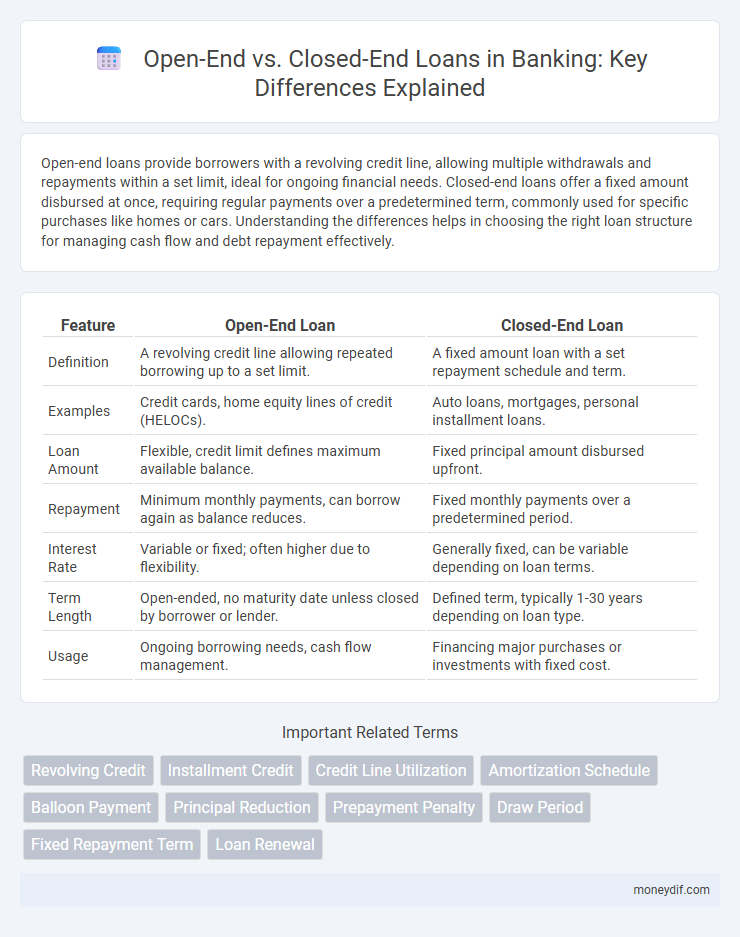

Open-end loans provide borrowers with a revolving credit line, allowing multiple withdrawals and repayments within a set limit, ideal for ongoing financial needs. Closed-end loans offer a fixed amount disbursed at once, requiring regular payments over a predetermined term, commonly used for specific purchases like homes or cars. Understanding the differences helps in choosing the right loan structure for managing cash flow and debt repayment effectively.

Table of Comparison

| Feature | Open-End Loan | Closed-End Loan |

|---|---|---|

| Definition | A revolving credit line allowing repeated borrowing up to a set limit. | A fixed amount loan with a set repayment schedule and term. |

| Examples | Credit cards, home equity lines of credit (HELOCs). | Auto loans, mortgages, personal installment loans. |

| Loan Amount | Flexible, credit limit defines maximum available balance. | Fixed principal amount disbursed upfront. |

| Repayment | Minimum monthly payments, can borrow again as balance reduces. | Fixed monthly payments over a predetermined period. |

| Interest Rate | Variable or fixed; often higher due to flexibility. | Generally fixed, can be variable depending on loan terms. |

| Term Length | Open-ended, no maturity date unless closed by borrower or lender. | Defined term, typically 1-30 years depending on loan type. |

| Usage | Ongoing borrowing needs, cash flow management. | Financing major purchases or investments with fixed cost. |

Understanding Open-End Loans in Banking

Open-end loans in banking function as revolving credit lines, allowing borrowers to repeatedly access funds up to a specified limit without reapplying. These loans, such as credit cards and home equity lines of credit (HELOCs), offer flexibility with variable interest rates and minimum payment requirements based on outstanding balances. Financial institutions use open-end loans to manage ongoing credit relationships while monitoring borrower creditworthiness to mitigate risk.

Overview of Closed-End Loans

Closed-end loans are a type of financing where the borrower receives a lump sum upfront and repays the loan through fixed monthly payments over a predetermined term, commonly used for mortgages, auto loans, and personal loans. These loans have a specified repayment schedule and a fixed or variable interest rate, ensuring predictable payment amounts and a clear payoff date. Unlike open-end loans, closed-end loans restrict additional borrowing without refinancing, providing lenders with reduced risk and borrowers with disciplined repayment plans.

Key Differences Between Open-End and Closed-End Loans

Open-end loans, such as credit cards and home equity lines of credit (HELOCs), allow borrowers to withdraw funds repeatedly up to a predetermined credit limit, offering flexible repayment terms and variable interest rates. Closed-end loans include mortgages, auto loans, and personal loans with fixed amounts disbursed at once, fixed repayment schedules, and generally fixed interest rates. The key differences lie in the borrowing structure, repayment flexibility, and interest rate variability, which affect borrowing cost and cash flow management.

Benefits of Open-End Loans for Borrowers

Open-end loans offer borrowers flexible access to funds with the ability to borrow repeatedly up to a specified credit limit without reapplying, enhancing cash flow management. Interest is typically charged only on the outstanding balance, reducing overall borrowing costs compared to closed-end loans. This revolving credit structure supports ongoing financial needs, making open-end loans ideal for managing expenses with unpredictable or recurring cash requirements.

Advantages of Closed-End Loans in Banking

Closed-end loans provide borrowers with fixed repayment schedules and predetermined interest rates, offering financial predictability and ease of budgeting. Lenders benefit from reduced risk due to the set loan term and collateral requirements, enhancing loan security. These loans often feature lower interest rates compared to open-end loans, making them cost-effective for consumers seeking structured debt solutions.

Common Examples of Open-End Loans

Common examples of open-end loans include credit cards, home equity lines of credit (HELOCs), and personal lines of credit, which allow borrowers to repeatedly access funds up to a predefined credit limit. Unlike closed-end loans such as traditional mortgages and auto loans that require fixed payments over a set term, open-end loans offer flexibility in borrowing and repayment schedules. These revolving credit options are widely used for ongoing expenses, emergency funds, and variable cash flow management in both personal and business banking contexts.

Typical Uses for Closed-End Loans

Closed-end loans are commonly used for significant, one-time purchases such as homes, vehicles, or major appliances, offering fixed repayment terms and interest rates. These loans provide borrowers with a clear repayment schedule, making them suitable for planned expenses and long-term financial commitments. Mortgage loans, auto loans, and personal installment loans are typical examples of closed-end loans used in banking.

Risk Factors in Open-End vs Closed-End Lending

Open-end loans carry higher risk due to their revolving credit nature, allowing borrowers to repeatedly access funds up to a limit, which can lead to potential overextension and increased default probability. Closed-end loans typically involve fixed amounts and terms, reducing uncertainty for lenders by limiting borrower risk exposure and ensuring scheduled repayments. The fluctuating outstanding balance and unpredictable repayment patterns of open-end loans create more complex risk management challenges compared to the structured risk profile of closed-end lending.

How Banks Assess Eligibility for Each Loan Type

Banks assess eligibility for open-end loans by evaluating the borrower's credit score, income stability, and existing debt-to-income ratio to ensure they can manage revolving credit limits responsibly. For closed-end loans, banks focus on the borrower's ability to repay fixed installments by analyzing credit history, employment status, and collateral, if applicable. Both loan assessments prioritize financial capacity and creditworthiness but differ in risk evaluation due to the loan structure.

Choosing the Right Loan: Open-End or Closed-End

Selecting between an open-end loan and a closed-end loan depends on your financial needs and repayment flexibility; open-end loans, such as credit cards or lines of credit, offer revolving credit with variable borrowing limits and ongoing access, ideal for fluctuating expenses. Closed-end loans, including mortgages and auto loans, provide a fixed amount with a set repayment schedule, suited for specific, one-time purchases requiring predictable payments. Understanding interest rates, loan terms, and your cash flow patterns is crucial to choosing the most cost-effective and manageable loan type.

Important Terms

Revolving Credit

Revolving credit allows borrowers to access funds repeatedly up to a set credit limit, characteristic of open-end loans such as credit cards and home equity lines of credit. Closed-end loans, including auto loans and mortgages, provide a fixed amount upfront with scheduled repayments and no option for re-borrowing once the loan is paid off.

Installment Credit

Installment credit typically involves closed-end loans where borrowers receive a lump sum and repay fixed monthly installments over a set period, contrasting with open-end loans that allow revolving credit with flexible repayment terms and borrowing limits. Closed-end loans include mortgages and auto loans, while open-end loans encompass credit cards and home equity lines of credit (HELOCs), emphasizing differences in borrowing structure and repayment flexibility.

Credit Line Utilization

Credit line utilization measures the proportion of a borrower's available credit currently being used on open-end loans, such as credit cards or lines of credit, impacting credit scores more significantly than closed-end loans like auto or mortgage loans that have fixed repayment terms and do not affect credit utilization ratios. Managing utilization below 30% on open-end loans optimizes creditworthiness, whereas closed-end loan balances primarily influence debt-to-income ratios rather than credit utilization metrics.

Amortization Schedule

An amortization schedule for open-end loans, such as credit lines, allows flexible borrowing and repayment with varying interest accrued on outstanding balances, whereas closed-end loans have fixed payments and a predetermined amortization timeline, ensuring full repayment by the loan term's end. Understanding these differences is essential for managing loan cash flows, interest costs, and repayment strategies effectively.

Balloon Payment

Balloon payment refers to a large, lump-sum payment due at the end of a loan term, commonly associated with both open-end and closed-end loans, where open-end loans allow borrowers to borrow up to a credit limit with variable payments, while closed-end loans require fixed payments over a set period. In open-end loans, balloon payments may arise if the borrower fails to make minimum payments, whereas in closed-end loans, the balloon payment is a predetermined final installment that significantly reduces monthly payments earlier in the loan term.

Principal Reduction

Principal reduction lowers the outstanding loan balance, benefiting borrowers by decreasing interest costs and monthly payments. In open-end loans, principal reduction can increase available credit, whereas closed-end loans have fixed amounts, limiting changes to the loan balance.

Prepayment Penalty

Prepayment penalties typically apply to closed-end loans, discouraging early payoff by charging a fee, whereas open-end loans generally do not impose such penalties, offering more flexibility for borrowers to repay without additional costs. Understanding the specific terms of prepayment clauses is crucial for comparing the financial impact of early repayment in both open-end and closed-end loan structures.

Draw Period

The Draw Period in an Open-End Loan allows borrowers to repeatedly access funds up to a credit limit during a specified timeframe, contrasting with Closed-End Loans that disburse a fixed amount upfront with no additional borrowing. This flexible draw feature in Open-End Loans supports ongoing financing needs, while Closed-End Loans follow a fixed repayment schedule without further credit access.

Fixed Repayment Term

Fixed repayment terms are characteristic of closed-end loans, where borrowers repay a predetermined amount over a set period until the loan is fully paid off; open-end loans, by contrast, offer flexible repayment schedules without a fixed end date, allowing ongoing borrowing and repayments. Closed-end loans provide predictability and structured payment plans, making them ideal for loans like auto or mortgage financing, whereas open-end loans, such as credit cards and home equity lines of credit, adapt to fluctuating borrowing needs.

Loan Renewal

Loan renewal often depends on the type of loan, with open-end loans offering flexible repayment terms and the ability to borrow repeatedly up to a credit limit, while closed-end loans require full repayment of the original amount before renewal. Open-end loans like credit cards or home equity lines of credit provide ongoing access, whereas closed-end loans such as auto or personal loans have fixed schedules and typically require refinancing for renewal.

Open-End Loan vs Closed-End Loan Infographic

moneydif.com

moneydif.com