Ring-fencing in banking involves separating core retail banking activities from riskier investment operations to protect customer deposits and maintain financial stability. Fire-walling refers to internal controls designed to prevent information flow and risk contagion between different banking divisions. Both practices aim to enhance regulatory compliance and minimize systemic risk within financial institutions.

Table of Comparison

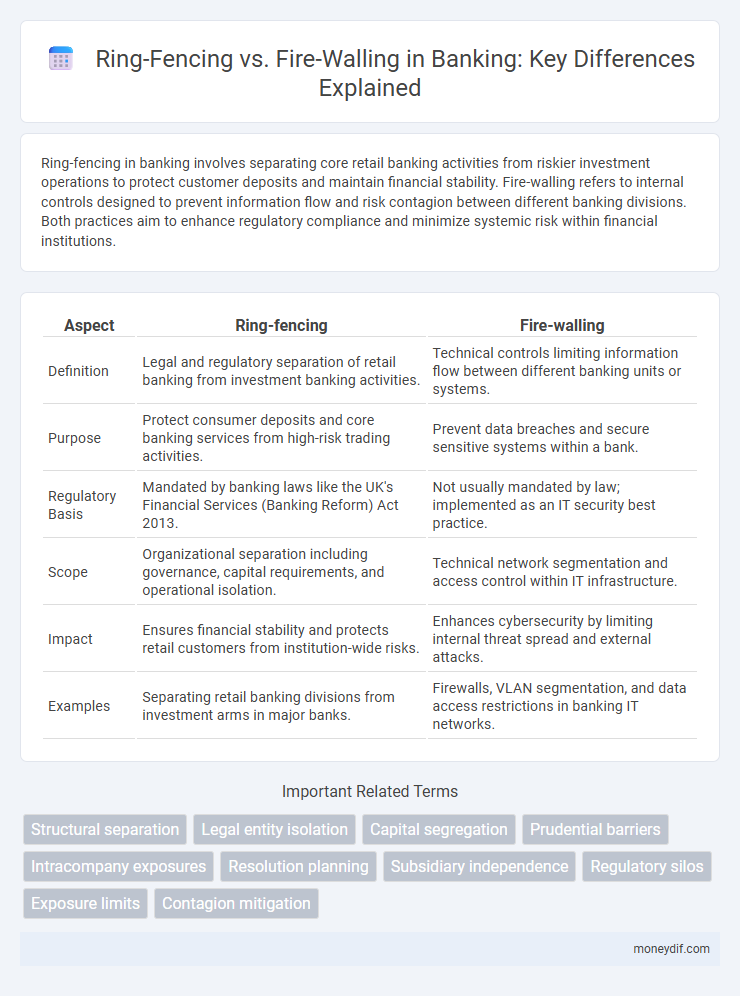

| Aspect | Ring-fencing | Fire-walling |

|---|---|---|

| Definition | Legal and regulatory separation of retail banking from investment banking activities. | Technical controls limiting information flow between different banking units or systems. |

| Purpose | Protect consumer deposits and core banking services from high-risk trading activities. | Prevent data breaches and secure sensitive systems within a bank. |

| Regulatory Basis | Mandated by banking laws like the UK's Financial Services (Banking Reform) Act 2013. | Not usually mandated by law; implemented as an IT security best practice. |

| Scope | Organizational separation including governance, capital requirements, and operational isolation. | Technical network segmentation and access control within IT infrastructure. |

| Impact | Ensures financial stability and protects retail customers from institution-wide risks. | Enhances cybersecurity by limiting internal threat spread and external attacks. |

| Examples | Separating retail banking divisions from investment arms in major banks. | Firewalls, VLAN segmentation, and data access restrictions in banking IT networks. |

Introduction to Ring-Fencing and Fire-Walling in Banking

Ring-fencing in banking refers to legally separating a bank's core retail operations from its investment activities to protect consumer deposits and ensure financial stability. Fire-walling involves creating operational and informational barriers within the bank to prevent conflicts of interest and safeguard sensitive data between different business units. Both strategies aim to enhance risk management and regulatory compliance by isolating high-risk activities from essential banking services.

Defining Ring-Fencing: Purpose and Mechanisms

Ring-fencing in banking involves segregating a bank's core retail operations from its riskier investment activities to protect consumer deposits and maintain financial stability. This regulatory mechanism ensures that essential banking functions such as payments, deposits, and loans remain insulated from potential losses in trading or investment divisions. By creating a legal and operational barrier, ring-fencing enforces capital requirements and limits risk transmission within a financial institution, promoting resilience during economic stress.

Understanding Fire-Walling: Key Concepts and Applications

Fire-walling in banking refers to the implementation of strict internal controls and barriers to restrict the flow of information and transactions between different departments or business units, ensuring operational independence and risk containment. This technique prevents conflicts of interest and protects sensitive data, especially within financial institutions managing both retail and investment banking activities. Fire-walling is critical for regulatory compliance, maintaining data security, and safeguarding customer assets by isolating high-risk activities from core banking operations.

Historical Evolution of Bank Structural Reforms

Ring-fencing originated from the 2008 financial crisis reforms, aiming to separate retail banking from riskier investment activities to protect consumer deposits. Fire-walling predates ring-fencing by decades, designed to create regulatory or operational barriers within banks to prevent contagion of financial distress across departments. The historical evolution of bank structural reforms reflects a shift from broad protective measures like fire-walls to more targeted and legally mandated ring-fencing strategies to enhance financial stability and compliance.

Regulatory Drivers: Why Ring-Fencing and Fire-Walling?

Regulatory drivers emphasize ring-fencing and fire-walling to protect retail banking operations from risks related to investment banking activities, ensuring financial stability and consumer protection. Ring-fencing mandates structural separation of core retail banking services, while fire-walling enforces information barriers within the same institution to prevent risk contagion. These measures align with global regulatory frameworks like the UK's Ring-Fencing Regulations and Basel III to enhance resilience against systemic shocks.

Comparative Analysis: Ring-Fencing vs Fire-Walling

Ring-fencing isolates crucial banking operations such as retail deposits from riskier investment activities by creating a legal and operational barrier within the same institution, ensuring depositor protection and financial stability. Fire-walling employs internal policies and information barriers to prevent the flow of sensitive information between different divisions, reducing conflict of interest and insider trading risks without structurally separating assets or liabilities. While ring-fencing offers stronger regulatory safeguards through clear segregation of balance sheets, fire-walling provides more flexible, internal risk controls centered on compliance and ethical conduct.

Impact on Banking Operations and Risk Management

Ring-fencing in banking creates a structural separation of core retail banking activities from riskier investment operations, significantly reducing the risk of contagion and protecting customer deposits. Fire-walling employs information barriers within institutions to prevent the exchange of sensitive data, minimizing conflicts of interest and insider trading risks without altering business structures. Both mechanisms enhance risk management by isolating potential financial shocks, but ring-fencing imposes more operational rigidity compared to the flexible, policy-driven approach of fire-walling.

International Case Studies: Implementation Across Jurisdictions

International case studies reveal divergent approaches to ring-fencing and fire-walling in banking regulation, with the UK implementing ring-fencing through the Financial Services (Banking Reform) Act 2013 to separate retail banking from investment activities. In contrast, U.S. regulations like the Dodd-Frank Act employ fire-walling mechanisms, such as the Volcker Rule, to restrict proprietary trading within large financial institutions. These jurisdictional implementations reflect tailored responses to systemic risk, balancing financial stability with market competitiveness.

Challenges and Criticisms of Structural Separation

Structural separation in banking, including ring-fencing and fire-walling, faces challenges such as increased operational complexity and higher compliance costs. Critics argue that these measures may reduce economies of scale and limit risk-sharing benefits within banking groups. Furthermore, enforcement difficulties and regulatory arbitrage risks undermine the effectiveness of structural separation in preventing financial crises.

Future Trends in Banking Regulation and Structural Reforms

Ring-fencing in banking involves isolating critical functions within a bank to protect retail deposits from risks associated with investment activities, while fire-walling creates operational boundaries to prevent sensitive information flow and risk contagion between divisions. Future regulatory trends emphasize enhanced ring-fencing mechanisms to improve financial stability, driven by lessons from past crises and increasing systemic risk, alongside evolving fire-walling frameworks to address cyber threats and data integrity challenges. Structural reforms anticipate integration of advanced technology and real-time monitoring to enforce these separations more effectively, supporting resilience in increasingly complex banking environments.

Important Terms

Structural separation

Structural separation enforces independent operational boundaries within a company to prevent conflicts of interest, often through ring-fencing by legally isolating assets and liabilities. Fire-walling complements this by implementing strict information barriers between units, ensuring confidential data does not cross divisions and supports compliance with regulatory frameworks.

Legal entity isolation

Legal entity isolation enhances financial and operational risk management by creating distinct corporate entities with separate liabilities, crucial in ring-fencing strategies that protect core business units from external risks. Fire-walling focuses on operational controls and information barriers within the same entity to prevent conflict of interest or unauthorized information flow, complementing ring-fencing by restricting internal exposure rather than structural separation.

Capital segregation

Capital segregation involves the allocation and separation of financial resources to protect assets within different parts of a corporate structure, enhancing risk management. Ring-fencing legally isolates capital to shield a specific business unit from external liabilities, whereas fire-walling restricts information flow and operational interactions to prevent contagion between entities without necessarily segregating capital.

Prudential barriers

Prudential barriers such as ring-fencing enforce strict separation of financial activities to protect critical banking functions from risky ventures, enhancing systemic stability by isolating core banking operations. Fire-walling complements this by implementing robust controls and monitoring mechanisms to prevent the transmission of risks across business units, thereby safeguarding the institution's financial health and regulatory compliance.

Intracompany exposures

Intracompany exposures involve financial transactions or risk exposures between different entities within the same corporate group, which are critical in managing regulatory ring-fencing and fire-walling measures; ring-fencing separates critical banking activities to protect depositors, while fire-walling restricts information flow and risk contagion between group entities. Effective structuring of intracompany exposures ensures compliance with regulatory capital requirements and limits contagion risks, supporting the stability and resilience of the overall financial group.

Resolution planning

Resolution planning involves creating strategies to manage and mitigate financial institution failures with minimal systemic impact, where ring-fencing isolates critical operations within the same entity to protect vital functions, while fire-walling establishes strict barriers between subsidiaries or business units to prevent financial contagion. Regulatory frameworks such as the EU's Bank Recovery and Resolution Directive (BRRD) emphasize ring-fencing to safeguard domestic operations, whereas fire-walling supports capital and liquidity segregation under frameworks like the UK's Financial Services Act.

Subsidiary independence

Subsidiary independence involves ensuring operational and financial separation to limit risk contamination between entities, where ring-fencing establishes legal and financial boundaries to isolate subsidiaries, and fire-walling refers to internal controls preventing sensitive information or risks from crossing operational divisions. Effective ring-fencing enhances regulatory compliance by protecting parent companies from subsidiary liabilities, while fire-walling supports data confidentiality and risk management within corporate groups.

Regulatory silos

Regulatory silos create distinct compliance boundaries that separate financial activities and risks, enhancing stability by preventing contagion across different sectors. Ring-fencing isolates specific banking functions to protect retail deposits, while fire-walling establishes information and operational barriers to limit risk transmission within complex institutions.

Exposure limits

Exposure limits define the maximum allowable risk concentration within a financial entity, ensuring that losses do not exceed predefined thresholds. Ring-fencing isolates critical assets or functions within a subsidiary to protect them from group-level risks, whereas fire-walling establishes barriers to prevent risk transmission between business units, both integral to maintaining regulatory compliance and operational resilience.

Contagion mitigation

Contagion mitigation in financial systems involves ring-fencing, which isolates vulnerable assets or entities to prevent systemic risk spread, contrasted with fire-walling that establishes barriers within institutions to contain internal shocks. Ring-fencing strategically separates high-risk operations, while fire-walling focuses on strengthening internal controls to halt contagion transmission across organizational units.

Ring-fencing vs Fire-walling Infographic

moneydif.com

moneydif.com