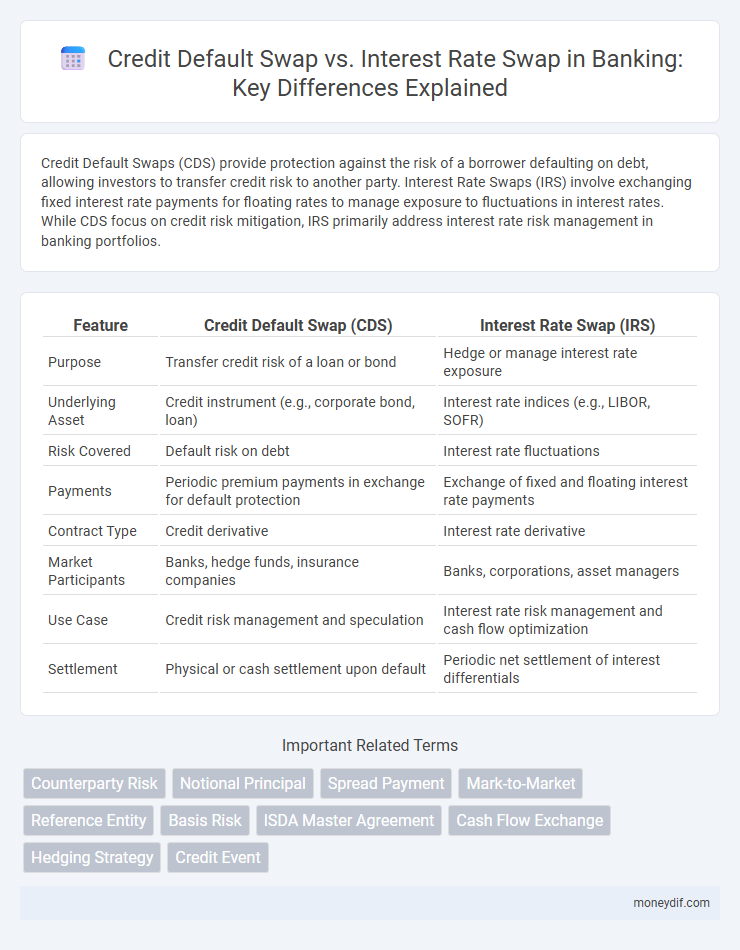

Credit Default Swaps (CDS) provide protection against the risk of a borrower defaulting on debt, allowing investors to transfer credit risk to another party. Interest Rate Swaps (IRS) involve exchanging fixed interest rate payments for floating rates to manage exposure to fluctuations in interest rates. While CDS focus on credit risk mitigation, IRS primarily address interest rate risk management in banking portfolios.

Table of Comparison

| Feature | Credit Default Swap (CDS) | Interest Rate Swap (IRS) |

|---|---|---|

| Purpose | Transfer credit risk of a loan or bond | Hedge or manage interest rate exposure |

| Underlying Asset | Credit instrument (e.g., corporate bond, loan) | Interest rate indices (e.g., LIBOR, SOFR) |

| Risk Covered | Default risk on debt | Interest rate fluctuations |

| Payments | Periodic premium payments in exchange for default protection | Exchange of fixed and floating interest rate payments |

| Contract Type | Credit derivative | Interest rate derivative |

| Market Participants | Banks, hedge funds, insurance companies | Banks, corporations, asset managers |

| Use Case | Credit risk management and speculation | Interest rate risk management and cash flow optimization |

| Settlement | Physical or cash settlement upon default | Periodic net settlement of interest differentials |

Understanding Credit Default Swaps (CDS)

Credit Default Swaps (CDS) are financial derivatives that function as insurance contracts, allowing investors to hedge against the risk of a borrower's default by paying periodic premiums to the seller. These swaps transfer credit exposure between parties without exchanging the underlying loan or bond, providing a method for managing credit risk in banking portfolios. Unlike Interest Rate Swaps, which manage fluctuations in interest rates, CDS specifically focus on default risk, making them vital tools in credit risk management and financial stability analysis.

What Are Interest Rate Swaps?

Interest rate swaps are financial derivatives in which two parties exchange interest rate cash flows, typically swapping fixed-rate payments for floating-rate payments based on a notional principal amount. These instruments are widely used by banks and financial institutions to manage interest rate risk, hedge exposure, or speculate on interest rate movements. Unlike credit default swaps that protect against credit events, interest rate swaps primarily address fluctuations in interest rates without transferring credit risk.

Key Differences Between CDS and Interest Rate Swaps

Credit Default Swaps (CDS) primarily provide protection against credit risk by allowing parties to transfer the risk of default on debt instruments, whereas Interest Rate Swaps (IRS) focus on exchanging fixed and floating interest rate payments to manage exposure to interest rate fluctuations. CDS contracts involve a credit event trigger such as default or restructuring, while IRS contracts settle based on interest rate differentials without credit event contingencies. The key distinctions lie in their underlying risks, with CDS addressing credit risk and IRS addressing interest rate risk, influencing their valuation and use in financial risk management.

How Credit Default Swaps Work in Banking

Credit Default Swaps (CDS) function as financial derivatives allowing banks to transfer the credit risk of a loan or bond to another party, effectively serving as insurance against default. When a borrower defaults, the CDS seller compensates the buyer, mitigating potential losses and stabilizing the bank's balance sheet. This mechanism enhances risk management by enabling banks to hedge credit exposure and maintain liquidity in lending operations.

Mechanisms Behind Interest Rate Swaps

Interest rate swaps involve exchanging fixed interest rate payments for floating rate payments between two parties to hedge against interest rate risk or to speculate on rate movements. The mechanism relies on the notional principal amount, which remains unchanged and is never exchanged, with settlements based on the difference between fixed and floating rates at specified intervals. This allows institutions to manage exposure to fluctuations in benchmark interest rates such as LIBOR or SOFR without altering the underlying debt structure.

Risk Management: CDS vs Interest Rate Swaps

Credit Default Swaps (CDS) provide targeted credit risk protection by transferring the risk of a borrower's default to a counterparty, making them essential for managing credit exposure. Interest Rate Swaps (IRS) primarily hedge interest rate risk by exchanging fixed and floating rate payments, allowing institutions to stabilize cash flows and manage sensitivity to interest rate fluctuations. Both instruments are critical in banking risk management but address distinct types of financial risks--credit risk for CDS and interest rate risk for IRS.

Use Cases in Banking: CDS and Interest Rate Swaps

Credit Default Swaps (CDS) are primarily used by banks to manage and hedge credit risk associated with loan portfolios and bonds by transferring default exposure to counterparties, thus enhancing risk management and regulatory capital efficiency. Interest Rate Swaps (IRS) enable banks to manage interest rate exposure by exchanging fixed-rate payments for floating-rate payments, optimizing balance sheet sensitivity to interest rate fluctuations. Both instruments support liquidity management and strategic asset-liability adjustments in banking, with CDS focusing on credit risk protection and IRS addressing interest rate risk.

Regulatory Implications of Swaps in Banking

Credit Default Swaps (CDS) and Interest Rate Swaps (IRS) are subject to stringent regulatory frameworks designed to mitigate systemic risk in banking, including requirements under the Dodd-Frank Act and EMIR (European Market Infrastructure Regulation). Banks engaging in these swaps must comply with mandatory clearing, reporting, and margin requirements to enhance transparency and reduce counterparty risks. Regulatory bodies also emphasize robust risk management practices and capital adequacy standards to ensure the stability of financial institutions utilizing CDS and IRS instruments.

Market Trends: CDS and Interest Rate Swap Adoption

Credit Default Swap (CDS) and Interest Rate Swap markets exhibit divergent growth trajectories shaped by regulatory shifts and evolving risk management demands. CDS adoption concentrates in credit risk hedging, showing resilience amid market stress, while Interest Rate Swap volumes expand driven by rising interest rate volatility and monetary policy adjustments. Market participants increasingly leverage Interest Rate Swaps for managing interest rate exposure, reflecting broader trends in derivative instrument integration within banking risk strategies.

Choosing the Right Swap Instrument for Banking Needs

Credit Default Swaps (CDS) protect banks against the risk of borrower default by transferring credit risk to another party, making them ideal for managing credit exposure in loan portfolios. Interest Rate Swaps (IRS) allow banks to exchange fixed-rate payments for floating rates, effectively managing interest rate risk and optimizing funding costs. Selecting between CDS and IRS depends on whether the primary need is credit risk mitigation or interest rate risk management within the bank's broader risk strategy.

Important Terms

Counterparty Risk

Counterparty risk in Credit Default Swaps (CDS) refers to the possibility that the protection seller may default on payment if the credit event occurs, while in Interest Rate Swaps (IRS), counterparty risk arises from changes in interest rate exposure and potential failure to meet payment obligations. CDS typically involves higher default risk due to credit event dependency, whereas IRS counterparty risk is often linked to market interest rate fluctuations and the counterpart's financial stability.

Notional Principal

Notional principal in a Credit Default Swap (CDS) represents the reference amount on which credit protection payments are based, while in an Interest Rate Swap (IRS), it serves as the hypothetical principal used to calculate interest cash flows without exchanging the principal itself. The notional amount in CDS determines the payout upon a credit event, whereas in IRS, it underpins the calculation of floating and fixed interest payments exchanged between counterparties.

Spread Payment

Spread Payment in Credit Default Swaps (CDS) refers to periodic premium payments made by the protection buyer to the seller, reflecting the credit risk spread of the reference entity, whereas in Interest Rate Swaps (IRS), spread payments typically involve the difference between fixed and floating interest rates exchanged between parties. The CDS spread captures default risk and influences spread payments, while IRS spread payments are tied to interest rate differentials affecting cash flow hedging and interest rate exposure management.

Mark-to-Market

Mark-to-Market valuation for Credit Default Swaps (CDS) involves calculating the present value of expected credit protection payments against the probability of default, reflecting real-time credit risk exposure; in contrast, Interest Rate Swaps (IRS) are marked-to-market by discounting future fixed and floating cash flows using current interest rate curves, highlighting changes in interest rate expectations and liquidity conditions. The CDS mark-to-market is highly sensitive to credit spread fluctuations while the IRS valuation primarily depends on shifts in yield curves and basis spreads.

Reference Entity

A Reference Entity in a Credit Default Swap (CDS) is the underlying borrower or issuer whose credit risk is being transferred, serving as the basis for protection payments upon default or credit events. In contrast, Interest Rate Swaps (IRS) do not involve a Reference Entity, as they focus on exchanging cash flows based on interest rate fluctuations rather than credit risk of a specific entity.

Basis Risk

Basis risk in Credit Default Swaps (CDS) arises from the mismatch between the reference entity's default risk and the CDS contract terms, causing discrepancies in protection effectiveness. In Interest Rate Swaps (IRS), basis risk occurs due to differences between the benchmark rates used for swap payments, leading to potential hedging inefficiencies and financial exposure.

ISDA Master Agreement

The ISDA Master Agreement standardizes terms and mitigates counterparty risk for both Credit Default Swaps (CDS), which provide credit protection against default events, and Interest Rate Swaps (IRS), which manage exposure to fluctuations in interest rates. Its framework facilitates netting provisions, collateral management, and default remedies, essential for the effective risk management of these derivative contracts.

Cash Flow Exchange

Cash Flow Exchange in Credit Default Swaps (CDS) involves periodic premium payments from the protection buyer to the seller, with a contingent payment occurring upon a credit event, while Interest Rate Swaps (IRS) primarily exchange fixed-rate payments for floating-rate payments based on a notional principal. The CDS cash flows focus on credit risk transfer, whereas IRS cash flows manage interest rate exposure through regular net settlements without credit event triggers.

Hedging Strategy

A hedging strategy involving Credit Default Swaps (CDS) typically aims to mitigate credit risk by providing protection against potential default on debt instruments, while Interest Rate Swaps (IRS) are used to manage exposure to fluctuations in interest rates by exchanging fixed and floating rate payments. Institutions often combine CDS and IRS to simultaneously hedge credit risk and interest rate risk, optimizing portfolio risk management in environments of market volatility.

Credit Event

A Credit Event triggers the settlement of a Credit Default Swap (CDS), providing protection against default or restructuring of the reference entity, whereas Interest Rate Swaps (IRS) deal with exchanging fixed and floating interest payments without involving credit risk linked to default events. Credit Events such as bankruptcy, failure to pay, or restructuring directly impact CDS contracts by activating credit protection payments, contrasting with IRS that primarily manage interest rate exposure without default considerations.

Credit Default Swap vs Interest Rate Swap Infographic

moneydif.com

moneydif.com