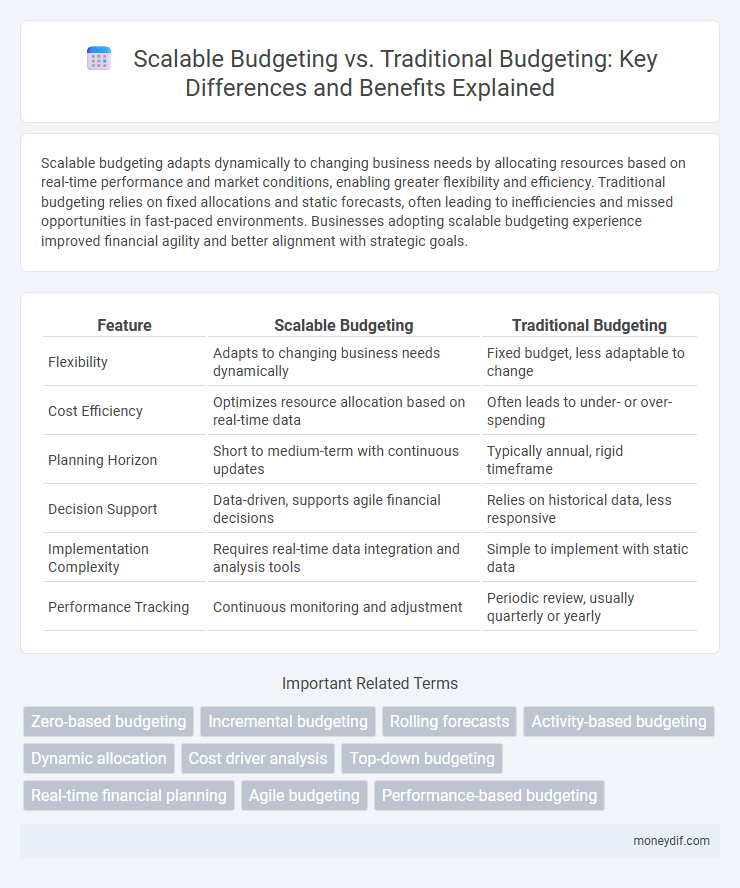

Scalable budgeting adapts dynamically to changing business needs by allocating resources based on real-time performance and market conditions, enabling greater flexibility and efficiency. Traditional budgeting relies on fixed allocations and static forecasts, often leading to inefficiencies and missed opportunities in fast-paced environments. Businesses adopting scalable budgeting experience improved financial agility and better alignment with strategic goals.

Table of Comparison

| Feature | Scalable Budgeting | Traditional Budgeting |

|---|---|---|

| Flexibility | Adapts to changing business needs dynamically | Fixed budget, less adaptable to change |

| Cost Efficiency | Optimizes resource allocation based on real-time data | Often leads to under- or over-spending |

| Planning Horizon | Short to medium-term with continuous updates | Typically annual, rigid timeframe |

| Decision Support | Data-driven, supports agile financial decisions | Relies on historical data, less responsive |

| Implementation Complexity | Requires real-time data integration and analysis tools | Simple to implement with static data |

| Performance Tracking | Continuous monitoring and adjustment | Periodic review, usually quarterly or yearly |

Introduction to Scalable and Traditional Budgeting

Scalable budgeting adapts dynamically to fluctuating business conditions, allowing for flexible allocation of resources based on real-time data and growth projections. Traditional budgeting follows a fixed, annual financial plan, often limiting responsiveness to market changes and operational demands. Businesses adopting scalable budgeting achieve greater agility and accuracy in financial planning compared to the rigid structure of traditional methods.

Key Differences Between Scalable and Traditional Budgeting

Scalable budgeting adapts dynamically to changing business conditions by allowing flexible allocation and real-time adjustments, unlike traditional budgeting which relies on fixed annual estimates and rigid processes. Key differences include scalability supporting continuous forecasting and responsiveness, while traditional methods often result in static, inflexible financial plans. Scalable budgeting leverages data-driven insights and automated tools to optimize resource allocation, improving accuracy and strategic agility.

Benefits of Scalable Budgeting

Scalable budgeting adapts dynamically to changing business conditions, enabling real-time allocation of resources and optimizing financial performance. It promotes flexibility by allowing organizations to adjust budgets quickly in response to market fluctuations, enhancing decision-making accuracy compared to traditional static budgets. This approach improves resource efficiency and supports sustainable growth by aligning expenditures directly with current operational needs.

Drawbacks of Traditional Budgeting Methods

Traditional budgeting methods often lack flexibility, making it difficult for organizations to adapt to rapid market changes and unexpected financial challenges. These static budgets can lead to inefficient resource allocation and hinder timely decision-making, reducing overall business agility. Furthermore, traditional approaches frequently rely on historical data, which may not accurately reflect future conditions, resulting in less accurate financial planning.

Flexibility and Adaptability in Budgeting Approaches

Scalable budgeting offers superior flexibility by allowing organizations to adjust financial plans dynamically based on real-time data and changing market conditions, unlike traditional budgeting which often relies on fixed, rigid allocations. This adaptability ensures that resources can be efficiently reallocated in response to unexpected challenges or opportunities, enhancing overall financial agility. Consequently, scalable budgeting supports continuous optimization and strategic responsiveness, critical for maintaining competitive advantage in volatile environments.

Technology’s Role in Scalable Budgeting

Technology enables scalable budgeting by automating data collection, real-time analytics, and forecasting, which enhances accuracy and responsiveness compared to traditional budgeting methods. Cloud-based platforms facilitate collaboration across departments, allowing dynamic adjustments to budgets as business conditions evolve. Machine learning algorithms identify spending patterns and opportunities for cost optimization, driving more strategic financial planning.

Impact on Organizational Growth

Scalable budgeting enables organizations to dynamically adjust financial plans based on real-time data, fostering agile decision-making and supporting rapid business expansion. This approach enhances resource allocation efficiency compared to traditional budgeting, which often relies on static forecasts that may hinder responsiveness to market changes. As a result, scalable budgeting drives sustainable organizational growth by aligning expenditures more closely with evolving strategic priorities.

Implementation Challenges and Solutions

Scalable budgeting faces implementation challenges such as data integration complexities, real-time forecasting demands, and dynamic resource allocation, which traditional budgeting methods often lack. Solutions include leveraging advanced financial software, adopting agile planning frameworks, and continuous stakeholder collaboration to enhance accuracy and flexibility. These approaches enable organizations to adapt budgeting processes swiftly to changing market conditions and operational needs.

Case Studies: Scalable vs Traditional Budgeting

Case studies comparing scalable budgeting and traditional budgeting reveal scalable budgeting's superior adaptability in dynamic market conditions, enabling businesses to reallocate resources swiftly and improve financial performance. Companies adopting scalable budgeting report enhanced forecasting accuracy and operational flexibility, leading to increased ROI and reduced budget variances compared to static, traditional approaches. Data from diverse industries consistently highlights scalable budgeting's role in accelerating decision-making while maintaining robust control over expenditures.

Choosing the Right Budgeting Method for Your Business

Scalable budgeting offers dynamic allocation of resources based on real-time business performance, making it ideal for fast-growing companies or those operating in volatile markets. Traditional budgeting relies on fixed annual allocations, providing predictability but lacking flexibility to adapt to sudden changes in revenue or expenses. Businesses seeking to optimize financial efficiency should evaluate their growth stage, industry volatility, and internal reporting capabilities when choosing between scalable and traditional budgeting methods.

Important Terms

Zero-based budgeting

Zero-based budgeting enhances financial efficiency by requiring every expense to be justified from scratch, contrasting with traditional budgeting's reliance on previous budgets and offering more scalability for dynamic resource allocation.

Incremental budgeting

Incremental budgeting adjusts previous budgets by a fixed percentage, offering less flexibility than scalable budgeting, which dynamically allocates resources based on changing organizational needs and growth opportunities.

Rolling forecasts

Rolling forecasts enable real-time financial planning by continuously updating projections, offering greater adaptability and accuracy compared to traditional budgeting's fixed annual cycles. Scalable budgeting leverages rolling forecasts to dynamically allocate resources, enhancing responsiveness to market changes and improving strategic decision-making.

Activity-based budgeting

Activity-based budgeting (ABB) allocates costs based on actual activities driving expenses, offering more precise cost control and scalability compared to traditional budgeting, which relies on historical data and fixed line items. ABB enhances scalability by enabling dynamic adjustments aligned with operational changes, whereas traditional budgeting often lacks flexibility and accuracy in rapidly evolving business environments.

Dynamic allocation

Dynamic allocation enhances scalable budgeting by continuously adjusting resources based on real-time performance metrics, unlike traditional budgeting's fixed and static resource distribution.

Cost driver analysis

Cost driver analysis identifies key factors influencing expenses, enabling scalable budgeting to dynamically adjust resource allocation, unlike traditional budgeting which relies on fixed assumptions and static cost estimates.

Top-down budgeting

Top-down budgeting enables scalable budgeting by setting overall financial targets from leadership that align with organizational growth, unlike traditional budgeting which involves detailed bottom-up estimates limiting flexibility and scalability.

Real-time financial planning

Real-time financial planning enhances scalability by enabling dynamic budgeting adjustments based on current data, unlike traditional budgeting which relies on fixed, periodic forecasts.

Agile budgeting

Agile budgeting enhances financial flexibility by allowing iterative adjustments based on real-time project feedback, contrasting with traditional budgeting's fixed annual allocations. Scalable budgeting supports Agile by enabling dynamic resource reallocation aligned with changing priorities and market conditions, leading to improved responsiveness and optimized capital utilization.

Performance-based budgeting

Performance-based budgeting prioritizes resource allocation based on measurable outcomes, enabling scalable budgeting to adapt dynamically to organizational growth, unlike traditional budgeting which relies on fixed historical allocations.

Scalable budgeting vs Traditional budgeting Infographic

moneydif.com

moneydif.com