A fixed budget establishes a set amount of financial resources allocated for a specific period, providing clear limits and predictability in spending. In contrast, a flexible budget adjusts based on actual activity levels or changes in business conditions, allowing for more adaptive financial management. Understanding the differences between a fixed budget and a flexible budget is crucial for effective cost control and resource allocation.

Table of Comparison

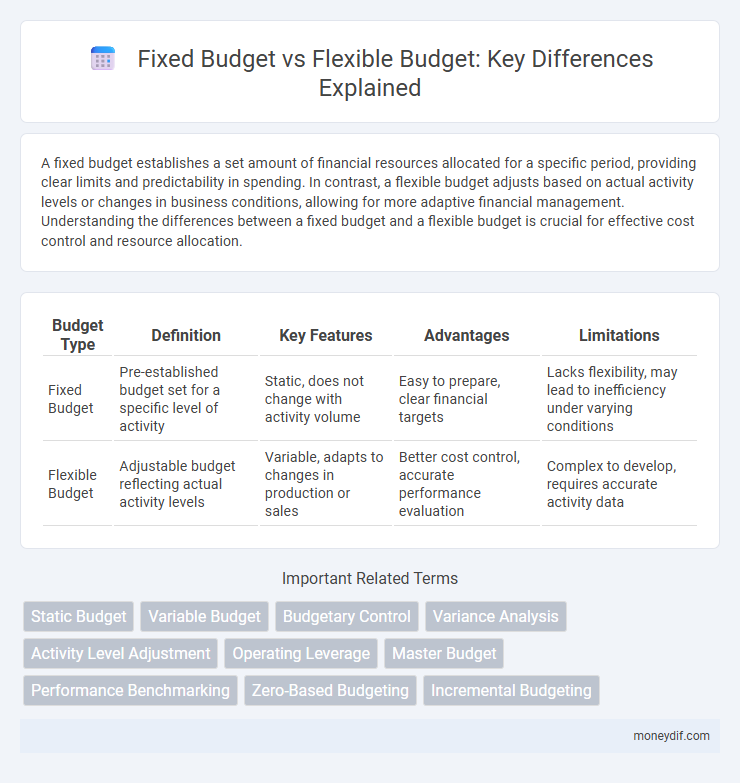

| Budget Type | Definition | Key Features | Advantages | Limitations |

|---|---|---|---|---|

| Fixed Budget | Pre-established budget set for a specific level of activity | Static, does not change with activity volume | Easy to prepare, clear financial targets | Lacks flexibility, may lead to inefficiency under varying conditions |

| Flexible Budget | Adjustable budget reflecting actual activity levels | Variable, adapts to changes in production or sales | Better cost control, accurate performance evaluation | Complex to develop, requires accurate activity data |

Understanding Fixed Budgets

Fixed budgets allocate a predetermined amount of resources for specific activities, unaffected by actual variations in business operations or sales volume. These budgets are ideal for stable environments where costs and revenues remain consistent, providing predictable financial control. Understanding fixed budgets is crucial for businesses seeking to maintain strict expense discipline and avoid overspending.

What Is a Flexible Budget?

A flexible budget adjusts according to changes in actual activity levels, providing a more accurate tool for performance evaluation compared to a fixed budget. It recalculates budgeted costs based on real-time data such as sales volume or production output, allowing organizations to control expenses and identify variances effectively. This dynamic budgeting approach supports better financial planning and resource allocation in environments with fluctuating operational demands.

Key Differences: Fixed vs Flexible Budgets

Fixed budgets allocate a predetermined set of resources regardless of actual activity levels, ensuring strict cost control but limiting adaptability to changing conditions. Flexible budgets adjust expenditures based on real-time production or sales volume, providing more accurate performance evaluation and efficient resource utilization. Key differences include responsiveness to operational fluctuations, variance analysis capability, and alignment with organizational agility requirements.

Advantages of Fixed Budgets

Fixed budgets provide clear financial targets, enabling organizations to maintain strict cost control and monitor performance consistently. They simplify financial planning by establishing predetermined limits, which helps in reducing uncertainty and enhancing discipline across departments. This stability supports effective resource allocation and long-term strategic decision-making.

Benefits of Flexible Budgets

Flexible budgets provide more accurate financial control by adjusting expenses based on actual activity levels, allowing businesses to respond effectively to fluctuations in sales or production. They enhance performance evaluation by comparing actual costs to variable budgeted costs, aiding in identifying inefficiencies or cost savings. This adaptability improves decision-making and resource allocation, particularly in dynamic industries with changing market conditions.

Limitations of Fixed Budgets

Fixed budgets restrict an organization's ability to adapt to changing market conditions, leading to potential inefficiencies and lost opportunities. They often fail to accommodate unexpected expenses or fluctuations in revenue, resulting in inaccurate financial planning. This rigidity can hinder responsive decision-making and reduce overall operational effectiveness.

Drawbacks of Flexible Budgets

Flexible budgets can lead to inaccurate performance evaluations due to their dependence on estimated activity levels, which may not reflect actual operational conditions. They require frequent adjustments and complex calculations, increasing administrative workload and potential for errors. This variability can also complicate cost control by making it harder to distinguish between controllable and uncontrollable variances.

Choosing the Right Budgeting Approach

Choosing the right budgeting approach depends on organizational goals and the predictability of expenses; a fixed budget sets predetermined limits suitable for stable environments, while a flexible budget adjusts according to actual activity levels or revenue fluctuations. Companies with variable costs benefit from flexible budgets, enabling better resource allocation and performance evaluation by aligning expenses with real-time business conditions. Fixed budgets provide rigorous cost control but may hinder adaptability during market changes or unexpected financial challenges.

Real-World Examples: Fixed vs Flexible Budgets

Real-world examples of fixed vs flexible budgets highlight their practical applications in business settings. Fixed budgets, such as a manufacturing company's annual expenditure plan, remain constant regardless of production volume, providing stability but limited adaptability. In contrast, a flexible budget used by retail chains adjusts expenses like labor and materials based on sales fluctuations, offering responsiveness and cost control aligned with actual business activity.

Fixed or Flexible Budget: Which Suits Your Business?

A fixed budget sets predetermined expenses regardless of actual business performance, providing stability but lacking adaptability for fluctuating costs. Flexible budgets adjust based on real-time activity levels, allowing businesses to respond dynamically to changes in revenue and operational needs. Choosing between fixed or flexible budgets depends on your industry's volatility, cost structure, and management's preference for control versus adaptability in financial planning.

Important Terms

Static Budget

Static budget remains constant regardless of changes in activity levels, making it ideal for organizations with predictable expenses and fixed costs. In contrast, flexible budget adjusts based on actual activity or production levels, providing a more accurate financial framework for businesses with variable costs and fluctuating operations.

Variable Budget

Variable budget adjusts expenses based on actual activity levels, unlike a fixed budget which remains constant regardless of output variations. Flexible budget also adapts to changes in volume but provides a framework for comparing budgeted versus actual costs, making it more dynamic than a fixed budget and more structured than a pure variable budget.

Budgetary Control

Budgetary control involves comparing actual financial performance against predetermined budgets to manage costs effectively. Fixed budgets allocate set amounts regardless of activity level, whereas flexible budgets adjust expenditures based on real-time operational changes, enhancing responsiveness to varying business conditions.

Variance Analysis

Variance analysis distinguishes between fixed budget and flexible budget by evaluating performance discrepancies; fixed budget variance compares actual results to a static budget regardless of activity levels, while flexible budget variance adjusts for actual production volume, providing a more accurate measure of operational efficiency and cost control. This analysis enables organizations to identify cost behavior patterns, assess management effectiveness, and optimize resource allocation by isolating volume-related variances from those arising from price or efficiency changes.

Activity Level Adjustment

Activity level adjustment is crucial when comparing fixed budgets to flexible budgets, as it accounts for changes in actual production or sales volume, enabling more accurate performance analysis. Flexible budgets adjust costs based on activity levels, providing a realistic financial framework, whereas fixed budgets remain constant regardless of activity, often leading to variances that require explanation.

Operating Leverage

Operating leverage measures the impact of fixed costs on a company's earnings before interest and taxes (EBIT), highlighting the sensitivity of profit to changes in sales volume within a fixed budget framework. A flexible budget adjusts for actual sales activity, reducing the fixed cost emphasis and providing a more accurate analysis of operating leverage effects on profitability.

Master Budget

A Master Budget integrates various individual budgets into a comprehensive financial plan, serving as a fixed budget with predetermined revenue and expense targets. Unlike a flexible budget, which adjusts based on actual activity levels, the Master Budget provides a static framework critical for organizational planning and performance evaluation.

Performance Benchmarking

Performance benchmarking involving fixed budgets compares actual financial results against predetermined static allocations, highlighting variances caused by volume or operational efficiency. Flexible budget benchmarking adjusts for changes in activity levels, enabling more accurate performance evaluation by isolating cost behavior and managerial effectiveness.

Zero-Based Budgeting

Zero-Based Budgeting requires every expense to be justified from scratch, unlike fixed budgets which allocate predetermined costs regardless of actual activity levels. Flexible budgets adjust expenditures based on real-time operational changes, making them more adaptable than the rigid framework of fixed budgets but less detailed in justifying costs than Zero-Based Budgeting.

Incremental Budgeting

Incremental budgeting allocates resources based on the previous period's budget with adjustments for new demands, often leading to rigid financial planning compared to flexible budgeting, which adapts expenses according to actual activity levels; fixed budgets remain constant regardless of performance, making incremental budgeting more aligned with them, whereas flexible budgets provide more accuracy and control by reflecting operational changes. This approach can result in inefficiencies or budget slack in fixed budgets but offers stability in incremental budgeting, contrasting with the dynamic nature of flexible budgeting that supports better variance analysis.

fixed budget vs flexible budget Infographic

moneydif.com

moneydif.com