A flexible budget adjusts based on actual activity levels, allowing for more accurate performance evaluation by reflecting real-time changes in costs and revenues. In contrast, a static budget remains fixed regardless of fluctuations in production or sales volume, often leading to variances that do not account for operational shifts. Companies use flexible budgets to improve financial planning and control by aligning budget expectations dynamically with actual business conditions.

Table of Comparison

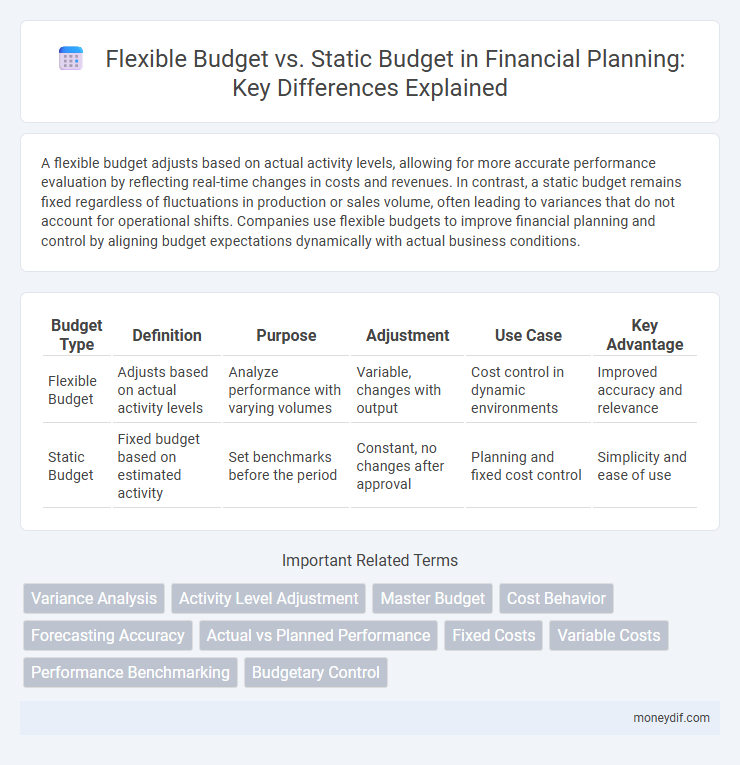

| Budget Type | Definition | Purpose | Adjustment | Use Case | Key Advantage |

|---|---|---|---|---|---|

| Flexible Budget | Adjusts based on actual activity levels | Analyze performance with varying volumes | Variable, changes with output | Cost control in dynamic environments | Improved accuracy and relevance |

| Static Budget | Fixed budget based on estimated activity | Set benchmarks before the period | Constant, no changes after approval | Planning and fixed cost control | Simplicity and ease of use |

Introduction to Flexible and Static Budgets

Flexible budgets adjust based on actual activity levels, providing a dynamic framework for budgeting that reflects changes in production or sales volume. Static budgets remain fixed regardless of activity variations, offering a set benchmark that is useful for planning but less adaptable to real-time fluctuations. Understanding the distinctions between flexible and static budgets is crucial for accurate financial management and performance evaluation.

Definition of Flexible Budget

A flexible budget adjusts expected costs and revenues based on varying levels of actual activity, enabling more accurate performance evaluation and resource allocation. Unlike a static budget, which remains fixed regardless of changes in output or sales volume, a flexible budget dynamically aligns with real-time operational conditions. This adaptability allows organizations to manage financial performance effectively under fluctuating business environments.

Definition of Static Budget

A static budget is a fixed financial plan that establishes revenue and expense targets based on a specific level of activity, remaining unchanged regardless of actual performance variations. It is typically prepared before the beginning of a fiscal period and does not adjust for fluctuations in sales volume, production, or other operational factors. Static budgets facilitate straightforward comparisons between planned and actual outcomes but may lack responsiveness to dynamic business environments.

Key Differences Between Flexible and Static Budgets

Flexible budgets adjust based on actual activity levels, allowing businesses to compare real performance with variable costs, while static budgets remain fixed regardless of changes in production or sales volume. Key differences include adaptability, as flexible budgets reflect operational changes and provide more accurate cost control, whereas static budgets are useful for setting initial financial targets but may lead to variances when assumptions shift. The adjustable nature of flexible budgets supports dynamic decision-making, whereas static budgets serve as a benchmark for evaluating overall financial discipline.

Advantages of Flexible Budget

Flexible budgets provide real-time adaptability by adjusting costs based on actual activity levels, enhancing accuracy in financial planning and control. They facilitate better performance evaluation by comparing actual expenses with variable budgeted amounts aligned to operational output. This dynamic approach improves resource allocation and supports more effective decision-making under varying business conditions.

Advantages of Static Budget

Static budgets provide clear financial targets based on predetermined costs and revenues, facilitating straightforward performance evaluation and variance analysis. They enable organizations to maintain strict cost control and resource allocation within fixed limits, promoting disciplined fiscal management. Stability in planning allows for consistent financial reporting and simplifies budget communication across departments.

Limitations of Flexible Budget

Flexible budgets face limitations in their reliance on accurate and timely data inputs, which can lead to incorrect variance analysis if actual activity levels or costs are misestimated. They often struggle with quickly changing market conditions or unexpected economic fluctuations, making adjustments less effective in dynamic environments. Furthermore, the complexity of preparing and updating flexible budgets requires significant time and resources, potentially reducing their practical applicability in fast-paced decision-making scenarios.

Limitations of Static Budget

Static budgets fail to accommodate changes in actual activity levels, leading to inaccurate financial planning and performance evaluation. This rigidity can result in variances that obscure true operational efficiency, as the budget remains fixed regardless of fluctuations in sales volume or production costs. Consequently, static budgets provide limited insight for dynamic business environments where flexibility is crucial for effective resource allocation and decision-making.

When to Use Flexible vs Static Budgets

Flexible budgets are ideal for businesses experiencing variable activity levels, allowing adjustments based on actual performance to provide more accurate financial analysis. Static budgets are best suited for organizations with stable, predictable operations where fixed allocations are necessary for control and planning. Choosing between flexible and static budgets depends on the level of uncertainty in business volume and the need for adaptability in financial management.

Conclusion: Choosing the Right Budgeting Approach

Choosing the right budgeting approach depends on the organization's need for adaptability and accuracy in financial planning. Flexible budgets provide dynamic adjustments based on actual activity levels, enhancing variance analysis and responsiveness to operational changes. Static budgets serve well in stable environments with predictable expenses, offering straightforward benchmarks but limited flexibility.

Important Terms

Variance Analysis

Variance analysis evaluates discrepancies between flexible and static budgets by comparing actual performance against budgeted figures adjusted for actual activity levels. This process isolates variances caused by changes in volume from those due to operational efficiency, enabling precise financial performance assessment.

Activity Level Adjustment

Activity Level Adjustment refines budget comparisons by aligning flexible budget costs with actual activity levels, contrasting static budgets fixed at predetermined volumes. This adjustment enables more accurate variance analysis by isolating performance differences from changes in activity, enhancing budgetary control and decision-making.

Master Budget

The master budget integrates all lower-level budgets into a comprehensive financial plan, serving as a benchmark for both static and flexible budgets. Unlike the static budget, which remains fixed regardless of activity levels, the flexible budget adjusts based on actual output, providing more accurate performance evaluations.

Cost Behavior

Cost behavior analysis reveals how costs change in response to activity levels, crucial for comparing flexible budgets that adjust expenses based on actual output with static budgets fixed at predetermined activity levels, enabling more accurate performance evaluation and variance analysis. Understanding direct, variable, and fixed costs within these budget types helps managers identify inefficiencies and control expenditures effectively.

Forecasting Accuracy

Forecasting accuracy improves when comparing flexible budgets to static budgets, as flexible budgets adjust for actual activity levels, providing a more realistic basis for performance evaluation. Flexible budgets enhance variance analysis by incorporating changes in operational volume, leading to more precise financial planning and control.

Actual vs Planned Performance

Actual vs planned performance analysis compares real financial outcomes with forecasted targets, highlighting variances caused by operational efficiency and market conditions. Flexible budgets adjust expected costs and revenues based on actual activity levels, providing a more accurate benchmark than static budgets that remain fixed regardless of volume changes.

Fixed Costs

Fixed costs remain constant regardless of activity levels, making them easier to predict in static budgets, which assume a single level of output. In contrast, flexible budgets adjust fixed costs to reflect changes in operational conditions and provide more accurate cost control and performance evaluation.

Variable Costs

Variable costs fluctuate directly with production volume and are captured accurately in a flexible budget, which adjusts cost estimates based on actual activity levels, unlike a static budget that remains fixed regardless of output changes. This adaptability makes flexible budgets more effective for cost control and performance evaluation in dynamic operating environments.

Performance Benchmarking

Performance benchmarking involves comparing actual financial outcomes against flexible budgets that adjust for real activity levels, providing a more accurate measure of efficiency than static budgets which remain fixed regardless of operational changes. This dynamic comparison highlights variances attributable to both cost control and activity volume, enabling precise performance evaluation and strategic decision-making.

Budgetary Control

Budgetary control evaluates performance by comparing actual costs to a static budget fixed at the start of the period, while a flexible budget adjusts for changes in activity levels, providing a more accurate analysis of variances. Utilizing a flexible budget in budgetary control enables managers to distinguish between cost variances due to efficiency and those caused by volume changes, enhancing financial decision-making.

flexible budget vs static budget Infographic

moneydif.com

moneydif.com