invoices, whereas factoring involves selling invoices to a third party who assumes collection risk, and forfaiting focuses on medium to long-term receivables typically in international trade with non-recourse financing.

Export Finance

Export finance options include factoring, which involves selling receivables for immediate cash and credit risk protection, and forfaiting, which provides non-recourse purchase of medium to long-term export receivables secured by promissory notes or bills of exchange.

Non-Recourse Funding

Non-recourse funding in factoring involves a financier purchasing receivables without recourse to the seller, whereas in forfaiting, it specifically entails the purchase of medium to long-term export receivables, providing exporters with upfront cash and eliminating credit risk.

Discounted Bills

Discounted bills involve selling receivables at a discount for immediate cash, with factoring providing ongoing account management and recourse options, while forfaiting offers non-recourse, long-term financing typically for international transactions.

Credit Risk Transfer

Credit risk transfer in factoring involves selling accounts receivable to improve cash flow, while forfaiting transfers medium- to long-term trade receivables without recourse, reducing credit risk exposure for exporters.

Collection Services

Factoring provides short-term financing through invoice purchase and credit management, while forfaiting offers medium- to long-term financing by purchasing trade receivables without recourse, both enhancing collection services for improved cash flow.

Cross-Border Trade Finance

Cross-border trade finance involves factoring for short-term receivables with recourse, while forfaiting provides non-recourse financing for medium- to long-term receivables, mitigating international payment risks.

Supplier Financing

Supplier financing options include factoring, which involves selling accounts receivable to improve cash flow, and forfaiting, a method of selling medium- to long-term export receivables at a discount without recourse.

Factoring vs Forfaiting Infographic

moneydif.com

moneydif.com