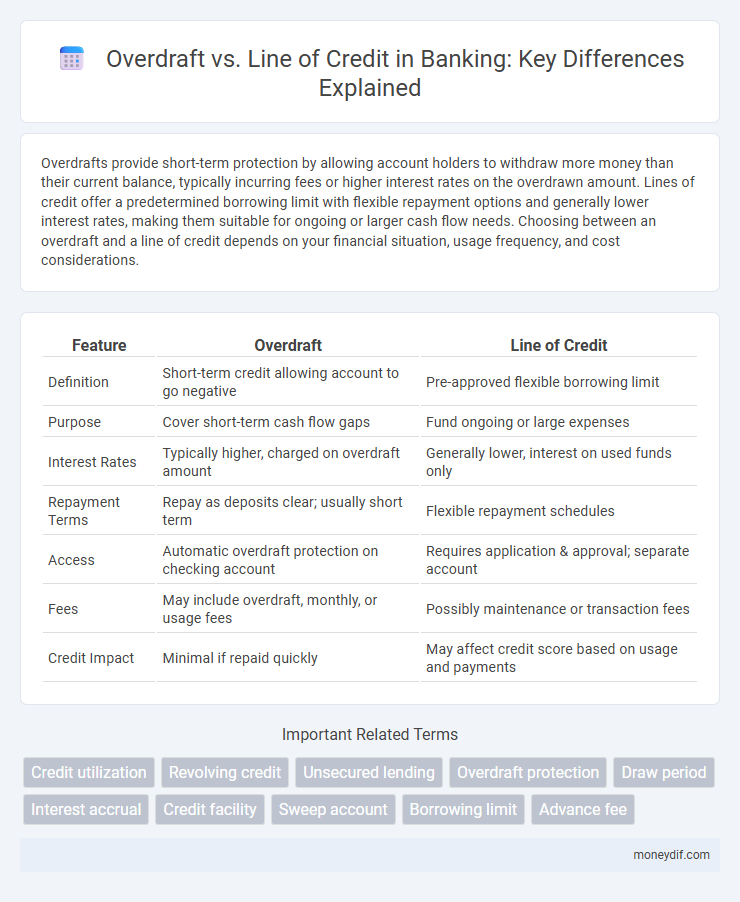

Overdrafts provide short-term protection by allowing account holders to withdraw more money than their current balance, typically incurring fees or higher interest rates on the overdrawn amount. Lines of credit offer a predetermined borrowing limit with flexible repayment options and generally lower interest rates, making them suitable for ongoing or larger cash flow needs. Choosing between an overdraft and a line of credit depends on your financial situation, usage frequency, and cost considerations.

Table of Comparison

| Feature | Overdraft | Line of Credit |

|---|---|---|

| Definition | Short-term credit allowing account to go negative | Pre-approved flexible borrowing limit |

| Purpose | Cover short-term cash flow gaps | Fund ongoing or large expenses |

| Interest Rates | Typically higher, charged on overdraft amount | Generally lower, interest on used funds only |

| Repayment Terms | Repay as deposits clear; usually short term | Flexible repayment schedules |

| Access | Automatic overdraft protection on checking account | Requires application & approval; separate account |

| Fees | May include overdraft, monthly, or usage fees | Possibly maintenance or transaction fees |

| Credit Impact | Minimal if repaid quickly | May affect credit score based on usage and payments |

Understanding Overdrafts and Lines of Credit

Overdrafts allow customers to withdraw more money than their account balance up to a set limit, providing short-term liquidity for unexpected expenses. Lines of credit offer a flexible borrowing facility with a predetermined credit limit that can be used repeatedly as funds are repaid, typically with interest charged only on the amount withdrawn. Understanding the differences helps in choosing the right financial tool for managing cash flow and avoiding high fees.

Key Differences Between Overdrafts and Lines of Credit

Overdrafts provide short-term liquidity by allowing account holders to withdraw beyond their available balance, typically with immediate access and higher interest rates. Lines of credit offer a predetermined borrowing limit with flexible repayment options, often featuring lower interest rates and more structured terms. Overdrafts primarily cover unexpected cash flow gaps, whereas lines of credit support planned financing needs and larger amounts.

How Overdrafts Work in Banking

Overdrafts in banking provide short-term liquidity by allowing account holders to withdraw more money than their available balance, up to a predetermined limit set by the bank. Interest or fees are typically charged only on the overdrawn amount and for the duration it remains outstanding, making it a flexible solution for managing unexpected expenses or cash flow gaps. Unlike lines of credit, overdrafts are linked directly to checking accounts and are automatically activated when withdrawals exceed available funds.

How Personal Lines of Credit Function

Personal lines of credit provide flexible borrowing limits that consumers can draw from repeatedly up to the approved credit amount, offering convenient access to funds for various expenses. Interest is charged only on the amount withdrawn, making it a cost-effective alternative to standard loans with fixed payments. Unlike overdrafts, personal lines of credit typically have lower interest rates and no automatic repayment requirements, allowing borrowers to manage cash flow more efficiently.

Interest Rates: Overdraft vs Line of Credit

Overdrafts typically have higher interest rates compared to lines of credit, reflecting their short-term, high-risk nature for banks. Lines of credit often offer lower, variable interest rates that depend on credit scores and market conditions, providing more cost-effective access to funds over longer periods. Choosing between the two depends on the borrower's repayment capacity and the intended duration of credit usage.

Fees and Charges Compared

Overdraft fees typically include daily or monthly charges and high interest rates on the borrowed amount, often resulting in higher costs for short-term borrowing. Lines of credit usually have lower interest rates and may charge an annual or maintenance fee, offering more cost-effective access to funds. Comparing fees, lines of credit provide greater flexibility and lower overall charges, making them preferable for longer-term or larger borrowing needs.

Eligibility and Approval Criteria

Overdraft and line of credit eligibility depend on credit history, income stability, and relationship with the bank. Overdraft approval typically requires an active checking account and low credit risk, while lines of credit demand a higher credit score and detailed financial documentation. Banks assess debt-to-income ratios and repayment capacity more rigorously for lines of credit compared to overdrafts.

Use Cases: When to Choose Each Option

Overdraft protection is ideal for short-term cash flow gaps or unexpected expenses, providing immediate access to funds linked to your checking account to prevent declined transactions or overdraft fees. A line of credit suits longer-term financing needs, such as managing larger expenses or smoothing irregular income, offering flexible borrowing up to a predetermined limit with interest charged only on the amount used. Choosing overdraft is best when occasional, small-dollar coverage is needed, while a line of credit is preferable for ongoing access to substantial funds with structured repayment options.

Risks and Benefits of Overdrafts and Lines of Credit

Overdrafts offer immediate access to funds beyond the current account balance, providing a safety net for short-term cash flow needs but often carry higher interest rates and fees if not repaid quickly. Lines of credit deliver more flexible borrowing options with potentially lower interest rates and higher limits, though they require disciplined repayment to avoid accruing substantial debt. Both overdrafts and lines of credit can impact credit scores if mismanaged, so understanding the terms and using them responsibly is essential for financial health.

Choosing the Best Credit Option for Your Needs

Overdraft and line of credit both provide flexible borrowing options, but overdraft applies to checking accounts with automatic short-term coverage, while a line of credit offers a pre-approved credit limit for larger or ongoing expenses. Choosing the best credit option depends on your cash flow needs, repayment ability, and interest rates, with overdrafts typically suited for occasional shortfalls and lines of credit better for planned or substantial borrowing. Evaluating fees, interest rates, and usage frequency ensures the selected credit product aligns with your financial goals and minimizes borrowing costs.

Important Terms

Credit utilization

Credit utilization impacts overdraft and line of credit differently, with overdrafts typically causing higher interest rates and fees, while lines of credit often offer lower rates and flexible repayment options.

Revolving credit

Revolving credit includes both overdraft and line of credit options, where overdraft allows temporary negative balance on checking accounts and line of credit provides pre-approved borrowing limits accessible anytime.

Unsecured lending

Unsecured lending options like overdrafts offer flexible short-term credit tied to checking accounts, while lines of credit provide a revolving borrowing limit with potentially lower interest rates for longer-term financial needs.

Overdraft protection

Overdraft protection prevents declined transactions by linking a checking account to a line of credit, which covers overdrafts up to a pre-approved credit limit, unlike a standard overdraft that may result in fees or declined payments.

Draw period

The draw period for an overdraft typically offers short-term access to funds with automatic repayment upon deposit, while a line of credit allows borrowing up to a set limit with flexible repayment over a longer draw period.

Interest accrual

Interest accrual on overdrafts typically occurs daily based on the outstanding negative balance, resulting in potentially higher short-term costs compared to a line of credit, which usually accrues interest only on the drawn amount and often features a lower interest rate. A line of credit offers more predictable interest expenses with scheduled repayments, while overdrafts provide flexible, short-term funding but may carry higher fees and variable interest rates.

Credit facility

An overdraft provides short-term credit linked to a current account with automatic repayment on deposits, while a line of credit offers flexible borrowing up to a preset limit with variable repayment schedules and usually requires approval.

Sweep account

A sweep account automatically transfers funds between a checking account and a linked line of credit to prevent overdrafts and reduce interest costs compared to traditional overdraft fees.

Borrowing limit

The borrowing limit for an overdraft typically aligns with a pre-approved amount linked to a checking account, while a line of credit offers a flexible borrowing limit based on creditworthiness and negotiated terms.

Advance fee

Advance fees for overdrafts typically apply when a bank allows transactions exceeding the available balance, often incurring a flat or percentage-based charge. Line of credit advance fees are usually structured as interest on the drawn amount, with periodic maintenance fees depending on the agreement terms.

Overdraft vs Line of credit Infographic

moneydif.com

moneydif.com