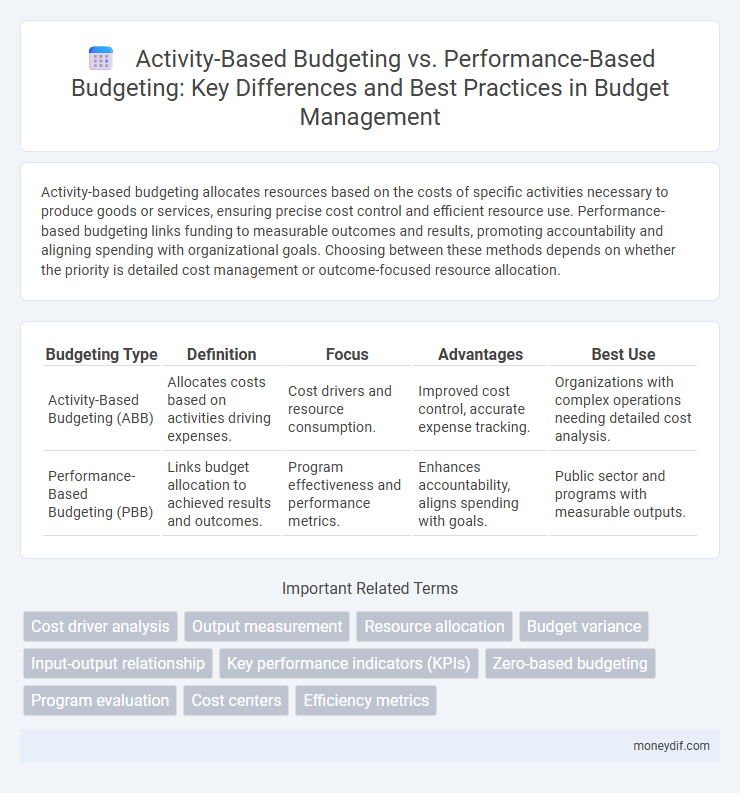

Activity-based budgeting allocates resources based on the costs of specific activities necessary to produce goods or services, ensuring precise cost control and efficient resource use. Performance-based budgeting links funding to measurable outcomes and results, promoting accountability and aligning spending with organizational goals. Choosing between these methods depends on whether the priority is detailed cost management or outcome-focused resource allocation.

Table of Comparison

| Budgeting Type | Definition | Focus | Advantages | Best Use |

|---|---|---|---|---|

| Activity-Based Budgeting (ABB) | Allocates costs based on activities driving expenses. | Cost drivers and resource consumption. | Improved cost control, accurate expense tracking. | Organizations with complex operations needing detailed cost analysis. |

| Performance-Based Budgeting (PBB) | Links budget allocation to achieved results and outcomes. | Program effectiveness and performance metrics. | Enhances accountability, aligns spending with goals. | Public sector and programs with measurable outputs. |

Introduction to Activity-Based vs Performance-Based Budgeting

Activity-Based Budgeting (ABB) allocates resources based on the costs of specific activities required to produce goods or services, enabling precise cost management and operational efficiency. Performance-Based Budgeting (PBB) links funding to measurable outcomes and performance indicators, driving accountability and results-oriented decision-making. Both approaches enhance fiscal discipline but differ in focus: ABB emphasizes cost drivers and processes, while PBB prioritizes achieving strategic goals through performance metrics.

Core Principles of Activity-Based Budgeting

Activity-Based Budgeting (ABB) prioritizes identifying and allocating costs based on specific business activities that drive expenses, emphasizing a detailed analysis of resource consumption. Core principles of ABB include tracing costs to activities, understanding cost drivers, and ensuring budgets reflect the true cost of business processes to enhance accuracy and efficiency. This contrasts with Performance-Based Budgeting, which focuses primarily on outcomes and results rather than the granular activities that generate costs.

Fundamentals of Performance-Based Budgeting

Performance-based budgeting centers on allocating funds based on measurable outcomes and results, ensuring resources directly support organizational goals and improve accountability. This budgeting method emphasizes linking financial inputs to performance indicators, enabling more effective evaluation of program efficiency and impact. Unlike activity-based budgeting, which assesses costs by activities performed, performance-based budgeting drives strategic decision-making through outcome-focused financial planning.

Key Differences Between Activity-Based and Performance-Based Budgeting

Activity-based budgeting allocates funds based on the costs of specific activities required to produce goods or services, emphasizing cost control and resource allocation at the activity level. Performance-based budgeting links budget allocations to measurable outcomes and goals, prioritizing results and program effectiveness to improve accountability. Key differences include activity-based budgeting's focus on detailed cost tracking of processes versus performance-based budgeting's emphasis on achieving strategic objectives and performance metrics.

Advantages of Activity-Based Budgeting in Financial Planning

Activity-Based Budgeting (ABB) improves financial planning by providing precise cost allocation based on actual activities, enhancing budget accuracy and resource utilization. ABB enables organizations to identify and eliminate non-value-added activities, leading to more efficient spending and cost control. This method supports strategic decision-making by linking expenses directly to business processes, facilitating better performance management and financial forecasting.

Benefits of Performance-Based Budgeting for Organizational Effectiveness

Performance-based budgeting enhances organizational effectiveness by directly linking resource allocation to measurable outcomes and strategic goals, ensuring funds are utilized efficiently to achieve targeted performance levels. This approach promotes accountability and transparency, as departments are evaluated based on results rather than mere expenditure, driving continuous improvement and informed decision-making. By focusing on outcomes, performance-based budgeting supports better prioritization of programs, leading to optimized use of budget resources and improved public service delivery.

Implementation Steps for Activity-Based Budgeting

Activity-based budgeting implementation involves identifying key activities within an organization, assigning costs to each activity based on resource consumption, and forecasting the required budget to support these activities. The process starts with analyzing cost drivers, mapping activities to organizational goals, and collecting data on current resource usage. This method provides precise cost control and enhances decision-making by linking budget allocations directly to operational tasks.

How to Adopt Performance-Based Budgeting in Practice

Adopting performance-based budgeting starts with defining clear, measurable objectives aligned with organizational goals and linking budget allocations to these performance indicators. Incorporate robust data collection and analysis systems to monitor outcomes and adjust resources dynamically, ensuring accountability and improved efficiency. Training staff on performance metrics and fostering a culture of continuous evaluation enable seamless integration of performance-based budgeting across departments.

Challenges and Limitations of Each Budgeting Approach

Activity-based budgeting (ABB) faces challenges such as the complexity of accurately identifying and assigning costs to specific activities, which can lead to time-consuming data collection and analysis. Performance-based budgeting (PBB) often struggles with setting measurable performance indicators that truly reflect outcomes, risking misaligned resource allocation and difficulties in linking budgets directly to results. Both approaches require significant organizational commitment and continuous data accuracy to effectively drive financial discipline and strategic priorities.

Choosing the Right Budgeting Method for Your Organization

Activity-based budgeting allocates resources based on the costs of specific activities, improving accuracy in cost management and operational efficiency. Performance-based budgeting links funding to measurable outcomes, driving accountability and aligning budgets with strategic objectives. Choosing the right budgeting method depends on your organization's focus, whether it's on detailed cost control or achieving performance targets for effective resource utilization.

Important Terms

Cost driver analysis

Cost driver analysis identifies the specific activities or factors that cause costs in activity-based budgeting, enabling more accurate allocation of overhead expenses. In contrast, performance-based budgeting focuses on linking expenditures directly to measurable outcomes without explicitly analyzing underlying cost drivers.

Output measurement

Output measurement in activity-based budgeting focuses on quantifying the efficiency and cost-effectiveness of specific activities, allocating resources based on activity costs to improve operational performance. In contrast, performance-based budgeting assesses outputs against predetermined performance targets, linking financial allocations directly to measurable outcomes and organizational goals.

Resource allocation

Resource allocation in activity-based budgeting focuses on assigning costs to specific activities to enhance cost control and efficiency, while performance-based budgeting allocates funds based on measurable outcomes and performance indicators to ensure accountability and goal achievement. Both approaches optimize financial resources but emphasize different aspects: activity-based budgeting targets detailed cost management, whereas performance-based budgeting prioritizes results-driven funding.

Budget variance

Budget variance analysis reveals that activity-based budgeting (ABB) focuses on aligning costs with specific activities to identify inefficiencies, while performance-based budgeting (PBB) links expenditures directly to outcomes and goals, enhancing accountability. ABB provides detailed cost control through cost drivers, whereas PBB aids in measuring effectiveness and resource allocation based on performance metrics.

Input-output relationship

Activity-based budgeting allocates resources based on detailed analysis of activities driving costs, closely linking inputs to outputs for precise cost control and efficiency improvement. Performance-based budgeting emphasizes achieving specific outcomes by allocating funds according to results, thereby aligning inputs with measurable performance indicators and strategic goals.

Key performance indicators (KPIs)

Key performance indicators (KPIs) in activity-based budgeting focus on measuring resource efficiency and cost drivers linked to specific activities, while KPIs in performance-based budgeting emphasize outcomes, service delivery effectiveness, and alignment with strategic goals. Comparing these budgeting approaches, activity-based KPIs track operational costs and process improvements, whereas performance-based KPIs evaluate program impact and results against predefined targets.

Zero-based budgeting

Zero-based budgeting requires justifying all expenses from scratch, contrasting with activity-based budgeting that allocates costs based on specific business activities and processes, while performance-based budgeting links funding directly to measurable outcomes and results. Integrating zero-based budgeting with activity-based and performance-based approaches enhances resource allocation efficiency by aligning budget decisions with operational activities and performance metrics.

Program evaluation

Program evaluation plays a critical role in distinguishing activity-based budgeting, which allocates resources based on detailed cost analysis of specific activities, from performance-based budgeting that links funding directly to measurable outcomes and results; this evaluation helps organizations optimize resource allocation and enhance accountability by aligning expenditures with program effectiveness and strategic goals. By integrating program evaluation into budgeting processes, agencies can identify cost drivers, assess performance metrics, and make data-driven decisions that improve financial efficiency and promote continuous improvement in service delivery.

Cost centers

Cost centers in activity-based budgeting focus on assigning costs to specific activities based on resource consumption, enabling detailed analysis and precise budgeting tied to operational tasks. In contrast, performance-based budgeting allocates funds linked to the outcomes or outputs of cost centers, emphasizing efficiency and effectiveness in achieving organizational goals.

Efficiency metrics

Efficiency metrics in activity-based budgeting focus on the cost-effectiveness of individual activities by analyzing resource allocation and consumption patterns, enabling precise identification of inefficiencies. In performance-based budgeting, efficiency is measured through outcome-driven indicators that link financial inputs to measurable results, emphasizing the optimization of expenditure to achieve specific performance targets.

activity-based budgeting vs performance-based budgeting Infographic

moneydif.com

moneydif.com