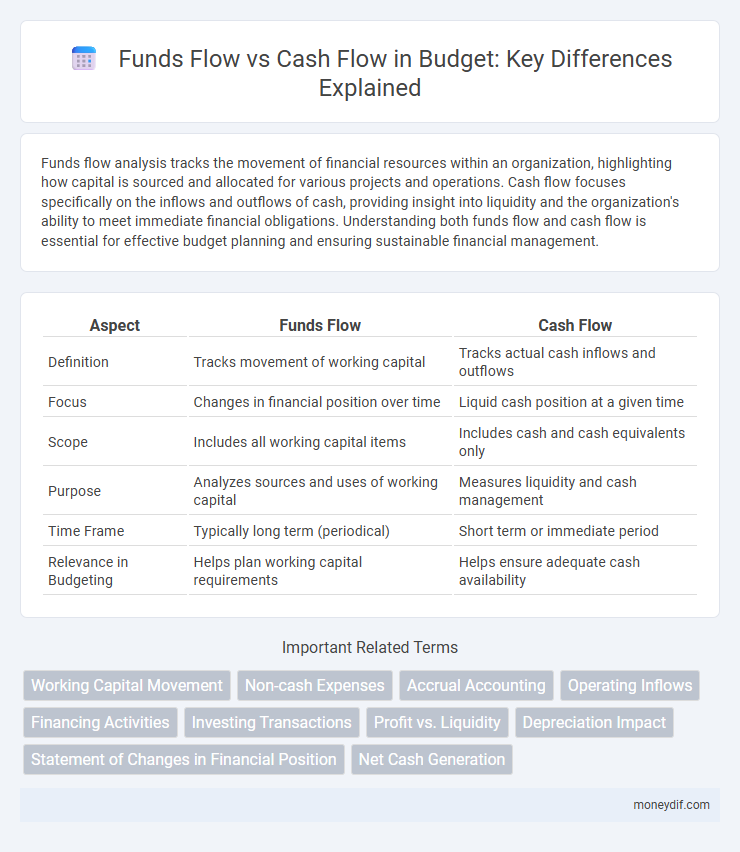

Funds flow analysis tracks the movement of financial resources within an organization, highlighting how capital is sourced and allocated for various projects and operations. Cash flow focuses specifically on the inflows and outflows of cash, providing insight into liquidity and the organization's ability to meet immediate financial obligations. Understanding both funds flow and cash flow is essential for effective budget planning and ensuring sustainable financial management.

Table of Comparison

| Aspect | Funds Flow | Cash Flow |

|---|---|---|

| Definition | Tracks movement of working capital | Tracks actual cash inflows and outflows |

| Focus | Changes in financial position over time | Liquid cash position at a given time |

| Scope | Includes all working capital items | Includes cash and cash equivalents only |

| Purpose | Analyzes sources and uses of working capital | Measures liquidity and cash management |

| Time Frame | Typically long term (periodical) | Short term or immediate period |

| Relevance in Budgeting | Helps plan working capital requirements | Helps ensure adequate cash availability |

Understanding Funds Flow and Cash Flow

Understanding funds flow involves tracking the movement of financial resources within an organization, highlighting how funds are generated and utilized over a period. Cash flow specifically measures the inflow and outflow of actual cash, providing insight into liquidity and operational efficiency. Analyzing both funds flow and cash flow is essential for effective budget management, ensuring sufficient cash availability while monitoring overall financial health.

Key Differences Between Funds Flow and Cash Flow

Funds flow analysis tracks the movement of working capital between balance sheet accounts over a period, highlighting changes in financial position and sources or uses of funds. Cash flow focuses specifically on the inflow and outflow of cash and cash equivalents, providing insights into liquidity and the company's ability to meet short-term obligations. Unlike cash flow, funds flow includes non-cash transactions, offering a broader view of financial resource management.

Importance of Funds Flow in Budget Planning

Funds flow provides a comprehensive view of the movement of financial resources within a company, crucial for effective budget planning and monitoring financial health. Unlike cash flow, which tracks actual cash transactions, funds flow accounts for both cash and non-cash items, enabling more accurate forecasting and allocation of resources. Proper analysis of funds flow ensures optimized budget decisions, helping to avoid liquidity crises and align expenditures with strategic financial goals.

The Role of Cash Flow in Financial Management

Cash flow plays a crucial role in financial management by ensuring liquidity and enabling businesses to meet short-term obligations. Unlike funds flow, which tracks the movement of funds between long-term accounts, cash flow focuses on the inflow and outflow of cash within a specific period, directly impacting operational efficiency. Effective cash flow management supports budgeting decisions, prevents insolvency, and sustains ongoing business activities.

Analyzing Funds Flow Statements

Analyzing Funds Flow Statements provides insights into the movement of working capital by tracking sources and uses of funds between accounting periods. Unlike cash flow statements, funds flow statements emphasize changes in financial position and long-term resources rather than immediate liquidity. This analysis assists in assessing an organization's ability to finance operations, meet obligations, and plan strategic investments effectively.

Preparing Accurate Cash Flow Statements

Preparing accurate cash flow statements requires a thorough understanding of funds flow, which tracks the movement of financial resources within a business. Cash flow focuses specifically on the timing and liquidity of cash receipts and payments, critical for managing operational efficiency and financial stability. Detailed reconciliation between funds flow and cash flow ensures precise forecasting and effective budget management.

How Funds Flow Impacts Budget Forecasting

Funds flow provides a detailed view of the sources and uses of financial resources, directly influencing the accuracy of budget forecasting by highlighting inflows and outflows over specific periods. Unlike cash flow, which tracks liquidity, funds flow emphasizes capital allocation and long-term financial planning, enabling more precise projection of budget surpluses or deficits. Effective analysis of funds flow ensures better alignment of budget forecasts with organizational financial strategies and investment decisions.

Cash Flow Challenges in Budget Execution

Cash flow challenges in budget execution often arise from timing mismatches between funds flow and actual cash availability, causing delays in expenditure and project implementation. Inconsistent funds flow can lead to liquidity shortages, restricting the ability to meet operational expenses and contractual obligations promptly. Effective cash flow management requires aligning budgetary allocations with real-time cash disbursements to ensure smooth fiscal operations and minimize financial risks.

Integrating Funds Flow and Cash Flow for Better Budgets

Integrating funds flow and cash flow provides a comprehensive view of an organization's financial health, ensuring accurate budget planning and resource allocation. Funds flow tracks the movement of capital through various accounts, highlighting financing activities and long-term investments, while cash flow focuses on liquidity from operating, investing, and financing activities. Combining these analyses enables businesses to optimize budget forecasts, maintain sufficient liquidity, and improve decision-making for sustainable financial management.

Practical Tips to Optimize Funds and Cash Flow

Understanding the distinction between funds flow and cash flow is crucial for effective budget management; funds flow tracks the movement of financial resources within different accounts, while cash flow focuses on the actual inflow and outflow of cash. To optimize both, businesses should implement real-time cash monitoring tools, prioritize receivables collection, and manage payables strategically to maintain liquidity and support operational needs. Regularly reviewing budget forecasts against actual funds and cash movements helps identify discrepancies early and enables proactive adjustments to enhance overall financial health.

Important Terms

Working Capital Movement

Working capital movement reflects changes in current assets and liabilities, directly impacting cash flow from operating activities by indicating how efficiently a company manages its short-term financial resources. Funds flow analysis, on the other hand, provides a broader view of a company's financial health by tracking the sources and uses of funds across operating, investing, and financing activities, highlighting the overall liquidity and capital structure adjustments beyond just cash transactions.

Non-cash Expenses

Non-cash expenses such as depreciation and amortization reduce net income on the income statement without affecting cash flow, requiring adjustments in the funds flow statement to reconcile net income with cash from operating activities. These expenses decrease reported profits but do not involve actual cash outflows, highlighting their critical role in differentiating funds flow analysis from cash flow analysis for accurate financial assessment.

Accrual Accounting

Accrual accounting recognizes revenues and expenses when they are earned or incurred, impacting funds flow by reflecting changes in working capital through accounts receivable and payable, whereas cash flow focuses solely on actual cash transactions. This distinction highlights that funds flow statements capture the movement of resources beyond immediate cash changes, providing a comprehensive view of an organization's financial health.

Operating Inflows

Operating inflows represent cash generated from a company's core business activities, directly impacting cash flow but not necessarily reflected in funds flow, which includes non-cash transactions and adjustments. Cash flow from operating activities captures actual liquidity changes, while funds flow provides a broader view of financial resource movements within the business.

Financing Activities

Financing activities in funds flow analysis focus on changes in long-term liabilities and equity that impact the overall financial position, whereas cash flow from financing activities specifically tracks the inflow and outflow of cash related to borrowing, repaying debt, issuing stock, and paying dividends. Differences arise because funds flow captures non-cash transactions affecting working capital, while cash flow strictly measures actual cash movements within the financing section.

Investing Transactions

Investing transactions impact funds flow by reflecting the movement of cash related to the purchase or sale of long-term assets, such as property, equipment, or securities, directly affecting a company's financial resources. Cash flow from investing activities differs from overall cash flow as it specifically tracks investment-related cash inflows and outflows, offering insights into an organization's growth strategy and asset management.

Profit vs. Liquidity

Profit reflects the net income over a period, while liquidity measures the availability of cash to meet short-term obligations; funds flow analysis tracks changes in working capital affecting liquidity, whereas cash flow focuses on actual cash transactions impacting a company's cash position. Effective financial management requires balancing profitability with maintaining sufficient liquidity through monitoring both funds flow and cash flow statements.

Depreciation Impact

Depreciation reduces taxable income without affecting cash flow, leading to a non-cash expense that impacts funds flow by lowering accounting profits but preserving actual cash. This creates a divergence where funds flow from operations includes depreciation adjustments, whereas cash flow reports only real cash movements.

Statement of Changes in Financial Position

The Statement of Changes in Financial Position primarily tracks the movement of working capital and changes in sources and uses of funds, reflecting funds flow activities over a period. In contrast, the Cash Flow Statement specifically details cash inflows and outflows, focusing on liquidity by categorizing activities into operating, investing, and financing cash flows.

Net Cash Generation

Net cash generation measures the actual increase in cash from operating, investing, and financing activities, directly reflecting funds flow's impact on a company's liquidity. Unlike cash flow, which tracks individual cash movements, net cash generation summarizes the overall cash availability after all transactions, highlighting financial health and operational efficiency.

funds flow vs cash flow Infographic

moneydif.com

moneydif.com