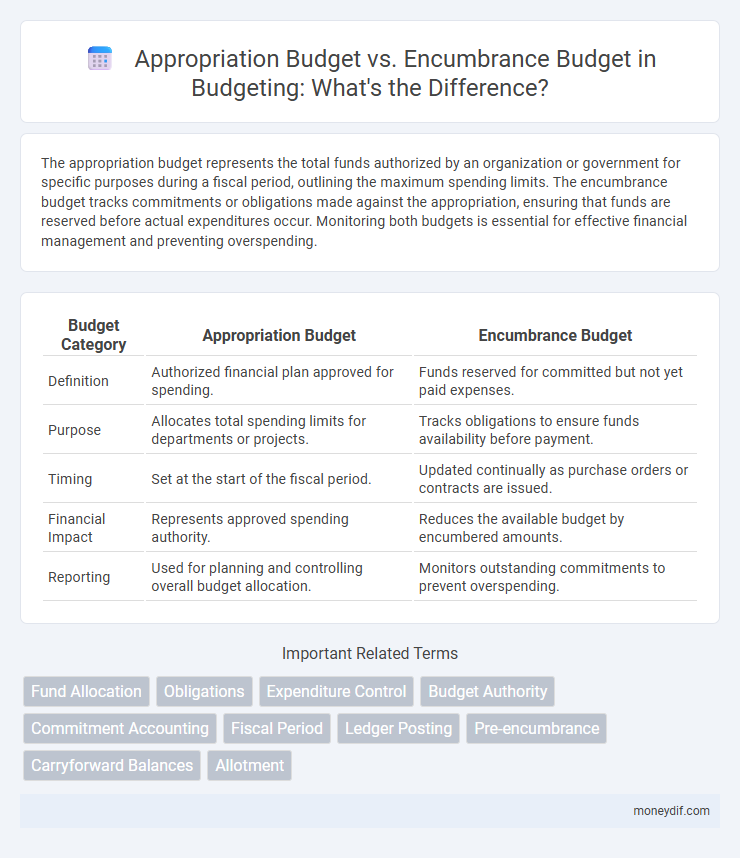

The appropriation budget represents the total funds authorized by an organization or government for specific purposes during a fiscal period, outlining the maximum spending limits. The encumbrance budget tracks commitments or obligations made against the appropriation, ensuring that funds are reserved before actual expenditures occur. Monitoring both budgets is essential for effective financial management and preventing overspending.

Table of Comparison

| Budget Category | Appropriation Budget | Encumbrance Budget |

|---|---|---|

| Definition | Authorized financial plan approved for spending. | Funds reserved for committed but not yet paid expenses. |

| Purpose | Allocates total spending limits for departments or projects. | Tracks obligations to ensure funds availability before payment. |

| Timing | Set at the start of the fiscal period. | Updated continually as purchase orders or contracts are issued. |

| Financial Impact | Represents approved spending authority. | Reduces the available budget by encumbered amounts. |

| Reporting | Used for planning and controlling overall budget allocation. | Monitors outstanding commitments to prevent overspending. |

Understanding Appropriation Budgets

Appropriation budgets allocate specific funds authorized by a legislative body for designated purposes within a fiscal period, ensuring legal spending limits. These budgets serve as a financial framework that guides governmental or organizational spending, preventing overspending by defining the maximum allowed expenditures. Understanding appropriation budgets is critical for effective fiscal management, as they establish spending authority before encumbrances or expenses occur.

What Are Encumbrance Budgets?

Encumbrance budgets represent funds reserved for specific expenditures before actual payments are made, ensuring that allocated money is set aside to cover anticipated obligations. Unlike appropriation budgets, which outline the total authorized spending limit, encumbrance budgets track commitments such as purchase orders or contracts that reduce available funds. This accounting control helps organizations prevent overspending by reflecting money that is earmarked but not yet disbursed.

Key Differences Between Appropriation and Encumbrance Budgets

Appropriation budgets allocate specific funds authorized by a governing body for particular purposes, establishing legal spending limits for a fiscal period. Encumbrance budgets track commitments or obligations against these appropriated funds, ensuring that future expenditures align with available resources before actual disbursement. Understanding the distinction between appropriation budgets, which define the spending authority, and encumbrance budgets, which monitor reserved funds for planned expenses, is crucial for effective fiscal management and preventing budget overruns.

Purpose and Function of Appropriation Budgets

Appropriation budgets allocate specific funds authorized by legislation to cover planned expenses, ensuring legal compliance and fiscal control over government or organizational spending. They function as a financial plan that sets spending limits for departments or projects, enabling effective resource management and accountability. Unlike encumbrance budgets, which track committed funds for future expenditures, appropriation budgets focus on the authorized spending authority within a fiscal period.

How Encumbrance Budgets Support Financial Management

Encumbrance budgets enhance financial management by reserving funds for anticipated expenditures, preventing overspending and ensuring compliance with budget limits. They provide real-time tracking of committed amounts against the budget appropriation, allowing accurate forecasting and cash flow control. This proactive allocation fosters accountability and supports effective resource planning within organizations.

Benefits of Appropriation Budgeting

Appropriation budgeting allocates specific funds to departments or projects, ensuring clear financial boundaries and accountability. It enhances fiscal control by legally authorizing expenditures, reducing the risk of overspending and enabling better cash flow management. This method supports strategic planning and prioritization, allowing organizations to allocate resources efficiently according to their goals and regulatory requirements.

Tracking Commitments with Encumbrance Budgets

Encumbrance budgets track financial commitments by reserving funds for anticipated expenditures before actual payments occur, providing real-time visibility into available resources. Appropriation budgets allocate authorized spending limits approved by governing bodies but do not capture ongoing purchase orders or contracts. Using encumbrance budgeting ensures accurate monitoring of obligations, preventing overspending and enhancing fiscal control.

Appropriation vs. Encumbrance: Impact on Fiscal Control

Appropriation budget establishes the maximum authorized spending limits approved for a fiscal period, serving as a legal control to prevent overspending. Encumbrance budget records commitments for specific expenses before actual payments, ensuring funds are reserved and not inadvertently over-allocated. Comparing appropriation vs. encumbrance highlights their combined impact on fiscal control by balancing spending authorization with real-time fund reservation and expenditure tracking.

Implementing Appropriation and Encumbrance Budgets in Organizations

Implementing appropriation and encumbrance budgets in organizations ensures precise financial control by allocating approved funds and reserving necessary amounts for future commitments. Appropriation budgets define legal spending limits, while encumbrance budgets track obligations before actual expenditure, enhancing transparency and preventing overspending. Effective integration of both budgets supports accurate financial planning, real-time budget monitoring, and compliance with regulatory requirements.

Best Practices for Managing Appropriation and Encumbrance Budgets

Effective management of appropriation and encumbrance budgets involves regularly reconciling budgeted amounts with actual expenditures to prevent overspending and identify discrepancies early. Implementing automated tracking systems enhances accuracy by providing real-time visibility into committed funds and available appropriations. Establishing clear policies for timely encumbrance recording and periodic review ensures alignment with organizational financial goals and compliance requirements.

Important Terms

Fund Allocation

Fund allocation distinguishes between appropriation budgets, which authorize maximum expenditure limits based on legislative approvals, and encumbrance budgets that reserve specific funds for anticipated commitments to ensure financial control. Tracking appropriation ensures compliance with legal spending limits, while monitoring encumbrances provides real-time visibility into funds tied to purchase orders or contracts, preventing budget overruns.

Obligations

Obligations represent the legal commitment of funds within the appropriation budget, ensuring that resources are reserved for specific contracts or purchases, whereas the encumbrance budget reflects the administrative reservation of funds for anticipated expenses before actual expenditures occur. Managing obligations accurately within the appropriation budget is critical for maintaining fiscal control and preventing overspending in government financial operations.

Expenditure Control

Expenditure control involves monitoring actual spending against the appropriation budget, which sets the authorized funding limits, and the encumbrance budget, which accounts for committed but not yet incurred expenses. Effective management ensures that encumbrances do not exceed appropriations, preventing budget overruns and maintaining financial accountability.

Budget Authority

Budget Authority defines the legally approved limit for spending within an appropriation budget, establishing the maximum funds available for specific purposes. Encumbrance budget tracks commitments or obligations against these appropriated funds, ensuring that spending does not exceed authorized limits before actual expenses occur.

Commitment Accounting

Commitment accounting tracks financial obligations by recording encumbrances against the appropriation budget to ensure funds are reserved for specific contracts or purchase orders before actual expenditures occur. This process helps maintain budgetary control by comparing encumbrance budgets to appropriation budgets, preventing overspending and enabling accurate forecasting of available resources.

Fiscal Period

The fiscal period defines the specific time frame in which the appropriation budget, representing authorized spending limits, is allocated and monitored against the encumbrance budget, which accounts for committed funds not yet expended. Managing the relationship between appropriation and encumbrance budgets during the fiscal period ensures accurate tracking of available resources and prevents overspending within government or organizational financial operations.

Ledger Posting

Ledger posting records financial transactions by comparing appropriation budgets, which allocate specific funds for planned expenditures, against encumbrance budgets that track committed but not yet spent amounts. This process ensures accurate budget control, preventing overspending by updating the general ledger according to real-time obligations and available appropriations.

Pre-encumbrance

Pre-encumbrance represents a financial commitment in the appropriation budget that reserves funds before a purchase order is fully approved, ensuring budget availability without immediately impacting the encumbrance budget. It functions as an early hold on funds within the appropriation budget, distinguishing it from the encumbrance budget where funds are formally obligated after purchase authorization.

Carryforward Balances

Carryforward balances represent unspent funds from an appropriation budget that are authorized to be used in a subsequent fiscal period, ensuring financial resources remain available beyond the original budget year. These balances differ from encumbrance budgets, which specifically reserve funds for committed expenditures, thereby preventing overspending before actual costs are incurred.

Allotment

Allotment represents the specific portion of the appropriation budget allocated for spending within a fiscal period, ensuring funds are available for planned expenses. Encumbrance budget captures commitments against the allotment for contracts or purchase orders, preventing overspending by reserving funds before actual disbursement.

appropriation budget vs encumbrance budget Infographic

moneydif.com

moneydif.com