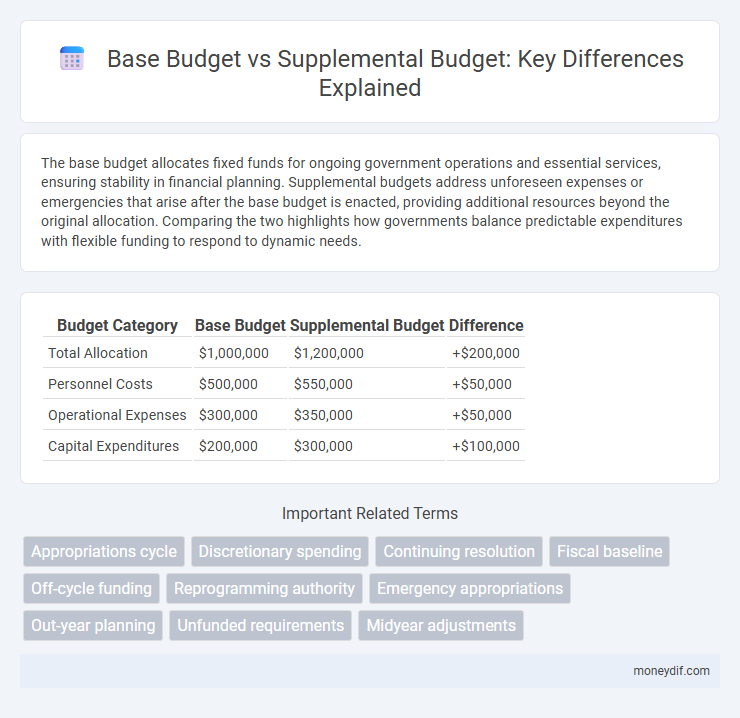

The base budget allocates fixed funds for ongoing government operations and essential services, ensuring stability in financial planning. Supplemental budgets address unforeseen expenses or emergencies that arise after the base budget is enacted, providing additional resources beyond the original allocation. Comparing the two highlights how governments balance predictable expenditures with flexible funding to respond to dynamic needs.

Table of Comparison

| Budget Category | Base Budget | Supplemental Budget | Difference |

|---|---|---|---|

| Total Allocation | $1,000,000 | $1,200,000 | +$200,000 |

| Personnel Costs | $500,000 | $550,000 | +$50,000 |

| Operational Expenses | $300,000 | $350,000 | +$50,000 |

| Capital Expenditures | $200,000 | $300,000 | +$100,000 |

Understanding the Base Budget: Definition and Purpose

The base budget refers to the initial financial plan that outlines the standard operating costs and essential expenses required to maintain ongoing government programs and services. It serves as a baseline for fiscal planning, enabling consistent fund allocation and resource management throughout the fiscal year. Understanding the base budget is crucial for distinguishing routine expenditures from additional needs addressed in the supplemental budget.

What Is a Supplemental Budget? Key Differences Explained

A supplemental budget is an additional allocation of funds approved beyond the original base budget to address unforeseen expenses or new priorities within a fiscal year. Unlike the base budget, which outlines planned expenditures based on projected revenues and ongoing programs, a supplemental budget adjusts financial plans in response to emergencies, revenue shortfalls, or policy changes. Key differences include timing, with the base budget set annually and the supplemental budget arising as needed, and flexibility, as supplemental budgets provide governments and organizations the ability to manage unexpected financial demands effectively.

Core Components of a Base Budget

The base budget includes core components such as recurring personnel costs, ongoing operational expenses, and essential program funding that sustain government functions. It reflects predictable, steady expenditures required to maintain current services without new initiatives or one-time investments. Supplemental budgets address unforeseen needs or emergency funding beyond the scope of the base budget.

Common Triggers for Supplemental Budgets

Common triggers for supplemental budgets include unexpected expenditures such as natural disasters, emergency response costs, or significant economic changes impacting revenue projections. Supplemental budgets are often necessitated by unforeseen government obligations like increased healthcare needs, infrastructure repairs, or shifts in federal funding. These adjustments ensure that the base budget remains flexible to accommodate sudden financial demands while maintaining essential public services.

Budgeting Process: Base Budget vs. Supplemental Adjustments

The budgeting process involves establishing a base budget, which allocates initial funds based on projected revenue and planned expenditures for a fiscal year. Supplemental budgets adjust this foundation by providing additional appropriations in response to unforeseen expenses or changes in priorities during the year. Effective management of both base budgets and supplemental adjustments ensures fiscal responsibility and responsiveness to evolving financial needs.

Financial Planning Implications of Each Budget Type

Base budgets provide a stable financial framework that supports ongoing operations and long-term commitments, ensuring predictable resource allocation. Supplemental budgets address unforeseen expenses or emergent needs, allowing flexibility but potentially disrupting fiscal consistency and requiring careful monitoring. Financial planning must balance the reliability of the base budget with the adaptability of supplemental appropriations to maintain overall budgetary control and strategic objectives.

Advantages and Limitations of Base Budgets

Base budgets provide a stable financial framework by allocating recurring funds essential for ongoing operations, ensuring predictability and efficient resource planning. They limit flexibility since adjustments are constrained to predefined amounts, potentially hindering responsiveness to emergent needs or unexpected expenditures. However, base budgets promote fiscal discipline and accountability by emphasizing consistent funding priorities and enabling performance evaluation over time.

When and Why to Use a Supplemental Budget

A supplemental budget is used when unforeseen expenses or emergencies arise after the base budget has been approved, ensuring adequate funding for unexpected needs. Governments and organizations rely on supplemental budgets to address issues such as natural disasters, economic downturns, or urgent infrastructure repairs that were not accounted for in the initial budget. Implementing a supplemental budget allows for financial flexibility and responsiveness without disrupting the original fiscal plan.

Case Studies: Real-World Applications of Both Budgets

Case studies reveal that base budgets typically fund essential government operations and long-term projects, while supplemental budgets address unforeseen expenses such as natural disasters or economic crises. For example, during the 2020 COVID-19 pandemic, many states utilized supplemental budgets to allocate emergency relief funds and healthcare resources outside their established base budgets. Organizations like the Department of Defense often rely on base budgets for personnel and maintenance, supplementing them with additional appropriations to cover unexpected deployments or equipment needs.

Strategic Decision-Making: Choosing Between Base and Supplemental Budgets

Strategic decision-making in budgeting requires evaluating the stability and flexibility offered by base budgets versus supplemental budgets. Base budgets provide consistent, recurring funding aligned with long-term organizational goals, ensuring essential operations are maintained without disruption. Supplemental budgets offer targeted, short-term financial resources to address unexpected needs or opportunities, enabling agile responses without altering the foundational budget framework.

Important Terms

Appropriations cycle

The appropriations cycle involves the allocation of government funds, distinguishing between the base budget, which covers ongoing operational expenses, and supplemental budgets that provide additional resources for unforeseen or emergency needs during the fiscal year. Understanding this cycle is crucial for effective fiscal management and ensuring that both fixed and variable funding requirements are met.

Discretionary spending

Discretionary spending refers to the portion of the federal budget that Congress funds annually through the base budget, excluding mandatory programs like Social Security or Medicare. Supplemental budgets provide additional funds beyond the base budget for unforeseen expenses such as disaster relief or military operations, allowing flexibility in government spending.

Continuing resolution

A continuing resolution (CR) temporarily funds government operations at the previous fiscal year's base budget levels when regular appropriations bills are delayed, preventing a government shutdown. Unlike supplemental budgets that provide additional funding beyond the base budget for unforeseen expenses or emergencies, CRs maintain baseline funding without addressing new priorities or increases.

Fiscal baseline

The fiscal baseline represents the projected federal spending and revenue levels based on the base budget, excluding proposed supplemental budgets which account for additional or emergency expenditures. Comparing the base budget to supplemental budgets highlights how unforeseen needs or policy changes lead to deviations from the original fiscal baseline estimates.

Off-cycle funding

Off-cycle funding refers to financial resources allocated outside the regular budget cycle, often addressing urgent or unforeseen needs, contrasting with the base budget which covers planned expenditures for an entire fiscal year. Supplemental budgets provide additional funding to the base budget, supporting off-cycle requirements such as disaster response or policy changes that arise after the initial budget approval.

Reprogramming authority

Reprogramming authority allows federal agencies to shift funds between budget categories within the base budget without additional congressional approval, facilitating flexibility in resource allocation. Supplemental budgets, by contrast, require separate congressional authorization to provide funding beyond the base budget, typically addressing unforeseen expenses or emergency needs.

Emergency appropriations

Emergency appropriations are funds allocated outside the regular base budget to address unforeseen and urgent needs, ensuring rapid governmental response without disrupting planned expenditures. Unlike supplemental budgets, which adjust or increase the existing fiscal plan, emergency appropriations specifically target crisis situations, providing immediate financial resources distinct from routine budget cycles.

Out-year planning

Out-year planning involves forecasting future fiscal requirements by analyzing the base budget, which covers ongoing operational costs, versus the supplemental budget, allocated for unforeseen or one-time expenses. Effective allocation between these budgets ensures sustainable financial management and aligns resources with long-term strategic goals.

Unfunded requirements

Unfunded requirements occur when the base budget fails to cover all necessary expenses, leading to a gap between allocated funds and actual needs. Supplemental budgets provide additional financial resources to address these shortfalls and ensure critical operations and projects can proceed without interruption.

Midyear adjustments

Midyear adjustments involve revising the base budget to allocate additional funds or reallocate existing resources through a supplemental budget, addressing unforeseen expenses or changes in revenue projections. This process ensures financial plans remain accurate and responsive to evolving operational needs and funding priorities.

base budget vs supplemental budget Infographic

moneydif.com

moneydif.com