Basel III enhances regulatory standards by improving bank capital quality, liquidity, and risk management to ensure financial stability. Basel IV introduces more stringent risk sensitivity measures, tighter capital requirements, and revised leverage ratios to address weaknesses identified in Basel III. Both frameworks collectively strengthen global banking resilience but differ in scope and implementation timelines.

Table of Comparison

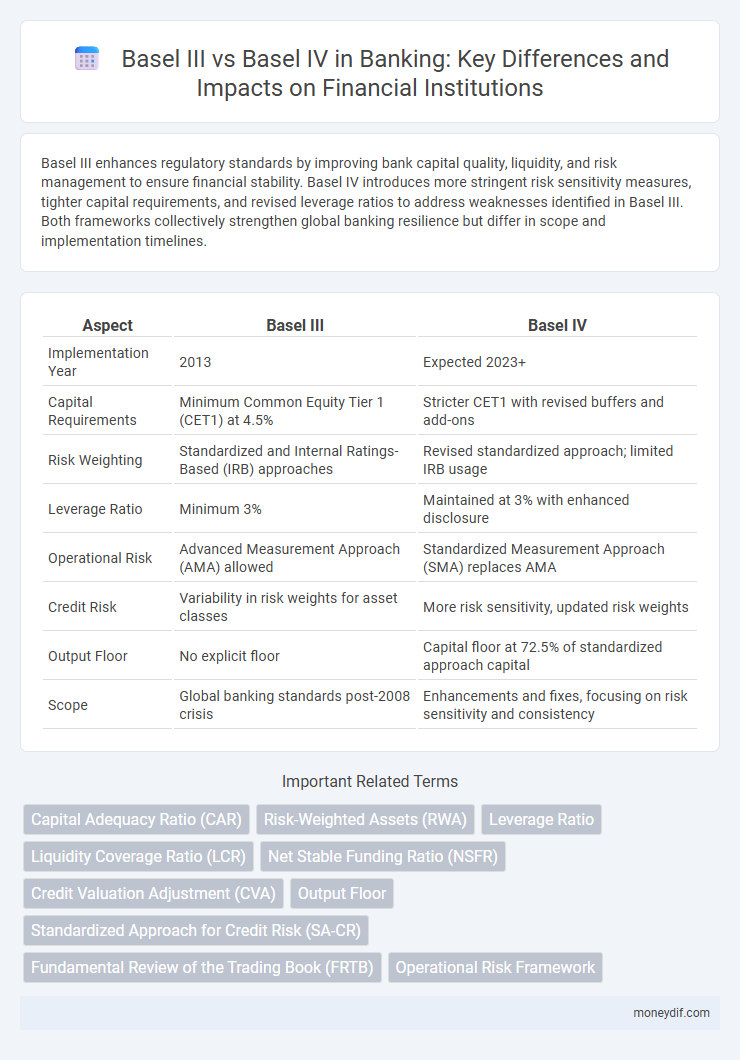

| Aspect | Basel III | Basel IV |

|---|---|---|

| Implementation Year | 2013 | Expected 2023+ |

| Capital Requirements | Minimum Common Equity Tier 1 (CET1) at 4.5% | Stricter CET1 with revised buffers and add-ons |

| Risk Weighting | Standardized and Internal Ratings-Based (IRB) approaches | Revised standardized approach; limited IRB usage |

| Leverage Ratio | Minimum 3% | Maintained at 3% with enhanced disclosure |

| Operational Risk | Advanced Measurement Approach (AMA) allowed | Standardized Measurement Approach (SMA) replaces AMA |

| Credit Risk | Variability in risk weights for asset classes | More risk sensitivity, updated risk weights |

| Output Floor | No explicit floor | Capital floor at 72.5% of standardized approach capital |

| Scope | Global banking standards post-2008 crisis | Enhancements and fixes, focusing on risk sensitivity and consistency |

Introduction to Basel III and Basel IV

Basel III, introduced by the Basel Committee on Banking Supervision, sets comprehensive regulatory standards to strengthen bank capital requirements, improve risk management, and enhance transparency following the 2008 financial crisis. Basel IV, often viewed as an extension of Basel III, refines capital calculations by incorporating more stringent risk-sensitive approaches and tighter restrictions on internal models for credit risk. Both frameworks aim to increase banking sector resilience, with Basel IV focusing on closing remaining regulatory gaps and improving comparability among banks globally.

Key Objectives of Basel III and Basel IV

Basel III aims to strengthen bank capital requirements by increasing liquidity, enhancing risk management, and improving the transparency of financial institutions to reduce systemic risk and enhance banking sector resilience. Basel IV, often considered an extension rather than a distinct framework, focuses on refining risk-weighted asset calculations, standardizing credit risk models, and tightening operational risk measurement to improve capital adequacy accuracy. Both frameworks collectively seek to bolster financial stability, but Basel IV places greater emphasis on risk sensitivity and consistency in capital determination.

Major Differences Between Basel III and Basel IV

Basel IV introduces more stringent capital requirements and risk sensitivity compared to Basel III, particularly in the calculation of risk-weighted assets (RWA) for credit, market, and operational risks, aiming to reduce variability and improve comparability across banks. Basel IV also incorporates revised leverage ratio frameworks and introduces a leverage ratio buffer for global systemically important banks (G-SIBs), enhancing resilience against leverage risks that Basel III partially addressed. Furthermore, Basel IV tightens the treatment of internal models, limits the use of model-based approaches, and increases standardization to strengthen the overall regulatory framework.

Evolution of Capital Requirements

Basel III introduced stringent capital requirements focusing on higher quality capital such as Common Equity Tier 1 (CET1) to enhance bank resilience against financial shocks. Basel IV refines these standards by revising the standardized approach for credit risk, tightening operational risk frameworks, and implementing output floor constraints to limit model-based risk-weighted asset benefits. These evolutionary changes enhance risk sensitivity and promote greater capital adequacy across global banking institutions.

Changes in Risk Assessment Approaches

Basel IV introduces more granular risk assessment methodologies compared to Basel III, emphasizing standardized approaches to credit, market, and operational risks to enhance risk sensitivity and comparability across banks. It tightens rules on Internal Ratings-Based (IRB) models, limiting banks' discretion and increasing capital requirements for higher-risk exposures. The revisions aim to reduce model variability and improve the robustness of risk-weighted assets calculations, strengthening overall banking sector resilience.

Impact on Liquidity Standards

Basel III strengthened liquidity standards by introducing the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) to ensure banks maintain adequate high-quality liquid assets and stable funding profiles. Basel IV expands on these requirements by refining risk sensitivity and imposing stricter capital floors, indirectly influencing liquidity through enhanced capital adequacy and risk management practices. The combined effect of Basel III and Basel IV fosters greater resilience in liquidity buffers, reducing systemic risks during financial stress.

Implications for Credit and Market Risk

Basel III enhances credit risk management by tightening capital requirements and introducing leverage ratios, while Basel IV further refines risk sensitivity through revised standardized approaches and output floor implementation. Market risk calculations under Basel III utilize the Fundamental Review of the Trading Book (FRTB), with Basel IV expanding on model approval processes and stressing more conservative capital buffers. Both frameworks aim to strengthen bank resilience, but Basel IV imposes stricter constraints on internal models, increasing capital charges for higher-risk exposures.

Challenges in Basel IV Implementation

Basel IV introduces more stringent capital requirements and complex risk-weighted asset calculations, significantly increasing operational burdens for banks compared to Basel III. The challenges in Basel IV implementation include enhanced data quality demands, updates to risk modeling frameworks, and greater regulatory reporting complexity. These factors collectively necessitate substantial investments in technology and risk management infrastructure to ensure compliance.

Basel IV’s Influence on Global Banking Stability

Basel IV introduces more stringent capital requirements and enhanced risk sensitivity compared to Basel III, aiming to strengthen global banking stability by reducing systemic risks. It emphasizes improved credit risk modeling, operational risk measurement, and leverage ratio calculations, ensuring banks maintain higher quality capital buffers. These changes promote greater resilience and transparency across international financial institutions, fostering a more stable global banking environment.

Future Outlook for Regulatory Compliance

Basel IV introduces more stringent capital requirements and enhanced risk sensitivity compared to Basel III, demanding banks to refine their internal models and data management systems for compliance. Regulatory authorities are increasingly emphasizing transparency, stress testing, and operational resilience to mitigate systemic risks in the evolving financial landscape. Banks investing in advanced analytics and automation technologies will better navigate the complex regulatory environment and align with future compliance expectations.

Important Terms

Capital Adequacy Ratio (CAR)

The Capital Adequacy Ratio (CAR) under Basel III introduced stricter minimum capital requirements and enhanced risk coverage compared to Basel II, focusing on improving the quality and quantity of capital to withstand financial stress. Basel IV, often termed a revision or extension of Basel III, further refines risk-weighted asset calculations and introduces more stringent constraints on capital deductions and operational risk, aiming to strengthen bank resilience and reduce regulatory arbitrage.

Risk-Weighted Assets (RWA)

Risk-Weighted Assets (RWA) under Basel III are calculated to ensure banks maintain adequate capital against credit, market, and operational risks, with standardized approaches and internal models guiding assessments. Basel IV introduces more stringent RWA calculation methodologies, including revised standardized approaches and constraints on internal models, aiming to reduce variability and enhance the comparability and stability of banks' capital requirements.

Leverage Ratio

The Leverage Ratio under Basel III requires banks to maintain a minimum of 3% Tier 1 capital against total exposure to limit excessive leverage, while Basel IV proposes adjustments that enhance risk sensitivity and incorporate additional adjustments for off-balance sheet exposures to strengthen the leverage ratio framework. These changes aim to improve the comparability and robustness of the Leverage Ratio, reducing systemic risk and promoting financial stability across global banking institutions.

Liquidity Coverage Ratio (LCR)

The Liquidity Coverage Ratio (LCR) under Basel III mandates banks to hold high-quality liquid assets covering 30-day net cash outflows to enhance short-term resilience, whereas Basel IV refines these requirements by adjusting asset classifications and incorporating stress scenarios for more granular risk assessment. Basel IV introduces stricter liquidity standards and tighter definitions of eligible liquid assets, aiming to improve the overall stability of financial institutions in periods of market stress.

Net Stable Funding Ratio (NSFR)

Net Stable Funding Ratio (NSFR) is a key liquidity standard introduced under Basel III to ensure banks maintain a stable funding profile in relation to their on- and off-balance sheet activities over a one-year horizon. Basel IV, while primarily focused on enhancing credit risk and output floor frameworks, does not significantly alter the NSFR requirements, maintaining Basel III's liquidity coverage standards to promote long-term financial stability.

Credit Valuation Adjustment (CVA)

Credit Valuation Adjustment (CVA) quantifies counterparty credit risk in over-the-counter derivatives by adjusting the mark-to-market valuation for potential default losses. Basel III introduced stringent CVA capital charges to enhance risk sensitivity, while Basel IV refines these requirements by incorporating updated risk models and standardized approaches for more accurate and risk-sensitive capital calculations.

Output Floor

Output Floor under Basel IV establishes a minimum level, set at 72.5%, below which banks' risk-weighted assets (RWAs) calculated using internal models cannot fall compared to standardized approaches, enhancing capital adequacy and addressing variability issues identified in Basel III. This measure curbs excessive model-driven capital relief and promotes a level playing field across financial institutions.

Standardized Approach for Credit Risk (SA-CR)

The Standardized Approach for Credit Risk (SA-CR) under Basel III provides a framework for calculating credit risk capital requirements using risk weights assigned to various asset classes, while Basel IV introduces revisions to enhance risk sensitivity by refining risk weight calculations and incorporating more granular exposure categories. Basel IV's updates aim to reduce reliance on external credit ratings and improve the accuracy of risk assessments to strengthen the capital adequacy of banks.

Fundamental Review of the Trading Book (FRTB)

The Fundamental Review of the Trading Book (FRTB) enhances market risk capital requirements by introducing a standardized approach and an internal models approach under Basel III reforms, aiming for more risk-sensitive and consistent measures. Basel IV further refines these standards by tightening model approval criteria and increasing capital floors, intensifying market risk resilience in the banking sector.

Operational Risk Framework

The Operational Risk Framework under Basel III primarily relies on standardized approaches such as the Basic Indicator Approach and the Standardized Approach, emphasizing risk-weighted assets to quantify operational risk capital requirements. Basel IV introduces a more advanced and risk-sensitive Standardized Measurement Approach (SMA), integrating internal loss data, business indicators, and external data to enhance risk capture and regulatory capital precision.

Basel III vs Basel IV Infographic

moneydif.com

moneydif.com