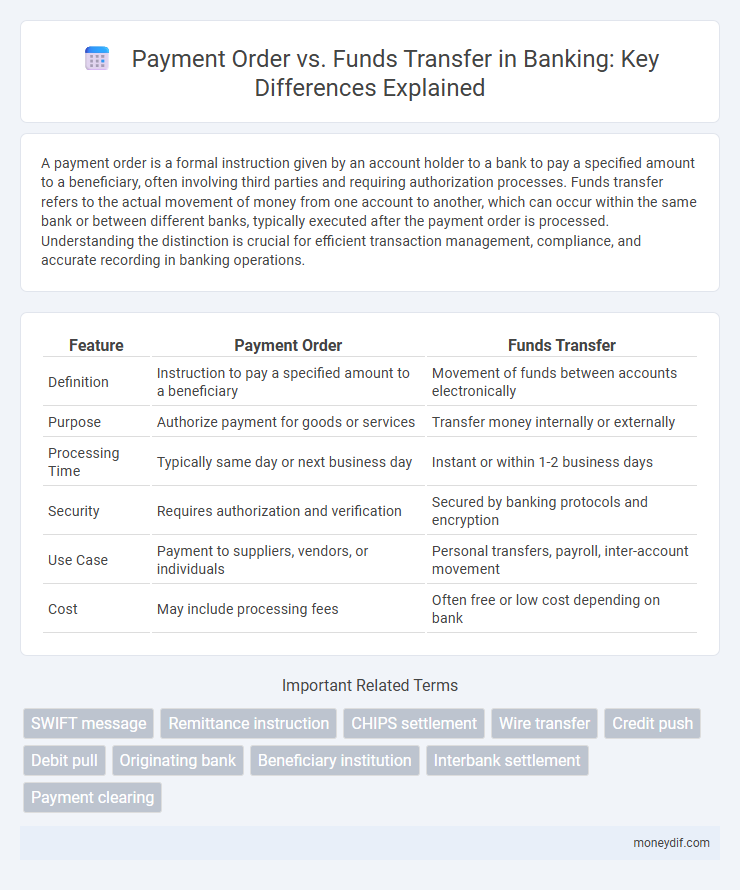

A payment order is a formal instruction given by an account holder to a bank to pay a specified amount to a beneficiary, often involving third parties and requiring authorization processes. Funds transfer refers to the actual movement of money from one account to another, which can occur within the same bank or between different banks, typically executed after the payment order is processed. Understanding the distinction is crucial for efficient transaction management, compliance, and accurate recording in banking operations.

Table of Comparison

| Feature | Payment Order | Funds Transfer |

|---|---|---|

| Definition | Instruction to pay a specified amount to a beneficiary | Movement of funds between accounts electronically |

| Purpose | Authorize payment for goods or services | Transfer money internally or externally |

| Processing Time | Typically same day or next business day | Instant or within 1-2 business days |

| Security | Requires authorization and verification | Secured by banking protocols and encryption |

| Use Case | Payment to suppliers, vendors, or individuals | Personal transfers, payroll, inter-account movement |

| Cost | May include processing fees | Often free or low cost depending on bank |

Understanding Payment Orders in Banking

Payment orders are formal instructions issued by an account holder to their bank, authorizing the transfer of a specified amount to a beneficiary's account, ensuring precise control and documentation of transactions. These orders form the foundation for executing funds transfers, but they emphasize the directive nature and compliance with banking regulations. Understanding payment orders is essential for managing transaction records, avoiding errors, and ensuring secure, traceable movement of funds within banking networks.

What Is a Funds Transfer?

A funds transfer is the electronic movement of money between bank accounts, typically initiated by the account holder or an authorized party. This process ensures the secure and immediate transfer of funds across domestic or international financial institutions. It differs from a payment order, which is a directive instructing the bank to execute a payment, as funds transfer encompasses the actual transaction and settlement of money.

Key Differences Between Payment Orders and Funds Transfers

Payment orders are formal instructions issued by account holders directing their banks to pay a specified amount to a beneficiary, often used in transactions involving third-party intermediaries or cross-border payments. Funds transfers involve the direct movement of money between accounts within the same bank or across different banks, typically reflecting the actual debit and credit entries in the involved accounts. Key differences include payment orders serving as authorization documents, while funds transfers represent the execution of payments, with varying processing times and regulatory requirements depending on the transaction type.

Processes Involved in Payment Orders

Payment orders involve a formal instruction from an account holder to their bank, specifying the amount and beneficiary for the transaction, requiring verification and authorization processes to ensure compliance and security. The bank processes the payment order through systems such as SWIFT or domestic payment networks, performing validation checks, fraud detection, and account balance verification before executing the transfer. This process contrasts with funds transfers, which may be initiated internally or through digital platforms with varying levels of control and confirmation.

How Funds Transfers Work in Modern Banking

Funds transfers in modern banking operate through electronic networks that facilitate the immediate or scheduled movement of money between accounts within the same bank or across different financial institutions. These transfers use secure protocols such as SWIFT, ACH, or real-time payment systems to ensure accuracy and prevent fraud. Payment orders act as formal instructions from the payer to the bank, initiating these funds transfers promptly and efficiently.

Security Measures for Payment Orders vs Funds Transfers

Payment orders require strict authentication protocols such as two-factor authentication (2FA) and digital signatures to prevent unauthorized initiation. Funds transfers implement encryption standards like SSL/TLS and limit access through role-based controls to safeguard transactional data. Both processes benefit from real-time monitoring and anomaly detection to identify and block fraudulent activities promptly.

Advantages of Using Payment Orders

Payment orders provide enhanced security by requiring authorization before funds are moved, reducing the risk of unauthorized transactions. They offer clearer audit trails and detailed transaction records, facilitating better compliance with regulatory requirements. Payment orders also enable precise control over payment timing and conditions, improving cash flow management for businesses and financial institutions.

Benefits of Funds Transfers for Businesses and Individuals

Funds transfers provide businesses and individuals with faster transaction processing, enabling immediate access to funds and improved cash flow management. Enhanced security features, such as encryption and multi-factor authentication, reduce the risk of fraud compared to traditional payment orders. The ability to execute domestic and international transactions seamlessly through electronic funds transfers supports global commerce and personal financial convenience.

Regulatory Compliance: Payment Orders and Funds Transfers

Payment orders and funds transfers must adhere to strict regulatory compliance frameworks, including anti-money laundering (AML) and know your customer (KYC) requirements mandated by financial authorities. Payment orders often require detailed documentation and authorization processes to prevent fraud, while funds transfers need to comply with cross-border transaction regulations such as FATF guidelines and SWIFT standards. Banks implement robust monitoring systems to ensure each transaction aligns with legal standards, mitigating risks of sanctions violations and financial crimes.

Choosing the Right Method: Payment Order or Funds Transfer?

Choosing the right method between a payment order and funds transfer depends on factors such as transaction speed, cost, and security requirements. Payment orders are ideal for instructing banks to pay a specific amount to a beneficiary, often used in international transactions requiring detailed processing instructions. Funds transfers offer direct movement of money between accounts, providing faster settlements suitable for domestic payments and routine banking operations.

Important Terms

SWIFT message

A SWIFT payment order initiates the instruction to transfer funds from the sender to the receiver's account, while a funds transfer confirms the actual movement of money between financial institutions.

Remittance instruction

A remittance instruction specifies payment details within a payment order, guiding the funds transfer process to ensure accurate recipient crediting.

CHIPS settlement

CHIPS settlement finalizes payment orders by instantaneously transferring funds between member banks through a secure, real-time electronic funds transfer system.

Wire transfer

A wire transfer is an electronic payment method where a payment order instructs a financial institution to transfer funds from the sender's account to the recipient's account, distinguishing the payment order as the directive and funds transfer as the actual movement of money.

Credit push

Credit push initiates payments by the payer sending funds directly to the payee's account, differing from funds transfer where the payment order is sent through intermediaries to move money between accounts.

Debit pull

Debit pull initiates payment by authorizing funds transfer from the payer's account, directly linking the payment order to the transfer process.

Originating bank

The originating bank initiates the payment order authorizing funds transfer, ensuring transaction validation and fund availability before processing the transfer.

Beneficiary institution

Beneficiary institutions play a crucial role by receiving payment orders and executing funds transfers to ensure accurate and timely crediting of beneficiary accounts.

Interbank settlement

Interbank settlement involves the confirmation and transfer of funds between banks based on payment orders, ensuring accurate and timely funds transfer across financial institutions.

Payment clearing

Payment clearing involves the reconciliation and settlement of payment orders, ensuring the accurate and timely transfer of funds between financial institutions.

Payment order vs Funds transfer Infographic

moneydif.com

moneydif.com