An adverse action in banking refers to a lender's decision to deny credit, increase interest rates, or take other negative steps based on a consumer's credit report or application information. A charge-off occurs when the lender writes off a debt as unlikely to be collected, typically after prolonged delinquency. While both impact a borrower's credit profile, an adverse action affects credit approval processes, whereas a charge-off signifies actual financial loss for the lender.

Table of Comparison

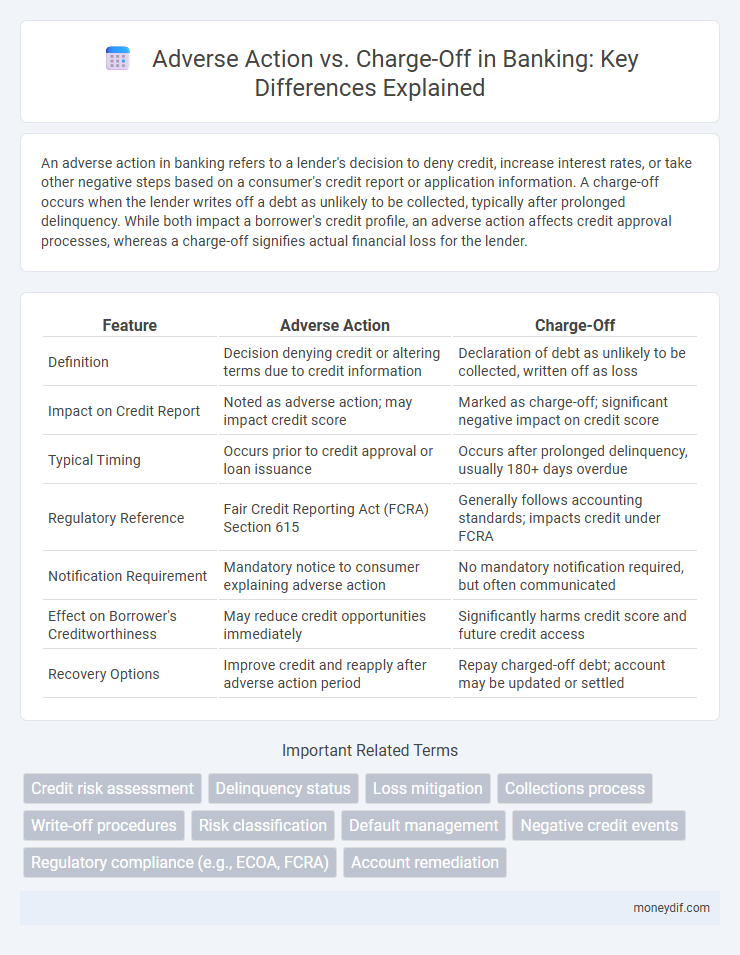

| Feature | Adverse Action | Charge-Off |

|---|---|---|

| Definition | Decision denying credit or altering terms due to credit information | Declaration of debt as unlikely to be collected, written off as loss |

| Impact on Credit Report | Noted as adverse action; may impact credit score | Marked as charge-off; significant negative impact on credit score |

| Typical Timing | Occurs prior to credit approval or loan issuance | Occurs after prolonged delinquency, usually 180+ days overdue |

| Regulatory Reference | Fair Credit Reporting Act (FCRA) Section 615 | Generally follows accounting standards; impacts credit under FCRA |

| Notification Requirement | Mandatory notice to consumer explaining adverse action | No mandatory notification required, but often communicated |

| Effect on Borrower's Creditworthiness | May reduce credit opportunities immediately | Significantly harms credit score and future credit access |

| Recovery Options | Improve credit and reapply after adverse action period | Repay charged-off debt; account may be updated or settled |

Understanding Adverse Action in Banking

Adverse action in banking refers to any negative decision made by a lender, such as denial of credit, increase in interest rates, or unfavorable changes to loan terms, based on credit reports or application data. This process is regulated under the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA), requiring lenders to provide adverse action notices explaining the reasons for denial or other unfavorable terms. Understanding adverse action helps consumers identify and address credit issues, improving their chances for future loan approvals.

What is a Charge-Off?

A charge-off in banking occurs when a lender writes off a debt as unlikely to be collected, typically after 180 days of delinquency on a credit account. It represents a significant adverse action that negatively impacts a borrower's credit score and remains on the credit report for up to seven years. Unlike an adverse action notice, which informs a consumer of a denied credit decision, a charge-off reflects the creditor's financial loss and initiates efforts to recover the outstanding balance through collections or legal means.

Key Differences Between Adverse Action and Charge-Off

Adverse action in banking refers to a lender's refusal or unfavorable change to a credit application based on credit report findings, while a charge-off occurs when a creditor writes off a debt as unlikely to be collected after prolonged delinquency. Adverse actions impact credit reports by indicating negative credit decisions, but charge-offs directly lower credit scores and reflect debt default status. Understanding these distinctions is critical for managing credit health and negotiating with financial institutions.

Regulatory Guidelines: Adverse Action vs Charge-Off

Regulatory guidelines distinguish adverse action and charge-off in banking by defining adverse action as any denial or unfavorable change in credit terms triggered by factors such as credit score or income, governed by the Equal Credit Opportunity Act (ECOA) and Fair Credit Reporting Act (FCRA). Charge-off occurs when a creditor writes off an uncollectible debt, following guidelines established by the Federal Financial Institutions Examination Council (FFIEC) and Generally Accepted Accounting Principles (GAAP) for financial reporting and capital adequacy. Compliance with these regulatory frameworks ensures transparent communication to consumers and accurate financial disclosures for institutions.

Impact on Credit Scores

Adverse actions such as loan denials or increased interest rates typically cause a minor to moderate decline in credit scores due to lenders' negative reporting. Charge-offs, which occur when a creditor writes off a delinquent debt as a loss, have a significantly more severe impact, often reducing credit scores by 100 points or more. Both actions remain on credit reports for up to seven years, but charge-offs signal a higher risk to future lenders, leading to greater difficulty in obtaining credit.

Consumer Rights and Protections

Adverse action in banking refers to decisions like credit denial or increased interest rates based on consumer credit reports, triggering the right to receive a notice explaining the reason under the Fair Credit Reporting Act (FCRA). Charge-off occurs when a creditor deems a debt unlikely to be collected, often after 180 days of delinquency, impacting credit scores but not erasing the consumer's obligation to pay. Consumers are protected by regulations requiring clear communication about adverse actions and the ability to dispute inaccurate information affecting their credit profiles.

How Banks Handle Adverse Actions

Banks handle adverse actions by conducting thorough credit assessments and notifying customers of the reasons for denial or changes in credit terms, as required by the Equal Credit Opportunity Act (ECOA). These actions include loan denials, interest rate increases, or reduced credit limits, and banks must provide an adverse action notice outlining specific factors influencing the decision. Effective management of adverse actions helps banks maintain regulatory compliance and supports transparent communication with borrowers to minimize disputes and credit risks.

The Charge-Off Process Explained

The charge-off process in banking occurs when a lender classifies a delinquent loan as a loss after 180 days of non-payment, formally removing it from the balance sheet. This process involves writing off the loan amount as uncollectible, impacting the borrower's credit score and signaling severe financial distress. Unlike an adverse action, which denotes a negative decision such as loan denial, a charge-off reflects the lender's financial acknowledgment of default and initiates potential recovery or collection efforts.

Preventing Adverse Actions and Charge-Offs

Preventing adverse actions and charge-offs in banking requires proactive credit risk management and customer engagement strategies. Implementing early warning systems to detect signs of financial distress enables timely intervention through payment plans or loan modifications, reducing default rates. Enhancing borrower education about credit obligations and maintaining transparent communication helps minimize negative outcomes and preserves asset quality.

Rebuilding Credit After Adverse Action or Charge-Off

Rebuilding credit after an adverse action or charge-off involves timely payments and responsible credit use to demonstrate financial reliability. Securing a secured credit card or credit-builder loan helps establish a positive payment history and improves credit scores over time. Monitoring credit reports regularly ensures accurate information and identifies errors for dispute, accelerating the recovery process.

Important Terms

Credit risk assessment

Credit risk assessment identifies potential losses by distinguishing between adverse actions, which involve denying credit based on risk evaluation, and charge-offs, which represent debt the lender deems uncollectible after default.

Delinquency status

Delinquency status indicates overdue payments that may trigger adverse actions such as account restrictions or credit reporting, while a charge-off represents a creditor's declaration of uncollectible debt typically occurring after prolonged delinquency.

Loss mitigation

Loss mitigation strategies aim to prevent adverse actions such as charge-offs by negotiating loan modifications or repayment plans to reduce borrower default risk.

Collections process

The Collections process accelerates after an Adverse Action is recorded and intensifies following a Charge-off, which signifies a debt is unlikely to be collected through normal billing.

Write-off procedures

Write-off procedures involve formally removing uncollectible debt from accounts, with adverse action referring to credit or employment decisions based on outstanding debts, while charge-off signifies the creditor's declaration of debt as unlikely to be collected.

Risk classification

Risk classification differentiates adverse actions, which include credit denials and increased interest rates, from charge-offs representing definitive financial losses after debt collection efforts fail.

Default management

Default management strategies prioritize distinguishing between adverse action notifications for credit denials and charge-off processes to optimize risk mitigation and regulatory compliance.

Negative credit events

Negative credit events such as adverse actions, including loan denials or increased interest rates, directly impact creditworthiness by reflecting lender risk assessments, whereas charge-offs represent a creditor's formal declaration that a debt is unlikely to be collected, significantly damaging credit scores. Both adverse actions and charge-offs trigger negative notations on credit reports, influencing future lending decisions and overall credit health.

Regulatory compliance (e.g., ECOA, FCRA)

Regulatory compliance under ECOA and FCRA mandates accurate notification and documentation of adverse actions, while charge-offs require clear reporting to maintain consumer credit integrity.

Account remediation

Account remediation involves resolving issues by managing adverse actions such as credit denials or account closures before accounts progress to charge-off status, which represents a complete write-off of unpaid debt.

Adverse action vs Charge-off Infographic

moneydif.com

moneydif.com