Direct participation in banking involves investors having a hands-on role in managing assets or projects, enabling full control and potentially higher returns, whereas indirect participation refers to investing through intermediaries like mutual funds or banks, offering diversification and reduced management responsibility. Direct involvement often requires greater expertise and higher risk tolerance, while indirect participation provides accessibility and professional oversight with relatively lower risk. Choosing between the two depends on the investor's knowledge, risk appetite, and desired level of engagement in financial decision-making.

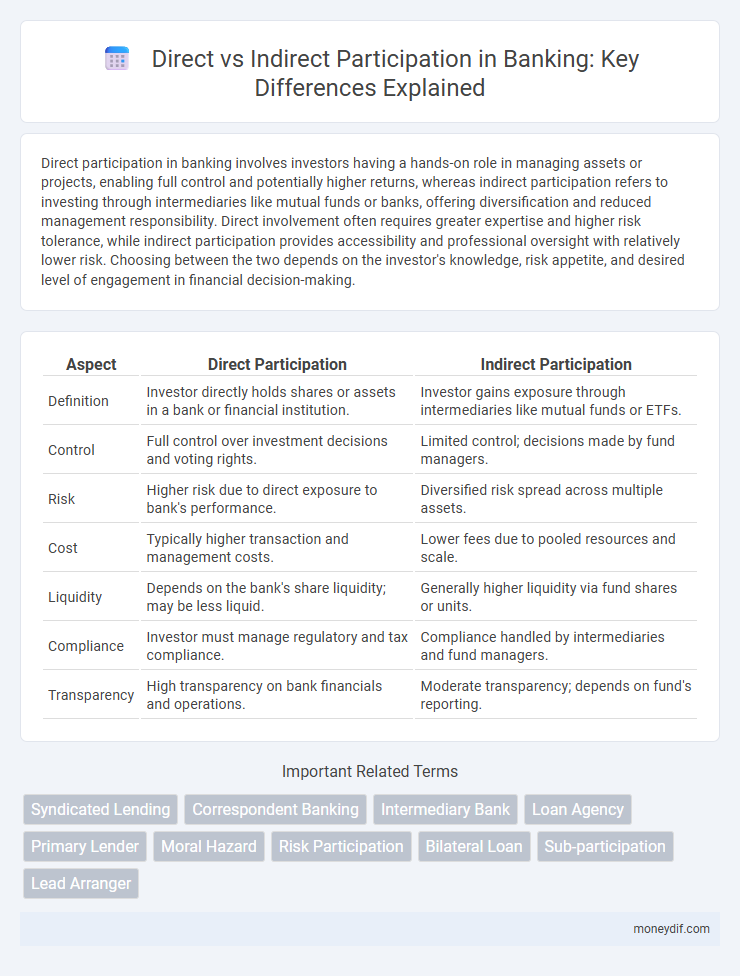

Table of Comparison

| Aspect | Direct Participation | Indirect Participation |

|---|---|---|

| Definition | Investor directly holds shares or assets in a bank or financial institution. | Investor gains exposure through intermediaries like mutual funds or ETFs. |

| Control | Full control over investment decisions and voting rights. | Limited control; decisions made by fund managers. |

| Risk | Higher risk due to direct exposure to bank's performance. | Diversified risk spread across multiple assets. |

| Cost | Typically higher transaction and management costs. | Lower fees due to pooled resources and scale. |

| Liquidity | Depends on the bank's share liquidity; may be less liquid. | Generally higher liquidity via fund shares or units. |

| Compliance | Investor must manage regulatory and tax compliance. | Compliance handled by intermediaries and fund managers. |

| Transparency | High transparency on bank financials and operations. | Moderate transparency; depends on fund's reporting. |

Understanding Direct vs Indirect Participation in Banking

Direct participation in banking involves investors holding equity or debt instruments of financial institutions personally, allowing for greater control and direct influence on bank operations and returns. Indirect participation occurs when investors gain exposure through intermediaries, such as mutual funds or investment trusts, which pool resources to invest in banking assets, offering diversification but less control. Understanding these distinctions helps investors balance risk, control, and potential returns when engaging with banking sector investments.

Key Features of Direct Participation

Direct participation in banking involves investors directly owning shares or stakes in financial assets or projects, enabling them to influence management decisions and benefit from returns without intermediaries. It offers transparency, higher control over investment portfolios, and direct exposure to the asset's performance, unlike indirect participation through mutual funds or pooled investment vehicles. Key features include ownership rights, voting privileges, and the potential for higher risk and reward tied to the specific underlying asset.

Defining Indirect Participation in Banking Systems

Indirect participation in banking systems refers to the process where banks engage in financial activities through intermediaries or third parties rather than directly interacting with the end clients. This method allows banks to extend their reach and manage risks by leveraging partnerships with brokers, agents, or other financial institutions. Indirect participation helps diversify services and enhances liquidity by facilitating transactions without the bank holding the underlying assets directly.

Benefits of Direct Participation for Financial Institutions

Direct participation enables financial institutions to gain greater control over investment decisions and risk management, enhancing portfolio customization and alignment with strategic goals. It allows institutions to capture higher returns by bypassing intermediaries and accessing unique asset classes or projects. This hands-on approach also improves transparency and accountability, fostering stronger client trust and regulatory compliance.

Advantages of Indirect Participation for Smaller Banks

Indirect participation allows smaller banks to access diversified loan portfolios and larger credit facilities without bearing the full risk, enhancing their lending capacity. By partnering with larger financial institutions or loan syndicates, smaller banks benefit from risk-sharing and improved capital adequacy ratios. This approach promotes operational efficiency and regulatory compliance while expanding market reach and revenue potential.

Risks Associated with Direct Participation

Direct participation in banking involves investors having a direct stake in the institution's assets, exposing them to higher risks such as credit default, liquidity shortages, and regulatory non-compliance. These risks are intensified due to the lack of diversification and immediate exposure to the bank's operational and market fluctuations. Direct participants must conduct thorough due diligence and maintain robust risk management strategies to mitigate potential financial losses.

Challenges Faced in Indirect Participation

Indirect participation in banking faces challenges such as limited control over portfolio management and reliance on intermediaries for investment decisions, which can lead to misaligned interests and increased risk exposure. Transparency issues often arise due to less direct oversight, complicating risk assessment and compliance monitoring. Furthermore, indirect participants may encounter higher fees and delayed access to performance data, affecting investment responsiveness and overall returns.

Regulatory Framework for Participation Models

Direct participation in banking involves investors having ownership stakes and active roles in managing assets, requiring strict compliance with regulatory frameworks such as Basel III and national banking laws to ensure transparency and risk management. Indirect participation relies on intermediaries like mutual funds or trusts, governed by securities regulations and oversight bodies such as the SEC or FCA to protect investor interests and maintain market stability. Both models demand adherence to anti-money laundering (AML) and know-your-customer (KYC) protocols, with regulatory emphasis varying based on the nature and level of investor involvement.

Impact on Transaction Speed and Settlement

Direct participation in banking enables faster transaction speed and immediate settlement by eliminating intermediaries, facilitating real-time fund transfers and streamlined processing. In contrast, indirect participation involves third parties such as clearinghouses or correspondent banks, which introduces delays due to additional verification steps and reconciliation processes, slowing down settlement times. The choice between direct and indirect participation significantly affects operational efficiency, with direct methods enhancing liquidity and reducing counterparty risk in financial transactions.

Choosing the Right Participation Model for Your Institution

Selecting the appropriate participation model in banking hinges on factors such as risk tolerance, capital availability, and operational capacity. Direct participation allows institutions to maintain control over loan servicing and underwriting, enhancing customization and potentially higher returns. Indirect participation, typically through loan syndication or correspondent banking, offers diversification and reduced operational burden but may involve less control and transparency.

Important Terms

Syndicated Lending

Syndicated lending involves multiple lenders sharing the risk and funding of a single borrower, with direct participation referring to lenders actively involved in negotiations and loan management, while indirect participation occurs when lenders invest through intermediaries or agents without direct involvement in loan administration. Direct participants typically have greater control and access to loan information, whereas indirect participants rely on intermediaries for risk assessment and repayment monitoring.

Correspondent Banking

Correspondent banking enables financial institutions to provide services in foreign markets through direct participation by establishing correspondent accounts or through indirect participation by relying on intermediary banks. Direct participation offers greater control and transparency in cross-border transactions, while indirect participation typically reduces operational complexity but may increase costs and risk exposure.

Intermediary Bank

An intermediary bank facilitates the transfer of funds between the payer's and beneficiary's banks, playing a crucial role in indirect participation by acting as a conduit rather than a direct party to the transaction. Direct participation involves the payer and beneficiary banks interacting without such intermediaries, resulting in faster processing times and reduced fees.

Loan Agency

Loan agencies facilitate direct participation by enabling investors to hold fractional ownership in loans, providing greater control and transparency. Indirect participation, often managed through loan agencies, involves pooled investments where returns depend on the overall performance of the loan portfolio rather than individual loan assets.

Primary Lender

Primary lenders engage directly with borrowers, holding the loan on their balance sheets and managing credit risk firsthand, which characterizes direct participation. Indirect participation occurs when lenders invest through intermediaries or syndicates, spreading risk but reducing direct control over loan servicing and borrower relations.

Moral Hazard

Moral hazard in direct participation occurs when investors actively manage assets and may take excessive risks due to asymmetric information and alignment issues, whereas indirect participation involves intermediaries, potentially reducing moral hazard through professional oversight and diversified risk management. The distinction affects risk exposure and incentive structures, with direct participation requiring stronger governance mechanisms to mitigate moral hazard.

Risk Participation

Risk participation involves one party sharing a portion of the credit risk with another, typically through loan syndication or risk transfer agreements. Direct participation occurs when investors hold an explicit interest in the underlying assets or loans, while indirect participation involves exposure through intermediaries such as mutual funds or securitized products.

Bilateral Loan

Bilateral loans involve a direct lending relationship where the borrower receives funds from a single lender, facilitating direct participation with customized terms and closer control over credit exposure. Indirect participation occurs when intermediary financial institutions aggregate or distribute portions of a bilateral loan to other investors, thereby diversifying risk and enhancing funding flexibility without altering the original loan agreement.

Sub-participation

Sub-participation refers to the transfer of participation rights in a financial asset from the original holder to a third party without transferring ownership, distinguishing it from direct participation where the investor holds the asset title; indirect participation involves intermediaries managing the investment on behalf of the participant, often seen in pooled investment vehicles. This structure allows risk and return sharing without altering the primary contract, facilitating liquidity and risk management in financial markets.

Lead Arranger

A lead arranger coordinates syndicated loans, managing both direct participation by individual lenders who contribute capital directly to the loan, and indirect participation involving agents or intermediaries who facilitate investment without holding the loan on their balance sheet. This structure optimizes risk distribution and capital allocation, enhancing loan syndication efficiency and investor diversification.

Direct participation vs Indirect participation Infographic

moneydif.com

moneydif.com