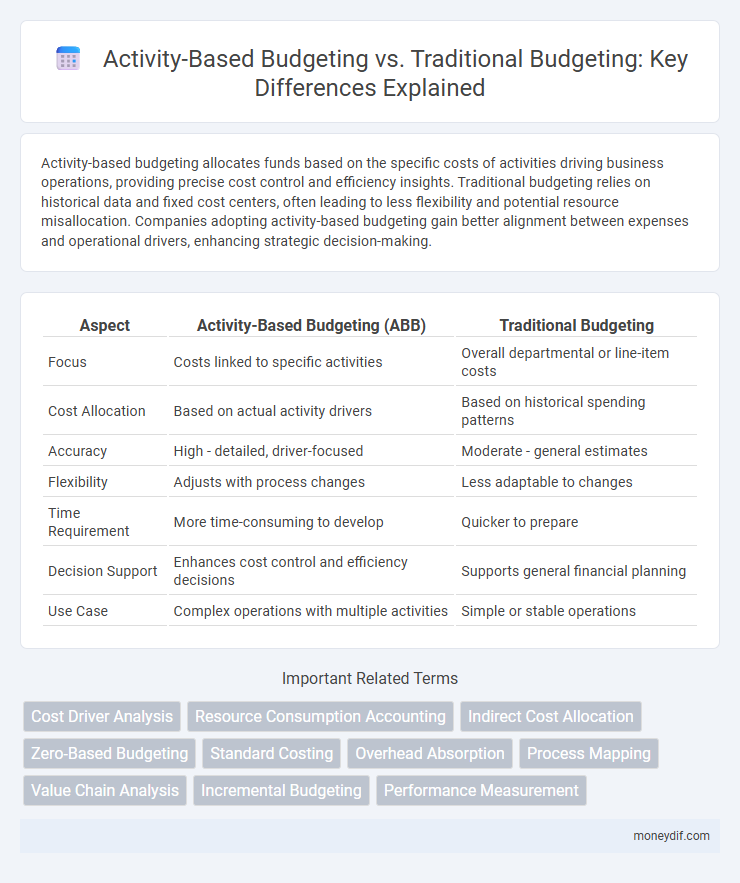

Activity-based budgeting allocates funds based on the specific costs of activities driving business operations, providing precise cost control and efficiency insights. Traditional budgeting relies on historical data and fixed cost centers, often leading to less flexibility and potential resource misallocation. Companies adopting activity-based budgeting gain better alignment between expenses and operational drivers, enhancing strategic decision-making.

Table of Comparison

| Aspect | Activity-Based Budgeting (ABB) | Traditional Budgeting |

|---|---|---|

| Focus | Costs linked to specific activities | Overall departmental or line-item costs |

| Cost Allocation | Based on actual activity drivers | Based on historical spending patterns |

| Accuracy | High - detailed, driver-focused | Moderate - general estimates |

| Flexibility | Adjusts with process changes | Less adaptable to changes |

| Time Requirement | More time-consuming to develop | Quicker to prepare |

| Decision Support | Enhances cost control and efficiency decisions | Supports general financial planning |

| Use Case | Complex operations with multiple activities | Simple or stable operations |

Understanding Activity-Based Budgeting

Activity-Based Budgeting (ABB) allocates costs based on activities that drive expenses, offering a precise method to identify resource consumption compared to Traditional Budgeting, which often relies on historical data and fixed line-items. ABB enhances cost management by linking budget allocations to operational processes and performance metrics, improving accuracy and strategic decision-making. This budgeting approach supports organizations in optimizing resource use and fostering efficiency through detailed analysis of activity drivers and cost behavior.

Overview of Traditional Budgeting

Traditional budgeting relies on historical financial data to establish fixed expenditure limits, often emphasizing incremental adjustments from previous budgets. This method prioritizes financial stability and control by allocating resources based on past performance and predetermined cost centers. Despite its simplicity, traditional budgeting can lack flexibility and may not accurately reflect current operational needs or strategic priorities.

Key Differences Between ABB and Traditional Budgeting

Activity-based budgeting (ABB) allocates resources based on the costs of specific activities, providing a more detailed and accurate understanding of expense drivers compared to traditional budgeting, which relies on historical spending patterns. ABB emphasizes cost drivers and operational efficiency, enabling more strategic decision-making, whereas traditional budgeting focuses on incremental changes from past budgets. ABB aligns budget allocation with organizational goals by analyzing activities, while traditional budgeting often results in fixed, less flexible financial plans.

Pros and Cons of Activity-Based Budgeting

Activity-based budgeting (ABB) allocates resources based on activities driving costs, enhancing cost accuracy and operational efficiency compared to traditional budgeting's flat allocations. ABB provides detailed insights into cost drivers, promoting better decision-making and resource optimization, yet it requires extensive data collection and can increase administrative complexity. While ABB improves budget flexibility and aligns spending with strategic goals, its implementation demands significant time and expertise, potentially limiting its suitability for smaller organizations.

Advantages and Disadvantages of Traditional Budgeting

Traditional budgeting offers simplicity and ease of implementation, making it suitable for organizations with stable operations and predictable expenses. However, its fixed allocation of resources often leads to inefficiencies, reduced flexibility, and limited insight into cost drivers, hindering dynamic financial management. The lack of alignment with specific activities can result in budget overruns or underspending, negatively impacting overall organizational performance and strategic goals.

Impact on Cost Control and Allocation

Activity-based budgeting (ABB) enhances cost control by assigning expenses directly to activities, resulting in more precise cost allocation and identification of cost drivers. Traditional budgeting allocates funds based on historical expenditures, often leading to less accurate cost distribution and potential inefficiencies. ABB's focus on activity costs improves resource management, making it more effective for dynamic operational environments compared to the more static, top-down approach of traditional budgeting.

Implementation Challenges for Both Methods

Activity-based budgeting faces challenges such as the need for detailed activity data collection and complex cost driver analysis, which can be resource-intensive and time-consuming. Traditional budgeting often struggles with inaccuracies due to reliance on historical data and limited flexibility to adapt to changing business conditions. Both methods require significant organizational commitment and skilled personnel to ensure accurate budget formulation and effective implementation.

Suitability for Different Business Types

Activity-based budgeting suits businesses with diverse products or services and complex cost structures, as it allocates resources based on activities driving costs. Traditional budgeting works well for stable, predictable businesses with straightforward operations and fixed expenses. Companies with dynamic environments benefit from activity-based budgeting's detailed cost insights, whereas those with consistent processes often prefer the simplicity of traditional budgeting.

Case Studies: ABB vs Traditional Budgeting

Case studies reveal Activity-Based Budgeting (ABB) enhances cost accuracy by allocating expenses based on actual activities, unlike Traditional Budgeting, which relies on historical data and fixed increments. Companies using ABB, such as manufacturing firms, report improved resource allocation and operational efficiency through detailed cost driver analysis. In contrast, Traditional Budgeting often results in budgetary slack and less adaptive financial planning, limiting responsiveness to market changes.

Choosing the Right Budgeting Approach for Your Organization

Activity-based budgeting allocates resources based on activities that drive costs, offering precise cost management tailored to operational drivers, while traditional budgeting typically relies on historical data and incremental adjustments. Organizations seeking enhanced cost control and strategic alignment benefit from activity-based budgeting's detailed insight into expense causality, whereas those prioritizing simplicity and lower administrative effort might prefer traditional methods. Selecting the optimal budgeting approach depends on factors such as organizational complexity, available data granularity, and the need for accurate cost attribution to support decision-making.

Important Terms

Cost Driver Analysis

Cost Driver Analysis identifies activities causing costs to more accurately allocate resources in Activity-Based Budgeting, enhancing precision over Traditional Budgeting's broad, volume-based cost allocations. By focusing on specific cost drivers such as machine hours, labor hours, or production batches, organizations achieve improved cost control and decision-making compared to the often less granular approach of Traditional Budgeting.

Resource Consumption Accounting

Resource Consumption Accounting (RCA) integrates with Activity-Based Budgeting (ABB) by providing detailed cost and resource usage data that improves budgeting accuracy compared to Traditional Budgeting, which relies on historical costs and often overlooks resource variability. RCA enhances ABB by aligning resource capacity and consumption with activities, enabling more precise cost management and dynamic budget adjustments based on actual operational drivers.

Indirect Cost Allocation

Indirect cost allocation in Activity-based budgeting (ABB) assigns overhead expenses to specific activities based on actual resource consumption, enhancing accuracy and cost transparency compared to Traditional budgeting, which allocates indirect costs using broad, volume-based measures often leading to cost distortions. ABB facilitates more precise financial planning and decision-making by linking costs directly to operations, unlike Traditional budgeting's reliance on arbitrary allocation bases that can obscure true cost drivers.

Zero-Based Budgeting

Zero-Based Budgeting (ZBB) allocates resources by justifying every expense from zero, offering more precise cost control compared to Traditional Budgeting, which relies on previous budgets with incremental increases. Unlike Activity-Based Budgeting (ABB), which focuses on budgeting based on activities driving costs, ZBB evaluates each function's necessity independently, leading to optimized resource allocation and reduced waste.

Standard Costing

Standard costing integrates with activity-based budgeting by assigning precise cost standards to activities, enabling more accurate expense forecasts compared to traditional budgeting, which often relies on aggregated and less detailed cost allocations. Activity-based budgeting enhances cost control by focusing on resource drivers and activity costs, while traditional budgeting typically emphasizes incremental adjustments based on historical financial data.

Overhead Absorption

Overhead absorption in Activity-based budgeting allocates costs based on actual activities driving overhead, enhancing accuracy and cost control compared to Traditional budgeting, which often uses arbitrary allocation bases like direct labor hours, potentially distorting product costs. This distinction allows Activity-based budgeting to provide more precise insights into overhead consumption, improving strategic decision-making and resource allocation.

Process Mapping

Process mapping enhances visibility into cost drivers and resource allocation, enabling more accurate Activity-Based Budgeting (ABB) by linking expenses directly to business activities, unlike Traditional Budgeting which relies on historical financial data and often overlooks process-level efficiencies. Integrating process maps with ABB facilitates strategic decision-making by identifying non-value-added activities and optimizing resource distribution, leading to improved cost control and operational performance.

Value Chain Analysis

Value Chain Analysis enhances cost management by identifying key activities that drive value, enabling Activity-Based Budgeting (ABB) to allocate resources more accurately based on actual activity costs rather than arbitrary estimates typical in Traditional Budgeting. ABB improves financial planning precision by linking budget allocations directly to value-creating business processes, whereas Traditional Budgeting often relies on historical data without reflecting the true cost dynamics within the value chain.

Incremental Budgeting

Incremental budgeting adjusts previous budgets by a fixed percentage, often leading to inefficiencies compared to Activity-based budgeting (ABB), which allocates funds based on detailed cost drivers and activities, enhancing resource optimization. Traditional budgeting relies on historical data with minimal analytical focus, whereas ABB provides a more accurate and strategic financial plan by aligning expenditures directly with organizational activities and value creation.

Performance Measurement

Performance measurement in activity-based budgeting (ABB) focuses on cost drivers and resource usage, providing detailed insights into operational efficiency and cost control, unlike traditional budgeting which emphasizes overall expenses and revenue targets without linking costs to activities. ABB enables more accurate performance evaluation by aligning budget allocations with specific business processes, improving decision-making and accountability compared to the aggregated approach of traditional budgeting.

Activity-based budgeting vs Traditional budgeting Infographic

moneydif.com

moneydif.com