Sunset budgeting requires periodic review and automatic expiration of programs unless explicitly renewed, promoting efficiency and accountability by preventing the continuation of outdated expenditures. Baseline budgeting assumes current funding levels as the starting point for future budgets, often leading to incremental increases without thorough evaluation of existing programs. Choosing sunset budgeting can drive fiscal discipline, while baseline budgeting may result in budgetary inertia and less responsive allocation of resources.

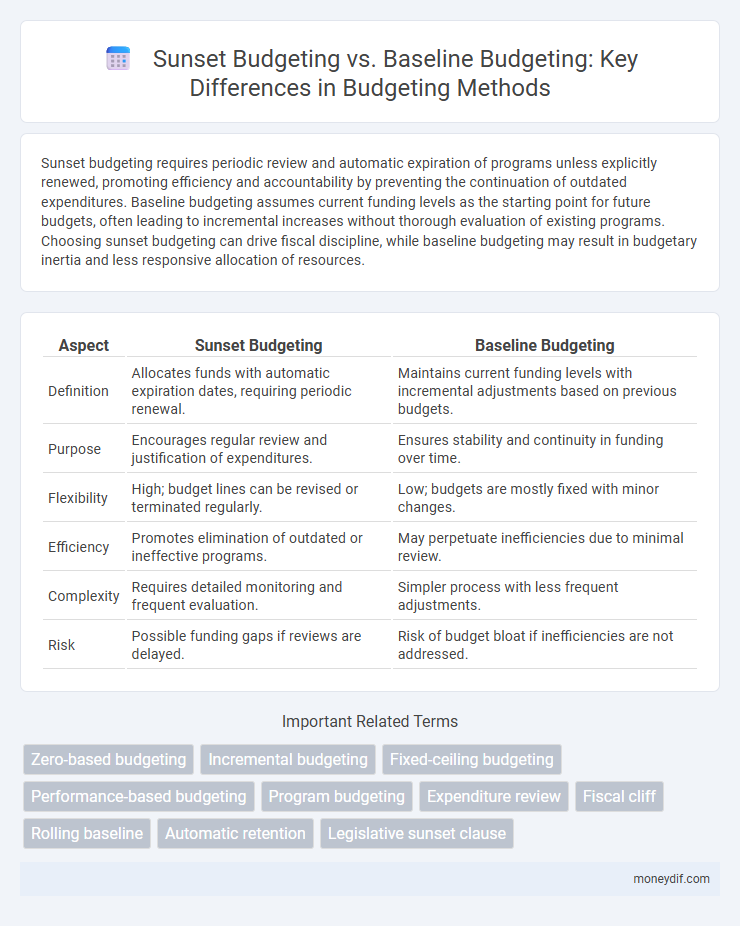

Table of Comparison

| Aspect | Sunset Budgeting | Baseline Budgeting |

|---|---|---|

| Definition | Allocates funds with automatic expiration dates, requiring periodic renewal. | Maintains current funding levels with incremental adjustments based on previous budgets. |

| Purpose | Encourages regular review and justification of expenditures. | Ensures stability and continuity in funding over time. |

| Flexibility | High; budget lines can be revised or terminated regularly. | Low; budgets are mostly fixed with minor changes. |

| Efficiency | Promotes elimination of outdated or ineffective programs. | May perpetuate inefficiencies due to minimal review. |

| Complexity | Requires detailed monitoring and frequent evaluation. | Simpler process with less frequent adjustments. |

| Risk | Possible funding gaps if reviews are delayed. | Risk of budget bloat if inefficiencies are not addressed. |

Understanding Sunset Budgeting: A Brief Overview

Sunset budgeting sets automatic expiration dates on programs or funding unless explicitly renewed, promoting regular review and preventing outdated expenditures. Baseline budgeting projects future funding needs based on current spending levels, maintaining consistent financial support over time. Understanding sunset budgeting highlights its role in enhancing accountability and encouraging periodic evaluation within the budget process.

What is Baseline Budgeting? Core Principles

Baseline budgeting is a method that uses the previous year's budget as a starting point, adjusting for inflation, new policies, or economic conditions. Core principles include maintaining stable funding levels, prioritizing ongoing programs, and improving efficiency without reducing essential services. This approach contrasts with sunset budgeting, which requires periodic review and justification for each program to continue receiving funds.

Key Differences: Sunset vs Baseline Budgeting

Sunset budgeting requires programs to expire after a set period unless renewed, promoting regular evaluation and resource reallocation, whereas baseline budgeting assumes existing programs automatically continue, increasing the risk of outdated or inefficient spending. Sunset budgeting drives accountability by mandating periodic reviews, contrasting with baseline budgeting's tendency to perpetuate previous funding levels without systematic reassessment. This fundamental difference impacts fiscal discipline, transparency, and government adaptability to changing priorities.

Advantages of Sunset Budgeting in Fiscal Planning

Sunset budgeting enhances fiscal discipline by mandating the expiration of programs unless explicitly renewed, ensuring periodic review and preventing automatic funding continuation. This method promotes efficient allocation of public resources by eliminating obsolete or underperforming initiatives, aligning spending with current policy priorities. Agencies are incentivized to demonstrate measurable results, fostering transparency and accountability in the budgeting process.

Benefits of Baseline Budgeting for Long-Term Stability

Baseline budgeting ensures long-term fiscal stability by using the previous year's budget as a foundation, which promotes predictable government spending and efficient resource allocation. This method helps avoid sudden funding cuts and supports continuous program funding, fostering sustained economic growth. Its emphasis on incremental changes makes it easier to plan and adjust financial priorities over multiple fiscal years.

Common Challenges in Implementing Sunset Budgeting

Sunset budgeting faces common challenges such as accurately determining the expiration dates for programs and ensuring legislative consensus on budget discontinuations. Difficulties arise in forecasting long-term fiscal impacts and managing political resistance to terminating established expenditures. These issues often result in implementation delays and complicate efforts to improve budgetary efficiency compared to baseline budgeting.

Potential Pitfalls of Baseline Budgeting

Baseline budgeting can lead to inflated government spending as agencies often receive automatic increases based on prior budgets regardless of actual need. This method risks perpetuating inefficiencies and discourages critical evaluation of program effectiveness. Consequently, resources may be misallocated, limiting fiscal flexibility and undermining long-term financial sustainability.

Practical Scenarios: When to Use Sunset or Baseline Budgeting

Sunset budgeting is ideal for projects with fixed durations or experimental programs requiring periodic reassessment to avoid automatic funding renewals, ensuring resources align with current priorities. Baseline budgeting suits ongoing operational expenses and long-term commitments by providing consistent funding based on historical data and adjusted growth factors. Selecting between these approaches depends on organizational goals, with sunset budgeting offering flexibility for change and baseline budgeting ensuring stability in routine expenditures.

Sunset vs Baseline Budgeting: Impact on Government Efficiency

Sunset budgeting mandates periodic review and termination of programs unless explicitly renewed, promoting fiscal discipline and reducing government inefficiency by eliminating outdated expenditures. Baseline budgeting automatically adjusts prior budgets for inflation and growth, potentially perpetuating inefficiencies through an incremental increase in spending regardless of performance. The contrast between Sunset and Baseline budgeting highlights the former's ability to enhance government efficiency by enforcing accountability and continuous program evaluation.

Choosing the Right Budgeting Approach for Your Organization

Sunset budgeting requires periodic review and expiration of budget items, promoting accountability and flexibility in resource allocation. Baseline budgeting uses the previous period's budget as a starting point, ensuring stability and consistent funding levels. Organizations seeking adaptive financial control may prefer sunset budgeting, while those prioritizing predictable expenditure often choose baseline budgeting.

Important Terms

Zero-based budgeting

Zero-based budgeting requires each expense to be justified from scratch, contrasting with baseline budgeting that adjusts previous budgets incrementally, and sunset budgeting which mandates automatic review and expiration of programs to eliminate inefficiencies. This approach promotes resource optimization by focusing on outcomes and eliminating non-essential expenditures rather than relying on historical spending patterns.

Incremental budgeting

Incremental budgeting focuses on adjusting previous budgets by adding or subtracting incremental amounts, contrasting with baseline budgeting, which sets budget levels based on existing service levels, and sunset budgeting, which requires periodic review and justification for continuing expenditures. Sunset budgeting promotes efficiency by eliminating outdated programs, whereas incremental budgeting may perpetuate inefficiencies by assuming past allocations are justified.

Fixed-ceiling budgeting

Fixed-ceiling budgeting allocates a set expenditure limit regardless of past budgets, contrasting with baseline budgeting, which adjusts allocations based on previous spending levels. Sunset budgeting introduces automatic program termination dates to promote efficiency, differing from fixed-ceiling approaches that emphasize strict spending caps without predetermined phases.

Performance-based budgeting

Performance-based budgeting allocates funds based on measurable outcomes and efficiency, promoting accountability and resource optimization in public sector programs. Compared to baseline budgeting, which relies on previous budget levels, and sunset budgeting, which mandates program termination unless renewed, performance-based budgeting emphasizes results to drive funding decisions and improve government effectiveness.

Program budgeting

Program budgeting allocates funds based on specific programs' goals and outcomes, enhancing transparency and accountability, while Sunset budgeting introduces automatic review and termination dates for programs, ensuring ongoing relevance and efficiency. Baseline budgeting, in contrast, uses prior year spending as a reference point, often limiting adaptability by focusing on incremental changes rather than program effectiveness or timed evaluations.

Expenditure review

Expenditure review involves analyzing government spending to improve efficiency, with Sunset budgeting requiring periodic reassessment of programs for continuation or termination, promoting fiscal discipline. Baseline budgeting assumes existing programs continue without change, often leading to incremental increases in expenditures and less rigorous evaluation.

Fiscal cliff

The fiscal cliff refers to the economic impact triggered when multiple tax increases and spending cuts, often tied to sunset budgeting provisions, automatically take effect simultaneously after a set period. Unlike baseline budgeting, which assumes current funding levels continue unless changed, sunset budgeting involves automatic expiration of funding unless explicitly renewed, increasing the risk of abrupt fiscal tightening and economic uncertainty at the fiscal cliff.

Rolling baseline

Rolling baseline budgeting continuously updates the budget forecast by adding a new budget period as the current period completes, allowing for more adaptive financial planning compared to static baseline budgeting. Sunset budgeting sets expiration dates for budget items, requiring periodic review and renewal, which contrasts with the rolling baseline's ongoing adjustments without fixed sunset clauses.

Automatic retention

Automatic retention ensures certain budget items persist without explicit review, contrasting with sunset budgeting's approach to systematically eliminate or review programs unless renewed. Baseline budgeting maintains existing funding levels as a reference point, creating inertia that automatic retention leverages to sustain ongoing expenditures without reevaluation.

Legislative sunset clause

Legislative sunset clauses mandate the automatic expiration of laws or programs after a specific period unless explicitly renewed, promoting periodic review and accountability. Sunset budgeting contrasts with baseline budgeting by allocating funds for programs with defined end dates subject to reevaluation, rather than assuming ongoing funding based on previous budgets.

Sunset budgeting vs Baseline budgeting Infographic

moneydif.com

moneydif.com