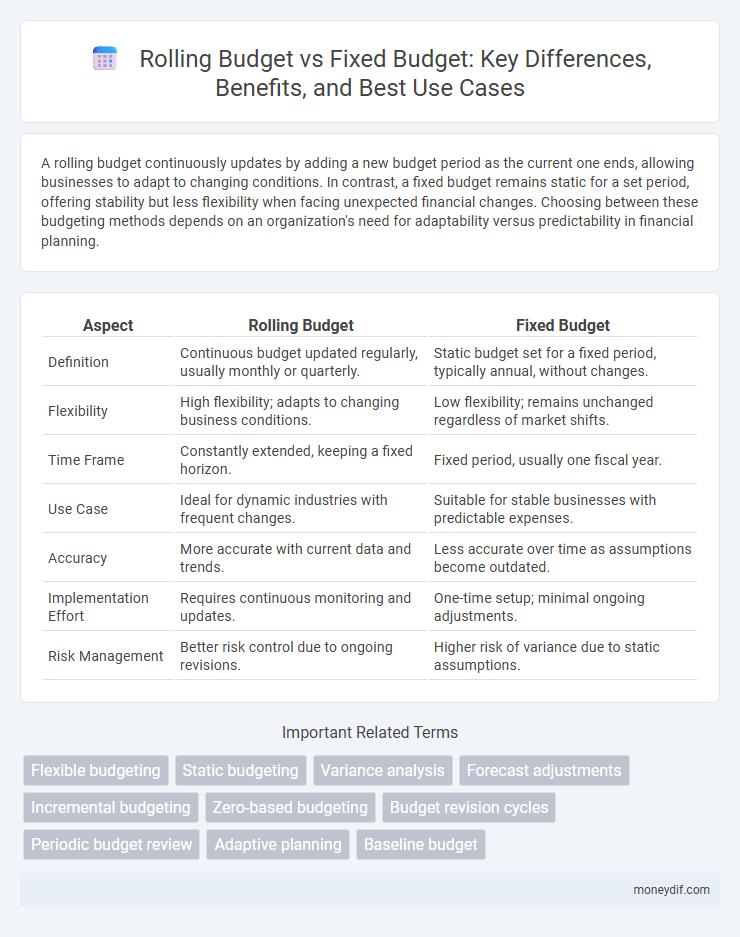

A rolling budget continuously updates by adding a new budget period as the current one ends, allowing businesses to adapt to changing conditions. In contrast, a fixed budget remains static for a set period, offering stability but less flexibility when facing unexpected financial changes. Choosing between these budgeting methods depends on an organization's need for adaptability versus predictability in financial planning.

Table of Comparison

| Aspect | Rolling Budget | Fixed Budget |

|---|---|---|

| Definition | Continuous budget updated regularly, usually monthly or quarterly. | Static budget set for a fixed period, typically annual, without changes. |

| Flexibility | High flexibility; adapts to changing business conditions. | Low flexibility; remains unchanged regardless of market shifts. |

| Time Frame | Constantly extended, keeping a fixed horizon. | Fixed period, usually one fiscal year. |

| Use Case | Ideal for dynamic industries with frequent changes. | Suitable for stable businesses with predictable expenses. |

| Accuracy | More accurate with current data and trends. | Less accurate over time as assumptions become outdated. |

| Implementation Effort | Requires continuous monitoring and updates. | One-time setup; minimal ongoing adjustments. |

| Risk Management | Better risk control due to ongoing revisions. | Higher risk of variance due to static assumptions. |

Understanding Rolling Budgets: Definition and Key Features

A rolling budget is a dynamic financial plan that continuously updates by adding a new budget period as the most recent one concludes, ensuring a consistent forecasting horizon. Unlike fixed budgets, rolling budgets adapt to changing business conditions, providing enhanced flexibility and more accurate resource allocation. Key features include ongoing revisions, continuous planning cycles, and real-time alignment with organizational goals and market trends.

What is a Fixed Budget? Core Principles Explained

A fixed budget allocates a predetermined amount of resources and expenses for a specific period, regardless of changes in actual activity levels. It is based on forecasted data and remains unchanged, serving as a benchmark for performance evaluation. Core principles include strict adherence to cost control, emphasizing predictability and stability in financial planning.

Advantages of Rolling Budgets for Modern Businesses

Rolling budgets offer modern businesses enhanced flexibility by continuously updating financial plans to reflect real-time market changes, promoting more accurate forecasting and resource allocation. This dynamic approach enables quicker adaptation to economic fluctuations, improving decision-making and operational efficiency. Businesses benefit from better risk management and strategic agility compared to the static nature of fixed budgets.

Fixed Budgets: Benefits and Suitable Use Cases

Fixed budgets provide businesses with clear financial targets, enabling consistent expense control and easier performance evaluation. They are ideal for stable environments with predictable costs, such as manufacturing or utilities, where expenses remain relatively constant over time. This budgeting approach simplifies planning and reduces administrative effort, supporting efficient resource allocation and long-term financial stability.

Drawbacks of Rolling Budgets: Challenges and Limitations

Rolling budgets require continuous updating, which can be time-consuming and resource-intensive for organizations with limited financial staff. Frequent adjustments may lead to short-term focus, undermining long-term strategic planning and causing potential volatility in financial projections. The complexity of forecasting frequently changing market conditions also increases the risk of inaccuracies and complicates performance evaluation.

Limitations of Fixed Budgets: Common Pitfalls

Fixed budgets often fail to accommodate unexpected changes in market conditions or operational costs, leading to inaccurate financial projections. Their rigidity can restrict organizational flexibility, making it difficult to respond swiftly to fluctuating demand or unplanned expenses. This inflexibility commonly results in resource misallocation and decreased efficiency, undermining overall budget effectiveness.

Comparing Rolling and Fixed Budgets: Key Differences

Rolling budgets are continuously updated, incorporating actual performance data to adjust future projections dynamically, while fixed budgets remain static during the fiscal period regardless of changes in business conditions. Rolling budgets enhance flexibility and responsiveness by revising forecasts regularly, leading to more accurate resource allocation and improved financial control. Fixed budgets provide stability and simplicity, making them suitable for organizations with predictable expenses and revenue streams, but they risk becoming outdated if market conditions shift significantly.

Selecting the Right Budgeting Approach for Your Organization

Selecting the right budgeting approach involves evaluating the flexibility needs and operational dynamics of your organization. A rolling budget continuously updates forecasts based on recent data, promoting adaptability in fluctuating markets, while a fixed budget remains static, providing stability and ease of control but less responsiveness. Organizations facing rapid change often benefit more from rolling budgets, whereas those with stable environments may find fixed budgets more effective for long-term planning.

Industry Trends: Rolling vs Fixed Budgets in Practice

Rolling budgets gain traction in dynamic industries by enabling continuous financial adjustments based on real-time data, enhancing responsiveness to market fluctuations. Fixed budgets remain prevalent in stable sectors where predictable costs and revenue are essential for long-term planning and compliance. Industry trends show a growing preference for rolling budgets in technology, retail, and manufacturing due to their flexibility and alignment with agile business strategies.

Best Practices for Effective Budget Implementation

Rolling budgets provide flexibility by continuously updating forecasts based on actual performance, enhancing responsiveness to market changes. Fixed budgets establish clear financial targets and control costs by setting predetermined limits, supporting stability and discipline in resource allocation. Combining rolling updates with fixed budget guidelines promotes adaptive yet controlled financial planning, optimizing budget accuracy and organizational agility.

Important Terms

Flexible budgeting

Flexible budgeting adjusts costs based on actual activity levels, offering more adaptability compared to fixed budgets, while rolling budgets continuously update projections to reflect changing conditions and provide ongoing financial planning accuracy.

Static budgeting

Static budgeting allocates a fixed amount based on initial estimates, while rolling budgets continuously update financial plans to reflect changing business conditions.

Variance analysis

Variance analysis compares actual financial performance against budgeted expectations, highlighting differences between a rolling budget, which is continuously updated based on recent data and forecasts, and a fixed budget, established for a set period without adjustments. Rolling budget variance analysis enables more flexible and accurate financial control by identifying deviations in real-time, whereas fixed budget variance analysis may overlook changing economic conditions or business dynamics.

Forecast adjustments

Forecast adjustments in a rolling budget allow continuous financial updates based on real-time data, offering more flexibility compared to the static assumptions of a fixed budget.

Incremental budgeting

Incremental budgeting adjusts previous budgets by a fixed percentage, making it less flexible compared to rolling budgets that are continuously updated, whereas fixed budgets remain static throughout the period regardless of changes.

Zero-based budgeting

Zero-based budgeting requires justifying all expenses from scratch, making it more adaptable compared to fixed budgets, while rolling budgets continuously update forecasts for better alignment with actual performance.

Budget revision cycles

Budget revision cycles differ significantly between rolling and fixed budgets, with rolling budgets undergoing continuous updates--typically monthly or quarterly--to reflect real-time financial data, enhancing responsiveness to market changes. Fixed budgets, in contrast, are established annually without interim revisions, potentially limiting adaptability and accuracy in dynamic business environments.

Periodic budget review

Periodic budget reviews enable organizations to adjust rolling budgets flexibly throughout the fiscal year, contrasting fixed budgets that remain static despite changing financial conditions.

Adaptive planning

Adaptive planning improves financial accuracy by enabling continuous updates in a rolling budget, unlike the static nature of a fixed budget.

Baseline budget

A baseline budget serves as a fixed financial plan against which rolling budgets, which are continuously updated forecasts, are compared to enhance adaptive financial planning and control.

Rolling budget vs Fixed budget Infographic

moneydif.com

moneydif.com