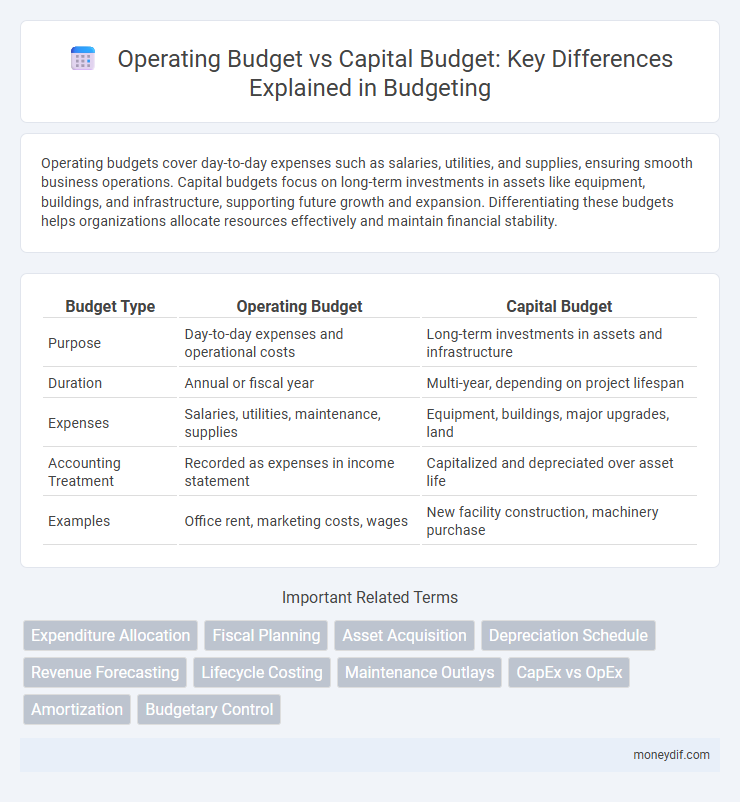

Operating budgets cover day-to-day expenses such as salaries, utilities, and supplies, ensuring smooth business operations. Capital budgets focus on long-term investments in assets like equipment, buildings, and infrastructure, supporting future growth and expansion. Differentiating these budgets helps organizations allocate resources effectively and maintain financial stability.

Table of Comparison

| Budget Type | Operating Budget | Capital Budget |

|---|---|---|

| Purpose | Day-to-day expenses and operational costs | Long-term investments in assets and infrastructure |

| Duration | Annual or fiscal year | Multi-year, depending on project lifespan |

| Expenses | Salaries, utilities, maintenance, supplies | Equipment, buildings, major upgrades, land |

| Accounting Treatment | Recorded as expenses in income statement | Capitalized and depreciated over asset life |

| Examples | Office rent, marketing costs, wages | New facility construction, machinery purchase |

Understanding Operating Budgets: Key Characteristics

Operating budgets focus on the day-to-day expenses required to run an organization, including salaries, utilities, and maintenance costs. These budgets are typically planned on an annual basis and emphasize short-term financial management to ensure smooth operations. Unlike capital budgets that deal with long-term investments in assets, operating budgets highlight ongoing operational functions and resource allocation.

Capital Budgets Explained: Purpose and Scope

Capital budgets outline long-term investments in assets such as buildings, machinery, and infrastructure, emphasizing expenditures that enhance the organization's capacity or efficiency over multiple years. These budgets enable strategic planning by allocating funds for significant projects and large-scale purchases that support growth and operational sustainability. Unlike operating budgets focused on day-to-day expenses, capital budgets prioritize asset acquisition and improvement, often involving detailed cost-benefit analyses and multi-year forecasting.

Fundamental Differences Between Operating and Capital Budgets

Operating budgets detail day-to-day expenses such as salaries, utilities, and maintenance, ensuring the organization runs smoothly within a specific fiscal period. Capital budgets focus on long-term investments like purchasing equipment, infrastructure projects, and major asset acquisitions that provide value over multiple years. The fundamental difference lies in operating budgets managing recurring expenditures, while capital budgets allocate funds for significant, non-recurring investments with extended asset life.

Components of an Operating Budget

An operating budget primarily includes components such as projected revenues, direct and indirect expenses, and overhead costs necessary for daily business functions. Key elements encompass salaries, utilities, rent, supplies, and maintenance, ensuring smooth operations throughout the fiscal period. This budget contrasts with a capital budget, which focuses on long-term investments and asset acquisitions.

Elements of a Capital Budget

A capital budget primarily includes expenditures related to acquiring or upgrading physical assets such as buildings, machinery, and equipment, which are essential for long-term operations. It encompasses project costs, land purchases, construction expenses, and the acquisition of technology infrastructure. Unlike the operating budget, which covers daily expenses, the capital budget focuses on investments that improve organizational capacity and are often funded through debt or long-term financing.

Planning and Approval Processes

Operating budgets are typically planned and approved annually, focusing on short-term expenses such as salaries, utilities, and maintenance, with input from department managers and finance teams to ensure alignment with organizational goals. Capital budgets involve long-term investments like infrastructure, equipment, and major projects, requiring detailed proposals, cost-benefit analyses, and multi-level approvals often including executive leadership and board oversight. The planning process for capital budgets is more rigorous and time-consuming due to the substantial financial commitment and strategic impact compared to the more routine and recurring nature of operating budgets.

Impact on Financial Statements

Operating budgets primarily influence the income statement by detailing projected revenues and expenses, directly affecting net profit or loss. Capital budgets impact the balance sheet by outlining significant investments in fixed assets, which are then depreciated over time, influencing both asset values and future income statements. Together, these budgets provide a comprehensive financial overview, essential for accurate forecasting and strategic planning.

Short-Term vs Long-Term Financial Impacts

Operating budgets primarily cover short-term expenses such as salaries, utilities, and routine maintenance, directly affecting an organization's day-to-day financial stability. Capital budgets involve long-term investments in assets like infrastructure, equipment, and technology, influencing financial health over multiple years through depreciation and asset appreciation. Balancing operating and capital budgets is crucial for sustainable financial planning, as operating costs impact immediate cash flow while capital expenditures shape future growth and competitive advantage.

Common Challenges in Managing Budgets

Operating budgets often face challenges in accurately forecasting recurring expenses due to fluctuating operational costs, while capital budgets struggle with estimating long-term asset investments and project timelines. Common issues include unexpected cost overruns, shifting priorities, and limited flexibility in reallocating funds between operating and capital expenditures. Effective budget management requires continuous monitoring, realistic assumptions, and clear differentiation between operational needs and capital investments to avoid financial shortfalls.

Best Practices for Budget Optimization

Effective budget optimization requires clearly distinguishing between operating budgets, which cover day-to-day expenses, and capital budgets, allocated for long-term investments in assets or infrastructure. Best practices include regular review and adjustment of operating budgets to improve efficiency and ensuring capital budgets align with strategic goals to maximize return on investment. Implementing robust forecasting models and integrating performance metrics can enhance accuracy and facilitate informed decision-making.

Important Terms

Expenditure Allocation

Expenditure allocation differentiates operating budgets, which cover day-to-day expenses like salaries and utilities, from capital budgets that fund long-term investments in assets such as equipment, infrastructure, and technology upgrades. Effective allocation ensures sustainable financial management by balancing routine operational costs with strategic capital expenditures that drive organizational growth.

Fiscal Planning

Fiscal planning distinguishes between operating budgets, which allocate funds for day-to-day expenses such as salaries, utilities, and maintenance, and capital budgets, focused on long-term investments in assets like infrastructure, equipment, and technology. Effective budget management ensures optimal resource allocation, balancing immediate operational needs with strategic capital expenditures to promote sustainable financial health.

Asset Acquisition

Asset acquisition impacts the capital budget by requiring substantial upfront investment in long-term assets, while the operating budget manages ongoing expenses related to asset maintenance and operational use. Distinguishing between these budgets ensures accurate financial planning, as capital expenditures improve asset value, whereas operating costs affect day-to-day profitability.

Depreciation Schedule

A depreciation schedule outlines the systematic allocation of an asset's cost over its useful life, directly impacting the operating budget through expense recognition while the initial asset purchase affects the capital budget. Accurate tracking of depreciation ensures proper financial planning by distinguishing long-term capital expenditures from routine operational costs.

Revenue Forecasting

Revenue forecasting involves projecting future income streams based on operating budgets that cover day-to-day expenses like salaries and utilities, while capital budgets focus on long-term investments such as equipment and infrastructure. Accurate revenue forecasts integrate the impact of operating budget constraints and planned capital expenditures to ensure financial stability and support strategic growth initiatives.

Lifecycle Costing

Lifecycle costing integrates both operating and capital budgets by evaluating the total cost of asset ownership, including initial acquisition, operation, maintenance, and disposal expenses. This approach enables organizations to optimize investment decisions by forecasting long-term financial impacts rather than focusing solely on upfront capital expenditures.

Maintenance Outlays

Maintenance outlays are often categorized within operating budgets as routine expenses necessary for preserving asset functionality, whereas capital budgets allocate funds for significant repairs or upgrades that extend the useful life of assets. Differentiating maintenance spending between these budgets is crucial for accurate financial planning and compliance with accounting standards such as GASB or FASB.

CapEx vs OpEx

Capital expenditures (CapEx) refer to investments in physical assets that appear in the capital budget and provide long-term value, while operational expenditures (OpEx) encompass ongoing costs necessary for daily operations, reflected in the operating budget. Effective financial management distinguishes CapEx as budgeted for asset acquisition or improvement, whereas OpEx covers expenses such as salaries, utilities, and maintenance, impacting short-term profitability and cash flow.

Amortization

Amortization impacts the operating budget by allocating the cost of intangible assets over their useful life, reducing annual expenses without immediate cash outflow, while the capital budget records the initial expenditure as a capital investment. Distinguishing between these budgets ensures accurate financial planning, with amortization expenses included in operating costs and capital investments reflected in long-term asset acquisition.

Budgetary Control

Budgetary control involves monitoring and managing expenditures to ensure alignment with the operating budget, which covers day-to-day expenses, and the capital budget, which focuses on long-term investments in assets. Effective budgetary control balances these budgets by allocating resources efficiently to sustain operational activities while funding strategic capital projects.

operating budget vs capital budget Infographic

moneydif.com

moneydif.com