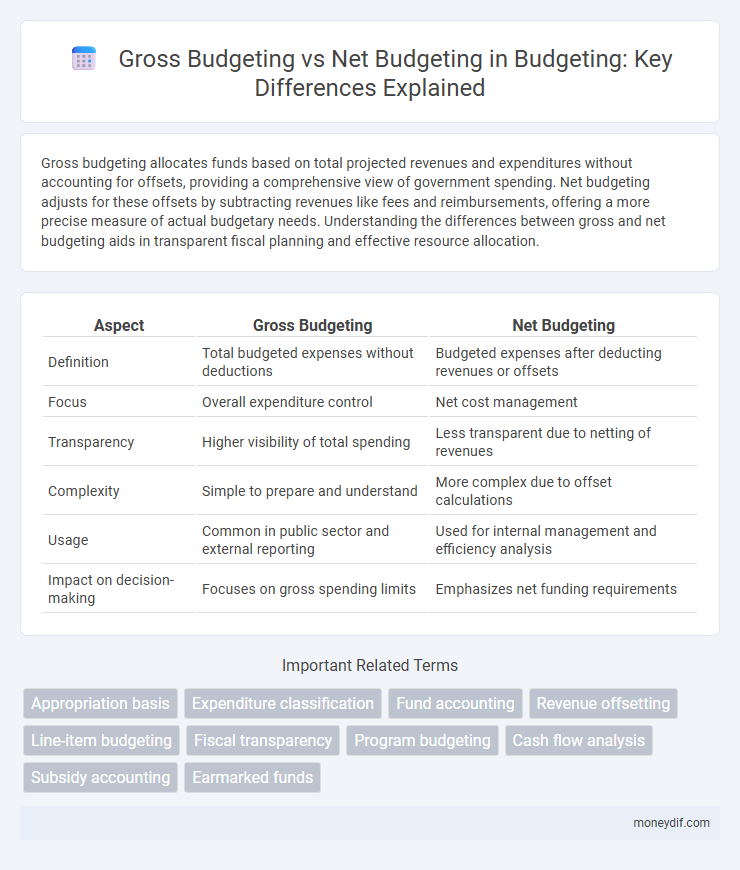

Gross budgeting allocates funds based on total projected revenues and expenditures without accounting for offsets, providing a comprehensive view of government spending. Net budgeting adjusts for these offsets by subtracting revenues like fees and reimbursements, offering a more precise measure of actual budgetary needs. Understanding the differences between gross and net budgeting aids in transparent fiscal planning and effective resource allocation.

Table of Comparison

| Aspect | Gross Budgeting | Net Budgeting |

|---|---|---|

| Definition | Total budgeted expenses without deductions | Budgeted expenses after deducting revenues or offsets |

| Focus | Overall expenditure control | Net cost management |

| Transparency | Higher visibility of total spending | Less transparent due to netting of revenues |

| Complexity | Simple to prepare and understand | More complex due to offset calculations |

| Usage | Common in public sector and external reporting | Used for internal management and efficiency analysis |

| Impact on decision-making | Focuses on gross spending limits | Emphasizes net funding requirements |

Introduction to Gross Budgeting vs Net Budgeting

Gross budgeting involves outlining total projected revenues and expenditures without accounting for deductions, providing a comprehensive overview of financial plans. Net budgeting subtracts specific expenses or revenues to reflect the actual available funds, offering a clearer picture of fiscal resources. Understanding the distinction between gross and net budgeting is essential for accurate fiscal analysis and effective financial planning.

Defining Gross Budgeting

Gross budgeting refers to the total allocation of financial resources without deducting any revenues or recoveries, providing a comprehensive view of expenditures. It emphasizes the full cost of programs or projects, facilitating transparency and accountability in fiscal planning. This approach contrasts with net budgeting, which subtracts expected income, potentially obscuring the actual scale of government or organizational spending.

Understanding Net Budgeting

Net budgeting emphasizes accounting for revenues and expenses to present a clear picture of actual resource needs, subtracting estimated income from gross expenditure. This approach enhances fiscal transparency and enables more precise allocation of funds by focusing on net outflows rather than total spending. Governments and organizations adopt net budgeting to improve financial efficiency and avoid overestimating budgetary requirements.

Key Differences Between Gross and Net Budgeting

Gross budgeting accounts for the total revenues and expenditures without deductions, providing a comprehensive view of all financial inflows and outflows. Net budgeting subtracts certain costs such as transfers and internal charges from total expenditures, focusing on the actual net expense the budget incurs. Key differences include transparency levels, with gross budgeting offering greater clarity on total resource allocation, while net budgeting emphasizes operational efficiency by highlighting net financial impacts.

Advantages of Gross Budgeting

Gross budgeting provides a clear and comprehensive view of total expenditures and revenues, promoting transparency and easier monitoring of financial activities. It facilitates accurate comparison between departments or projects by recording all budgeted amounts without netting expenses against revenues. This method supports better control and accountability by highlighting the full scale of resource allocation before any offsets.

Advantages of Net Budgeting

Net budgeting enhances fiscal accuracy by accounting for both revenues and expenses, providing a clearer picture of actual resource requirements. It improves financial transparency, enabling better allocation decisions and reducing the risk of budgetary overestimations. This method also streamlines budget monitoring, fostering efficient management of public or organizational funds.

Disadvantages of Gross Budgeting

Gross budgeting can lead to inefficiencies by overstating revenues and expenditures without showing net impact, causing confusion for stakeholders interpreting the budget. It may also reduce transparency, as the lack of offsetting figures hides the actual fiscal balance and potential savings from revenue-linked expenses. Organizations using gross budgeting often face challenges in making accurate financial decisions due to inflated budget numbers that do not reflect real resource availability.

Disadvantages of Net Budgeting

Net budgeting often obscures the true scale of government expenditures and revenues, making it challenging to assess fiscal transparency and accountability. It can lead to underestimating financial needs by excluding certain inflows and outflows, which complicates effective resource allocation. This approach may also reduce the ability to monitor and control public spending accurately, increasing risks of inefficiencies and fiscal imbalances.

Choosing the Right Budgeting Method

Choosing the right budgeting method depends on organizational goals and financial transparency needs. Gross budgeting records total revenues and expenditures separately, providing clear insight into overall resource allocation. Net budgeting consolidates revenues and expenses, offering a simplified view ideal for organizations prioritizing streamlined financial management.

Gross vs Net Budgeting: Real-World Examples

Gross budgeting encompasses the total planned expenditures without deducting any revenues, often used in public sector projects like infrastructure development where transparency on total costs is crucial. Net budgeting subtracts anticipated revenues from expenses to present a more precise financing need, common in business forecasts or enterprise fund accounting such as utilities or transport services. For example, a government infrastructure project might report a gross budget of $500 million, while the net budget reflects $300 million after factoring $200 million expected in grants or user fees.

Important Terms

Appropriation basis

Appropriation basis determines whether budgeting follows gross or net principles, where gross budgeting requires recording all expenditures and receipts separately, enhancing transparency and control. Net budgeting consolidates revenues and expenses, focusing on the net amount required, which simplifies budget presentation but may reduce detailed financial insight.

Expenditure classification

Expenditure classification organizes government spending into categories such as capital and recurrent expenses, essential for distinguishing between gross budgeting--allocating total expenditures without deducting revenues--and net budgeting, which subtracts expected revenues to focus on the net fiscal impact. This framework enhances financial transparency and accountability by providing clear insights into the full scope of expenditures versus the net budgetary position.

Fund accounting

Fund accounting distinguishes between gross budgeting, which records total revenues and expenditures separately to provide transparent financial reporting, and net budgeting, which offset revenues against expenditures to focus on the net financial position and simplify budget comparisons. Gross budgeting enhances accountability by tracking all fund inflows and outflows independently, while net budgeting streamlines financial planning by emphasizing net resource availability within governmental or nonprofit entities.

Revenue offsetting

Revenue offsetting involves reducing gross expenditures by the amount of related revenue received, which contrasts with net budgeting where only the net amount of spending after revenue is reported. This practice allows organizations to present a more accurate financial position by integrating corresponding revenues directly against gross budgeted expenses, enhancing budget transparency and control.

Line-item budgeting

Line-item budgeting allocates funds to specific expense categories, contrasting with gross budgeting, which requires full expenditure approval for each category regardless of potential offsets. Net budgeting adjusts allocations by subtracting expected revenues or recoveries, enabling a more precise reflection of net costs within budget planning.

Fiscal transparency

Fiscal transparency enhances government accountability by clearly distinguishing gross budgeting, which shows total expenditures and revenues, from net budgeting that presents budget figures after offsetting revenues. This clarity helps stakeholders assess true fiscal performance and facilitates better economic decision-making by providing comprehensive insights into public financial management.

Program budgeting

Program budgeting allocates funds based on specific programs, offering a clear view of financial resources and goals compared to gross budgeting, which presents total expenditures without deducting revenues. Net budgeting adjusts for expected income, providing a more accurate assessment of a program's actual funding needs by subtracting anticipated revenues from total costs.

Cash flow analysis

Cash flow analysis evaluates the timing and amount of cash inflows and outflows, essential for distinguishing gross budgeting, which accounts for total revenues and expenditures without netting, from net budgeting that focuses on the difference between revenues and expenses. Effective cash flow analysis ensures accurate financial planning by highlighting liquidity impacts under both gross and net budgeting methods.

Subsidy accounting

Subsidy accounting under gross budgeting records all revenues and expenditures separately, ensuring full transparency of government financial flow, whereas net budgeting consolidates subsidies by offsetting revenues against expenditures, presenting a simplified but less detailed fiscal overview. Gross budgeting enhances accountability by showing the actual fiscal effort involved in subsidy programs, while net budgeting emphasizes the net cost impact on public finances.

Earmarked funds

Earmarked funds represent financial resources allocated for specific purposes within gross budgeting, ensuring transparent allocation without offsetting revenues, whereas net budgeting combines expenditures and revenues, reducing visibility of designated funds by balancing inflows and outflows within the total budget. Understanding the distinction between earmarked funds in gross versus net budgeting is crucial for effective fiscal planning and accountability in public finance management.

gross budgeting vs net budgeting Infographic

moneydif.com

moneydif.com